India Snacks Market Report by Product Type (Chips, Salted Peanuts, Fryums, Popcorns), Pack Type (Pouch, and Others), Pack Size (Less than 50 gm, 50-100 gm, More than 100 gm), Distribution Channel (General Trade, Modern Trade, Online and E-Commerce, and Others), and State 2025-2033

India Snacks Market Size:

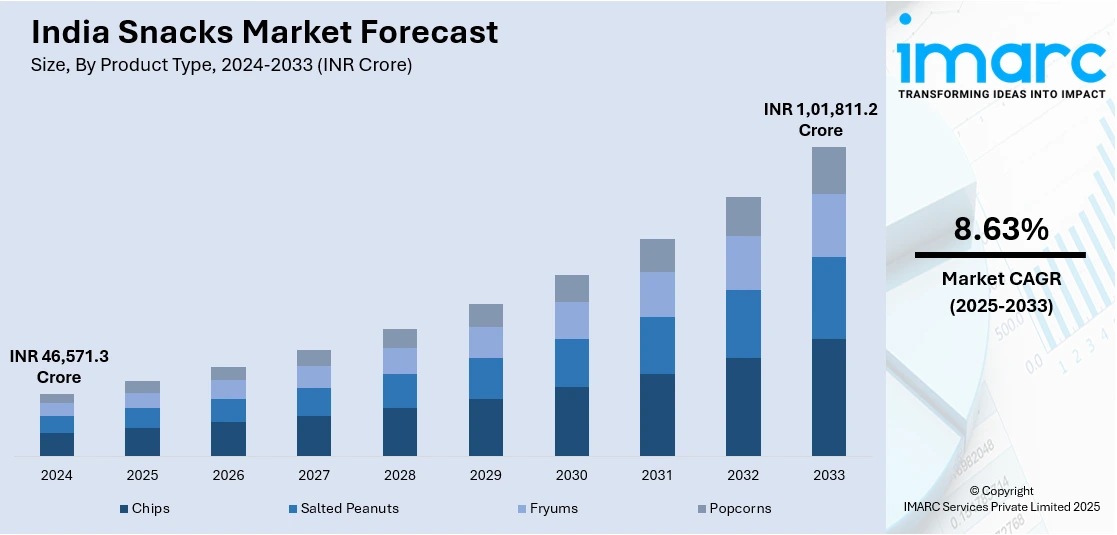

The India snacks market size reached INR 46,571.3 Crore in 2024. Looking forward, IMARC Group expects the market to reach INR 1,01,811.2 Crore by 2033, exhibiting a growth rate (CAGR) of 8.63% during 2025-2033. Increasing urbanization, along with rising disposable incomes and changing lifestyles, are driving the growth of the market. It is further supported by the growing young population and the influence of Western eating habits, which are boosting the demand for convenient ready-to-eat snack options across various demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 46,571.3 Crore |

|

Market Forecast in 2033

|

INR 1,01,811.2 Crore |

| Market Growth Rate 2025-2033 | 8.63% |

India Snacks Market Analysis:

- Major Market Drivers: The major drivers of India snacks market include rapid urbanization and a gradual shift in consumer lifestyle towards various convenience foods. Rising disposable income allow people for greater spending on processed foods while the young demographic which contributes a significant portion of population shows a strong preference for quick, easy and on-the-go snack options. The influence of western culture has also introduced a variety of snacks food into the Indian market promoting a taste for diverse and innovative products. In line with this, the expansion of retail infrastructure and ecommerce across the country has made snack foods more accessible further stimulating India snacks market growth.

- Key Market Trends: The India snacks market is witnessing various key trends which includes an increase in health-conscious snacking option as consumers nowadays increasingly seek healthier alternatives like baked, non-fried snacks and those with natural ingredients. There is also a growing preference for regional and ethnic flavors which leads the manufacturer to innovate with local taste profiles. In line with this, the increase in premiumization with consumers willing to pay more for gourmet and niche snack products is evident. The integration of convenient packaging and rise in online sales channels or also driving India snacks market growth.

