India Smart Packaging Market Size, Share, Trends and Forecast by Technology, Industry Vertical, and Region, 2025-2033

India Smart Packaging Market Overview:

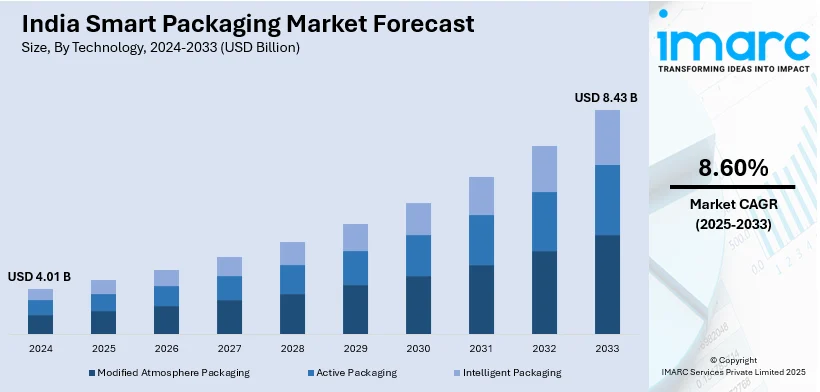

The India smart packaging market size reached USD 4.01 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.43 Billion by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The India smart packaging market is driven by increasing individual demand for transparency, interactive engagement, and product authenticity, alongside the rising adoption of smart labeling, anti-counterfeiting technologies, and digital tracking solutions to enhance brand trust, regulatory compliance, and supply chain security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.01 Billion |

| Market Forecast in 2033 | USD 8.43 Billion |

| Market Growth Rate (2025-2033) | 8.60% |

India Smart Packaging Market Trends:

Growing Consumer Demand for Transparency and Engagement

Personal choices are increasingly leaning towards enhanced transparency and involvement, resulting in the rise of smart packaging in India. Numerous individuals are seeking access to instant product details, including ingredient sourcing, authenticity checks, and expiration monitoring. Smart packaging solutions, such as labels with near field communication (NFC), blockchain-based traceability systems, and interactive quick response (QR) codes, are offering consumers immediate access to product information via their smartphones. This degree of openness fosters brand trust and guarantees adherence to ethical sourcing and safety regulations. Furthermore, the increasing health awareness among consumers is catalyzing the demand for packaging solutions that effectively showcase nutritional information and storage insights. With the rise of digital literacy and smartphone adoption, businesses are utilizing smart packaging to set their products apart, boost client loyalty, and elevate brand visibility. In 2025, KRBL Limited introduced its new customer-oriented packaging for India Gate Basmati Rice, aimed at enhancing transparency and equipping individuals with comprehensive product details. The revamped packaging, created in collaboration with Landor Associates, includes interactive elements such as QR codes and aims at different consumer mindsets. The introduction, supported by a robust marketing initiative, signifies an important move in transforming consumer involvement in the basmati rice market.

To get more information on this market, Request Sample

Rise of Smart Labeling and Anti-Counterfeiting Solutions

The increasing danger of counterfeit goods in numerous sectors, such as pharmaceuticals, electronics, and consumer items, is prompting faster implementation of smart labeling and authentication technologies in India. Counterfeiting impacts brand image and also presents significant dangers to user safety, especially in vital areas like healthcare. Smart packaging options, including radio-frequency identification (RFID)-equipped security labels, tamper-proof seals, blockchain-based tracking systems, and forensic markers are improving product authenticity and transparency in the supply chain. The government's drive for stringent anti-counterfeiting laws and serialization standards is urging manufacturers to incorporate these enhanced security attributes into their packaging. Moreover, intelligent labels featuring QR codes and NFC are enhancing user interaction by offering immediate product verification and comprehensive details. With businesses focusing on brand safeguarding and adherence to regulations, the need for innovative labeling and anti-counterfeiting measures is increasing, enhancing the importance of smart packaging in market safety. For example, in 2024, Myprotein launched a QR code verification feature on its Impact Whey Protein packaging in India. This enabled consumers to confirm product authenticity, check information such as country of origin, expiration date, and batch code. The action was intended to address counterfeit products and reinforce consumer trust in the brand.

India Smart Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology and industry vertical.

Technology Insights:

- Modified Atmosphere Packaging

- Active Packaging

- Antimicrobial

- Gas Scavengers

- Moisture Control

- Corrosion Control

- Intelligent Packaging

- Indicators

- Tracking Devices

The report has provided a detailed breakup and analysis of the market based on the technology. This includes modified atmosphere packaging, active packaging (antimicrobial, gas scavengers, moisture control, and corrosion control), and intelligent packaging (indicators and tracking devices).

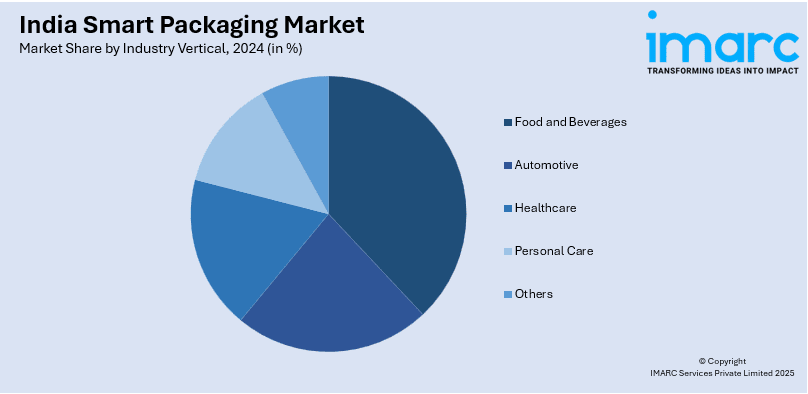

Industry Vertical Insights:

- Food and Beverages

- Automotive

- Healthcare

- Personal Care

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes food and beverages, automotive, healthcare, personal care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Packaging Market News:

- In August 2024, PackPlus 2024, India's leading packaging exhibition, occurred from August 22-24 at Pragati Maidan in New Delhi, showcasing more than 200 exhibitors and attracting over 15,000 visitors. The event highlighted the newest advancements in packaging technologies, featuring eco-friendly materials, intelligent packaging, and automation. The International Packaging Conclave additionally examined industry trends, sustainability, and AI's influence on packaging.

- In July 2024, the Council of Scientific and Industrial Research (CSIR) initiated a National Mission to create sustainable packaging solutions with the goal of reaching a net-zero future. The program, led by CSIR-NIIST, aimed at developing homegrown, advanced, and cohesive innovations in packaging materials, recycling, and intelligent packaging technologies. It also tackled concerns such as microplastics, packaging waste, and industry traceability.

India Smart Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Industry Verticals Covered | Food and Beverages, Automotive, Healthcare, Personal Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart packaging market in India was valued at USD 4.01 Billion in 2024.

The India smart packaging market is projected to exhibit a CAGR of 8.60% during 2025-2033, reaching a value of USD 8.43 Billion by 2033.

The market is driven by technological innovations like RFID, NFC, sensors, and IoT, enabling real-time product tracking, quality monitoring, and enhanced consumer interaction, especially in food, pharma, and e-commerce. Rising consumer demand for convenience, freshness, and safety drives adoption. Additionally, sustainability regulations and eco-friendly packaging trends further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)