India Smart Speaker Market Size, Share, Trends and Forecast by Component, Intelligent Virtual Assistant, Connectivity, Price Range, Distribution Channel, End User, and Region, 2025-2033

India Smart Speaker Market Size:

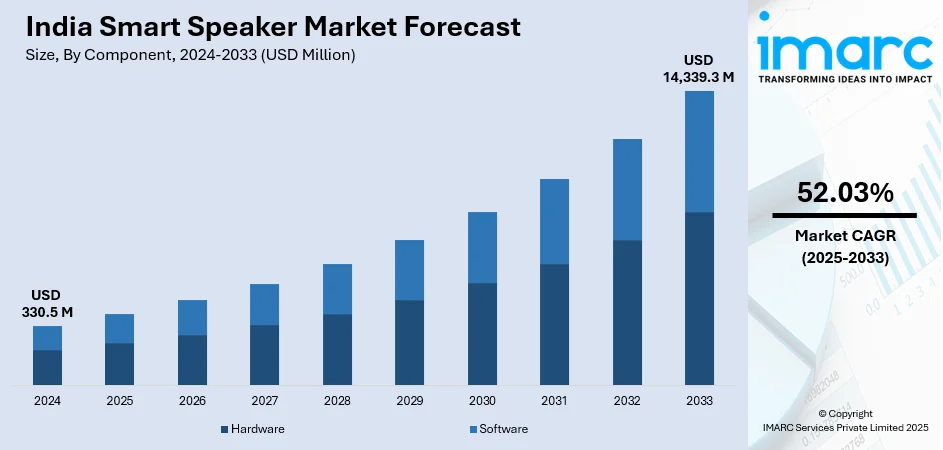

India smart speaker market size reached USD 330.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,339.3 Million by 2033, exhibiting a growth rate (CAGR) of 52.03% during 2025-2033. The increasing internet penetration, rising smart home adoption, growing consumer demand for voice-activated devices, expanding e-commerce channels, improved artificial intelligence (AI) technologies, competitive pricing, and integration with entertainment, home automation, and multilingual capabilities are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.5 Million |

| Market Forecast in 2033 | USD 14,339.3 Million |

| Market Growth Rate 2025-2033 | 52.03% |

India Smart Speaker Market Analysis:

- Major Market Drivers: Increasing internet penetration and rising smart home adoption are prime factors driving the market growth, as consumers seek convenience and connectivity. The growing demand for voice-activated devices, coupled with improved AI technologies, also fuels market expansion. Besides this, the competitive pricing and a broad range of smart speaker features cater to diverse consumer needs is impelling the market growth.

- Key Market Trends: Rising consumer adoption, advancements in voice recognition technology, and rising disposable incomes are some of the prominent trends influencing market expansion. In line with this, the surging popularity of smart home ecosystems and affordable pricing is fostering market growth. Moreover, major market players are focusing on enhancing local language support and integrating with other smart devices to capture a larger market share.

- Geographical Trends: North India, with high urbanization and disposable incomes, shows significant growth in premium and mid-range smart speakers. However, West and Central India benefit from rising consumer awareness and tech infrastructure, while South India’s tech-savvy population drives demand for innovative features. East and Northeast India are emerging markets with growing interest, supported by improved internet infrastructure.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: Challenges include regional disparities in internet access and varying levels of consumer awareness about smart speakers. Meanwhile, opportunities lie in addressing these disparities with affordable models, expanding regional language support, and enhancing the distribution network to reach untapped rural and semi-urban areas.

To get more information on this market, Request Sample

India Smart Speaker Market Trends:

Rising adoption of smart homes

With expanding urbanization across India, there is a growing trend towards the adoption of smart home technologies. Consumers are increasingly seeking convenience, efficiency, and security in their homes, leading to a surge in demand for smart devices. Smart speakers, as central hubs for controlling various connected devices, play a crucial role in this ecosystem. The ability to manage lighting, security systems, thermostats, and other smart appliances through voice commands has made smart speakers an integral part of modern homes. Additionally, the rise of affordable smart home products and greater awareness among consumers about the benefits of these technologies are further bolstering the India smart speaker market growth.

Rise of regional language support

India's linguistic diversity is vast, with hundreds of languages spoken across the country. Recognizing the importance of catering to this diversity, smart speaker manufacturers are increasingly focusing on incorporating regional language support into their devices. This trend is pivotal in making smart speakers more accessible to a broader audience, including non-English speaking users. By offering voice assistants that understand and respond in regional languages, companies are tapping into a massive potential market, particularly in rural and semi-urban areas. This development enhances user experience and fosters greater adoption among consumers who prefer interacting in their native languages. The availability of content and services in regional languages, such as news, music, and podcasts, is also boosting the India smart speaker demand by making them more attractive options for a diverse range of users.