- Competitive Landscape: Some of the major market players in the India snacks market industry include Balaji Wafers & Namkeens, Bikaji Foods International Limited, Bikanervala, Haldiram Snacks Food Pvt. Ltd., ITC Limited, Parle Products Pvt. Ltd, PepsiCo, Prataap Snacks Limited, Sundrop Brands Limited, and TTK Foods, among many others.

- Challenges and Opportunities: The India snacks market faces various challenges like fluctuation in raw material prices and strict food safety regulations that can impact the production cost and market entry. Competition from unorganized sectors also poses a significant challenge. However, opportunities abound with the increase in demand for convenience foods among the growing middle class and the country’s working population. There is a potential for India snacks market growth in Tier 2 and tier 3 cities where market penetration is still low. Furthermore, increase in consumer inclination towards organic and healthy snack options presents a promising avenue for new and existing players to explore and expand.

To get more information on this market, Request Sample

India Snacks Market Trends:

Rise in Health and Wellness Trends

The health and wellness trend in India snacks market is becoming increasingly prominent as consumer nowadays look for healthier eating options. The shift is evident in growing popularity of snacks that are natural, organic, vegan, low- calorie and gluten-free. These products cater to health-conscious consumers who are mindful of their dietary choices and prefer snacks that contribute to their well-being. According to an article published in the Times of India in 2023, 38% of the Indian population is strictly vegetarian. Snack manufacturers nowadays are responding to this trend by creating products that align with the customers health preferences thereby expanding India snacks market.

Increase in Retail Channels

The expansion of retail channels in India snacks market is notably influenced by the increase in online platforms mainly due to the COVID-19 pandemic. This trend is facilitated by the advancements of logistics and delivery networks across the country which allows for a broader reach and convenience. According to a report by Indian Brand Equity Foundation, India has gained 125 million online shoppers in the past three years with another 80 million expected by 2025. India's e-commerce market is expected to reach 111 billion USD by 2024 and 200 billion USD by 2026.

Innovation in Packaging

Innovations in packaging within India snacks market are mainly influenced by the rising consumer demands for convenience and sustainability. Pouch packaging has become especially popular and favored for its ease in use during on-the-go consumption and efficient storage capabilities. According to an article published by Invest India, India's food processing sector is expected to reach $535 Bn by 2025-26, with the food and beverage packaging industry projected to reach $86 Bn in 2029. Sustainable packaging, using biodegradable, recyclable, or compostable materials, is becoming increasingly popular. Eco-friendly materials include corn plastic, bamboo, wood and plant fibres, and mushroom-based packaging.

India Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and state levels for 2025-2033. Our report has categorized the market based on product type, pack type, pack size and distribution channel.

Breakup by Product Type:

- Chips

- Salted Peanuts

- Fryums

- Popcorns

Chips accounts for the majority of the India snacks market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes Chips, Salted Peanuts, Fryums, Popcorns. According to the report, Chips represented the largest segment.

The Indian snacks market is largely dominated by chips, owing to their immense popularity across all age groups. Chips come in a wide range of flavors and forms, catering to Indiaal tastes and preferences, which makes them a favorite among a vast consumer base. Manufacturers are continually innovating with new flavors and healthier options, such as baked and multigrain chips, to meet the growing demand. Furthermore, chips' dominance in the snacks sector is further reinforced by their easy availability, ranging from small retail shops to large supermarkets.

Breakup by Pack Type:

- Pouch

- Others

Pouch holds the largest share of the industry

A detailed breakup and analysis of the market based on the Pack Type have also been provided in the report. This includes pouch and others. According to the report, pouch accounted for the largest India snacks market share.

In the India snacks market, pouch packaging dominates due to its convenience, affordability, and effectiveness in preserving freshness. Pouches are favored for their lightweight nature and ease of storage, making them ideal for on-the-go consumption. They also offer excellent marketing surfaces for attractive designs and nutritional information, enhancing shelf appeal. The ability to seal in flavors and extend shelf life without the need for refrigeration further adds to their popularity. This packaging type's versatility allows it to cater to a wide range of snack products, securing its large market share.

