India Sexual Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End Use, and Region, 2025-2033

Market Overview:

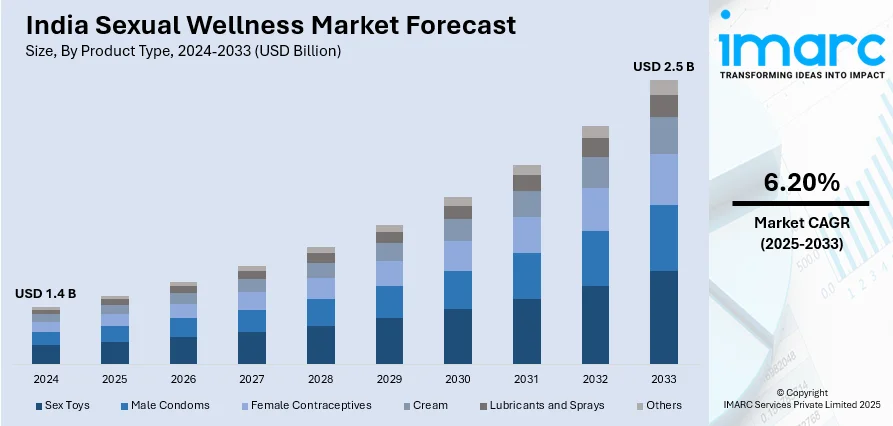

The India sexual wellness market size reached USD 1.4 Billion in 2024. The market is projected to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market growth is driven by rising awareness of sexual health, increasing incidences of STDs, government-backed education programs, the emergence of D2C startups offering discreet access to wellness products, and growing product availability online.

Market Insights:

- The regional segmentation includes North India, West and Central India, South India, and East India.

- The market is segmented by product type into sex toys, male condoms, female contraceptives, creams, lubricants and sprays, and others.

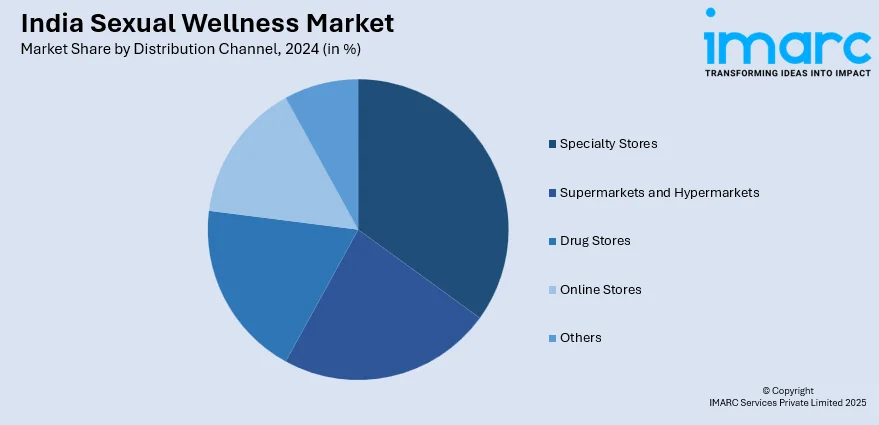

- The distribution channel segmentation includes specialty stores, supermarkets and hypermarkets, drug stores, online stores, and others.

- Based on end use, the market is categorized into men, women, and the LGBT community.

Market Size and Forecast:

- 2024 Market Size: USD 1.4 Billion

- 2033 Projected Market Size: USD 2.5 Billion

- CAGR (2025-2033): 6.20%

Sexual wellness is a personal care practice involving a state of physical, mental, and social well-being that is connected to one’s sexual desires and needs. A sexual wellness product is intended to warrant safe sex while enhancing pleasure during sexual interactions. It involves having access to sexual health information, education, and care. Moreover, these products and services ensure that the couples involved undergo a safe and pleasurable intimate experience without having to deal with coercion, discrimination, unplanned pregnancy, and violence. Increased exposure to sexual wellness can help create more awareness regarding planned pregnancy and considerably reduce the likelihood of contracting sexually transmitted diseases (STDs). Sexual wellness products include contraceptives, exotic lingerie and apparel, sex toys, lubricants, delay sprays, condoms, pregnancy testing products, menstrual cups, and dental dams.

To get more information of this market, Request Sample

The market is primarily driven by the growing number of health concerns regarding sexual dysfunction and well-being. This can be attributed to the increasing incidences of STDs such as human immunodeficiency virus (HIV), chlamydia, and herpes, across the country. Besides this, the Government of India is rolling out initiatives and schemes regarding comprehensive sex education programs, which is creating a positive India sexual wellness market outlook. The market is further driven by favorable initiatives by the government and independent NGOs promoting the proper use of contraceptives. Apart from this, numerous direct-to-consumer (D2C) startups are emerging across the country that offer sexual wellness products and solutions, including diagnostics and consultations with sexologists, to assist customers improve their sexual and reproductive health with free digital consultations and discreet product deliveries. Some of the other factors contributing to the market growth include the rising concerns regarding personal hygiene, the easy product availability across organized online retail platforms and extensive research and development (R&D) activities conducted by the key players.

