India Socks Market Size, Share, Trends and Forecast by Product, Material, Application, Distribution Channel, and Region, 2026-2034

India Socks Market Summary:

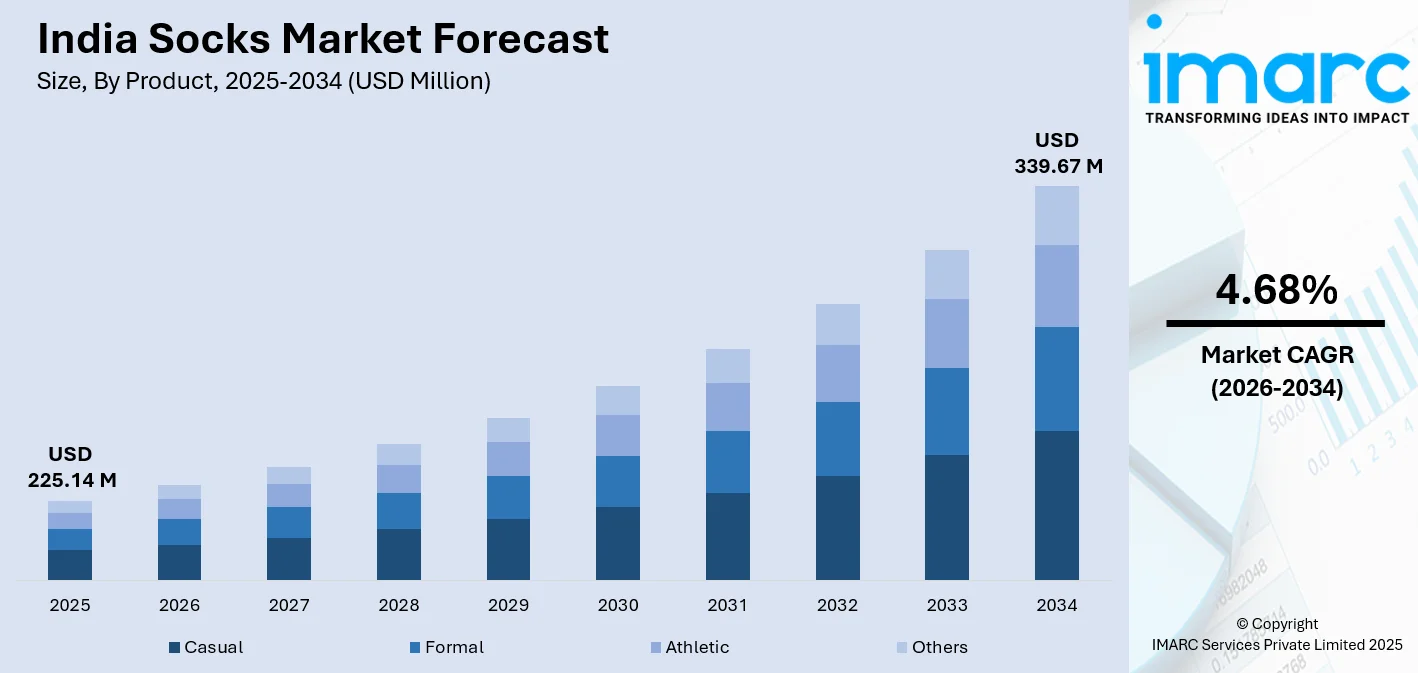

The India socks market size was valued at USD 225.14 Million in 2025 and is projected to reach USD 339.67 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

The growth of the India socks market is highly influenced by growing fashion consciousness, increasing urbanization, and rising disposable incomes among the burgeoning middle-class population. This, in turn, has translated into firm demand across various categories, wherein casual socks were leading product categories in the market. Increasing health consciousness, growing gym culture, and penetration of organized retail channels continue to drive market growth. Market evolution is also maintained through continuous penetration by e-commerce and the development of inventive fabric technologies.

Key Takeaways and Insights:

-

By Product: Casual socks dominate the market with a share of 56.75% in 2025, driven by the rise of athleisure trends, hybrid work culture adoption, and consumer preference for comfort-oriented everyday footwear options across urban and semi-urban regions.

