India Simulation Software Market Size, Share, Trends and Forecast by Component, Deployment, End Use, and Region, 2025-2033

Market Overview:

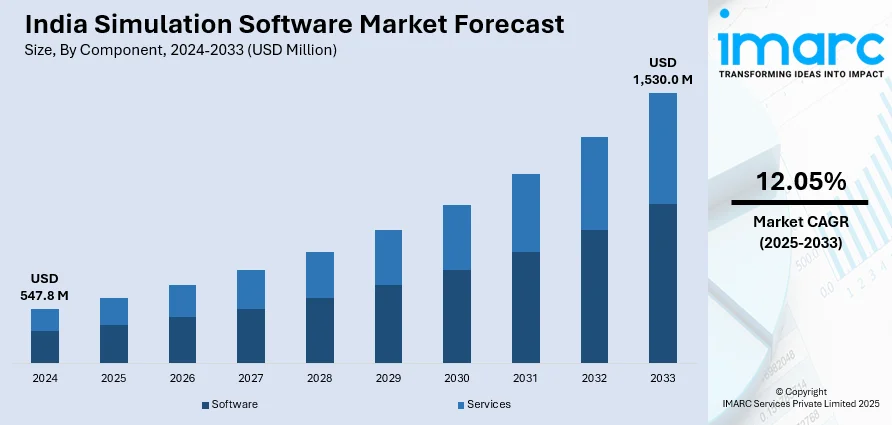

India simulation software market size reached USD 547.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,530.0 Million by 2033, exhibiting a growth rate (CAGR) of 12.05% during 2025-2033. The expanding industries such as aviation, defense, healthcare, and manufacturing that increasingly use simulation software for training purposes, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 547.8 Million |

| Market Forecast in 2033 | USD 1,530.0 Million |

| Market Growth Rate 2025-2033 | 12.05% |

Simulation software refers to computer programs designed to replicate real-world processes or systems. It allows users to model and analyze complex scenarios in a virtual environment. These simulations can represent various fields, such as engineering, science, business, and social systems. Users input data and parameters, and the software generates outcomes based on the given inputs. Simulation software is valuable for testing hypotheses, predicting outcomes, and optimizing processes without the need for real-world experimentation. It aids in decision-making, risk analysis, and training. Industries use simulation software for diverse purposes, including designing products, simulating physical phenomena, and assessing the performance of systems. Overall, simulation software facilitates a cost-effective and efficient means of understanding, experimenting, and improving processes by providing a digital representation of the real world. It is widely employed across disciplines to enhance understanding and make informed decisions in a controlled, virtual environment.

To get more information on this market, Request Sample

India Simulation Software Market Trends:

The simulation software market in India is thriving, driven by a confluence of factors that underscore its pivotal role in diverse industries. Firstly, the increasing complexity of real-world systems has intensified the demand for simulation tools across sectors such as manufacturing, healthcare, and automotive. Additionally, the growing emphasis on risk management and cost reduction propels the adoption of simulation software as organizations seek to optimize processes and mitigate potential pitfalls. Moreover, the rise of Industry 4.0 and the Internet of Things (IoT) has spurred a heightened need for realistic virtual environments to test and refine interconnected systems. Furthermore, the relentless pursuit of innovation and product development fuels the market, as companies leverage simulation software to prototype and refine designs before physical production. The integration of artificial intelligence and machine learning into simulation tools enhances their predictive capabilities, augmenting their appeal in decision-making processes. Furthermore, the regional push towards sustainability and eco-friendly practices amplifies the importance of simulation software in optimizing resource utilization and reducing environmental impact. As the market continues to evolve, the interconnected nature of these drivers ensures a robust trajectory for simulation software, establishing it as an indispensable tool for organizations navigating the complexities of the modern business landscape.

India Simulation Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment, and end use.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud-based.

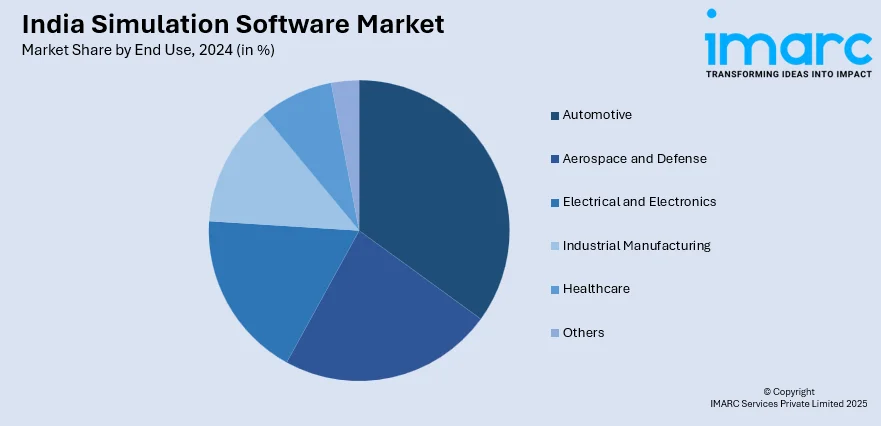

End Use Insights:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Industrial Manufacturing

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive, aerospace and defense, electrical and electronics, industrial manufacturing, healthcare, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Simulation Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Deployments Covered | On-premises, Cloud-based |

| End Uses Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Industrial Manufacturing, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India simulation software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India simulation software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India simulation software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The simulation software market in India was valued at USD 547.8 Million in 2024.

The India simulation software market is projected to exhibit a CAGR of 12.05% during 2025-2033, reaching a value of USD 1,530.0 Million by 2033.

The India simulation software market is driven by rapid adoption of digital technologies, growing manufacturing and automotive sectors, rising demand for cost-effective product design, increasing use of virtual training and modeling, and government initiatives supporting Industry 4.0 and advanced engineering solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)