India Sheet Metal Fabrication Market Size, Share, Trends and Forecast by Form, Material, End Use, and Region, 2026-2034

India Sheet Metal Fabrication Market Size and Share:

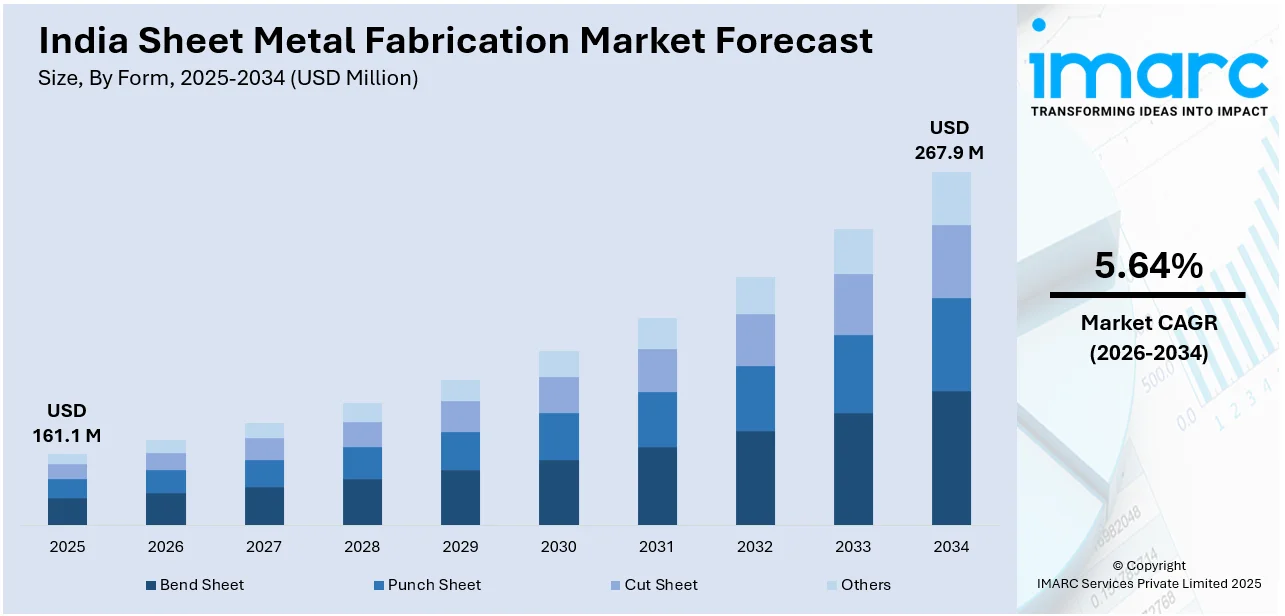

The India sheet metal fabrication market size reached USD 161.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 267.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.64% during 2026-2034. The Indian market is growing as a result of increasing demand in the automotive, construction, and industrial industries. Moreover, urbanization, infrastructure development, adoption of automation, and government policies are fueling growth. Also, CNC machining, laser cutting, and robotic welding are becoming more efficient and accurate with advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 161.1 Million |

| Market Forecast in 2034 | USD 267.9 Million |

| Market Growth Rate 2026-2034 | 5.64% |

India Sheet Metal Fabrication Market Trends:

Rising Adoption of Advanced Fabrication Technologies

The growing need for accuracy, efficiency, and automation in manufacturing is fueling the use of advanced fabrication technologies in India's sheet metal sector. Along with this, companies are moving towards laser cutting, CNC machining, and automated forming solutions to improve productivity and minimize material wastage. The emphasis on enhancing production capabilities is prompting companies to invest in high-performance equipment, resulting in increased operational efficiency. For example, in May 2024, BLECH India is set to host its 8th edition at the Bombay Exhibition Centre, Mumbai. With over 250 exhibitors and 15,000 visitors expected, the event highlights the growing role of laser cutting, forming, and automation in modern sheet metal fabrication. This show is a primary platform for manufacturers to discover innovations that enhance the speed, accuracy, and sustainability of production. The focus on automation is helping sectors like automotive, aerospace, and construction embrace innovative solutions that boost product quality. Government policies encouraging local manufacturing and industrial growth are further fueling this trend. Furthermore, firms are increasingly incorporating robotics and IoT-based solutions to automate fabrication processes. The shift towards sustainable practices, such as energy-efficient equipment and material optimization, is also picking up pace. The emergence of smart factories and automated production lines is defining the future of India's sheet metal fabrication industry, thereby ensuring long-term growth and global competitiveness.

To get more information on this market Request Sample

Rising Demand in Automotive & Infrastructure

The increased demand from the industrial, construction, and automotive industries is driving growth in India's sheet metal fabrication business. The demand for bespoke metal components is being driven by infrastructure projects and growing urbanization. In addition, the use of fabricated sheet metal in vehicle manufacture is increasing as a result of the automotive industry's adoption of lightweight materials for fuel efficiency. Furthermore, government programs like PLI schemes and Make in India are promoting local manufacturing and drawing investments in fabrication technologies. Moreover, manufacturers are combining robotic welding, laser cutting, and automated CNC equipment to increase productivity and accuracy. Precision metal frames and enclosures are needed in the consumer goods and electronics industries, which are also driving expansion. As multinational corporations look for trustworthy fabrication partners in India, export opportunities are growing. With advancements in automation, AI-driven quality control, and material innovations, the industry is moving toward cost-effective and high-precision manufacturing. Skilled labor availability and competitive costs make India a key player in global sheet metal production.

