India Smart Microgrids Market Size, Share, Trends and Forecast by Type, Component, Power Technology, Consumer Pattern, Application, and Region, 2025-2033

India Smart Microgrids Market Overview:

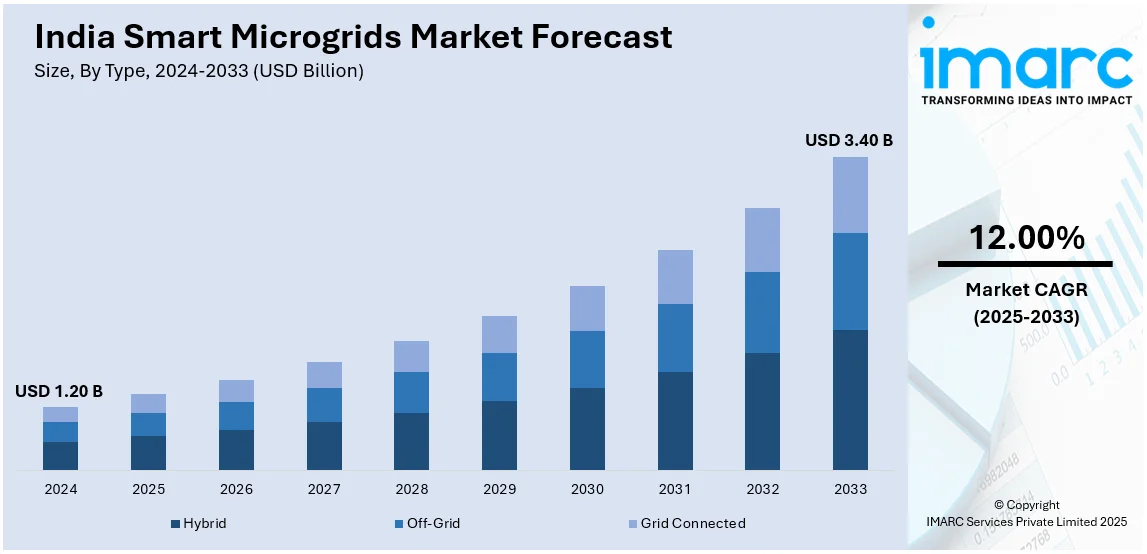

The India smart microgrids market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.40 Billion by 2033, exhibiting a growth rate (CAGR) of 12.00% during 2025-2033. India's smart microgrid market is expanding with the growing integration of renewable energy, rural electrification, and advanced grid modernization. Besides, government programs, energy efficiency initiatives, and growing demand for decentralized power solutions are promoting adoption, increasing grid resilience, and providing sustainable access to electricity in urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 3.40 Billion |

| Market Growth Rate 2025-2033 | 12.00% |

India Smart Microgrids Market Trends:

Advancing Smart Grid and Renewable Integration

India's smart microgrid industry is growing as initiatives to upgrade the power infrastructure and integrate renewable energy gain momentum. Moreover, the demand for a robust and intelligent electricity grid is propelling investments in cutting-edge grid technologies. Besides this, the use of microgrids is essential to stabilize the power supply with rising renewable energy capacity, provide energy security, and decrease reliance on traditional sources. Further, the momentum for decarbonization and transition to cleaner power sources is also driving the uptake of smart microgrids, providing energy distribution and storage efficiently. For example, in February 2025, India and the UK initiated the second phase of the ASPIRE program, aiming to enhance smart power infrastructure. The initiative focuses on grid transformation, integrating renewable energy sources, and advancing industrial decarbonization. India is augmenting its smart microgrid network by way of technical cooperation, thereby enhancing offshore wind energy utilization, and enhancing grid efficiency. All these are factors that are propelling the growing need for smart microgrids since they ensure that there is a consistent and stable power supply even in the remotest locations. Increased use of digital-based solutions and automation to manage power is also propelling the market. By integrating smart technologies, grid managers can maximize the distribution of power, minimize the loss of transmission, and increase overall efficiency, which makes smart microgrids the central part of India's dynamic energy future.

To get more information on this market, Request Sample

Enhancing Rural Energy Access and Efficiency

Rural electrification and energy efficiency are emerging as crucial factors influencing India's smart microgrid market. With millions still dependent on unreliable or expensive power sources, the demand for decentralized energy solutions is rising. Smart microgrids play a vital role in bridging the energy gap by providing stable, cost-effective, and sustainable power solutions to rural and underserved areas. The increasing focus on energy-efficient appliances and optimized power consumption is also fueling the adoption of microgrids, making them more viable for small businesses and local enterprises. In November 2024, TP Renewable Microgrid launched the "Less is More" initiative in Uttar Pradesh and Bihar. This program promotes energy-efficient appliances tailored for rural micro-enterprises, ensuring better utilization of available power. By improving energy access and affordability, the initiative strengthens microgrid adoption, making decentralized power solutions more sustainable. These efforts align with India's long-term goal of expanding smart microgrids to improve rural electrification and reduce reliance on costly diesel generators. The increasing emphasis on sustainable energy consumption and affordability is making microgrids a practical solution for rural communities. As energy efficiency improves, microgrids can serve more users without additional generation capacity, enhancing power availability while reducing operational costs. This trend is accelerating India's transition toward widespread adoption of smart microgrids.

