India Smart Water Management Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

Market Overview:

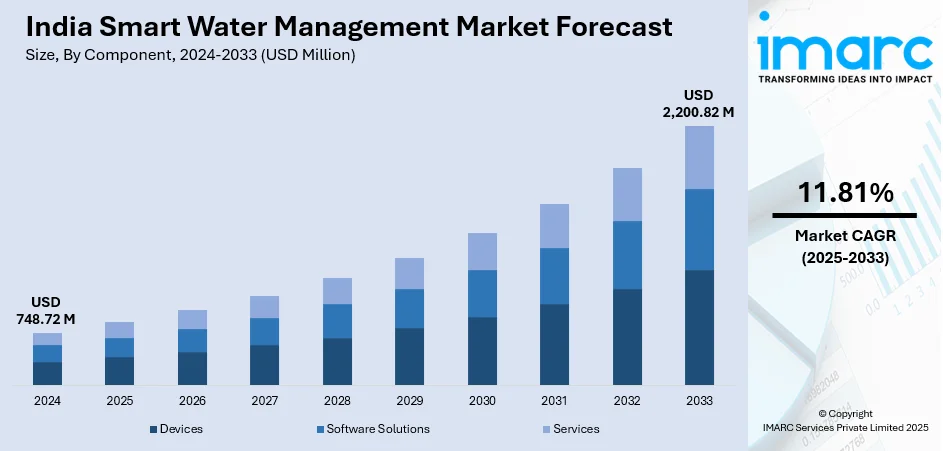

India smart water management market size reached USD 748.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,200.82 Million by 2033, exhibiting a growth rate (CAGR) of 11.81% during 2025-2033. The rising need for water conservation, advancements in ICT solutions, and the growing emphasis on environmental sustainability are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 748.72 Million |

|

Market Forecast in 2033

|

USD 2,200.82 Million |

| Market Growth Rate 2025-2033 | 11.81% |

Smart water management (SWM) denotes an information and communication technology (ICT) solution designed to gather, exchange, and analyze real-time data from water networks. Utilizing digital meters, sensors, supervisory control and data acquisition (SCADA) systems, and geographic information systems (GIS), it engages with wastewater systems for communication and interaction. SWM systems employ these technologies to identify leaks, optimize energy consumption, promote water conservation, forecast equipment malfunctions, and ensure adherence to regulatory standards. Additionally, these systems seamlessly integrate with advanced pressure management, sophisticated analytics, meter data management, residential water efficiency measures, and intelligent irrigation management systems, collectively contributing to heightened operational efficiency.

To get more information on this market, Request Sample

India Smart Water Management Market Trends:

The smart water management market in India is witnessing a transformative surge as the country leverages advanced information and communication technology (ICT) solutions to revolutionize water network operations. The implementation of smart water management in India addresses crucial aspects of water network management by utilizing innovative technologies. Additionally, these systems play a pivotal role in detecting leaks promptly, optimizing energy usage, promoting water conservation, predicting potential equipment failures, and ensuring compliance with regulatory standards. Besides this, the integration of smart water management with advanced pressure management, sophisticated analytics, meter data management, residential water efficiency measures, and intelligent irrigation management systems further enhances operational efficiency across the water sector. In the context of a rapidly growing population and increasing urbanization, efficient water management is a pressing concern for India. The adoption of smart water management aligns with the nation's commitment to leveraging technology for sustainable and resource-efficient practices. Apart from this, as India continues to invest in modernizing its water infrastructure, the integration of SWM is expected to play a pivotal role in achieving efficient, data-driven, and sustainable water management practices across urban and rural landscapes. The convergence of technology and water management positions SWM as a key contributor to India's efforts in securing a water-resilient future. This, in turn, is anticipated to fuel the market growth in the coming years.

India Smart Water Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component and application.

Component Insights:

- Devices

- Advanced Water Meters

- Meter Read Technology

- Software Solutions

- Asset Management

- Distribution Network Monitoring

- Supervisory Control and Data Acquisition (SCADA)

- Meter Data Management (MDM)

- Advance Analytics

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes devices (advanced water meters and meter read technology), software solutions (asset management, distribution network monitoring, supervisory control and data acquisition (SCADA), meter data management (MDM), advance analytics, and others), and services (managed services and professional services).

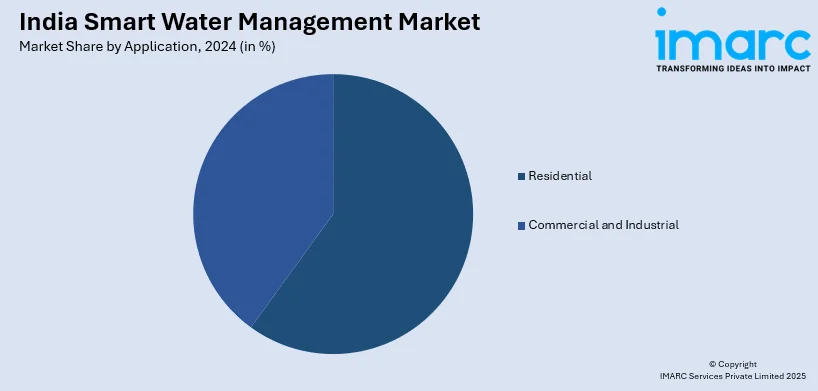

Application Insights:

- Residential

- Commercial and Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial and industrial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Water Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Residential, Commercial and Industrial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart water management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart water management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart water management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smart water management market was valued at USD 748.72 Million in 2024.

The India smart water management market is projected to exhibit a CAGR of 11.81% during 2025-2033, reaching a value of USD 2,200.82 Million by 2033.

The India smart water management market is driven by increasing water scarcity, rapid urbanization, and the need for efficient resource utilization. Government initiatives promoting smart cities, digital metering, and infrastructure upgrades support adoption. Additionally, rising industrial demand and awareness about sustainable water usage are accelerating investment in smart water solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)