India Security Market Size, Share, Trends and Forecast by System, Service, End User, and Region, 2026-2034

India Security Market Size and Share:

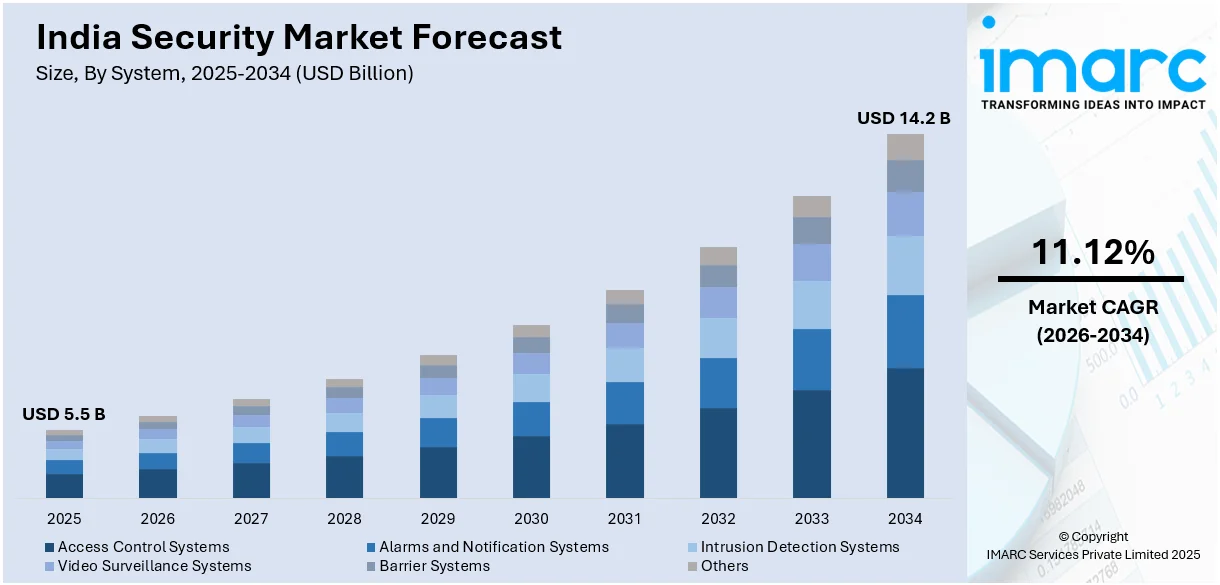

The India security market size was valued at USD 5.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 14.2 Billion by 2034, exhibiting a CAGR of 11.12% from 2026-2034. India's securities market is propelled by geopolitical tensions, leading to heightened border security measures and defense modernization. Increasing adoption of artificial intelligence (AI), Intent of Things (IoT), and big data analytics enhances threat detection and response capabilities. Additionally, the rise of e-commerce, fintech, and critical infrastructure protection drives demand for robust security frameworks and risk mitigation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.5 Billion |

|

Market Forecast in 2034

|

USD 14.2 Billion |

| Market Growth Rate (2026-2034) | 11.12% |

India's growing digitalization has increased cyber threats, and this has spurred investment in cybersecurity infrastructure. With heightened concerns regarding data breaches, ransomware, and cyber espionage, the government and private sectors are making advanced security solutions a priority. Programs like the National Cyber Security Strategy focus on enhancing protection of critical infrastructure. Other sectors such as banking, healthcare, and e-commerce are also embracing strong security solutions to protect sensitive information. The growth of cloud computing and IoT also requires stronger cybersecurity frameworks, which will increase demand for cybersecurity solutions, talented professionals, and AI-based threat detection technologies in India's security market.

To get more information on this market Request Sample

The government of India is investing significantly in security and defense upgradation under programs such as "Make in India" and "Atmanirbhar Bharat." Indigenous defense manufacturing policies are increasing domestic production and local content and decreasing reliance on overseas vendors. On top of this, smart city programs' extension and bolstering security checks on borders have lifted the need for surveillance networks, biometrics solutions, and AI warfare-based security products. Increasing tensions internationally are resulting in defense modernization prioritized by the government, fueling defense imports for upgraded defense gear, cyber-defense equipment, and AI surveillance equipment, pushing the nation's total defense security structure upward and further enhancing share.