- By Material: Cotton leads the market with a share of 52.08% in 2025, owing to its natural breathability, moisture absorption properties, and widespread consumer preference for comfortable, hypoallergenic, and affordable fabric options suited to India's diverse climate conditions.

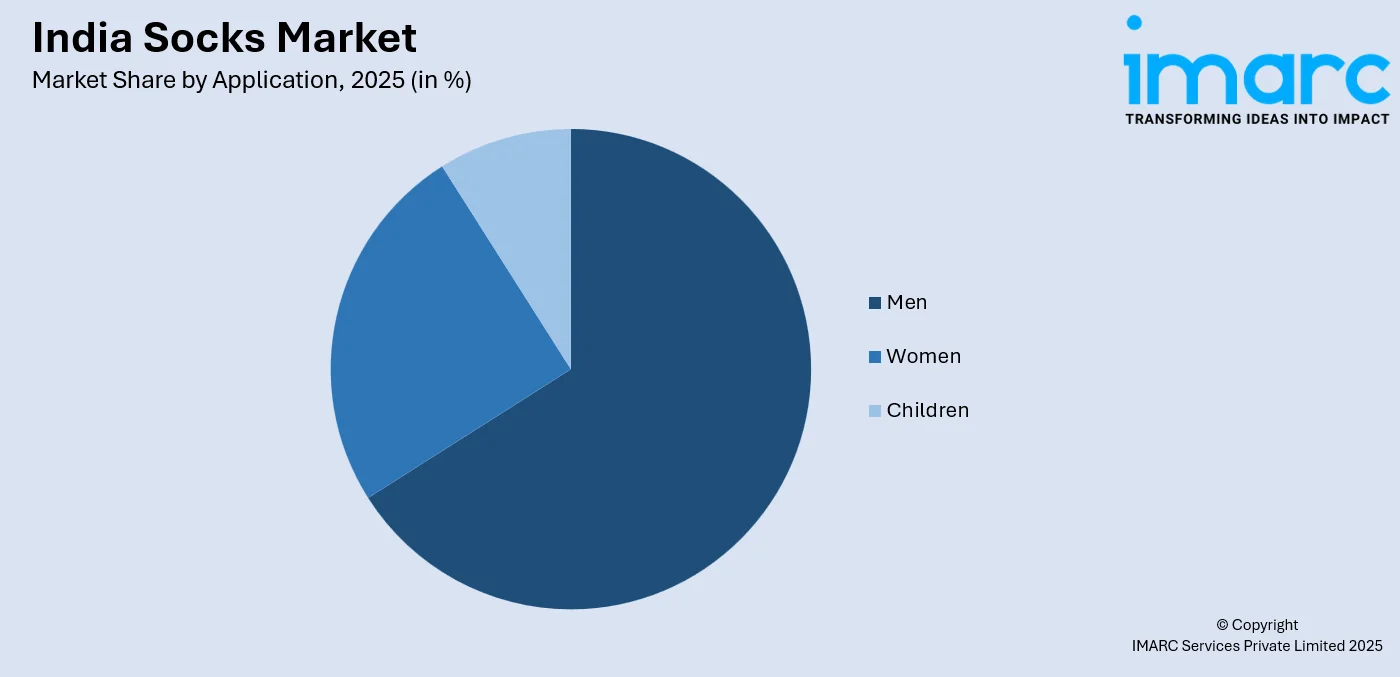

- By Application: Men represent the largest segment with a market share of 65.88% in 2025, attributable to consistent demand across formal, athletic, and casual categories, coupled with higher per capita consumption rates and growing fashion consciousness among male consumers.

- By Distribution Channel: Supermarkets and Hypermarkets dominates the market with a share of 57.69% in 2025, driven by consumer convenience, product variety, promotional bundling strategies, and the rapid expansion of organized retail chains across metropolitan and tier-two cities.

- By Region: Uttar Pradesh leads the market with a share of 12% in 2025, supported by high population density, robust retail infrastructure, seasonal demand variations, and the presence of major manufacturing hubs catering to regional consumption patterns.

