India Soft Drinks Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Market Overview:

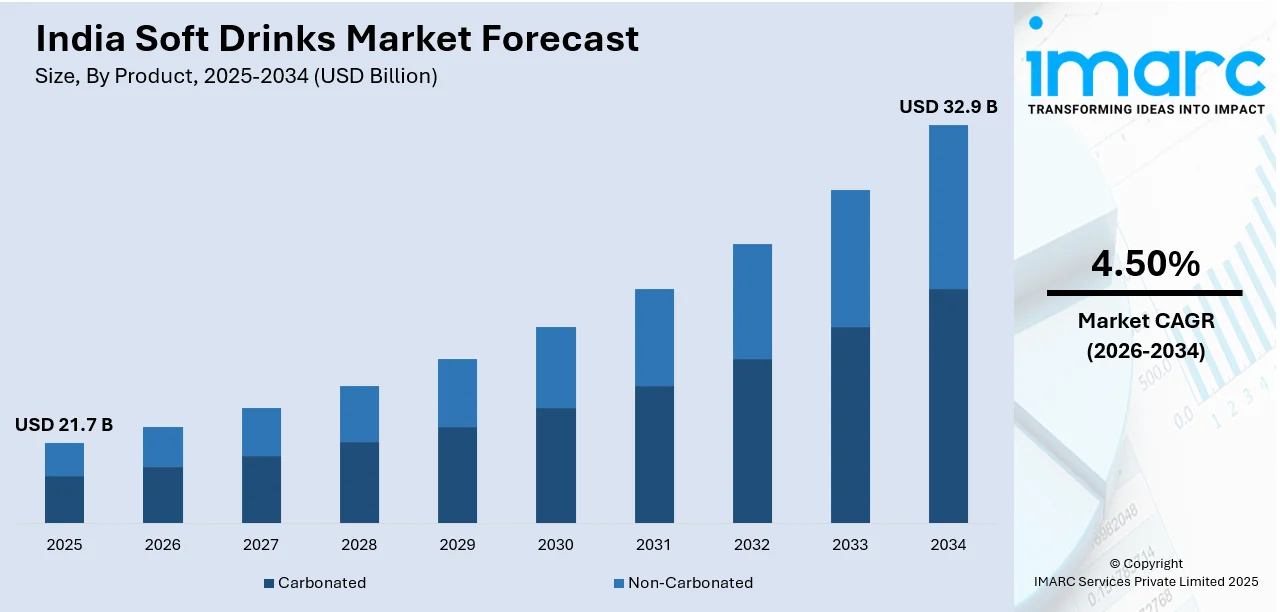

India soft drinks market size reached USD 21.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 32.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.50% during 2026-2034. The widespread adoption of ready-to-drink (RTD) beverages, along with the inflating popularity of low-sugar product variants, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.7 Billion |

| Market Forecast in 2034 | USD 32.9 Billion |

| Market Growth Rate (2026-2034) | 4.50% |

Soft drinks, or non-alcoholic beverages, are popularly enjoyed for their sweet taste and refreshing attributes. This category encompasses both carbonated and non-carbonated drinks, crafted from a combination of water, artificial flavors, high-fructose syrup, natural extracts, carbon dioxide (CO2) gas, caffeine, and preservatives. Soft drinks are known for their richness in calories, carbohydrates, and sodium, while also containing modest amounts of calcium, vitamins, and minerals. Widely consumed across various settings such as sporting events, movie theaters, restaurants, hotels, bars, parties, and social gatherings, soft drinks offer a convenient, cost-effective, and easily accessible option for maintaining hydration, boosting energy levels, uplifting mood, and providing a momentary sense of enjoyment. Additionally, these beverages are associated with several health benefits, including the improvement of cognitive function, a reduced risk of kidney stones, and the alleviation of pain related to menstrual cramps and headaches.