India Security Market Trends:

Integration of Artificial Intelligence (AI) in Defense

India's Defence Forces are adopting AI to increase defence strengths with emphasis on AI-based surveillance, autonomous war-fighting vehicles, and robot systems. The Defence Research and Development Organisation (DRDO) is at the forefront of AI deployment in military technology, bolstering intelligence gathering and decision-making. To drive innovation, AI labs such as the Indian Army's AI Incubation Centre and the Indian Air Force's Centre of Excellence for Artificial Intelligence have been created. These are indicators of India's efforts towards modernizing defence infrastructure and technological advancement. AI integration would further enhance national security, enhance efficiency in operations, and limit the reliance on traditional warfighting strategies, putting India ahead in AI-enabled defence development.

Expansion of Cybersecurity Measures

India's cybersecurity industry is expanding fast, propelled by rising digitalization in various industries. With the rise in cyber attacks, spending on cybersecurity infrastructure is growing to safeguard core systems. The industry is expected to expand at a CAGR of 20.2% between 2025 and 2030, to USD 20.48 billion by 2030. The growth is opening up job opportunities, especially in data analytics and cybersecurity functions. Cities such as Bengaluru are emerging as hotspots for cybersecurity professionals, with both international and local companies heading there. The emphasis on strong cybersecurity frameworks is driving innovation and keeping security solutions ahead. With companies making data protection a top priority, India's cybersecurity industry is proving to be a central driver of the country's digital transformation plan.

Emphasis on Indigenous Defense Manufacturing

India's "Make in India" campaign is pushing self-reliance in defense production, with a vision to place the nation among the world's top five defense producers within five years, with a target of exports of USD 5 billion. The thrust has considerably increased local production, resulting in order increases for Indian defense companies. Defense exports achieved a record 210 billion rupees in the year ended March 2025 as increasing global demand for locally made military products raises hopes for doubling exports within three years. India is strengthening its defense and promoting economic growth by reducing its reliance on imports. India is a major player in the defense industry thanks to its emphasis on domestic manufacturing, which also bolsters the technological advancements, innovation, and strategic alliances with international defense firms.

India Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India security market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on system, service, and end user.

Analysis by System:

- Access Control Systems

- Alarms and Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

Access control systems manage entry into areas that are limited through authentication procedures such as keycards, biometrics, and PIN codes. By only allowing authorized persons access, the systems increase security while keeping out intruders. Advanced models have cloud computing and AI to support remote management of access and real-time monitoring of security, raising the overall security efficiency.

Real-time alarm and notification systems give immediate notifications in the case of emergencies, fires, or security intrusions. Through sensors, sirens, and auto-notifications via control centers or mobile apps, these systems allow for quick reactions. Critical for home and business security, they reduce risks by allowing for timely action against imminent threats or suspicious behavior.

Moreover, the intrusion detection systems detect unauthorized access attempts via sensors, cameras, and artificial intelligence-based analytics. Through anomaly detection in physical spaces and network traffic, they alert security teams, serving as a key to preventing cyber and physical attacks. Intrusion detection systems allow organizations to respond quickly to potential security violations.

Likewise, the Video monitoring systems employ cameras, AI-powered analytics, and cloud storage to monitor in real-time. They prevent crime, aid investigations, and enhance security management. Facets such as facial recognition, motion detection, and remote connectivity make them crucial for companies, public areas, and protecting strategic infrastructure.

Also, the barrier systems block access to safe areas physically with gates, turnstiles, roadblocks, and bollards. Used primarily for high-security locations like military bases, airports, and business properties, automated barriers can be combined with access control systems to increase security and manage traffic effectively.

However, the other security technologies are biometric verification, perimeter security systems, and drone monitoring. These technologies counter particular weaknesses, improving overall security. Technologies such as AI-based threat detection and blockchain-based identity verification improve security measures, assisting in countering emerging digital and physical threats.

Analysis by Service:

- System Integration and Consulting

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

System integration and consultancy services make it easy to integrate security solutions into an organization's infrastructure. Professionals evaluate security requirements, suggest appropriate technologies, and install access control, surveillance, and intrusion detection systems. These services increase operational efficiency, optimize security procedures, and deliver custom solutions to address industry-specific demands.

Risk analysis and assessment services determine weaknesses in an organization's security system. Experts analyze possible threats, confirm adherence to security standards, and create mitigation plans. This forward-looking strategy enhances resilience, reduces cyber and physical security threats, and enacts protective measures to secure vital assets and sensitive information.