Breakup by Pack Size:

- Less than 50 gm

- 50-100 gm

- More than 100 gm

Less than 50 gm represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the pack size. This includes less than 50 gm, 50-100 gm, and more than 100 gm. According to the report, less than 50 gm represented the largest segment.

The India snacks market is currently being dominated by the less than 50 grams packaging segment. This is mainly due to the fact that consumers prefer smaller portions, as it allows them to try out new flavors without committing to larger quantities. This packaging size is highly appealing to individuals who are looking for light snacks or are managing their calorie intake. Additionally, it caters well to a transient customer base, such as commuters and schoolchildren who prefer quick and portable eating options. The affordability of these smaller packs encourages impulse purchases, which further boosts their popularity in the market.

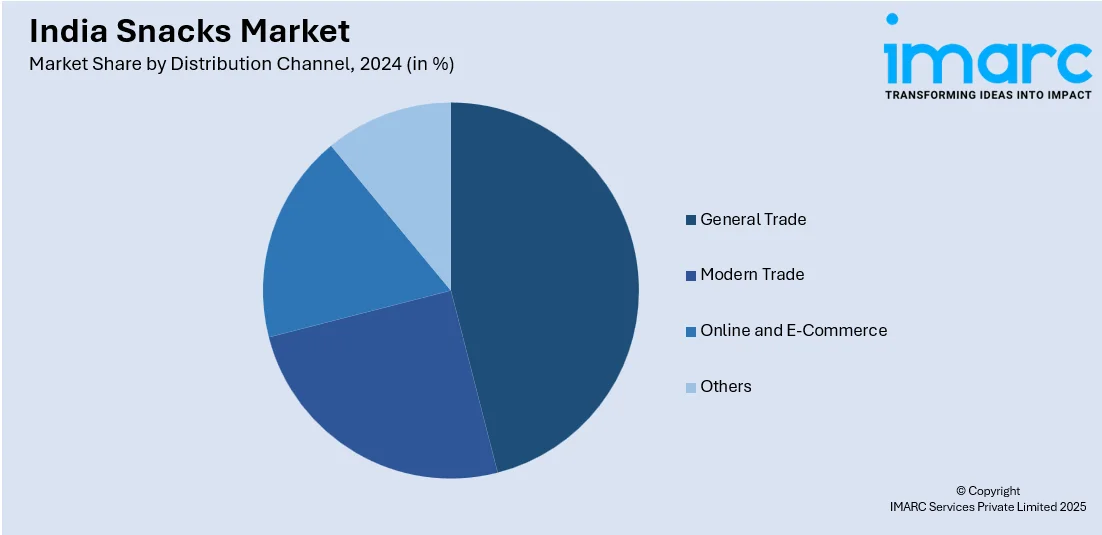

Breakup by Distribution Channel:

- General Trade

- Modern Trade

- Online and E-Commerce

- Others

General Trade exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes general trade, modern trade, online and e-commerce, and others. According to the report, general trade accounted for the largest market share.

General trade, comprising small retailers, local shops, and kiosks, exhibits clear dominance in the India snacks market. This sector's vast network and deep penetration into both urban and rural areas make it the most accessible shopping channel for the majority of consumers. These outlets are preferred for their convenience and the ability to offer localized, personal customer service. Moreover, general trade often provides flexible pricing and credit options, which are crucial in price-sensitive markets, ensuring its continued prevalence and dominance in the snacks industry.

Breakup by States:

- Maharashtra

- Uttar Pradesh

- Delhi

- Gujarat

- Karnataka

- Andhra Pradesh

- Telangana

- Goa

- Others

Maharashtra leads the market, accounting for the largest India snacks market share

The report has also provided a comprehensive analysis of all the major markets in the region, which include Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, Andhra Pradesh, Telangana, Goa, and others. According to the report, Maharashtra was the largest market for snacks in India.

The India snacks market is led by Maharashtra, owing to its large urban population and significant economic status. The cosmopolitan cities of Mumbai and Pune in the state have a fast-paced lifestyle and a diverse population that loves to experiment with various flavors and products, resulting in a high demand for snack foods. Maharashtra's strong retail infrastructure and high consumer spending power make it an important India for snack manufacturers. Often, new products are launched here to assess market trends and consumer preferences.

