India Smart Office Market Size, Share, Trends and Forecast by Component, Office Type, Technology, and Region, 2025-2033

India Smart Office Market Size and Share:

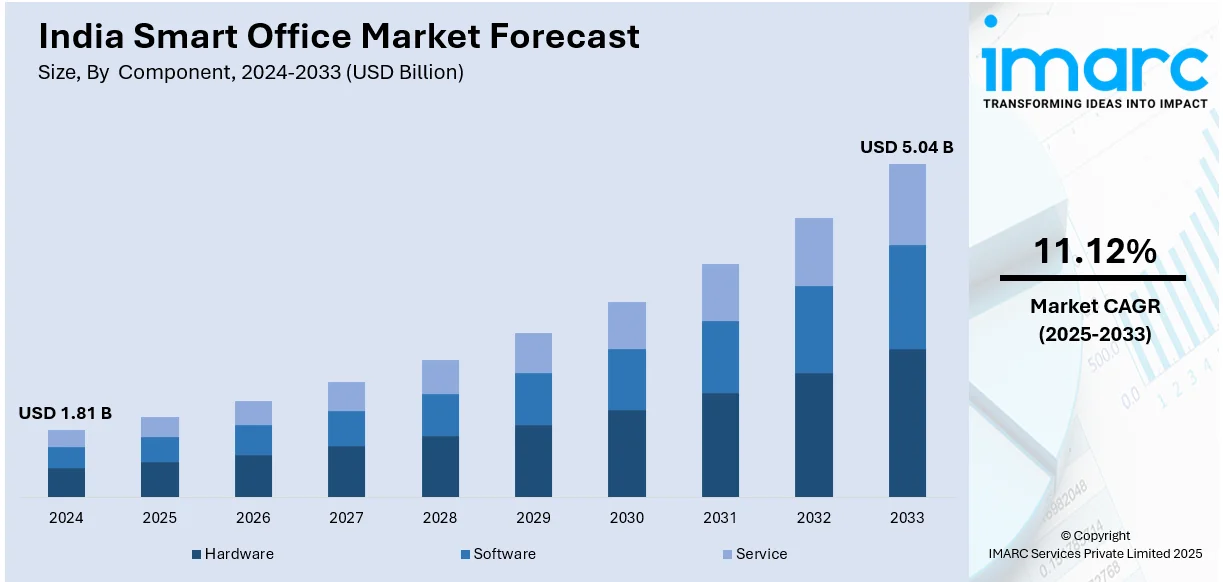

The India smart office market size reached USD 1.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.04 Billion by 2033, exhibiting a growth rate (CAGR) of 11.12% during 2025-2033. The market is driven by rising demand for energy-efficient solutions, IoT-enabled workplace automation, and government initiatives like Digital India, with key players offering advanced lighting, security, and HVAC systems to enhance productivity and sustainability, while increasing adoption of AI, cloud computing, and smart sensors fuels market growth across corporate and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.81 Billion |

| Market Forecast in 2033 | USD 5.04 Billion |

| Market Growth Rate (2025-2033) | 11.12% |

India Smart Office Market Trends:

Rise of AI-Integrated Smart Offices in India

The India smart office market is experiencing widespread adoption of Artificial Intelligence (AI) to optimize office efficiency. AI-based automation is revolutionizing office management through optimal utilization of energy, process optimization, and predictive maintenance of office infrastructure. For instance, in February 2024, Ramco Systems announced the launch of Ramco Payce, an artificial intelligence-powered payroll solution with no-code rule development, real-time compliance, and rapid processing, revolutionizing enterprise payroll management with automation, smooth integration, and cutting-edge analytics. Moreover, smart assistants, AI chatbots, and scheduling automation software are enhancing the productivity of employees, minimizing manual workload, and customizing workspace experiences. Firms are also implementing AI-based security solutions such as facial recognition and behavior-driven access control systems to maximize office security. Amidst India's emphasis on digitization and adoption of hybrid workplaces, integrating AI is now turning out to be a strong competitive advantage for businesses that intend to develop intelligent and responsive work environments. Moreover, AI-powered analytics are applied in order to measure employee interests, track the air quality level, and promote workplace ergonomics. As Indian businesses increasingly modernize, AI-driven intelligent office solutions will find even greater acceptance, accelerating efficiency and sustainability in the business world.

To get more information on this market, Request Sample

Growth of IoT-Enabled Smart Office Infrastructure

The growing use of the Internet of Things (IoT) is transforming smart offices in India by developing integrated ecosystems that enhance operational efficiency. IoT-driven smart lighting, temperature control, and occupancy sensors are being implemented to maximize energy consumption and minimize expenses. Offices are using IoT-based environmental monitoring systems to ensure indoor air quality and employee well-being. Emergence of IoT-capable workspace management platforms is also enabling firms to increase desk occupancy, meeting room reservations, and asset monitoring, which ultimately improves space utilization. IoT-powered access control solutions are enhancing security with enhanced seamless remote check-in functionality in hybrid workplaces. Businesses are also employing IoT-based predictive maintenance for office devices to lower downtime and minimize disruption of operations. With growing 5G networks in India, the merging of high-speed IoT applications will continue to add to the responsiveness and intelligence of office spaces, opening the way for more intelligent and sustainable workspaces.