Managed security services provide real-time monitoring, threat intelligence, and incident response through external cybersecurity capabilities. They enable companies to enhance security postures without having in-house capabilities. Such services involve the management of firewalls, monitoring of networks for security, protection of endpoints, and compliance management, providing adequate defense against progressive cyber attacks and unauthorized intrusions.

Support and maintenance services provide maximum security system performance with regular updates, repairs, and troubleshooting. Incorporating software patches, hardware servicing, and remote support, the services avoid system failures. Constant support and monitoring ensure organizations adhere to high levels of security and reduce downtime for mission-critical security operations.

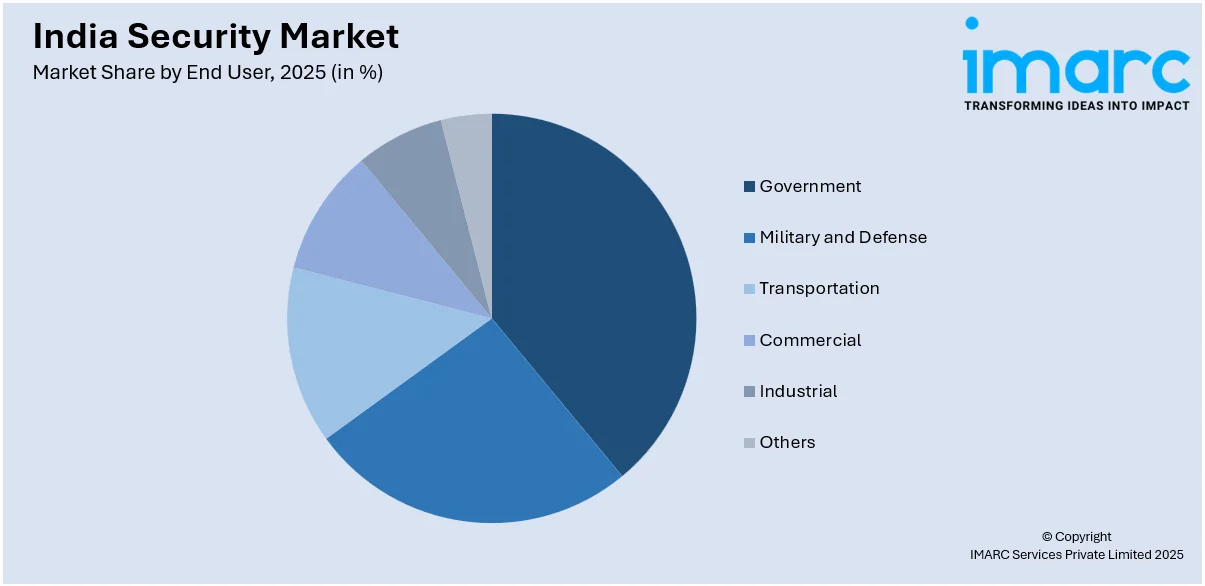

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Government

- Military and Defense

- Transportation

- Commercial

- Industrial

- Others

The government sector is one of the strongest drivers of India's security industry, making investments in high-end surveillance, cybersecurity, and biometric identification systems. Smart city projects, protection of critical infrastructure, and digital governance programs drive demand for AI-based security solutions to guarantee public safety, data security, and regulatory compliance with changing rules.

Additionally, the defence and military segment widely uses innovative security technologies like AI-based surveillance, cybersecurity mechanisms, and biometric authentication devices. Cyber warfare defense, border protection, and unmanned surveillance equipment investments improve the country's overall security. Defence Research and Development Organisation (DRDO) serves as a significant contributor to pushing security innovations to be used by the defence department.

Also, the transport industry consolidates security solutions for airports, railways, and mass transit to avert threats and ensure passenger security. Biometric verification, surveillance cameras, and artificial intelligence monitoring systems are commonly implemented. Government policies and intelligent transportation projects also fuel investments in access control, perimeter defense, and transport network cybersecurity.

Besides this, the business sector, such as retail, hospitality, and corporate spaces, is a significant user of security technologies. Companies spend on cloud-based surveillance, biometric access systems, and cybersecurity solutions to protect assets and information. Increased fear of fraud, data breaches, and physical security attacks fuels the use of sophisticated security infrastructure.

Furthermore, the manufacturing industry requires effective security solutions to secure factories, warehouses, and logistics centers. Surveillance through AI, perimeter security, and access control systems assist in reducing theft, sabotage, and cyber attacks. Smart security technology to ensure regulatory compliance and safety drives industries to implement smart security technologies for operational effectiveness and risk management.

