India Smartphone Market Size, Share, Trends and Forecast by Operating System, Display Technology, RAM Capacity, Price Range, Distribution Channel, and Region, 2026-2034

India Smartphone Market Size:

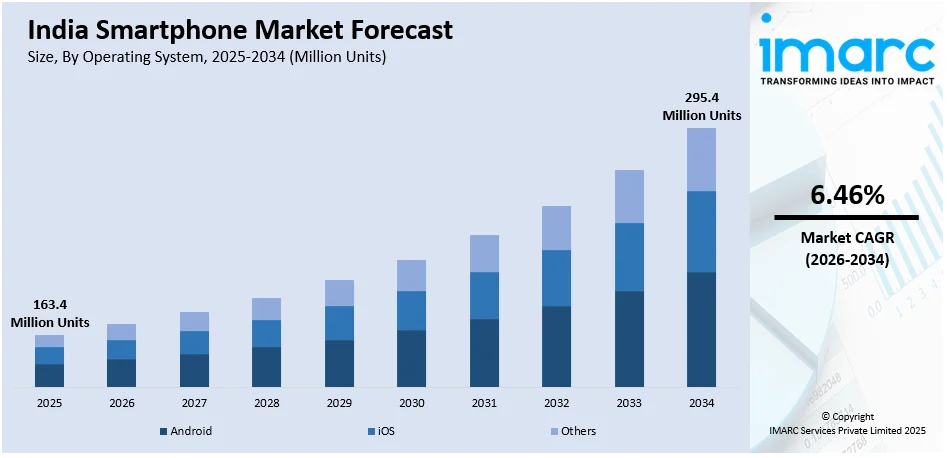

The India smartphone market size reached 163.4 Million Units in 2025. Looking forward, IMARC Group expects the market to reach 295.4 Million Units by 2034, exhibiting a growth rate (CAGR) of 6.46% during 2026-2034. The market is rapidly expanding due to the increasing internet penetration, rapid innovations in smartphone technologies, the rollout of advanced internet infrastructure like fifth-generation (5G) networks, increasing cost-effectiveness of smartphones, and the introduction of supportive government initiatives towards digital penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 163.4 Million Units |

| Market Forecast in 2034 | 295.4 Million Units |

| Market Growth Rate (2026-2034) | 6.46% |

India Smartphone Market Analysis:

- Major Market Drivers: The increasing utilization of the internet, fueled by low-cost data plans and government efforts, is accelerating smartphone adoption in India. Furthermore, the availability of smartphones at a variety of price points, combined with frequent technological breakthroughs, is driving the expansion of the market.

- Key Market Trends: The rise of e-commerce platforms and the preference for online shopping due to convenience and frequent discounts are boosting the market growth. Along with this, the rising disposable incomes and a tech-enthusiast youth population that demand mid-range and premium smartphones, as well as the rollout of fifth-generation (5G) technology, are influencing the India smartphone market growth.

- Geographical Trends: South and West India exhibit considerable demand for mid-range to high-end smartphones, which is supported by technologically advanced urban populations and a dynamic information technology (IT) sector. North and East India, on the other hand, have a more diverse market, with a stronger demand for low-cost smartphones in rural areas.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: The market encounters several challenges, such as price sensitivity and manufacturing competitiveness, which impede market growth. However, the rising demand for 5G smartphones, the expansion of its digital infrastructure, and a growing middle class are expected to drive the demand for more advanced and premium devices.

To get more information on this market Request Sample

India Smartphone Market Trends:

Rapid Digital Transformation and Increasing Internet Penetration

India's digital transformation is a crucial driver of the smartphone market. The country has witnessed a massive shift towards digitalization, driven by the government's push for a digital economy, increased internet penetration, and the rise of digital services. Over the last decade, India's internet user base has grown exponentially, largely due to the affordability and widespread availability of internet services. There were 751.5 million internet users in India at the start of 2024 when internet penetration stood at 52.4 percent. The introduction of 5G technology significantly lowered data costs, making internet access more affordable for the average consumer. This rise in internet penetration has directly influenced smartphone adoption, as more consumers require devices that can access the internet efficiently.