India Sheet Metal Fabrication Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on form, material, end use.

Form Insights:

- Bend Sheet

- Punch Sheet

- Cut Sheet

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes bend sheet, punch sheet, cut sheet, and others.

Material Insights:

- Silver

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes silver, aluminum, and others.

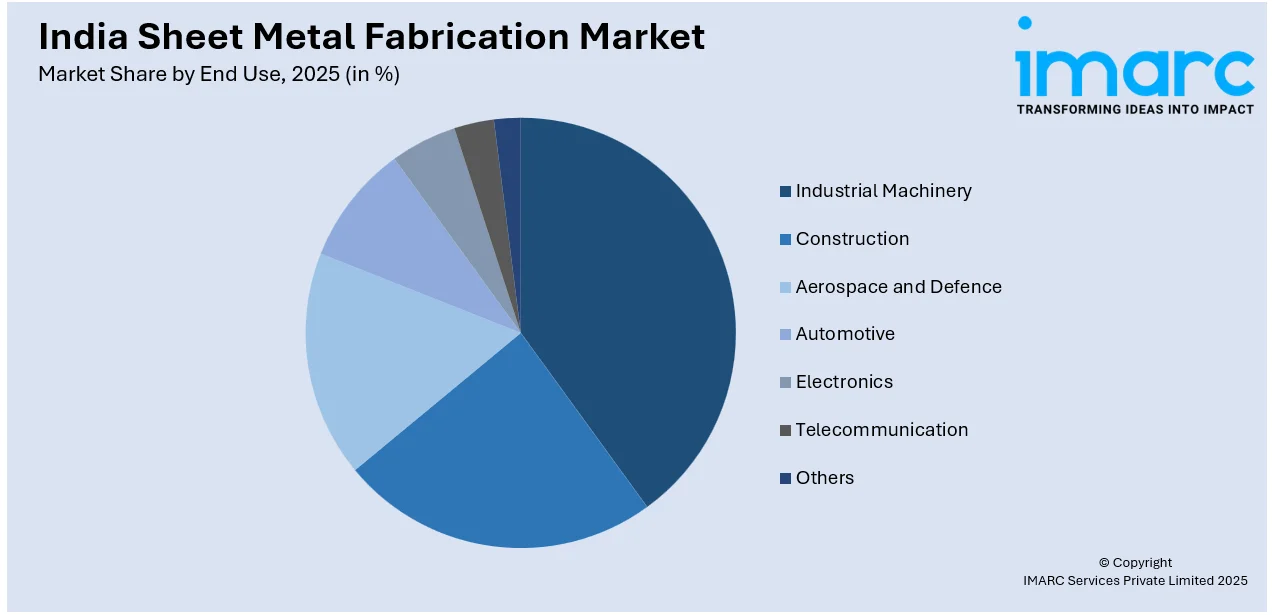

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Industrial Machinery

- Construction

- Aerospace and Defence

- Automotive

- Electronics

- Telecommunication

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes industrial machinery, construction, aerospace and defence, automotive, electronics, telecommunication, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sheet Metal Fabrication Market News:

- November 2024: Raghu Vamsi Group invested INR 300 Crore to build a precision manufacturing facility in Hyderabad. With advanced CNC machining and sheet metal fabrication, this expansion strengthens India's aerospace and defense supply chain, boosting local manufacturing capabilities and enhancing global competitiveness in high-precision components.

- September 2024: SLTL Group will showcase its 12kW Fiber Laser Cutting Machine at the Rajkot Machine Tools Show (September 25-28). This advancement in laser technology enhances precision, reduces material waste, and accelerates automation in India's sheet metal fabrication sector, boosting manufacturing efficiency and competitiveness.

India Sheet Metal Fabrication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Form Covered | Bend Sheet, Punch Sheet, Cut Sheet, Others |

| Material Covered | Silver, Aluminum, Others |

| End Use Covered | Industrial Machinery, Construction, Aerospace and Defence, Automotive, Electronics, Telecommunication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sheet metal fabrication market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sheet metal fabrication market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sheet metal fabrication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India sheet metal fabrication market was valued at USD 161.1 Million in 2025.

The India sheet metal fabrication market is projected to exhibit a CAGR of 5.64% during 2026-2034, reaching a value of USD 267.9 Million by 2034.

The India sheet metal fabrication market is driven by robust growth in automotive, aerospace, and heavy machinery sectors, alongside expanding infrastructure and construction projects. Technological advancements, such as laser cutting and CNC bending, enhance precision and efficiency. Rising demand for custom metal components and increasing emphasis on local manufacturing under “Make in India” also fuel market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)