India Silicone Additives Market Size, Share, Trends and Forecast by Function, End User, and Region, 2025-2033

India Silicone Additives Market Overview:

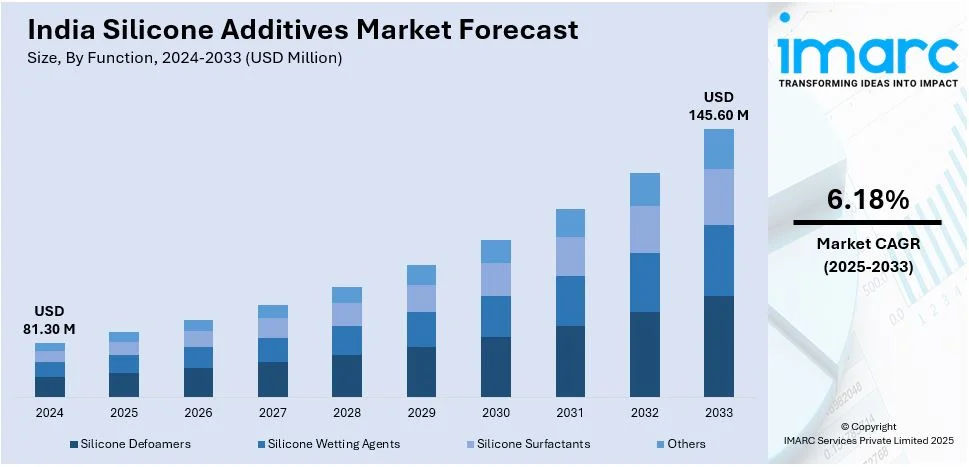

The India silicone additives market size reached USD 81.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 145.60 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by rising demand from the automotive, personal care, and construction industries. Growth in electric vehicle (EV) adoption, premium cosmetic formulations, and infrastructure expansion fuels demand. Increasing preference for high-performance, eco-friendly coatings and regulatory emphasis on durable, low-volatile organic compounds (VOC) materials further accelerates market growth across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 81.30 Million |

| Market Forecast in 2033 | USD 145.60 Million |

| Market Growth Rate 2025-2033 | 6.18% |

India Silicone Additives Market Trends:

Expanding Applications in Personal Care and Cosmetics

India's personal care and cosmetics market is growing rapidly, and the demand for silicon additives that improve texture, spread, and water resistance in formulations is fueling the growth. They are applied in most skincare, haircare, and makeup formulations to enhance the sensory benefit and long-lasting characteristics. Growing consumer demand for higher-end cosmetic products with better feel and durability is boosting the usage of silicones in formulations. In addition, innovation in silicone-based ingredients to be more environmentally friendly is moving towards biodegradable and toxin-free products. The globalization of beauty trends, along with rising disposable incomes, continues to reinforce the significance of silicone additives in India's personal care segment.

To get more information on this market, Request Sample

Growing Demand from the Automotive Sector

India's automotive industry contributes 6% to the national gross domestic product (GDP) and 35% to manufacturing GDP, driving demand for high-performance materials. The increasing uptake of silicone additives boosts material toughness, thermal stability, and resistance to harsh conditions. The additives find extensive applications in coatings, lubricants, and sealants to enhance the performance of vehicles. Increasing automotive manufacturing and the trend toward lightweight, fuel-efficient vehicles are further driving demand. Moreover, the increasing electric vehicle (EV) market is driving demand for silicone-based thermal management solutions to drive battery safety, and endurance. With tight controls on emissions and automotive safety, silicone additives are increasingly critical in next-generation automotive materials, providing enhanced efficiency, reliability, and sustainability in India's changing automotive picture.

Rising Adoption in Industrial Coatings and Construction

The India construction and industrial coatings industry is experiencing a high adoption of silicone additives because of their high weather resistance, water repellence, and durability. They extend the life of coatings by enhancing adhesion, anti-corrosion value, and resistance to ultra-violet (UV) radiation. Increased infrastructure development and urbanization in India are driving demand for high-performance protective coatings, where silicones are the key contributors. Also, the demand for eco-friendly and low-VOC coatings has prompted the formation of silicone-based solutions that satisfy tough environmental requirements. With growth in real estate investment and industrial development, silicone additives used in paints, coatings, and sealants are expected to experience stable growth.

India Silicone Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on function and end user.

Function Insights:

- Silicone Defoamers

- Silicone Wetting Agents

- Silicone Surfactants

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes silicone defoamers, silicone wetting agents, silicone surfactants, and others.

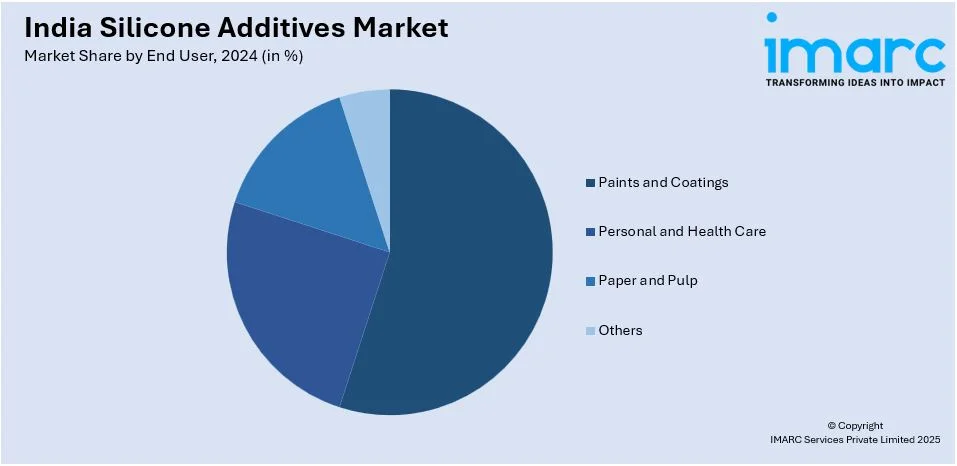

End User Insights:

- Paints and Coatings

- Personal and Health Care

- Paper and Pulp

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes paints and coatings, personal and health care, paper and pulp, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Silicone Additives Market News:

- In March 2024, Elkem will showcase its BLUESIL™ silicone rubber solutions at India Rubber Expo 2024 in Mumbai from March 20-22. Featuring HCR and LSR series, these solutions support electrical, railway, automotive, and industrial applications, enhancing safety, durability, and sustainability. With high heat resistance, flame retardancy, and low compression set, Elkem’s innovations align with India's growing demand for green, efficient, and advanced rubber technologies across multiple industries.

India Silicone Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Silicone Defoamers, Silicone Wetting Agents, Silicone Surfactants, Others |

| End Users Covered | Paints and Coatings, Personal and Health Care, Paper and Pulp, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India silicone additives market performed so far and how will it perform in the coming years?

- What is the breakup of the India silicone additives market on the basis of function?

- What is the breakup of the India silicone additives market on the basis of end user?

- What is the breakup of the India silicone additives market on the basis of region?

- What are the various stages in the value chain of the India silicone additives market?

- What are the key driving factors and challenges in the India silicone additives market?

- What is the structure of the India silicone additives market and who are the key players?

- What is the degree of competition in the India silicone additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India silicone additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India silicone additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India silicone additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)