Rising Innovation in Smartphone Technology

The growing rate of technological innovation, as smartphone manufacturers launch new models with upgraded features such as better cameras, larger screens, longer battery life, and faster processors at competitive pricing, is boosting the India smartphone market share. Furthermore, the use of technologies like artificial intelligence (AI), machine learning (ML), and augmented reality (AR) in smartphones to attract consumers who are seeking devices with more than just basic features is driving the market growth. As per industry reports, 62% of Indian consumers want technology that knows them and can make recommendations. These technological advancements cater to a variety of needs, such as gaming, photography, business, and education, thereby broadening the market appeal.

Expansion of Internet Infrastructure and 5G Rollout

The expansion of internet infrastructure is another major driver of the Indian smartphone market. Moreover, the development of a robust telecom infrastructure, particularly the installation of 5G networks to improve internet access across the country, is driving the expansion of this market. 5G provides faster download speeds, lower latency, and greater overall network performance, enhancing the user experience for streaming, gaming, and data-intensive applications. In accordance with this, the increased use of 5G-compatible smartphones to take advantage of these upgraded capabilities is increasing the India smartphone market size. Furthermore, the expansion of internet infrastructure is playing a crucial role in bridging the digital divide between urban and rural areas, is serving as a growth-promoting force. Along with this, the government and private telecom operators are enabling more people to participate in the digital economy by providing affordable and reliable internet access in underserved regions, which, in turn, is accelerating the market expansion.

India Smartphone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on operating system, display technology, RAM capacity, price range, and distribution channel.

Breakup by Operating System:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes android, iOS, and others.

The India smartphone market outlook suggests that the Android operating system offers a wide range of device options across various price points. Its open-source nature allows multiple manufacturers to offer smartphones that cater to different consumer needs and budgets. Additionally, Android's compatibility with numerous apps and services and its regular updates and customizability appeal to tech-enthusiast users.

The iOS segment caters to premium and affluent consumers. iOS devices are known for their seamless integration with the Apple ecosystem, high-quality hardware, and robust security features, which attract consumers seeking a premium user experience and brand prestige. Moreover, Apple's focus on product quality, design, and innovation has cultivated a loyal customer base in India.

Breakup by Display Technology:

- LCD Technology

- OLED Technology

A detailed breakup and analysis of the market based on the display technology have also been provided in the report. This includes LCD technology and OLED technology.

Smartphones with liquid crystal display (LCD) technology offer an affordable option for consumers who prioritize cost over high-end display quality. LCD screens are known for their brightness and good color reproduction, making them suitable for a variety of everyday tasks such as browsing, social media, and video streaming. Moreover, the widespread availability and affordability of LCD-equipped smartphones, making them a popular choice among a broad demographic, including first-time smartphone buyers and users in rural and semi-urban areas, is boosting the India smartphone demand.

Smartphones with organic light-emitting diode (OLED) technology offer superior display quality with vibrant colors, deeper blacks, and greater energy efficiency compared to LCDs. OLED screens are typically found in high-end smartphones, appealing to consumers who seek enhanced visual experiences for activities like gaming, watching videos, and using multimedia applications. Moreover, the ability of OLED displays to render more dynamic and high-contrast visuals is fueling the market growth.

Breakup by RAM Capacity:

- Below 4GB

- 4GB-8GB

- Over 8GB

The report has provided a detailed breakup and analysis of the market based on the RAM capacity. This includes below 4GB, 4GB-8GB, and over 8GB.

Smartphones with below 4GB RAM cater to budget-conscious consumers and first-time smartphone buyers. These devices are typically designed for basic use, such as calling, texting, browsing the internet, and using light applications. They are popular in rural and semi-urban areas, where affordability and essential functionality are the primary considerations for buyers.

Smartphones with 4GB to 8GB of RAM appeal to a diverse group of consumers who seek a balance between performance and affordability. This RAM capacity is ideal for users who require a smooth multitasking experience, enhanced gaming performance, and the ability to run a wide range of applications without significant lag.

As per the India smartphone market report, the over 8GB RAM segment represents the premium and flagship categories of the market, targeting tech enthusiasts and power users who demand high performance for gaming, content creation, and professional use. Smartphones in this segment are equipped with powerful processors and large amounts of RAM to handle heavy multitasking, high-end gaming, and resource-intensive applications like video editing and graphic design.

Breakup by Price Range:

- Ultra Low-End (Less Than $100)

- Low-End ($100-<$200)

- Mid-Range ($200-<$400)

- Mid to High-End ($400-<$600)

- High-End ($600-<$800)

- Premium ($800-<$1000) and Ultra-Premium ($1000 and Above)

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes ultra low-end (less than $100), low-end ($100-<$200), mid-range ($200-<$400), mid to high-end ($400-<$600), high-end ($600-<$800), and premium ($800-<$1000) and ultra-premium ($1000 and above).