Integration with entertainment and home automation systems

Another significant trend driving the market growth is the seamless integration of smart speakers with entertainment and home automation systems. Consumers are increasingly looking for devices that offer more than just basic functionalities, and smart speakers are evolving to meet these expectations. The ability to stream music, access on-demand video content, and control smart TVs and sound systems through voice commands has positioned smart speakers as central entertainment hubs in households. Furthermore, the integration with home automation systems, such as smart lighting, security cameras, and door locks, is enhancing the appeal of smart speakers. Besides this, extensive collaborations between smart speaker manufacturers and content providers to offer exclusive access to streaming services, personalized recommendations, and premium content through voice-activated commands are positively influencing the India smart speaker market outlook.

India Smart Speaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, intelligent virtual assistant, connectivity, price range, distribution channel, and end user.

Breakup by Component:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Based on the India smart speaker market research, the hardware component of smart speakers includes physical parts such as microphones, speakers, processors, and connectivity modules. These parts are necessary to process data, produce audio output, and record voice commands. Advancements in hardware technology are improving sound quality, responsiveness, and the overall performance of smart speakers, thereby aiding in market expansion.

In addition to this, the software component comprises voice recognition algorithms, artificial intelligence (AI), and cloud-based platforms that power smart speakers. This includes natural language processing (NLP) capabilities and integration with various services and devices. Continuous improvements in software enhance voice command accuracy, user experience, and the ability to perform complex tasks, fostering market growth.

Breakup by Intelligent Virtual Assistant:

- Amazon Alexa

- Google Assistant

- Siri

- Cortana

- Others

A detailed breakup and analysis of the market based on intelligent virtual assistant have also been provided in the report. This includes Amazon Alexa, Google Assistant, Siri, Cortana, and others.

Amazon Alexa is a widely popular virtual assistant integrated into Amazon's Echo devices. Known for its extensive skills library, Alexa supports smart home automation, music streaming, and voice-activated tasks. Its compatibility with numerous third-party devices and services makes it a leading choice in the smart speaker market.

Moreover, Google Assistant, featured in Google Nest smart speakers, excels in search-based tasks, integrating seamlessly with Google's ecosystem. Its advanced natural language processing allows it to handle complex queries, deliver personalized results, and control smart home devices. Its multilingual capabilities also make it appealing in diverse markets like India.

Besides this, Siri, Apple's voice-activated assistant is integrated into the HomePod smart speakers. It is known for its deep integration within Apple's ecosystem and supports seamless communication with iPhones, iPads, and other Apple devices. While it offers efficient voice commands and home automation control, its limited compatibility with third-party apps is a drawback.

Furthermore, Cortana, developed by Microsoft, was once prominent in smart speakers but has scaled back its consumer presence to focus more on productivity tasks, particularly in enterprise settings. Cortana still powers certain smart speaker devices but has shifted towards integrating with Microsoft 365 services and improving workplace efficiency.

Apart from this, other smaller virtual assistants like Samsung's Bixby and other region-specific AI platforms though less dominant in the global market, often focus on niche functionalities, such as specific device ecosystems or language preferences.

Breakup by Connectivity:

- Wi-Fi

- Bluetooth

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes Wi-Fi and Bluetooth.

According to the India smart speaker market forecast, Wi-Fi connectivity allows smart speakers to access the internet for cloud-based services, voice recognition, streaming media, and smart home control. It enables seamless integration with other smart devices, offering uninterrupted performance and access to advanced features. In addition to this, Wi-Fi is also essential for providing a high-quality, connected user experience.

In contrast, Bluetooth connectivity enables smart speakers to pair directly with nearby devices, such as smartphones or tablets, without needing internet access. While it offers a limited range and functionality compared to Wi-Fi, Bluetooth is useful for playing offline audio content and enhancing device portability in localized environments.

Breakup by Price Range:

- Low-range (Less than $100)

- Mid-range ($101 to $200)

- Premium (Above $200)

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range (less than $100), mid-range ($101 to $200), and premium (above $200).

Low-range smart speakers are budget-friendly devices with basic features, targeting cost-conscious consumers. These models often focus on essential functionalities like voice commands, music streaming, and basic smart home control. Despite fewer advanced features, these speakers are popular with first-time buyers and casual users entering the smart speaker market.

Along with this, mid-range smart speakers offer enhanced audio quality, better hardware, and more advanced features such as improved voice recognition, smart home integration, and compatibility with multiple services. These devices cater to consumers seeking a balance between affordability and performance, making them ideal for users looking for greater functionality and superior sound quality.

Furthermore, premium smart speakers feature superior audio quality, advanced smart home automation capabilities, and enhanced voice recognition technologies. These devices often support high-end streaming services, personalized content, and exclusive features. They cater to consumers who prioritize top-tier performance, integration with luxury home systems, and a seamless smart home experience.

