India Smart Welding Equipment Market Size, Share, Trends and Forecast by Component, Material Type, Welding Technology, Automation Level, End Use Industry, and Region, 2025-2033

India Smart Welding Equipment Market Overview:

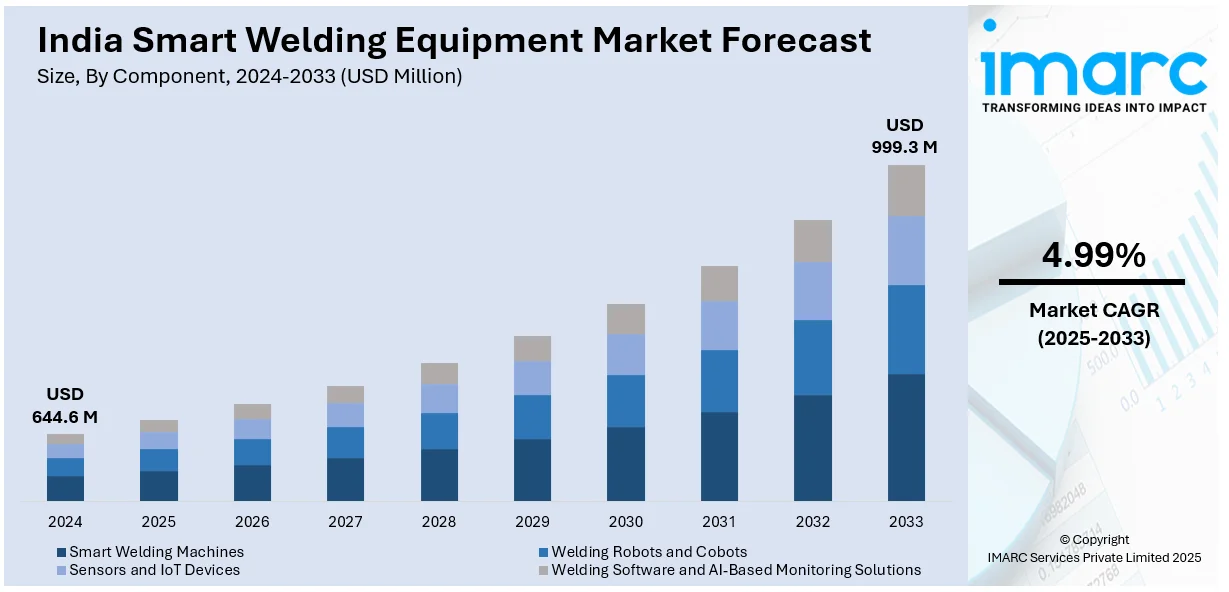

The India smart welding equipment market size reached USD 644.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 999.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.99% during 2025-2033. The market is driven due to technological innovations, accelerating industrial automation, and the demand for efficient and accurate welding solutions. Growing investments in advanced manufacturing processes are also supporting market growth and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 644.6 Million |

| Market Forecast in 2033 | USD 999.3 Million |

| Market Growth Rate 2025-2033 | 4.99% |

India Smart Welding Equipment Market Trends:

Adoption of Automated and Robotic Welding Solutions

The India smart welding equipment market is undergoing a transition toward automation and robotic welding systems. Companies in industries like automotive, construction, and heavy engineering are incorporating automated welding solutions to drive operational efficiency and accuracy. Robotic arms for welding and collaborative robots (cobots) fitted with sophisticated sensors and artificial intelligence (AI) algorithms are undertaking complicated and repetitive welding operations with minimal manual intervention. These systems provide consistent weld quality, minimize production time, and improve worker safety. Real-time monitoring and predictive maintenance capabilities also enable companies to optimize the usage of equipment and avoid downtime. With government programs such as "Make in India" spurting industry growth, organizations are making significant investments in intelligent welding technologies to compensate for growing production needs. The synergy of lower labor expenses, increased productivity, and better-quality control is rendering automated welding an attractive option for Indian manufacturers in the competitive industrial environment.

