India Seed Coating Market Size, Share, Trends and Forecast by Additive Type, Process, Crop Type, and Region, 2025-2033

India Seed Coating Market Overview:

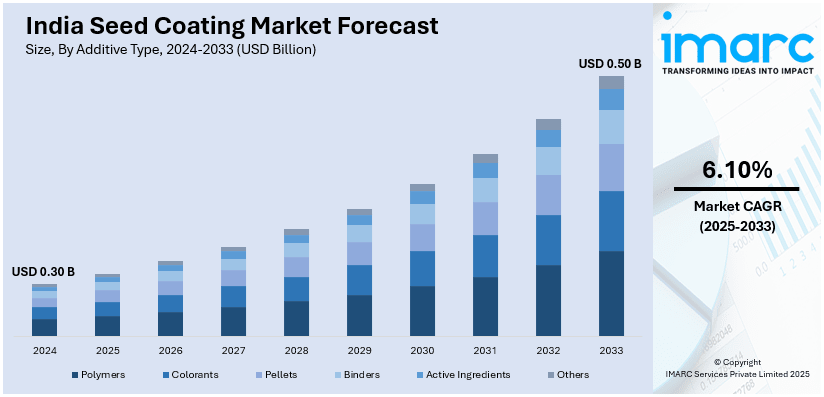

The India seed coating market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during2025-2033. The India seed coating market share is driven by rising adoption of hybrid and genetically modified (GM) seeds, which require coatings for protection and enhanced germination. Besides this, the expansion of precision farming increases demand for coated seeds, ensuring uniform sowing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.30 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate (2025-2033) | 6.10% |

India Seed Coating Market Trends:

Growing Adoption of Hybrid and Genetically Modified (GM) Seeds

Farmers prefer hybrid and GM seeds due to their higher yield potential and resistance to diseases. These seeds require protective coatings to enhance germination, seedling vigor, and overall crop performance. Seed coatings improve shelf life, preventing damage from pests, pathogens, and environmental factors. In 2024, genetically engineered insect-resistant seeds were used on 90% of US cotton acres, demonstrating their effectiveness in enhancing crop protection and yield. As hybrid and GM seeds are costlier, farmers use seed coatings to ensure maximum germination rates. Coated seeds offer uniform emergence, leading to better crop establishment and higher productivity in agricultural fields. The rising demand for food security encourages farmers to invest in high-quality, coated seeds. Improved seed coating technologies enhance nutrient uptake, promoting early plant growth and stress tolerance. Government initiatives supporting advanced seed technologies are further fueling the demand for coated hybrid seeds. The expansion of commercial and contract farming is increasing the use of coated seeds, further strengthening the India seed coating market growth. Seed coatings with bio stimulants, fungicides, and micronutrients provide additional benefits, ensuring healthier plant development. As the adoption of hybrid and GM seeds grows, the demand for advanced seed coating solutions continues to rise.

To get more information on this market, Request Sample

Expansion of Precision Farming

The India seed coating market outlook is being greatly impacted by the growth of precision farming. Utilizing cutting-edge methods, precision farming maximizes resource use and enhance agricultural output. According to data released by the IMARC Group, the size of the Indian smart agriculture market in 2024 was USD 714.1 million, demonstrating the growing use of farming solutions powered by technology. In precision farming systems, seed coating guarantees consistent seed dispersion, minimizing waste and improving crop establishment. Higher germination rates from coated seeds result in improved plant development and increased agricultural yields overall. Coated seeds are preferred by precision farmers due to their increased tolerance to environmental stress, illnesses, and pests. In precision agriculture, seed coatings offer vital micronutrients, bio stimulants, and protective substances to promote the healthy growth of seedlings. For effective sowing, seeds with consistent size and coating are necessary for precision farming's sophisticated equipment. The usage of coated seeds in precision farming is growing as a result of the rising need for sustainable agricultural methods. The need for seed coating technology is being further stimulated by government programs that support intelligent agricultural practices. Customized seed coatings for enhanced crop performance complement precision farming's emphasis on site-specific nutrient management. Farmers are being encouraged to purchase premium coated seeds by the incorporation of data-driven agricultural practices.

India Seed Coating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on additive type, process, and crop type.

Additive Type Insights:

- Polymers

- Colorants

- Pellets

- Binders

- Active Ingredients

- Others

The report has provided a detailed breakup and analysis of the market based on the additive type. This includes polymers, colorants, pellets, binders, active ingredients, and others.

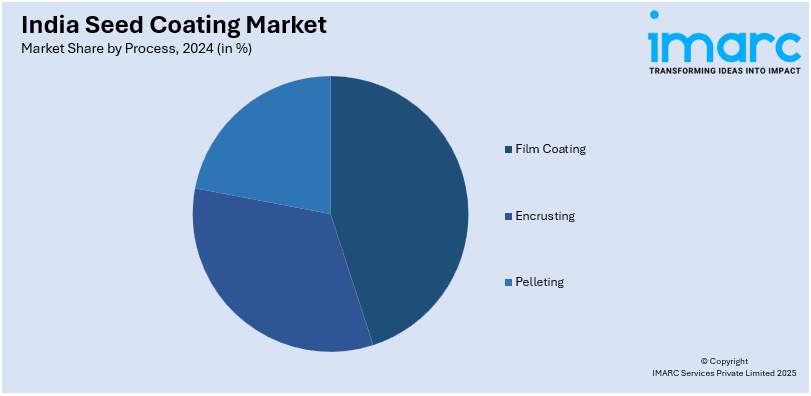

Process Insights:

- Film Coating

- Encrusting

- Pelleting

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes film coating, encrusting, and pelleting.

Crop Type Insights:

- Cereals and Grains

- Fruits and Vegetables

- Flowers and Ornamentals

- Oilseeds and Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals and grains, fruits and vegetables, flowers and ornamentals, oilseeds and pulses, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Seed Coating Market News:

- In December 2024, the Indian Institute of Oilseeds Research (IIOR) unveiled a biopolymer technology for seed coating to enhance agricultural productivity. This technology improved crop yields by 25-30% and provided cost-effective solutions by reducing the need for fertilizers and pesticides. IIOR partnered with private companies to commercialize this innovation across India.

- In September 2024, the ICAR-Indian Institute of Oilseeds Research (IIOR) developed a new seed treatment technology to protect microbial agents and soil nutrients, enhancing crop yields and soil health. This innovation offered farmers a sustainable solution to improve productivity while reducing chemical dependency, contributing to advancements in India's seed coating market and eco-friendly agricultural practices.

India Seed Coating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Additive Types Covered | Polymers, Colorants, Pellets, Binders, Active Ingredients, Others |

| Processes Covered | Film Coating, Encrusting, Pelleting |

| Crop Types Covered | Cereals and Grains, Fruits and Vegetables, Flowers and Ornamentals, Oilseeds and Pulses, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India seed coating market performed so far and how will it perform in the coming years?

- What is the breakup of the India seed coating market on the basis of additive type?

- What is the breakup of the India seed coating market on the basis of process?

- What is the breakup of the India seed coating market on the basis of crop type?

- What is the breakup of the India seed coating market on the basis of region?

- What are the various stages in the value chain of the India seed coating market?

- What are the key driving factors and challenges in the India seed coating market?

- What is the structure of the India seed coating market and who are the key players?

- What is the degree of competition in the India seed coating market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India seed coating market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India seed coating market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India seed coating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)