India Smart Microgrids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, component, power technology, consumer pattern, and application.

Type Insights:

- Hybrid

- Off-Grid

- Grid Connected

The report has provided a detailed breakup and analysis of the market based on the type. This includes hybrid, off-grid, and grid connected.

Component Insights:

- Storage

- Inverter

The report has provided a detailed breakup and analysis of the market based on the component. This includes storage and inverter.

Power Technology Insights:

- Fuel Cell

- CHP

A detailed breakup and analysis of the market based on the power technology have also been provided in the report. This includes fuel cell and CHP.

Consumer Pattern Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the consumer pattern have also been provided in the report. This includes urban and rural.

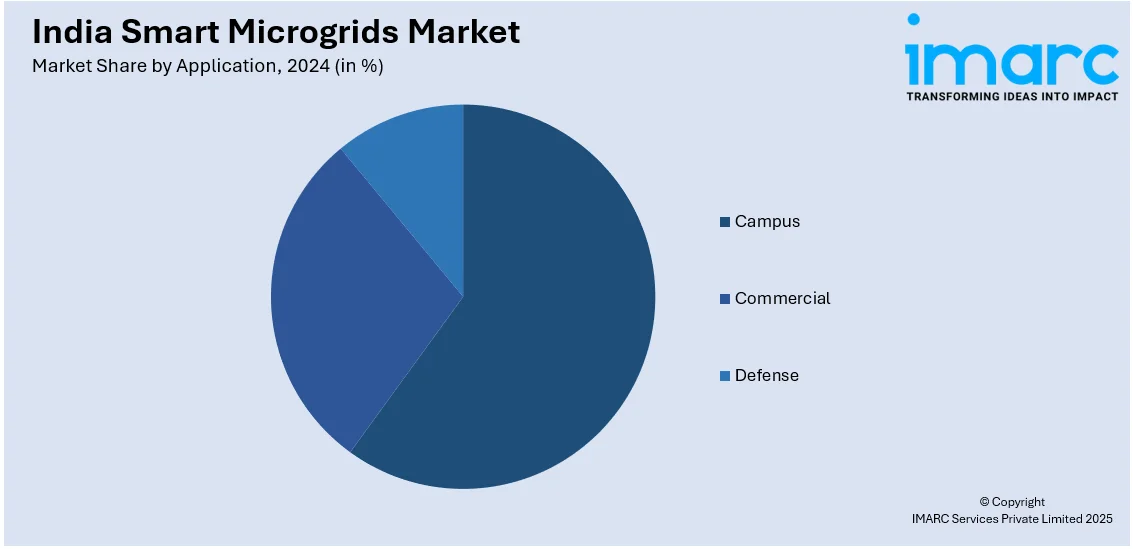

Application Insights:

- Campus

- Commercial

- Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes campus, commercial, and defense.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Microgrids Market News:

- October 2024: NTPC partnered with the Indian Army to develop a Solar Hydrogen-based Microgrid in Chushul, Ladakh. This 200kW system ensures round-the-clock power, replacing diesel generators, enhancing energy security in extreme conditions, and advancing India's smart microgrid and green hydrogen adoption for sustainable defense operations.

- September 2024: Honeywell commissioned India’s first on-grid solar microgrid with a 1.4MWh Battery Energy Storage System (BESS) in Lakshadweep. Featuring EMS and a Microgrid Controller, it reduces diesel reliance, enhances grid efficiency, and advances India’s smart microgrid adoption for sustainable energy transition.

India Smart Microgrids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Hybrid, Off-Grid, Grid Connected |

| Components Covered | Storage, Inverter |

| Power Technologies Covered | Fuel Cell, CHP |

| Consumer Patterns Covered | Urban, Rural |

| Applications Covered | Campus, Commercial, Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart microgrids market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart microgrids market on the basis of type?

- What is the breakup of the India smart microgrids market on the basis of component?

- What is the breakup of the India smart microgrids market on the basis of power technology?

- What is the breakup of the India smart microgrids market on the basis of consumer pattern?

- What is the breakup of the India smart microgrids market on the basis of application?

- What are the various stages in the value chain of the India smart microgrids market?

- What are the key driving factors and challenges in the India smart microgrids market?

- What is the structure of the India smart microgrids market and who are the key players?

- What is the degree of competition in the India smart microgrids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart microgrids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart microgrids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart microgrids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)