India Smart Grid Market Size, Share, Trends and Forecast by Component, End User, and Region, 2025-2033

Market Overview:

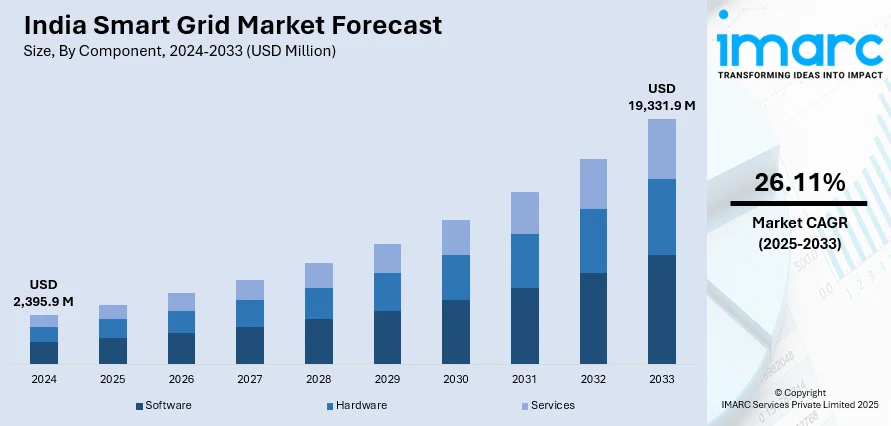

India smart grid market size reached USD 2,395.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 19,331.9 Million by 2033, exhibiting a growth rate (CAGR) of 26.11% during 2025-2033. The expanding power distribution infrastructures and the escalating demand for energy-efficient solutions are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,395.9 Million |

| Market Forecast in 2033 | USD 19,331.9 Million |

| Market Growth Rate (2025-2033) | 26.11% |

Smart grids are sophisticated electricity distribution systems that incorporate digital technology to enhance efficiency and reliability. Comprising elements like smart meters, sensors, and software, they facilitate real-time data monitoring and control. These grids have diverse uses, including demand response management, voltage regulation, advanced metering, outage detection, electric vehicle integration, load balancing, renewable energy integration, grid optimization, and cybersecurity. The adoption of smart grids contributes to minimizing energy consumption, cutting costs, enhancing grid resilience, and optimizing power distribution processes.

To get more information on this market, Request Sample

India Smart Grid Market Trends:

The India smart grid market has experienced significant growth and transformation in recent years, driven by the country's increasing energy demands, the need for a reliable and efficient power distribution system, and a growing emphasis on sustainability. In this nation, the market has evolved to address various challenges faced by the conventional power grid, such as power losses, inefficiencies, and difficulties in integrating renewable energy sources. One key component of the India smart grid landscape is the widespread deployment of smart meters. Additionally, these devices enable real-time monitoring of energy consumption, facilitate demand response management, and empower consumers with better insights into their electricity usage. Besides this, the government bodies have been actively promoting smart grid initiatives, emphasizing the importance of grid modernization to meet the evolving energy needs of the expanding population, thereby acting as another significant growth-inducing factor. The applications of smart grids in India extend beyond metering, encompassing areas like voltage regulation, outage detection, integration of electric vehicles, and optimization of the overall grid infrastructure. Moreover, the integration of renewable energy sources, such as solar and wind, is a crucial aspect of the smart grid strategy in India, contributing to the nation's commitment to sustainable and clean energy practices. Furthermore, the India smart grid market has witnessed investments in advanced technologies and software solutions that enhance grid resilience and cybersecurity. As the nation continues its journey towards a more digitally connected and energy-efficient future, the smart grid market is expected to fuel over the forecasted period.

India Smart Grid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component and end user.

Component Insights:

- Software

- Advanced Metering Infrastructure

- Smart Grid Distribution Management

- Smart Grid Network Management

- Substation Automation

- Others

- Hardware

- Sensor

- Programmable Logic Controller

- AMI Meter

- Networking Hardware

- Others

- Services

- Consulting

- Support and Maintenance

- Deployment and Integration

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (advanced metering infrastructure, smart grid distribution management, smart grid network management, substation automation, and others), hardware (sensor, programmable logic controller, AMI meter, networking hardware, and others), and services (consulting, support and maintenance, and deployment and integration).

End User Insights:

- Residential

- Commercial

- Industrial

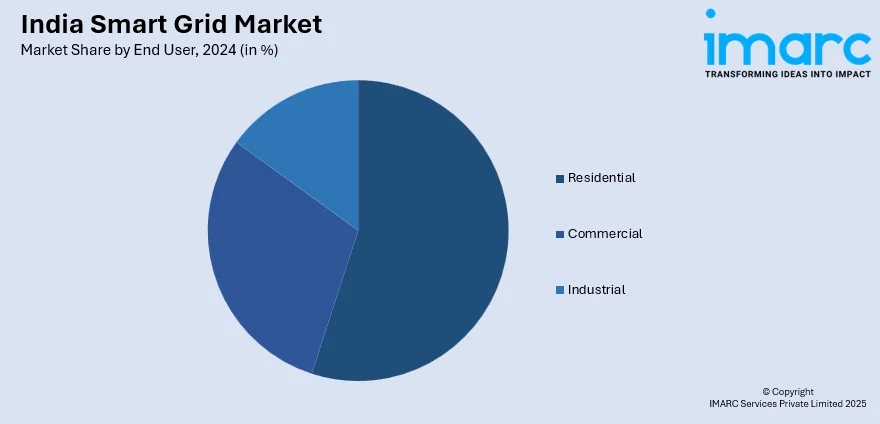

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Grid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart grid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart grid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart grid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart grid market in India was valued at USD 2,395.9 Million in 2024.

The India smart grid market is projected to exhibit a CAGR of 26.11% during 2025-2033, reaching a value of USD 19,331.9 Million by 2033.

The modernization of power systems, smart city initiatives, and the transition to cleaner energy sources drive growth in India’s smart grid market. Moreover, greater electricity use, outdated infrastructure, and the need for better grid control are key factors. Smart metering and policy backing also play a role.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)