- Key Players: The India socks market exhibits a moderately competitive landscape with both multinational sportswear giants and domestic manufacturers vying for market share. Key players are focusing on product innovation, sustainable materials, and omnichannel distribution strategies to capture diverse consumer segments. Some of the key players operating in the market include Adidas India Marketing Pvt. Ltd (Adidas AG), Bonjour Group, Filatex Fashions Ltd., Heelium Sports Private Limited, NIKE India Private Ltd (Nike, Inc.), PUMA India Ltd (PUMA SE), SockSoho, Supersox, and Vidhaan Socks.

To get more information on this market Request Sample

The India socks market is witnessing transformative growth underpinned by shifting lifestyle patterns and heightened consumer awareness regarding foot health and hygiene. In January 2025, leading Indian socks brand Bonjour launched a new eco‑friendly bamboo socks range with a “7 Days No Smell” campaign, reinforcing sustainable solutions for everyday wear and aligning with growing demand for environmentally conscious products. Rapid urbanization across metropolitan and tier-two cities is creating substantial demand for diverse sock categories catering to professional, athletic, and casual requirements. The expanding working population, particularly in corporate and service sectors, is driving sustained demand for formal and semi-formal socks. Rising participation in fitness activities and organized sports is catalyzing the athletic socks segment. The proliferation of e-commerce platforms has democratized product accessibility, enabling consumers in remote regions to access premium and specialized products. Additionally, growing environmental consciousness is steering manufacturers toward sustainable materials and eco-friendly production processes.

India Socks Market Trends:

Rising Demand for Sustainable and Eco-Friendly Materials

The India socks market is experiencing a significant shift toward sustainable and environmentally responsible products. Consumers are increasingly prioritizing eco-friendly materials such as bamboo fiber, organic cotton, and recycled polyester in their purchasing decisions. In March 2024, Indian sock supplier Texcyle launched a pioneering range of socks made with Bio‑Elastane, organic cotton, and recycled polyester to reduce carbon footprint and promote sustainable production processes in the industry. This trend reflects broader environmental consciousness among urban consumers who seek products that align with their values. Manufacturers are responding by developing innovative sustainable sock ranges that offer natural antibacterial properties, enhanced breathability, and reduced environmental footprint while maintaining comfort and durability standards.

Growth of Athleisure and Performance-Oriented Socks

The blurring boundaries between athletic and casual wear are driving substantial demand for versatile performance socks. The expanding fitness culture, growing gym memberships, and increased participation in recreational sports activities are propelling this trend. Global performance sock specialist Trusox entered the Indian market and roped in cricketer Rohit Sharma as its brand ambassador to promote high‑performance socks designed to enhance grip and support during athletic activities, reflecting rising consumer interest in specialized footwear accessories. Consumers are seeking socks with advanced features including moisture-wicking technology, cushioned soles, arch support, and compression capabilities. The rise of home fitness routines and outdoor activities has further amplified demand for specialized athletic socks that deliver enhanced comfort, support, and durability during physical activities.

Digital Transformation and E-Commerce Expansion

Digital channels are fundamentally reshaping how consumers discover and purchase socks in India. E-commerce platforms have emerged as crucial distribution channels, offering extensive product variety, competitive pricing, and convenient doorstep delivery. In June 2025, India’s The Sock Street launched its nationwide ‘Show Up As You’ influencer campaign across Instagram and YouTube, tapping fitness, lifestyle, and fashion creators to drive brand engagement and expand consumer reach. Social media marketing and influencer collaborations are becoming instrumental in shaping consumer preferences, particularly among younger demographics. Brands are leveraging digital platforms for targeted advertising, customer engagement, and community building. The subscription-based model for sock purchases is gaining traction, offering consumers curated selections delivered regularly.