Sustainability and Ecofriendly Smart Office Solutions

Sustainability is becoming one of the leading trends in India's smart office market, supported by corporate ESG aspirations and government programs focusing on green buildings. Organizations are implementing energy-saving smart lighting, climate-controlled air, and solar-powered office structures to lower carbon footprints. Smart office planning now integrates biophilic aspects, including ecofriendly walls and office plants, to improve the well-being and productivity of employees. Paperless office software, facilitated through digital documents and cloud computing, are further reducing environmental footprint. For example, in July 2024, Protean eGov Technologies Ltd. announced eSignPro, a smart documentation and automation suite of an enterprise grade integrated with a digital signature and e-stamping solution for enabling businesses and governance secure, paperless transactions. Furthermore, Indian companies are also adopting measures to reduce wastage, such as AI-facilitated smart recycling dustbins. Stricter regulations along with greater sustainability awareness are forcing companies to spend on leadership in energy and environmental design (LEED)- and Indian green building council (IGBC) -rated intelligent buildings. The emergence of circular economy programs, where office furniture and materials are recycled or reused, is also on the rise. As India progresses toward net-zero emissions, green smart offices will become an integral part of corporate responsibility and environmental stewardship.

India Smart Office Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, office type, and technology.

Component Insights:

- Hardware

- Security System and Controls

- Smart Lighting and Controls

- Energy Management Systems

- HVAC Control Systems

- Audio-Video Conferencing Systems

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (security system and controls, smart lighting and controls, energy management systems, HVAC control systems, and audio-video conferencing systems), software, and service.

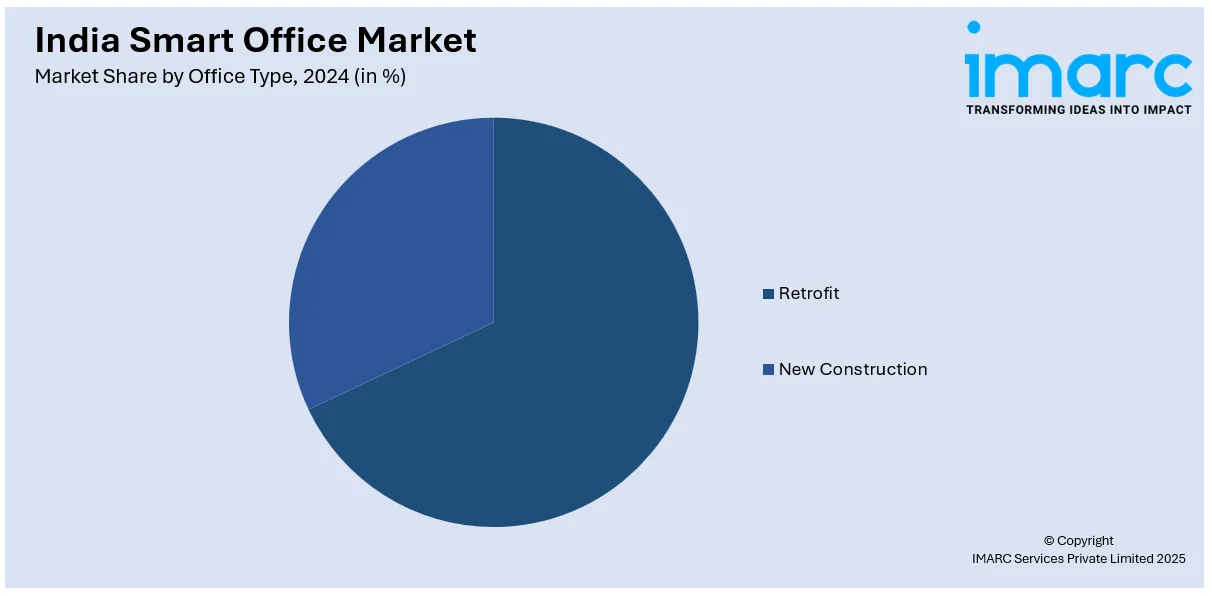

Office Type Insights:

- Retrofit

- New Construction

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes retrofit and new construction.

Technology Insights:

- Wireless Technology

- Wired Technology

The report has provided a detailed breakup and analysis of the market based on the technology. This includes wireless technology and wired technology.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Office Market News:

- In September 2024, Delta Electronics extended its smart office solutions in India with an additional R&D centre at Bengaluru, specializing in energy-efficient automation and digital infrastructure. The company intends to double its staff while offering more smart workplace technology solutions for intelligent offices, sustainability, and next-generation power management systems.

India Smart Office Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Office Type Covered | Retrofit, New Construction |

| Technologies Covered | Wireless Technology, Wired Technology |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart office market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart office market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart office industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart office market in India was valued at USD 1.81 Billion in 2024.

The India smart office market is projected to exhibit a CAGR of 11.12% during 2025-2033, reaching a value of USD 5.04 Billion by 2033.

The India smart office market is fueled by growing uptake of Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing technologies. Energy efficiency, digital collaboration tools, and secure building automation drive demand. Initiatives, such as Digital India by the government and increased investment in contemporary infrastructure also drive the growth of connected and productive workplaces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)