India Smart Hospitals Market Size, Share, Trends and Forecast by Component, Product, Service Offered, Connectivity, Technology, Application, and Region, 2025-2033

India Smart Hospitals Market Size and Share:

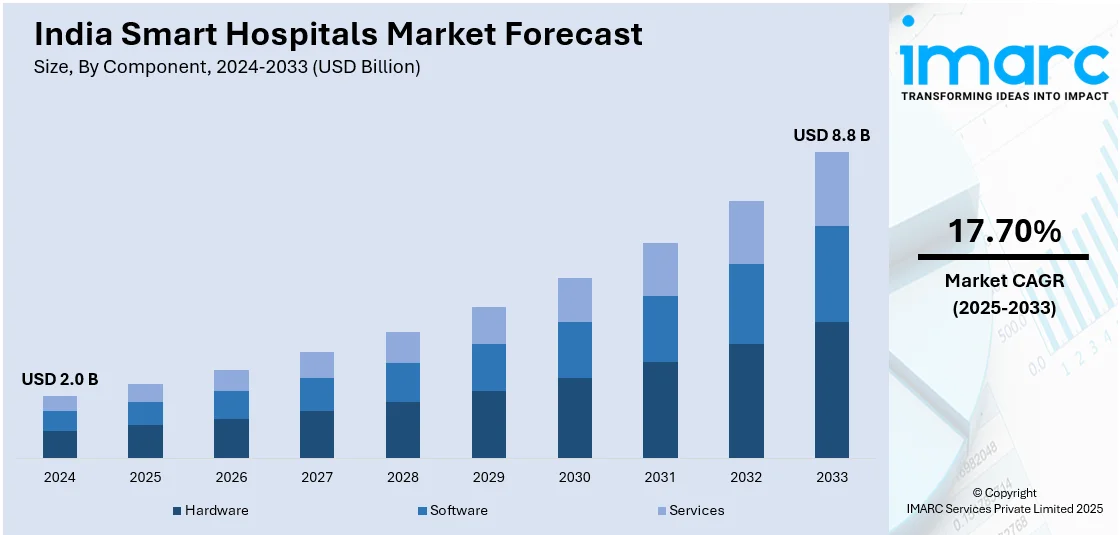

The India smart hospitals market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.8 Billion by 2033, exhibiting a growth rate (CAGR) of 17.70% during 2025-2033. The market is propelled by increasing healthcare digitization, AI and IoT adoption, rising demand for patient-centric care, government initiatives like Ayushman Bharat, growing investments in telemedicine, electronic health records (EHRs), and the need for operational efficiency and cost reduction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 8.8 Billion |

| Market Growth Rate 2025-2033 | 17.70% |

India Smart Hospitals Market Trends:

Increasing Healthcare Digitization and AI Adoption

India's healthcare sector is rapidly embracing digital transformation, integrating AI, IoT, and big data analytics to enhance patient care and operational efficiency. Smart hospitals use AI-powered diagnostics, robotic surgeries, and predictive analytics for better clinical outcomes. Artificial intelligence-powered patient monitoring systems allow for real-time monitoring of vitals, minimizing errors made by humans. With rising government support for digital health initiatives, hospitals are increasingly investing in cloud-based solutions, machine learning models, and automation, driving the India smart hospitals market growth. For instance, in March 2025, Wadhwani AI (collaborated with AIIMS New Delhi, acknowledged as an AI Centre of Excellence by the Indian government, to promote innovation in healthcare through AI. This partnership seeks to improve diagnostics and patient care throughout India.

To get more information on this market, Request Sample

Government Initiatives and Investments in Healthcare Infrastructure

The Indian government is actively promoting healthcare modernization through initiatives like the National Digital Health Mission (NDHM) and the Ayushman Bharat Digital Mission (ABDM). Public programs encourage healthcare facilities to implement electronic medical records (EMRs) together with AI-driven diagnostics along with digital health platforms. The push for public-private partnerships (PPPs), smart city health projects, and digital health regulations is also encouraging hospitals to adopt technology-driven healthcare models, fueling the India smart hospitals market share. For instance, in December 2024, The Indian Medical Association (IMA) revealed that the pilot phase of its "IMA AMR Smart Hospital Project" has been completed. This initiative seeks to address the escalating danger of AMR by establishing sophisticated Infection Prevention and Control (IPC) and Antimicrobial Stewardship (AMS) measures in medical institutions throughout India. The hospitals include KD Hospital in Ahmedabad, Gujarat; Sehgal Neo Hospital in Delhi; Ananthapuri Hospital and Research Institute in Kerala; and Mahavir Jaipuria Rajasthan Hospital in Jaipur.

Growing Need for Operational Efficiency and Cost Reduction

Smart hospitals aim to optimize resource management, reduce costs, and improve efficiency through automated hospital operations, AI-driven workflow management, and predictive maintenance of medical equipment which is creating a positive India smart hospitals market outlook. The use of robotics, AI chatbots, and digital supply chain systems minimizes manual interventions, reducing human errors and enhancing hospital productivity. Smart energy management systems operate to lower operational costs which enhances hospital sustainability. Advanced data analytics and automation streamline hospital operations, from bed management to inventory tracking, ensuring cost-effective healthcare delivery. With increasing healthcare demands, hospitals are leveraging smart technologies to enhance efficiency and financial sustainability. For instance, in November 2024, The Sancheti Group of Hospitals introduced its newest establishment, the Sancheti Advanced Orthocare Hospital. This medical center with 300 beds launches the region's first "Smart Ward" initiative, incorporating Dozee's AI-driven Remote Monitoring System (RMS) and Early Warning System (EWS).

