India Smart Food Packaging Market Size, Share, Trends and Forecast by Type, Material, and Region, 2025-2033

India Smart Food Packaging Market Overview:

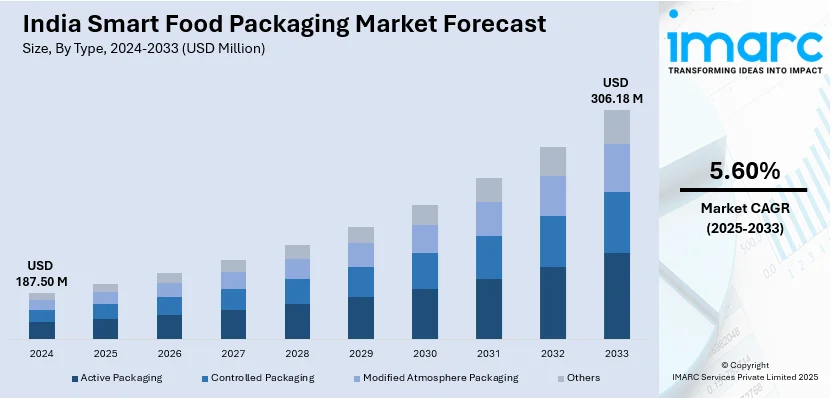

The India smart food packaging market size reached USD 187.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 306.18 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market is driven by increasing consumer demand for food safety and freshness, along with rising health awareness, fueling the adoption of intelligent packaging technologies in India that enable real-time quality tracking through spoilage, temperature, and contamination monitoring, thereby enhancing trust in packaged food across urban and semi-urban markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 187.50 Million |

| Market Forecast in 2033 | USD 306.18 Million |

| Market Growth Rate 2025-2033 | 5.60% |

India Smart Food Packaging Market Trends:

Integration of Internet of Things (IoT) in Packaging

The integration of IoT technologies is significantly transforming India’s smart food packaging landscape. Industry reports indicate that over 30% of packaged food brands in India are exploring smart packaging solutions like IoT sensors and connected labeling. These technologies enable real-time monitoring of temperature, humidity, and freshness throughout the supply chain, helping manufacturers and retailers maintain product quality and reduce food spoilage. IoT-enabled packaging also enhances traceability, allowing stakeholders to track products from production to end-user consumption. With growing smartphone penetration and improved digital infrastructure, these solutions are becoming increasingly scalable and accessible. Additionally, consumers benefit from greater transparency and food safety assurance. This shift aligns with the Indian government’s vision for a digitally empowered supply chain, supporting regulatory compliance, operational efficiency, and increased consumer trust in packaged food products.

To get more information on this market, Request Sample

Growing Adoption of Active Packaging Technologies

Active packaging is a growing trend in India's smart food packaging industry, which is being fuelled by the demand to enhance shelf life and ensure food quality. These packaging solutions contain active components like oxygen scavengers, moisture regulators, and antimicrobial agents that have an active interaction with the food or the surrounding environment. This trend holds strongly for fresh perishable foods like dairy, meat, and RTE foods that are increasing their uptake in urban and semi-urban areas in India. Not just do they enhance freshness but reduce wastage in foods as well, fitting within increased environmental worries. As consumers become more aware of food quality and hygiene, food processors and retailers are adopting active packaging as a means of solving the problem of product integrity and distribution extension.

Rise of Sustainable and Biodegradable Smart Packaging

The shift toward eco-friendly packaging solutions is strongly influencing India’s smart food packaging market. As environmental consciousness grows among consumers and regulators, there is a rising demand for smart packaging materials that are biodegradable, recyclable, or made from renewable resources. Brands are now combining sustainability with intelligent features, such as freshness indicators and quick response (QR) codes, without compromising environmental goals. This trend is being reinforced by government policies promoting plastic waste reduction and extended producer responsibility (EPR). Companies are exploring alternatives like bioplastics and cellulose-based films that support both sustainability and smart functionality. The convergence of smart technology and green materials is helping food companies cater to eco-conscious consumers while meeting regulatory norms, thereby reshaping packaging innovation across India’s food industry.

India Smart Food Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and material.

Type Insights:

- Active Packaging

- Controlled Packaging

- Modified Atmosphere Packaging

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes active packaging, controlled packaging, modified atmosphere packaging, and others.

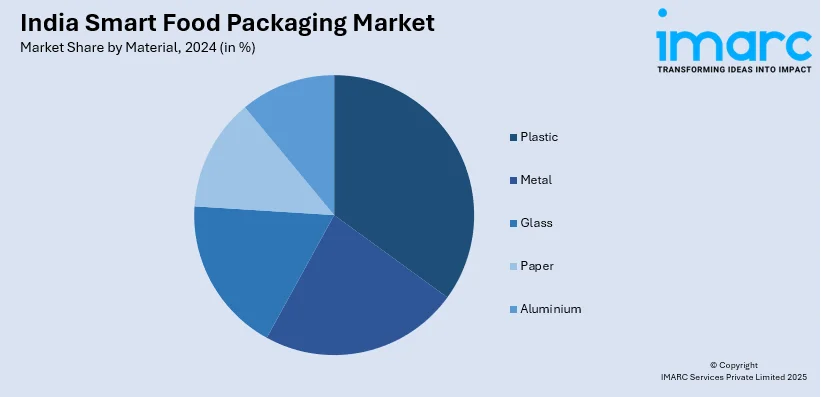

Material Insights:

- Plastic

- Metal

- Glass

- Paper

- Aluminium

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes plastic, metal, glass, paper, and aluminium.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Food Packaging Market News:

- In February 2025, ITC Ltd announced the 100% acquisition of Prasuma, a key player in India’s frozen, chilled, and ready-to-cook foods market. This move strengthens ITC’s presence in high-growth food segments, valued at over ₹10,000 crore. Prasuma offers 170+ products, including momos, baos, Korean fried chicken, and deli meats, known for innovation and healthy formulations. The acquisition aligns with ITC’s strategy to expand in fast-growing, consumer-focused food categories.

- In July 2024, India’s Council of Scientific and Industrial Research (CSIR) has launched the National Mission on Sustainable Packaging to promote eco-friendly packaging solutions. Led by CSIR-NIIST, the initiative focuses on reducing microplastic pollution and achieving a net-zero future through domestic innovation. It brings together eight CSIR labs and industry partners to develop integrated, advanced packaging technologies. The mission was officially unveiled by Dr. N Kalaiselvi, CSIR’s Director General.

India Smart Food Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Active Packaging, Controlled Packaging, Modified Atmosphere Packaging, Others |

| Materials Covered | Plastic, Metal, Glass, Paper, Aluminium |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart food packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart food packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart food packaging market in India was valued at USD 187.50 Million in 2024.

The India smart food packaging market is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 306.18 Million by 2033.

Key factors driving the India smart food packaging market include rising demand for extended shelf-life and food safety, increased consumer awareness about product freshness, and the need for real-time tracking. Growth in e-commerce, urbanization, and adoption of sustainable packaging technologies also support market expansion across diverse food segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)