India Smart Wearables Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

India Smart Wearables Market Overview:

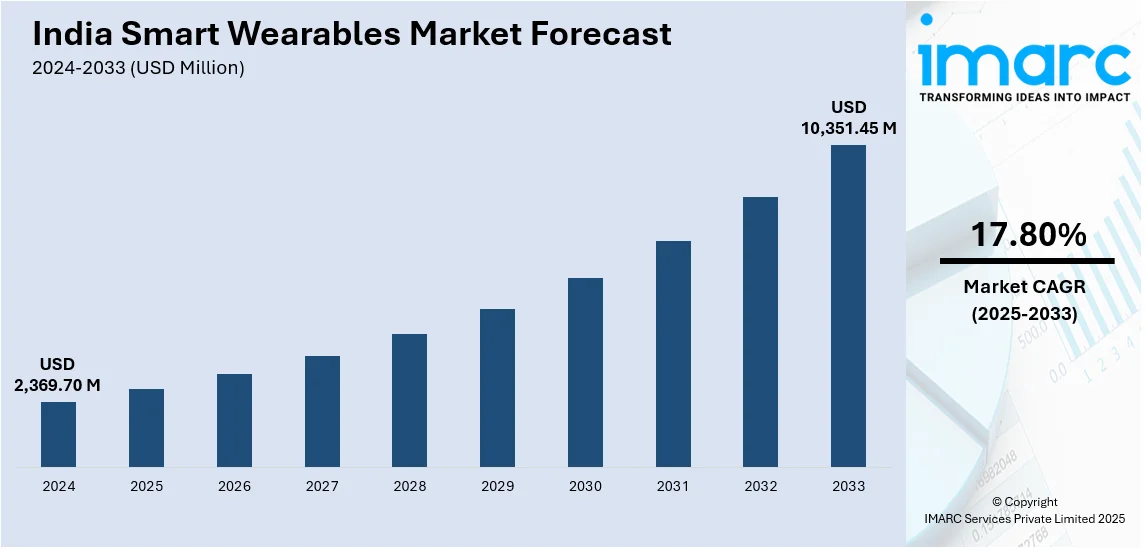

The India smart wearables market size reached USD 2,369.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,351.45 Million by 2033, exhibiting a growth rate (CAGR) of 17.80% during 2025-2033. Rising disposable incomes, increasing health awareness, growing smartphone penetration, rapid urbanization, increasing adopting fitness trackers, smartwatches, and connected devices for health monitoring, advancements in sensor technology, implementation of government initiatives promoting digital health are some of the major factors augmenting India smart wearables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,369.70 Million |

| Market Forecast in 2033 | USD 10,351.45 Million |

| Market Growth Rate 2025-2033 | 17.80% |

India Smart Wearables Market Trends:

Rising Adoption of Health and Fitness Tracking Features

The increased demand for health and fitness-focused devices as consumers prioritize wellness is positively impacting India smart wearables market outlook. According to an industry report, one in ten individuals has diabetes, with the number of affected adults projected to rise from 537 million to 643 million by 2030 and 784 million by 2045. Approximately 10% of adults over 18 experience mental health disorders. The increasing prevalence of lifestyle diseases like diabetes, hypertension, and obesity is driving individuals to monitor their health proactively. Smartwatches and fitness bands features cutting-edge sensors to measure blood oxygen levels (SpO2), heart rate, sleep quality, and even ECG readings, all of which greatly aid in health monitoring. The growing awareness regarding continuous health monitoring is providing an impetus to the market. In addition to this, corporate wellness programs are also incorporating wearables to encourage employee fitness, thereby strengthening fitness tracker adoption in workplaces. Furthermore, the integration of stress tracking and guided breathing exercises in newer models caters to the rising demand for mental health management. In line with this, the growing government's focus on preventive healthcare through initiatives like Ayushman Bharat Digital Mission is expected to drive demand for wearables with medical-grade features. This market trend is reshaping smart wearables from mere lifestyle gadgets to essential health management tools in India.

To get more information on this market, Request Sample

Expansion of Artificial Intelligence (AI) and IoT-Enabled Smart Wearables

The integration of artificial intelligence (AI) and the Internet of Things (IoT) in smart wearables is transforming user experiences and expanding their applications. AI-driven features, such as personalized fitness recommendations, adaptive workout tracking, and predictive health alerts, are enhancing the functionality of smart devices. Internet of things (IoT) connectivity enables seamless synchronization between wearables and smart home ecosystems, allowing users to control IoT-enabled appliances, receive real-time notifications, and even unlock vehicles through their smartwatches. Brands are investing in AI-based algorithms that analyze sleep patterns, stress levels, and workout efficiency, offering actionable insights tailored to individual users. For instance, on January 2025, Indian electronics brand Noise introduced its ColorFit Pro 6 Series smartwatches, comprising the ColorFit Pro 6 and ColorFit Pro 6 Max models. These devices feature AI-powered personalization, including adaptive watch faces and an AI Companion that provides personalized health insights. Both models offer advanced health tracking and gesture controls and are compatible with Android and iOS platforms. In addition to this, AI-powered voice assistants and gesture controls are enhancing accessibility, thereby facilitating India smart wearables market growth. Moreover, the government's push for domestic electronics manufacturing through the Production Linked Incentive (PLI) scheme is encouraging local brands to integrate advanced AI and IoT capabilities, which is strengthening the market.