India Smart Hospitals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on component, product, service offered, connectivity, technology, and application.

Component Insights:

- Hardware

- Stationary Medical Devices

- Implanted Medical Devices

- Wearable External Medical Devices

- Others

- Software

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (stationary medical devices, implanted medical devices, wearable external medical devices, and others), software, and services (professional services and managed services)

Product Insights:

- mHealth

- Telemedicine

- Smart Pills

- Electronic Health Record

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mHealth, telemedicine, smart pills, electronic health record, and others.

Service Offered Insights:

- General Services

- Specialty

- Super Specialty

The report has provided a detailed breakup and analysis of the market based on the service offered. This includes general services, specialty, and super specialty.

Connectivity Insights:

- Wireless

- Wi-Fi

- Radio Frequency Identification (RFID)

- Bluetooth

- Zigbee

- Near Field Communication (NFC)

- Others

- Wired

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes wireless, [Wi-Fi, radio frequency identification (RFID), Bluetooth, ZigBee, near field communication (NFC), and others], and wired.

Technology Insights:

- Artificial Intelligence

- Internet of Things

- Cloud Computing

- Big Data

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes artificial intelligence, internet of things, cloud computing, big data, and others.

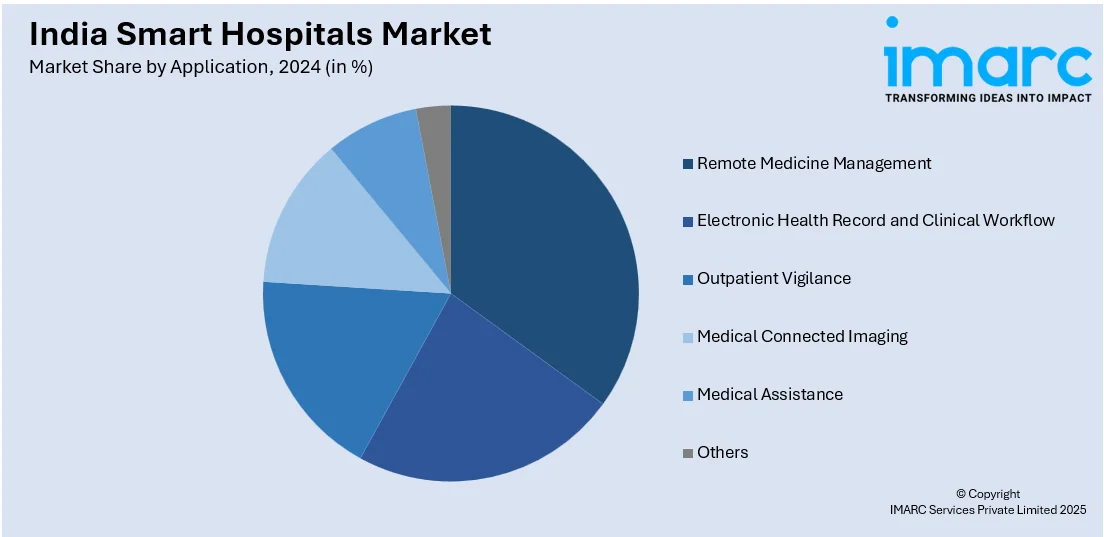

Application Insights:

- Remote Medicine Management

- Electronic Health Record and Clinical Workflow

- Outpatient Vigilance

- Medical Connected Imaging

- Medical Assistance

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes remote medicine management, electronic health record and clinical workflow, outpatient vigilance, medical connected imaging, medical assistance, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Hospitals Market News:

- In February 2025, Falcon ICU, part of Critical Care Unified (CCU), partnered with Mahajan Hospital to set up its second Smart ICU facility in Mumbai. This strategic alliance intends to tackle the increasing demand for ICU services led by skilled Intensivists, global standards, and technology.

- In March 2023, Amala Hospital, a premier multi-specialty hospital network located in Kerala, introduced a novel and advanced smart ward equipped with wearable wireless technology. This intelligent ward, the first of its kind in Kerala, features cutting-edge technology that enables ongoing patient monitoring and seeks to enhance patient outcomes while minimizing the likelihood of medical errors. The hospital network has teamed up with the Chennai-based health-tech startup, LifeSigns, to deploy their iMS technology throughout the cardiology and medicine departments at its Thrissur, Kerala hospital.

India Smart Hospitals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Products Covered | mHealth, Telemedicine, Smart Pills, Electronic Health Record, Others |

| Services Offered Covered | General Services, Specialty, Super Specialty |

| Connectivity Covered |

|

| Technologies Covered | Artificial Intelligence, Internet of Things, Cloud Computing, Big Data, Others |

| Applications Covered | Remote Medicine Management, Electronic Health Record and Clinical Workflow, Outpatient Vigilance, Medical Connected Imaging, Medical Assistance, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart hospitals market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart hospitals market on the basis of component?

- What is the breakup of the India smart hospitals market on the basis of product?

- What is the breakup of the India smart hospitals market on the basis of service offered?

- What is the breakup of the India smart hospitals market on the basis of connectivity?

- What is the breakup of the India smart hospitals market on the basis of technology?

- What is the breakup of the India smart hospitals market on the basis of application?

- What is the breakup of the India smart hospitals market on the basis of region?

- What are the various stages in the value chain of the India smart hospitals market?

- What are the key driving factors and challenges in the India smart hospitals market?

- What is the structure of the India smart hospitals market and who are the key players?

- What is the degree of competition in the India smart hospitals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart hospitals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart hospitals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart hospitals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)