To get more information on this market, Request Sample

Integration of Advanced Sensors and Artificial Intelligence (AI)

The fusion of next-generation sensors and artificial intelligence (AI) is revolutionizing India's smart welding equipment market. AI-based welding machines with smart sensors track important parameters like temperature, voltage, and weld seam position in real time. These sensors receive real-time data, facilitating predictive analysis and instant error detection. AI algorithms also optimally adjust welding parameters in real time to produce quality welds with less material wastage. For example, in March 2024, RR CAT made AI-based welding technologies propositions such as nitrogen-improved shield gas technology for enhanced fatigue, creep, and corrosion resistance of stainless steel welds to enhance sustainable manufacturing and maximize equipment service life. Further, AI-driven quality control solutions are able to identify microscopic faults that may remain undetected by human checkers. Usage of predictive maintenance solutions also reduces downtime by highlighting machine faults prior to causing any failure. Automobile, rail, and ship industries are increasingly employing AI-based welding solutions to achieve stringent quality controls and operational productivity. This technological innovation is setting up Indian producers to be more productive and cost-effective while improving the overall dependability of their welding operations.

Emphasis on Energy-Efficient and Sustainable Welding Technologies

Sustainability is emerging as a priority area in the Indian manufacturing industry, creating demand for smart welding machinery that is energy efficient. Next-generation welding equipment based on inverter technology is much more energy-efficient than conventional ones, lowering costs of operations and minimizing the carbon footprint. For instance, in September 2023, Ador Welding Limited introduced India's first battery-operated electric welder with 200A on battery and 400A on 3-phase power, in addition to its cutting-edge welding consumables and automation solutions, encouraging sustainability and lowering carbon footprints. Moreover, laser welding and friction stir welding technologies are picking up steam for their high-quality weld output while keeping energy usage to a minimum. In addition, smart welding solutions usually have energy management systems that maximize the utilization of power based on real-time data monitoring. The application of environmentally friendly shielding gases and recyclable materials is also complementing green manufacturing processes. Businesses are conforming their operations to government policies and sustainability requirements, which are helping lower carbon footprints. With India further emphasizing its efforts to become more ecofriendly through infrastructure and renewable energy projects, the use of energy-efficient welding technology will see an increase. This move demonstrates a general industry dedication to efficient operations and sustainable practices.

India Smart Welding Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, material type, welding technology, automation level, and end use industry.

Component Insights:

- Smart Welding Machines

- Welding Robots and Cobots

- Sensors and IoT Devices

- Welding Software and AI-Based Monitoring Solutions

The report has provided a detailed breakup and analysis of the market based on the component. This includes smart welding machines, welding robots and cobots, sensors and IoT devices, welding software and AI-based monitoring solutions.

Material Type Insights:

- Steel and Stainless Steel Welding

- Aluminum and Non-Ferrous Metal Welding

- Composite and Advanced Material Welding

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel and stainless-steel welding, aluminum and non-ferrous metal welding, composite and advanced material welding.

Welding Technology Insights:

- Arc Welding

- Resistance Welding

- Laser Welding

- Electron Beam Welding

- Ultrasonic Welding

- Friction Stir Welding

- Plasma Welding

The report has provided a detailed breakup and analysis of the market based on the welding technology. This includes arc welding, resistance welding, laser welding, electron beam welding, ultrasonic welding, friction stir welding, plasma welding.

Automation Level Insights:

- Manual Welding Equipment

- Semi-Automated Welding Systems

- Fully Automated and AI-Integrated Welding Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes manual welding equipment, semi-automated welding systems, fully automated and ai-integrated welding systems.