Market Outlook 2026-2034:

The socks market in India has been revealed to offer an opportunity for expansion, thanks to the demography and lifestyle changes being witnessed in India. With a growing number of households from the middle class expected by the end of the decade, there will be a higher need for high-quality product lines in India. Technology advancement in textile production, such as seamless knitting, will also contribute to the advancement of product quality and increasing appeal to fashion-conscious consumers in the country. The market generated a revenue of USD 225.14 Million in 2025 and is projected to reach a revenue of USD 339.67 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

India Socks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Casual |

56.75% |

|

Material |

Cotton |

52.08% |

|

Application |

Men |

65.88% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

57.69% |

|

Region |

Uttar Pradesh |

12% |

Product Insights:

- Casual

- Formal

- Athletic

- Others

The casual dominates with a market share of 56.75% of the total India socks market in 2025.

Casual socks account for the biggest category in the India socks market, thanks to the flexibility and usage of this type of sock in everyday environments and among different consumer segments in the country. Additionally, the increasing casualization of the working culture and the adoption of the hybrid lifestyle have contributed to the reduction in the gap that previously existed between casual and formal footwear, thereby fueling the demand for casual socks in the market.

The market is assisted by innovations occurring on a continuous basis in products by manufacturers launching advanced features such as anti-odor capabilities, breathable fabric combinations, and stylish designs. The rising trend among consumers for the adoption of comfort-driven apparel has resulted in casual socks becoming a necessary element for daily wear. Moreover, the growth of organized retail channels along with online shopping interfaces has allowed access to various types of casual socks.

Material Insights:

- Nylon

- Cotton

- Polyester

- Wool

- Waterproof Breathable Membrane

- Others

The cotton leads with a share of 52.08% of the total India socks market in 2025.

Cotton maintains its dominant position as the preferred material in India's socks market due to its inherent comfort, breathability, and moisture absorption capabilities. Brands like Jockey have expanded retail in India, increasing consumer access to cotton-rich socks that focus on comfort and breathability across formal, casual, and activewear, with over 1,500 outlets. The natural fiber's hypoallergenic properties make it particularly suitable for India's diverse climate conditions, ranging from humid coastal regions to dry northern plains. Consumers across all age groups and income segments consistently favor cotton socks for their softness against the skin and durability through multiple wash cycles.

The material's versatility allows manufacturers to create products suitable for various applications, from everyday casual wear to formal office settings. India's robust cotton production infrastructure ensures steady raw material availability and competitive pricing for manufacturers. Additionally, the growing emphasis on sustainable and eco-friendly products has reinforced cotton's appeal, as consumers increasingly prefer natural fibers over synthetic alternatives. Manufacturers are enhancing cotton socks with blended compositions that improve elasticity and shape retention.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Men

- Women

- Children

The men dominate with a market share of 65.88% of the total India socks market in 2025.

The men's segment commands the largest share of the India socks market, reflecting higher consumption rates driven by professional wardrobe requirements and growing fashion consciousness among male consumers. The expanding corporate workforce and formal workplace culture necessitate consistent demand for formal and semi-formal socks, while increasing fitness participation drives athletic sock purchases. Men's multi-pack purchasing behavior and higher replacement frequency contribute to sustained segment growth.

Brands have recognized this demographic's purchasing power and are offering extensive collections tailored to diverse male preferences, from classic office-appropriate designs to vibrant casual patterns and performance-oriented athletic variants. The segment benefits from strong brand loyalty and preference for value-oriented bundle purchases. E-commerce platforms have particularly enhanced accessibility for male consumers seeking convenient shopping experiences, driving online penetration within this demographic group.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The supermarkets and hypermarkets leads with a share of 57.69% of the total India socks market in 2025.

Supermarkets and hypermarkets maintain their position as the leading distribution channel for socks in India, offering consumers convenient one-stop shopping experiences alongside extensive product assortments. In July 2025, Avenue Supermarts, operator of DMart, announced plans to open up to 50 new stores across India, focusing on northern and smaller cities to expand organised retail access. The rapid expansion of organized retail chains across metropolitan areas and tier-two cities has significantly enhanced product accessibility. These retail formats leverage their scale to offer competitive pricing, promotional bundles, and seasonal discounts that attract price-conscious consumers.

The channel benefits from consumers' preference for physical product examination before purchase, particularly for items involving comfort and fit considerations. Strategic store locations in high-traffic areas, malls, and residential neighborhoods ensure consistent footfall. Large retailers also invest in dedicated apparel sections with trained staff who can assist customers in product selection. The integration of loyalty programs and cashback offers further strengthens customer retention within this distribution channel.