Competitive Landscape:

The competitive landscape of the India snacks market is vibrant and dynamic, characterized by the presence of both multinational giants and local players. Leading companies like PepsiCo, Haldiram Snacks Food Pvt. Ltd., and ITC Limited dominate with extensive product portfolios, strong brand recognition, and widespread distribution networks. For instance, PepsiCo India plans to invest 1,266 INR crore in a new flavor manufacturing facility in Ujjain, Madhya Pradesh. The facility will be operational by the first quarter of the year 2026 and run entirely on renewable energy, reducing carbon footprint and ensuring responsible water management. Furthermore, the market also sees continual entries from new startups focusing on health-oriented and premium snack options, further intensifying the competition.

The report provides a comprehensive analysis of the competitive landscape in the India snacks market with detailed profiles of all major companies, including:

- Balaji Wafers & Namkeens

- Bikaji Foods International Limited

- Bikanervala

- Haldiram Snacks Food Pvt. Ltd.

- ITC Limited

- Parle Products Pvt. Ltd

- PepsiCo

- Prataap Snacks Limited

- Sundrop Brands Limited

- TTK Foods

India Snacks Market News:

- In 2023, F&B giant Pepsico has joined the Open Network for Digital Commerce (ONDC) in India to expand product discoverability and reach a wider customer base through ONDC-affiliated seller applications. This partnership aims to leverage technology solutions for faster market approaches and enhanced consumer experiences, aligning with PepsiCo India's focus on maximizing consumer choices.

- In 2024, Bikano, a snacks and sweets maker, aims to achieve a turnover of Rs 1,800 crore by the end of FY24, driven by its capacity expansion and aggressive marketing strategy. The company has invested Rs 400 crore in a new plant in Greater Noida, which will help it expand its market footprint in the northern and eastern Indias.

India Snacks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore, ‘000 Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Chips, Salted Peanuts, Fryums, Popcorns |

| Pack Types Covered | Pouch, Others |

| Pack Sizes Covered | Less than 50 gm, 50-100 gm, More than 100 gm |

| Distribution Channels Covered | General Trade, Modern Trade, Online and E-Commerce, Others |

| States Covered | Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, Andhra Pradesh, Telangana, Goa, Others |

| Companies Covered | Balaji Wafers & Namkeens, Bikaji Foods International Limited, Bikanervala, Haldiram Snacks Food Pvt. Ltd., ITC Limited, Parle Products Pvt. Ltd, PepsiCo, Prataap Snacks Limited, Sundrop Brands Limited, TTK Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India snacks market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India snacks industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India snacks market was valued at INR 46,571.3 Crore in 2024.

We expect the India snacks market to exhibit a CAGR of 8.63% during 2025-2033.

The rising consumer inclination towards natural, organic, vegan, low-calorie, and gluten-free snack variants in different flavors, textures, and seasonings, is primarily driving the India snacks market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of snacks across the nation.

Based on the product type, the India snacks market has been divided into chips, salted peanuts, fryums, and popcorns. Among these, chips currently exhibit a clear dominance in the market.

Based on the pack type, the India snacks market can be categorized into pouch and others. Currently, pouch accounts for the majority of the total market share.

Based on the pack size, the India snacks market has been segregated into less than 50 gm, 50-100 gm, and more than 100 gm, where less than 50 gm currently holds the largest market share.

Based on the distribution channel, the India snacks market can be bifurcated into general trade, modern trade, online and e-commerce, and others. Currently, general trade exhibits a clear dominance in the market.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Delhi, Gujarat, Karnataka, Andhra Pradesh, Telangana, Goa, and others, where Maharashtra currently dominates the India snacks market.

Some of the major players in the India snacks market include Balaji Wafers & Namkeens, Bikaji Foods International Limited, Bikanervala, Haldiram Snacks Food Pvt. Ltd., ITC Limited, Parle Products Pvt. Ltd, PepsiCo, Prataap Snacks Limited, Sundrop Brands Limited, TTK Foods, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)