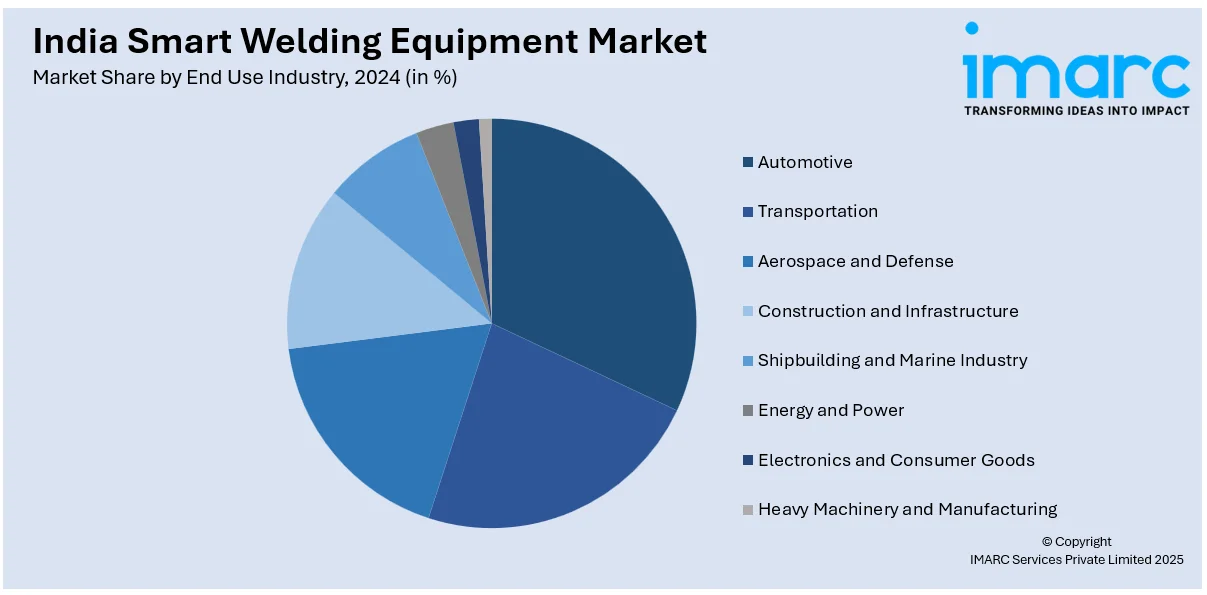

End Use Industry Insights:

- Automotive

- Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Shipbuilding and Marine Industry

- Energy and Power

- Electronics and Consumer Goods

- Heavy Machinery and Manufacturing

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, transportation, aerospace and defense, construction and infrastructure, shipbuilding and marine industry, energy and power, electronics and consumer goods, heavy machinery and manufacturing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Welding Equipment Market News:

- In February 2025, Delta debuted its D-Bot series of collaborative robots at ELECRAMA 2025 with smart manufacturing and sophisticated safety features, providing accurate, efficient, and high-speed welding solutions with payload ratings of up to 30 kg and speeds of 200 degrees per second.

- In June 2024, Arm Welders diversified into automation and laser welding with a new 2 lakh sq. ft. unit at Pune, expanding its business in the smart welding equipment sector by providing state-of-the-art, automated solutions to cater to changing industry requirements across the automotive, railway, and global manufacturing industries.

India Smart Welding Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Smart Welding Machines, Welding Robots, Cobots, Sensors, IoT Devices, Welding Software, AI-Based Monitoring Solutions |

| Material Types Covered | Steel, Stainless Steel Welding, Aluminum, Non-Ferrous Metal Welding, Composite, Advanced Material Welding |

| Welding Technologies Covered | Arc Welding, Resistance Welding, Laser Welding, Electron Beam Welding, Ultrasonic Welding, Friction Stir Welding, Plasma Welding |

| Automation Levels Covered | Manual Welding Equipment, Semi-Automated Welding Systems, Fully Automated, AI-Integrated Welding Systems |

| End Use Industries Covered | Automotive, Transportation, Aerospace, Defense, Construction, Infrastructure, Shipbuilding, Marine Industry, Energy, Power, Electronics, Consumer Goods, Heavy Machinery, Manufacturing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart welding equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart welding equipment market on the basis of component?

- What is the breakup of the India smart welding equipment market on the basis of material type?

- What is the breakup of the India smart welding equipment market on the basis of welding technology?

- What is the breakup of the India smart welding equipment market on the basis of automation level?

- What is the breakup of the India smart welding equipment market on the basis of end use industry?

- What is the breakup of the India smart welding equipment market on the basis of region?

- What are the various stages in the value chain of the India smart welding equipment market?

- What are the key driving factors and challenges in the India smart welding equipment?

- What is the structure of the India smart welding equipment market and who are the key players?

- What is the degree of competition in the India smart welding equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart welding equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart welding equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart welding equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)