According to the India smartphone market research report, the ultra low-end segment consists of smartphones priced below $100. It caters to first-time smartphone buyers, budget-conscious consumers, and users in rural or emerging markets in India. These devices are characterized by basic features, such as minimal RAM, low-resolution displays, and entry-level processors, focusing on providing essential functionality like calling, texting, and light internet browsing.

Smartphones in the low-end segment, priced between $100 and less than $200, offer a more balanced mix of affordability and functionality, appealing to a broad range of consumers seeking better performance without a significant price increase. These devices offer higher RAM capacity, better camera quality, and slightly more robust processors, making them suitable for basic multitasking, social media usage, and casual gaming.

The mid-range segment covers smartphones priced between $200 and less than $400. It targets a diverse consumer base, including young professionals, students, and tech enthusiasts who demand a good balance of performance, quality, and affordability. Smartphones in this category feature higher-resolution displays, more powerful processors, better camera systems, and larger battery capacities, making them ideal for multitasking, gaming, and multimedia consumption.

The mid to high-end segment, priced between $400 and less than $600, caters to consumers looking for premium features without the premium price tag. Smartphones in this category often include flagship-level features such as high-quality displays, advanced camera systems, powerful processors, and premium build materials. This segment attracts users who demand high performance for tasks like gaming, photography, and professional use but who do not want to invest in the most expensive devices.

As per the India smartphone market research report, smartphones in the high-end segment, priced between $600 and less than $800, are designed for consumers seeking a near-flagship experience, combining high performance, premium build quality, and advanced features. Devices in this segment come with powerful processors, high-resolution OLED displays, superior camera systems, and features like water resistance, wireless charging, and enhanced security.

The premium segment encompasses smartphones priced between $800 and less than $1000. It targets affluent consumers and professionals who prioritize the latest technology, superior build quality, and brand prestige. Devices in this category are flagship models from leading brands, offering the best in class in terms of display technology, camera performance, processing power, and design.

The ultra-premium segment includes smartphones priced at $1000 and above, catering to a niche market of tech enthusiasts, professionals, and luxury buyers who seek the absolute best in technology, design, and brand prestige. These devices represent the pinnacle of smartphone innovation, often featuring the most advanced camera systems, highest quality displays, fastest processors, and premium materials like glass, ceramic, or metal.

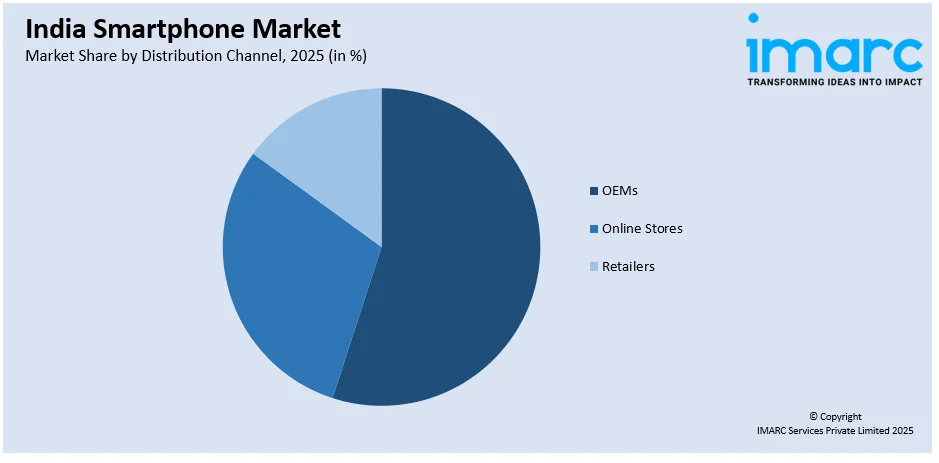

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- OEMs

- Online Stores

- Retailers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEMs, online stores, and retailers.

As per the India smartphone market trends, original equipment manufacturers (OEMs) include manufacturers that sell their devices directly to consumers through their own branded stores or official websites. This distribution channel allows manufacturers to maintain full control over the customer experience, pricing, and inventory management. OEMs offer exclusive models, promotions, and services and help manufacturers build stronger brand loyalty by providing personalized customer support, specialized retail environments, and seamless integration of their entire product ecosystem.