To get more information on this market Request Sample

India Soft Drinks Market Trends:

The soft drinks market in India has evolved into a dynamic and influential segment of the beverage industry, reflecting the changing preferences and lifestyles of the country's vast consumer base. The market is characterized by the popularity of well-known brands offering a spectrum of flavors, ranging from cola and citrus to fruit-based variants. Additionally, the convenience, affordability, and widespread availability of soft drinks contribute to their popularity in diverse settings, making them a go-to choice for hydration and enjoyment. Moreover, the industry is witnessing trends that align with changing consumer attitudes towards health and wellness. This has led to the introduction of low-calorie, diet, and natural ingredient-based soft drinks, addressing the growing demand for healthier beverage options. Furthermore, the soft drinks market in India is also influenced by cultural and seasonal factors. Traditional Indian festivals and the sweltering summer months drive increased consumption, prompting innovative marketing strategies and product launches during these periods. As India's economy continues to grow, and with a youthful population embracing new trends, the soft drinks market is poised for sustained expansion in the coming years.

India Soft Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Carbonated

- Non-Carbonated

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbonated and non- carbonated.

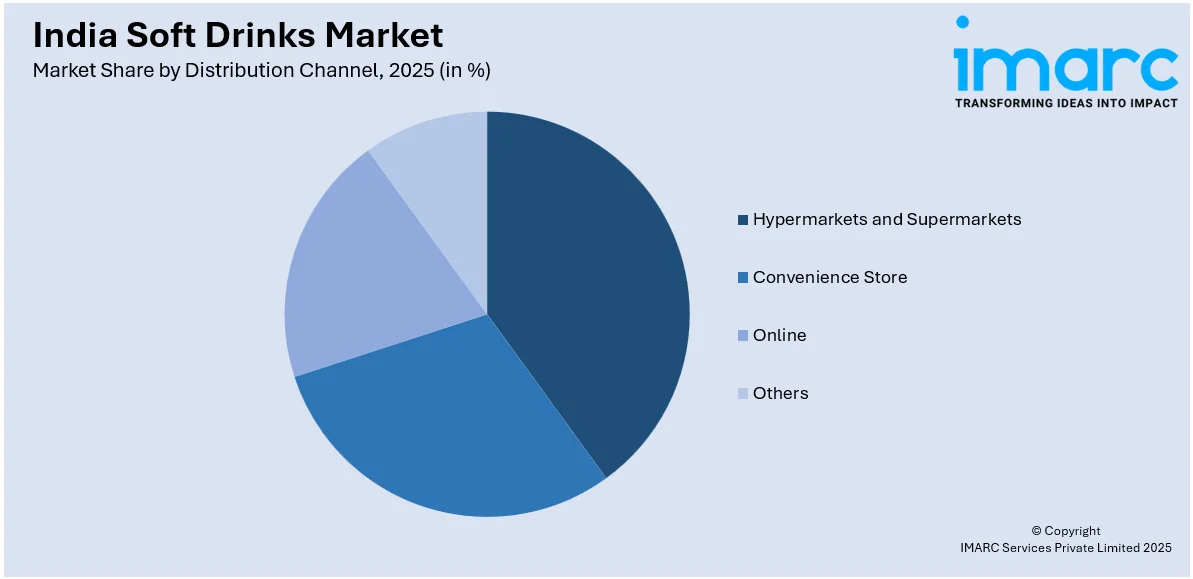

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Store

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience store, online, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soft Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Carbonated, Non- Carbonated |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Store, Online, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soft drinks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India soft drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soft drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soft drinks market in India was valued at USD 21.7 Billion in 2025.

The soft drinks market in India is projected to exhibit a (CAGR) of 4.50% during 2026-2034, reaching a value of USD 32.9 Billion by 2034.

The market is driven by rising disposable incomes, young consumers, and urbanization. Rising demand for convenience drinks and innovation in the form of low-sugar and functional versions fuels growth. Seasonal demand peaks and retail penetration also drive expansion. Promotional branding and endorsements also increase visibility, turning soft drinks into a high-volume category.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)