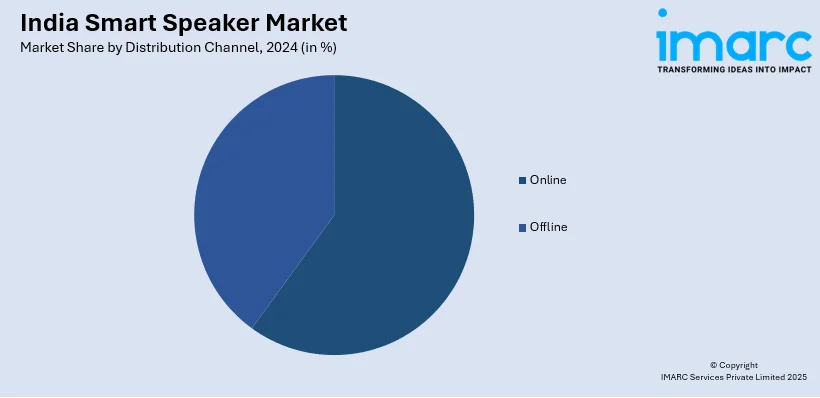

Breakup by Distribution Channel:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Online distribution channels, including e-commerce platforms and brand websites, offer consumers the convenience of purchasing smart speakers from anywhere. These channels provide access to a wide range of products, competitive pricing, and detailed product reviews, contributing to the growing preference for online shopping, thereby bolstering the India smart speaker market share.

On the other hand, offline distribution channels, such as electronics stores and retail outlets, allow consumers to physically experience smart speakers before purchasing. These channels are preferred by customers who value in-person assistance, demonstrations, and immediate access to the product.

Breakup by End User:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Personal end users include individual consumers who use smart speakers for home entertainment, voice assistance, and smart home control. This segment values features like music streaming, home automation, and personal productivity enhancements. Growth in this category is driven by increasing consumer interest in smart home technology and personal convenience.

Besides this, commercial end-users encompass businesses and organizations utilizing smart speakers for applications such as conference calls, customer service, and workplace automation. This segment benefits from smart speakers' ability to streamline operations, improve communication, and enhance customer interactions. Moreover, commercial adoption, driven by the need for efficient, scalable solutions in professional environments is acting as another significant growth-inducing factor.

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

The smart speaker market in North India is driven by high urbanization rates and increasing tech adoption in cities like Delhi and Chandigarh. Growing disposable incomes and a preference for smart home technology contribute to significant market growth in this region, with a focus on premium and mid-range models.

Concurrently, West and Central India, including cities like Mumbai and Pune, see robust growth due to a rising middle class and expanding tech infrastructure. The market benefits from increasing consumer awareness and demand for affordable and advanced smart speakers, supported by improving retail and online distribution channels.

Besides this, South India, with major urban centers like Bangalore and Chennai, demonstrates strong growth in the smart speaker market due to high tech-savvy populations and increasing smart home adoption. The region's preference for innovative features and premium devices drives demand, supported by a growing e-commerce presence.

Furthermore, East and Northeast India are emerging markets with growing interest in smart speakers, driven by rising disposable incomes and urbanization. While the market is currently smaller compared to other regions, the increasing availability of affordable models and improved internet infrastructure are contributing to its gradual expansion.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- The competitive landscape of the Indian smart speaker market is characterized by the presence of prominent manufacturers offering a range of products tailored to diverse consumer needs. However, manufacturers such as Amazon dominate with its Echo series, leveraging a vast ecosystem of skills and integrations. Google competes with its Nest series, emphasizing superior search capabilities and integration with Google’s services. Additionally, local players and brands are entering the market, offering affordable alternatives and region-specific features to cater to diverse linguistic and cultural preferences. This competition drives innovation, with companies continuously enhancing voice recognition capabilities, expanding smart home integrations, and improving user experience. The market is also influenced by growing e-commerce platforms, which provide a competitive edge in pricing and accessibility for consumers.

India Smart Speaker Market News:

- In July 2024, Apple introduced a new midnight color for the HomePod Mini smart speaker, crafted from 100% recycled mesh fabric. Priced at Rs. 10,990, this model mirrors the midnight HomePod second gen released last year. Available for pre-order now, it will launch in the U.S. on July 17 and in other countries on July 31. The HomePod Mini initially came in space grey and white, with yellow, orange, and blue added later.

- In June 2023, Amazon India expanded its Echo lineup with the launch of the Echo Pop smart speaker, priced at ₹4,999. Featuring a unique semi-hemisphere design, the Echo Pop is available in Charcoal, Glacier White, Lavender Bloom, and Midnight Teal. This compact speaker integrates Alexa, allowing users to play music, audiobooks, and podcasts from services like Amazon Music and Spotify, as well as set timers, check the weather, and more.

India Smart Speaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Intelligent Virtual Assistants Covered | Amazon Alexa, Google Assistant, Siri, Cortana, Others |

| Connectivities Covered | Wi-Fi, Bluetooth |

| Price Ranges Covered | Low-range (Less than $100), Mid-range ($101 to $200), Premium (Above $200) |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal, Commercial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart speaker market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India smart speaker market?

- What is the impact of each driver, restraint, and opportunity on the India smart speaker market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the India smart speaker market?

- What is the breakup of the market based on the intelligent virtual assistant?

- Which is the most attractive intelligent virtual assistant in the India smart speaker market?

- What is the breakup of the market based on the connectivity?

- Which is the most attractive connectivity in the India smart speaker market?

- What is the breakup of the market based on the price range?

- Which is the most attractive price range in the India smart speaker market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the India smart speaker market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the India smart speaker market?

- What is the competitive structure of the market?

- Who are the key players/companies in the India smart speaker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart speaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart speaker market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart speaker industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)