Regional Insights:

- Maharashtra

- Tamil Nadu

- Uttar Pradesh

- Gujarat

- Karnataka

- West Bengal

- Rajasthan

- Andhra Pradesh

- Telangana

- Madhya Pradesh

- Delhi NCR

- Punjab

- Haryana

- Others

Uttar Pradesh exhibits a clear dominance with a 12% share of the total India socks market in 2025.

Uttar Pradesh exhibits a clear dominance in the total India socks market, driven by its well-established textile and hosiery manufacturing ecosystem. The state benefits from a large pool of skilled labor, cost-efficient production, and strong presence of small and medium-scale hosiery units. Key industrial clusters support high-volume output, enabling manufacturers to meet domestic demand while maintaining competitive pricing across mass and mid-range sock segments nationwide.

The state’s strategic location and improving logistics infrastructure further strengthen Uttar Pradesh’s leadership in the Indian socks market. Proximity to major consumption centers in North and Central India allows faster distribution and lower transportation costs. Additionally, growing investments in modern knitting machinery and organized manufacturing practices are enhancing product quality and scale. These factors collectively position Uttar Pradesh as a primary production and supply hub for socks across India.

Market Dynamics:

Growth Drivers:

Why is the India Socks Market Growing?

Rising Urbanization and Expanding Middle-Class Population

India's accelerating urbanization trajectory is fundamentally reshaping consumer behavior and purchasing patterns in the socks market. The migration of population toward metropolitan areas and emerging urban centers is creating concentrated demand pockets with enhanced purchasing capacity. Urban consumers demonstrate heightened awareness regarding personal grooming, hygiene, and fashion, translating into increased sock consumption and higher willingness to pay for quality products. India’s urban population is projected to grow significantly, with estimates indicating that around 40% of the country’s population will be living in urban areas by 2030, supported by expanding retail infrastructure and rising discretionary spending. The expanding middle-class segment, with rising household incomes and aspirational lifestyles, represents a substantial consumer base driving market growth. This demographic shift is encouraging manufacturers to introduce diverse product ranges catering to varying price points and style preferences. Urban retail infrastructure development, including shopping centers and brand outlets, facilitates convenient product access and discovery.

Growing Health Consciousness and Fitness Culture

The proliferation of fitness culture and increasing health awareness among Indian consumers are significantly impacting socks market dynamics. Rising gym memberships, participation in recreational sports, and adoption of active lifestyles are driving demand for specialized athletic and performance socks. This trend is reflected in broader activewear growth, such as Japanese sportswear brand ASICS opening its first Company‑Owned Company‑Operated (COCO) store in India in late 2025 with plans to expand to 200 outlets nationwide, underscoring a growing commitment to fitness and lifestyle retail that supports performance‑oriented products. Consumers are increasingly recognizing the importance of proper footwear accessories in maintaining foot health, preventing injuries, and enhancing comfort during physical activities. This awareness extends beyond athletic contexts, with growing appreciation for features such as arch support, cushioning, and moisture management in everyday socks.

E-Commerce Expansion and Digital Retail Transformation

The rapid expansion of e-commerce platforms and digital retail channels is revolutionizing sock distribution and accessibility across India. Online marketplaces have democratized product access, enabling consumers in remote and underserved regions to purchase diverse sock varieties previously unavailable in local markets. Digital platforms offer extensive product comparisons, customer reviews, and competitive pricing that empower informed purchasing decisions. For example, premium sock brand The Sock Street partnered with quick‑commerce platform Blinkit in early 2025 to deliver men’s and women’s socks within minutes in select metro locations, demonstrating how digital channels are reshaping convenience and purchase behaviour. The convenience of doorstep delivery and hassle-free return policies has accelerated online adoption, particularly among younger, tech-savvy demographics. Social media marketing and influencer collaborations are effectively shaping consumer preferences and driving brand discovery.

Market Restraints:

What Challenges the India Socks Market is Facing?