India Sexual Wellness Market Trends:

Growth Drivers and Evolving Health Priorities

The sexual wellness industry in India is seeing robust traction due to shifting consumer priorities around holistic health and reproductive well-being. With increasing awareness of conditions like PCOS, hormonal imbalances, and fertility challenges, more consumers, especially women, are actively seeking preventive solutions, regular screening, and targeted wellness products. PCOS, now affecting a growing number of women in urban India, has opened new avenues for hormone-regulating supplements, intimate hygiene products, and personalized diagnostic tools. Fertility and conception-related concerns are also gaining attention among couples in both urban and semi-urban regions. This is driving demand for ovulation trackers, at-home semen analysis kits, and natural fertility boosters and expanding the India sexual wellness market share. These needs are being met through digitally enabled D2C brands and women’s health-focused startups that offer curated, education-driven products supported by virtual care services.

Changing Cultural Acceptance and Modern Consumer Behavior

There is a noticeable cultural shift in how sexual health is being approached, particularly among millennials and Gen Z consumers. Rising exposure to global narratives, sex-positive content on social media, and influencer-driven conversations around consent, pleasure, and reproductive health are helping dismantle long-standing stigmas, which is resulting in the India sexual wellness market growth. This is leading to greater openness in purchasing and discussing products ranging from lubricants to performance enhancers to fertility supplements. Regional preferences are also evolving, with a growing demand for Ayurvedic and herbal sexual wellness products that align with cultural values while addressing modern needs. Health-conscious consumers are now viewing sexual wellness as part of a broader self-care routine that is linked with mental health, hormonal balance, and relationship quality, rather than treating it as a taboo subject or a purely medical concern, as per the latest India sexual wellness market analysis.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India sexual wellness market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, distribution channel and end use.

Breakup by Product Type:

- Sex Toys

- Male Condoms

- Natural Latex Condoms

- Female Contraceptives

- Cream

- Waist/Hip Lightening Cream

- Hair Removal Foam/cream

- Lubricants and Sprays

- Gels

- Lubes

- Massage Oil

- Others

- Intimate Wash, Foam, Wipes

- Intimate Fragrances, Sprays, Pockets

Breakup by Distribution Channel:

- Specialty Stores

- Supermarkets and Hypermarkets

- Drug Stores

- Online Stores

- Others

Breakup by End Use:

- Men

- Women

- LGBT Community

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In April 2025, That Sassy Thing, India’s first women-first sexual wellness brand, raised approximately INR 6 Crore (USD 720,000) in a seed round led by Inflection Point Ventures, aiming to expand its product range and scale distribution across new channels. The company has served over 50,000 customers and achieved 200% year-on-year growth, while its online Sex Ed Masterclass on healing from sexual trauma won the UN Laadli Media & Advertising Award for Gender Sensitivity in 2024.

- In February 2025, Durex launched its first-ever podcast in India, hosted by Abhay Deol, to foster open and informed discussions about intimacy and pleasure, aiming to challenge misconceptions and break taboos in sexual wellness. By featuring prominent voices and real-life conversations, Durex is strengthening its role in India's sexual wellness market, encouraging a cultural shift toward healthier, stigma-free attitudes around intimacy.

- In December 2024, CondomBazaar.com announced the launch of Love Light Glow Condoms, India’s first glow-in-the-dark condom, set to debut at midnight on New Year's Eve. The product uses non-toxic phosphorescent material, offering a playful and safe intimacy experience, and reflects the growing trend toward innovative, stigma-free sexual wellness products in India.

- In December 2024, MyMuse introduced Edge, which it describes as India's most advanced vibrating male stroker, combining a textured 360° design and 10 vibration modes with an open-ended, discreet form for easy use and hygiene. Edge targets a growing market of Indian men interested in high-quality, stigma-free sexual wellness products. This release highlights the brand's continued innovation in men's sexual wellness and reflects the expanding demand for advanced, pleasure-focused products.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Distribution Channel, End Use, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

We expect the India sexual wellness market to exhibit a CAGR of 6.20% during 2025-2033.

The growing consumer health concerns towards sexual dysfunction and well-being, along with the increasing incidences of STDs, such as Human Immunodeficiency Virus (HIV), chlamydia, herpes, etc., are primarily driving the India sexual wellness market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of sexual wellness products across the nation.

Based on the product type, the India sexual wellness market can be categorized into sex toys, male condoms, female contraceptives, cream, lubricants and sprays, and others. Currently, sex toys account for the majority of the total market share.

Based on the distribution channel, the India sexual wellness market has been segregated into specialty stores, supermarkets and hypermarkets, drug stores, online stores, and others. Among these, drug stores currently exhibit a clear dominance in the market.

Based on the end use, the India sexual wellness market can be bifurcated into men, women, and LGBT community. Currently, men hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India sexual wellness market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)