India Smart Wearables Market Segmentation:

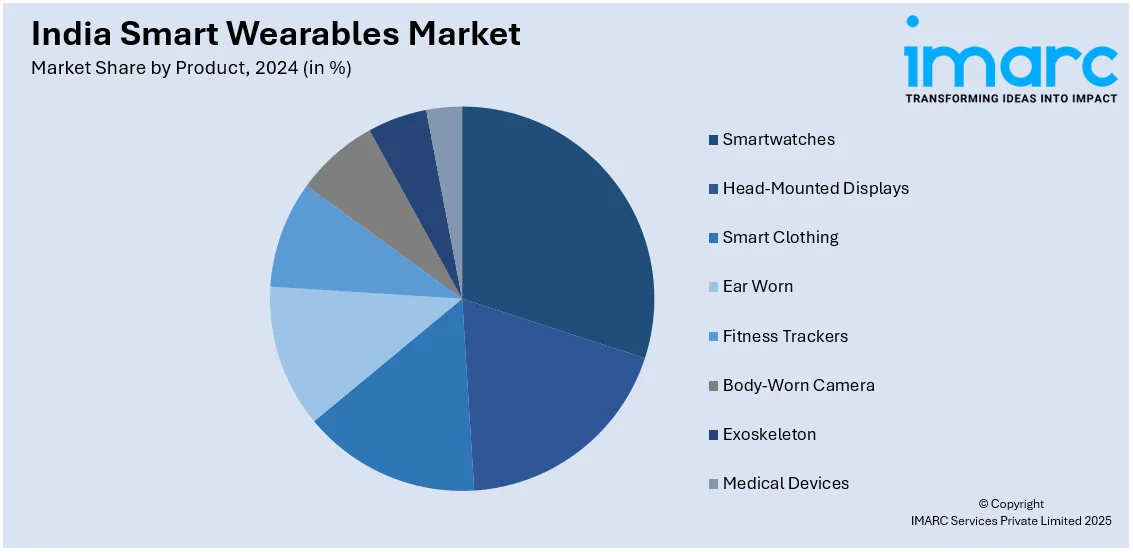

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Smartwatches

- Head-Mounted Displays

- Smart Clothing

- Ear Worn

- Fitness Trackers

- Body-Worn Camera

- Exoskeleton

- Medical Devices

The report has provided a detailed breakup and analysis of the market based on the product. This includes smartwatches, head-mounted displays, smart clothing, ear worn, fitness trackers, body-worn camera, exoskeleton, and medical devices.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Wearables Market News:

- On February 15, 2025, Lava's sub-brand, Prowatch, introduced the Prowatch X smartwatch in India, priced at INR 4,499 (about USD 51.91). This device features a 1.43-inch AMOLED display protected by Corning Gorilla Glass 3, supports over 110 sports modes, and offers advanced health monitoring tools such as VO₂ Max measurement and Heart Rate Variability tracking. The Prowatch X became available for purchase on Flipkart starting February 21, 2025.

- On March 12, 2025, Garmin launched the Enduro 3 series GPS smartwatches in India, targeting athletes and adventurers. Priced from INR 1,05,990 (about USD 1222.81), these 63-gram watches feature solar charging and offer up to 110 hours of battery life in GPS mode. They include advanced health and fitness tracking, preloaded TopoActive maps, and meet military-grade durability standards.

India Smart Wearables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smartwatches, Head-Mounted Displays, Smart Clothing, Ear Worn, Fitness Trackers, Body-Worn Camera, Exoskeleton, Medical Devices |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart wearables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart wearables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart wearables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart wearables market in the India was valued at USD 2,369.70 Million in 2024.

The India smart wearables market is projected to exhibit a CAGR of 17.80% during 2025-2033, reaching a value of USD 10,351.45 Million by 2033.

The smart wearables market in India is expanding rapidly, driven by factors like increasing health awareness, technological advancements, and rising disposable incomes. People are adopting devices such as smartwatches and fitness trackers for health monitoring and lifestyle management. Government initiatives and the growth of e-commerce are further accelerating the market adoption and accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)