Intense Price Competition and Margin Pressure

The India socks market faces significant challenges from intense price competition, particularly in the mass-market segment where numerous manufacturers compete aggressively on pricing. This competitive environment creates margin pressure for established brands and manufacturers, limiting investment capacity for innovation and quality enhancement. Price-sensitive consumers, especially in semi-urban and rural markets, often prioritize affordability over quality, constraining premiumization efforts.

Counterfeit Products and Quality Concerns

The proliferation of counterfeit and low-quality products poses challenges to legitimate market participants and brand reputation. Unorganized sector manufacturers often produce inferior quality socks that undermine consumer trust in the category. The difficulty in distinguishing authentic products from counterfeits in certain retail environments creates uncertainty among consumers, potentially affecting purchasing decisions for premium branded products.

Raw Material Price Volatility

Fluctuations in raw material prices, particularly cotton and synthetic fibers, create uncertainty in production costs and pricing strategies. Supply chain disruptions and global commodity market dynamics impact input costs, requiring manufacturers to balance cost management with quality maintenance. These volatilities can affect profit margins and pricing stability, particularly for smaller manufacturers with limited hedging capabilities.

Competitive Landscape:

The India socks market exhibits a moderately fragmented competitive structure characterized by the presence of multinational sportswear giants, established domestic manufacturers, and emerging direct-to-consumer brands. Market participants are increasingly differentiating through product innovation, sustainable material adoption, and omnichannel distribution strategies. Key competitive strategies include expanding retail presence, enhancing e-commerce capabilities, launching celebrity-endorsed marketing campaigns, and introducing specialized product lines targeting specific consumer segments. The market witnesses ongoing consolidation as larger players acquire regional brands to expand geographic coverage. Investment in manufacturing technology, particularly advanced knitting machinery and seamless production techniques, enables quality enhancement and cost optimization. Sustainability initiatives have become crucial competitive differentiators, with brands introducing eco-friendly product ranges and transparent supply chain practices.

Some of the key players include:

- Adidas India Marketing Pvt. Ltd (Adidas AG)

- Bonjour Group

- Filatex Fashions Ltd.

- Heelium Sports Private Limited

- NIKE India Private Ltd (Nike, Inc.)

- PUMA India Ltd (PUMA SE)

- SockSoho

- Supersox

- Vidhaan Socks

Recent Developments:

- In November 2025, Frido, an Indian D2C ergonomic brand, has partnered with activewear label HRX to launch India’s first barefoot sock‑shoe hybrid, combining ergonomic comfort with active lifestyle functionality. The collaboration aims to redefine casual and athletic footwear by merging the feel of barefoot movement with the protection of a shoe.

India Socks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Casual, Formal, Athletic, Others |

| Materials Covered | Nylon, Cotton, Polyester, Wool, Waterproof Breathable Membrane, Others |

| Applications Covered | Men, Women, Children |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, Karnataka, West Bengal, Rajasthan, Andhra Pradesh, Telangana, Madhya Pradesh, Delhi NCR, Punjab, Haryana, others |

| Companies Covered | Adidas India Marketing Pvt. Ltd (Adidas AG), Bonjour Group, Filatex Fashions Ltd., Heelium Sports Private Limited, NIKE India Private Ltd (Nike, Inc.), PUMA India Ltd (PUMA SE), SockSoho, Supersox, Vidhaan Socks, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India socks market size was valued at USD 225.14 Million in 2025.

The India socks market is expected to grow at a compound annual growth rate of 4.68% from 2026-2034 to reach USD 339.67 Million by 2034.

Casual socks dominated the market with a 56.75% share, driven by everyday utility, athleisure trends, hybrid work culture adoption, and consumer preference for comfortable footwear options across diverse settings.

Key factors driving the India socks market include rising urbanization, expanding middle-class population, growing health and fitness consciousness, e-commerce expansion, technological advancements in fabric materials, and increasing fashion awareness among consumers.

Major challenges include intense price competition creating margin pressure, proliferation of counterfeit and low-quality products affecting consumer trust, raw material price volatility impacting production costs, and limited brand awareness in rural and semi-urban markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)