India Soda Ash Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Market Overview:

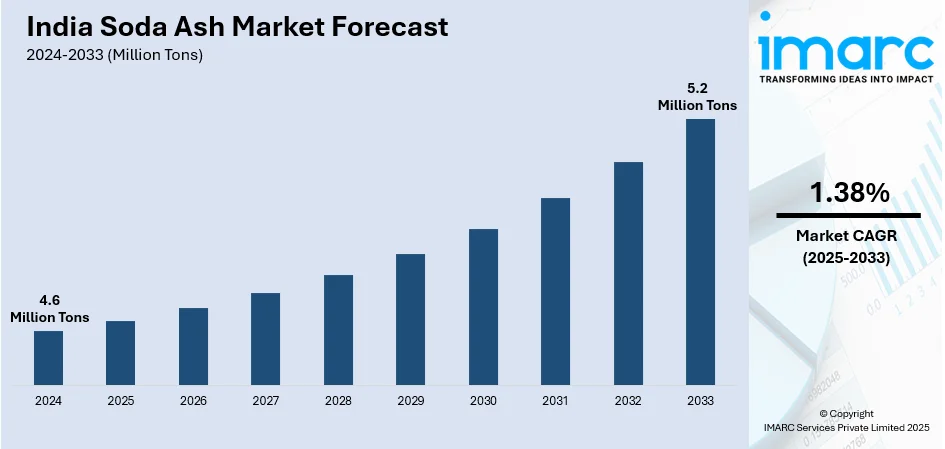

The India soda ash market size reached 4.6 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 5.2 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.38% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 4.6 Million Tons |

| Market Forecast in 2033 | 5.2 Million Tons |

| Market Growth Rate (2025-2033) | 1.38% |

Soda ash, also known as sodium carbonate, is a white crystalline solid that belongs to the chlor-alkali family. It can be extracted from the ashes of plants growing in sodium-rich soils, as well as produced naturally using mined trona and brine. On the other hand, commercial soda ash is mostly produced using the Solvay and Hou processes. In India, soda ash is widely used for water treatment and environmental applications to improve the alkalinity of lakes and control the pH of water.

To get more information on this market, Request Sample

The India soda ash market is primarily driven by the increasing product demand from the soap and detergent industry. It is extensively utilized as an additive in various home detergents and cleaning products due to its ability to remove alcohol and grease stain from clothing. Apart from this, a considerable increase in the production of glass due to the rising demand from the construction and renovation industries is also providing a boost to the market. This trend can be attributed to sustained economic growth, expanding commercial real estate and the rising urban population.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India soda ash market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on application.

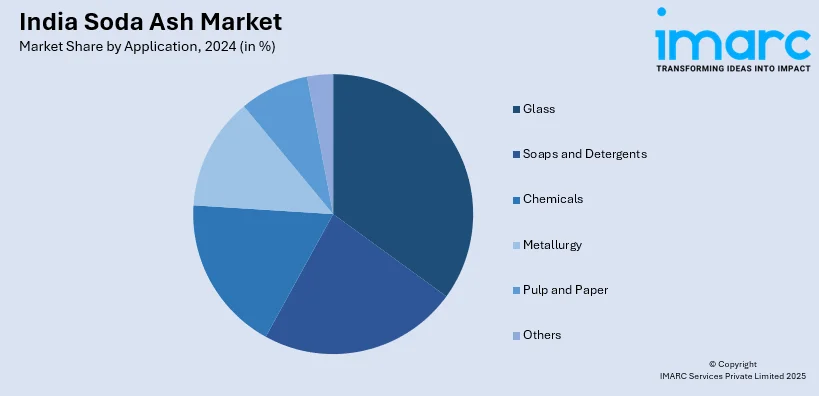

Breakup by Application:

- Glass

- Soaps and Detergents

- Chemicals

- Metallurgy

- Pulp and Paper

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India soda ash market reached a volume of 4.6 Million Tons in 2024.

We expect the India soda ash market to exhibit a CAGR of 1.38% during 2025-2033.

The rising demand for soda ash in various home detergents and cleaning products, owing to its ability to remove alcohol and grease stain from clothing, is primarily driving the India soda ash market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous production activities for soda ash.

Based on the application, the India soda ash market can be bifurcated into glass, soaps and detergents, chemicals, metallurgy, pulp and paper, and others. Currently, glass holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India soda ash market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)