The online stores segment is driven by the rapid growth of e-commerce platforms, as well as manufacturers' online stores. This channel appeals to a wide range of consumers due to its convenience, extensive product variety, competitive pricing, and frequent promotional offers, such as flash sales and discounts. Online stores also provide detailed product information, customer reviews, and comparison tools, helping consumers make informed purchasing decisions.

The retailer segment comprises organized retail chains and small independent shops. They provide a tactile shopping experience, allowing consumers to physically interact with the product before purchasing. Moreover, organized retail chains offer a range of smartphones across various brands that cater to diverse consumer needs with personalized customer service and post-purchase support, thus enhancing the India smartphone market share.

Breakup by Region:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India.

The smartphone market in South India is characterized by high adoption rates, driven by a strong urban population, a relatively higher standard of living, and widespread digital literacy. Moreover, the strong preference for mid-range to high-end smartphones, favoring brands that offer advanced features, superior build quality, and excellent after-sales support, is boosting the market growth.

The smartphone market in North India is highly diverse, reflecting the region's mix of urban, semi-urban, and rural areas. Moreover, the presence of consumers who are well-versed in digital technology and prefer smartphones with a good balance of performance, features, and affordability is fueling the market growth. Besides this, the strong demand for mid-range and premium smartphones, driven by brand-conscious consumers who are looking for devices that offer prestige and advanced functionality, is enhancing the market growth.

Based on the India smartphone market forecast, West and Central India represent a dynamic and evolving market, influenced by the region's economic diversity and varying levels of urbanization. The presence of a high concentration of young professionals and students, driving the demand for smartphones with advanced features suitable for multitasking, gaming, and content consumption, is stimulating the market growth.

The smartphone market in East India is growing steadily, with significant demand stemming from urban and rural areas. Moreover, the growing interest in mid-range smartphones that offer good performance, camera quality, and battery life, catering to the needs of a burgeoning middle class and a tech-aware youth demographic, is fueling the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- The major players in the market are leveraging a mix of aggressive pricing strategies, innovative technology offerings, and extensive distribution networks to capture diverse consumer segments. They are focusing on providing feature-rich smartphones at competitive prices, targeting price-sensitive consumers with online flash sales and strong e-commerce partnerships. Moreover, other brands are enhancing their mid-range and premium portfolios with innovations in display technology, camera systems, and 5G capabilities to appeal to tech-enthusiast users and professionals. Besides this, they are expanding their presence in the premium segment by offering financing options, trade-in programs, and local manufacturing to make the products more accessible.

India Smartphone Market News:

- In July 2024, TECNO launched the SPARK 20 Pro 5G in India. The product is available for purchase on Amazon and in offline stores. The smartphone features support for 10 5G bands, a 108MP camera, 16GB RAM, and up to 256GB storage. It boasts a 6.78-inch Full-HD+ display with a 120Hz refresh rate, powered by the MediaTek Dimensity 6080 chipset. The SPARK 20 Pro 5G also includes a 5,000mAh battery with fast charging, Dolby Atmos sound, and a stylish superellipse design.

- In August 2024, Google announced the production of its Pixel 8 smartphones in India ahead of its 'Made by Google' event. This step by Google aligns with India's 'Make in India' initiative. Pixel smartphones will be available offline at Reliance Digital and Croma stores, marking a major shift in Google's strategy. By manufacturing Pixel devices locally, Google aims to tap into the growing demand for premium smartphones in India and potentially reduce costs associated with imports.

India Smartphone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Systems Covered | Android, iOS, Others |

| Display Technologies Covered | LCD Technology, OLED Technology |

| RAM Capacities Covered | Below 4GB, 4GB-8GB, Over 8GB |

| Price Ranges Covered | Ultra Low-End (Less Than $100), Low-End ($100-<$200), Mid-Range ($200-<$400), Mid To High-End ($400-<$600), High-End ($600-<$800), Premium ($800-<$1000) and Ultra-Premium ($1000 And Above) |

| Distribution Channels Covered | OEMs, Online Stores, Retailers |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smartphone market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smartphone market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smartphone industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smartphone market reached 163.4 Million Units in 2025.

The India smartphone market is expected to exhibit a CAGR of 6.46% during 2026-2034, reaching 295.4 Million Units by 2034.

Growth is fueled by the expanding adoption of smartphones, growing consumer preference for enhanced functionalities, affordable devices, and wider internet access across both urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)