Along with this, the others segment comprises healthcare, education, and residential segments, each embracing customized security solutions. Hospitals employ cybersecurity and surveillance for protecting patient information, schools utilize access control systems for securing students, and residential complexes embrace AI-based security to avoid unauthorized entry, in line with the increasing focus on holistic security infrastructure in various sectors.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India is a central hub for the security market due to high urbanization, a robust IT sector, and growing infrastructure development. Bengaluru and Hyderabad are leading in cybersecurity and surveillance solutions, with major investments in biometric authentication, AI-based security, and cloud monitoring systems to provide safety and data protection.

Furthermore, North India witnesses enhanced demand for security solutions from mounting urban growth, industrialization, and smart city initiatives initiated by the government. Delhi NCR and other urban centers give more importance to state-of-the-art surveillance, perimeter security, and cybersecurity in response to expanding crime rates and cyber attacks. Regulative initiatives further fuel market growth across different industries.

Also, the West and Central India region, such as Maharashtra and Gujarat, is a key market for security solutions because of its robust industrial base and commercial centers. The concentration of financial institutions and manufacturing units drives demand for AI-based surveillance, biometric access control, and cloud-based security systems, with companies emphasizing compliance with changing security regulations.

But the East India security market is growing due to infrastructure expansion, rising smart city investment and government projects. Kolkata and other new urban metropolises are witnessing growing application of video surveillance, cybersecurity systems, and biometric solutions. The emphasis within the region for critical infrastructure protection further increases demand for sophisticated security technologies in the market.

Competitive Landscape:

India's security industry is characterized by high competition, driven by changing threats, regulatory requirements, and technological innovations. Companies focus on innovation, offering solutions in access control, cybersecurity, and surveillance to cater to increasing demand. Cloud monitoring, biometric authentication, and AI-based security products are becoming increasingly popular. New entrants use local know-how and low-cost solutions to disrupt incumbent companies. Government policies and industry norms play a crucial role in product development, adding to the market's dynamic and diversified nature. As businesses increase their capabilities, partnerships, strategic investments, and mergers are frequent. With the rising digital risks and infrastructure security threats, competition will only escalate, emphasizing scalability, reliability, and flexibility in security products.

The report provides a comprehensive analysis of the competitive landscape in the India security market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, The Data Security Council of India launched the ‘Cyber for HER’ Hackathon under the India-UK Cyber Programme to strengthen cybersecurity ties and workforce diversity. With rising cyber threats and gender disparities in the industry, the initiative aims to empower young women, bridging skill gaps and encouraging careers in cybersecurity for a safer digital future.

- In October 2024, Google announced the launch of its fraud detection pilot in India, following earlier rollouts in Brazil and Singapore. As cybercrime surges, companies are enhancing their cybersecurity measures, and Google is no exception. This initiative aims to tackle rising cyber fraud, with Indians losing over ₹1,750 crore ($212 million USD) in just the first four months of 2024, according to the Indian Cyber Crime Coordination Centre (I4C).

- In August 2024, Kyndryl launched a Security Operations Center (SOC) in Bengaluru, India, to enhance cybersecurity with AI-driven threat detection and automation. Operating 24/7, the center provides cyber threat intelligence and incident response, supporting businesses amid rising cyber risks. With over 400 million cyber threats detected in India in 2023, the SOC aims to safeguard enterprises, offering hybrid and fully managed security solutions through Kyndryl’s global cybersecurity expertise.

- In February 2024, The US Consulate and MCCIA launched the first-ever US-India Cyber Security Initiative to strengthen IT ties and drive innovation. Announced in Pune, the initiative unites global cybersecurity experts to create jobs, develop advanced solutions, and foster mentorship in cyberspace. With rapid digital advancements, it aims to enhance collaboration and people-to-people ties in cybersecurity between both nations.

India Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India security market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India security market was valued at USD 5.5 Billion in 2025.

The India security market was valued at USD 14.2 Billion in 2034 exhibiting a CAGR of 11.12% during 2026-2034.

The growth of India's security market is driven by rising cyber threats, increasing government investments in defense and surveillance, rapid digital transformation, and stringent regulatory compliance. Expanding smart city projects and growing corporate security needs further fuel demand for advanced security solutions, including cybersecurity, biometrics, and surveillance technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)