India Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Region, 2026-2034

India Secondhand Luxury Goods Market Summary:

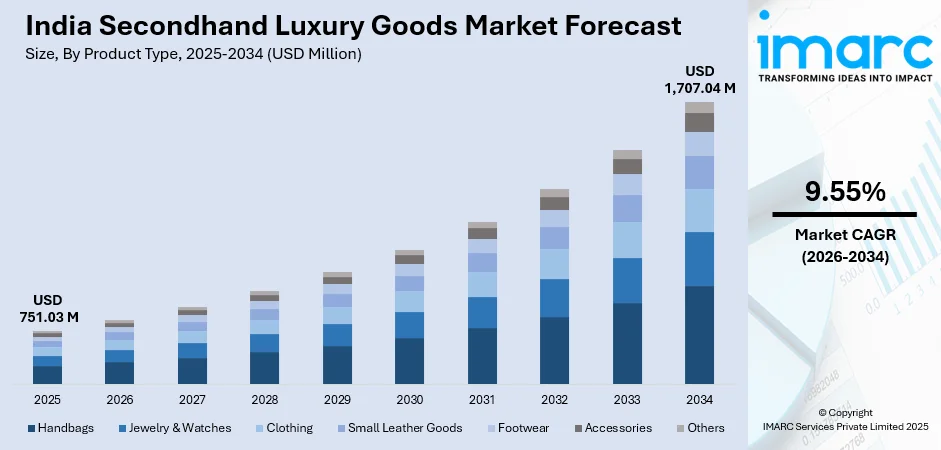

The India secondhand luxury goods market size was valued at USD 751.03 Million in 2025 and is projected to reach USD 1,707.04 Million by 2034, growing at a compound annual growth rate of 9.55% from 2026-2034.

The India secondhand luxury goods market is experiencing robust growth driven by evolving consumer attitudes toward sustainable fashion and increasing accessibility of premium brands at affordable prices. Rising disposable incomes among the urban middle class, coupled with growing environmental consciousness, are reshaping purchasing patterns across the nation. The expansion of digital resale platforms has revolutionized how consumers discover and acquire pre-owned luxury items, with authentication technologies building crucial trust in the marketplace. Younger demographics, particularly millennials and Gen Z consumers, are leading the adoption of secondhand luxury goods, prioritizing unique styles and value retention over traditional ownership models. The proliferation of organized retail channels and curated boutiques has further elevated market accessibility, enabling a broader consumer base to participate in the India secondhand luxury goods market share.

Key Takeaways and Insights:

- By Product Type: Handbags dominate the market with a share of 38% in 2025, owing to their enduring fashion appeal, strong brand recognition, and status symbolism among Indian consumers. Premium designer handbags retain value exceptionally well, making them ideal for resale transactions.

- By Demography: Women lead the market with a share of 64% in 2025. This dominance is driven by higher engagement with luxury fashion categories, particularly designer handbags, jewelry, and apparel, reflecting diverse style preferences and purchasing frequency.

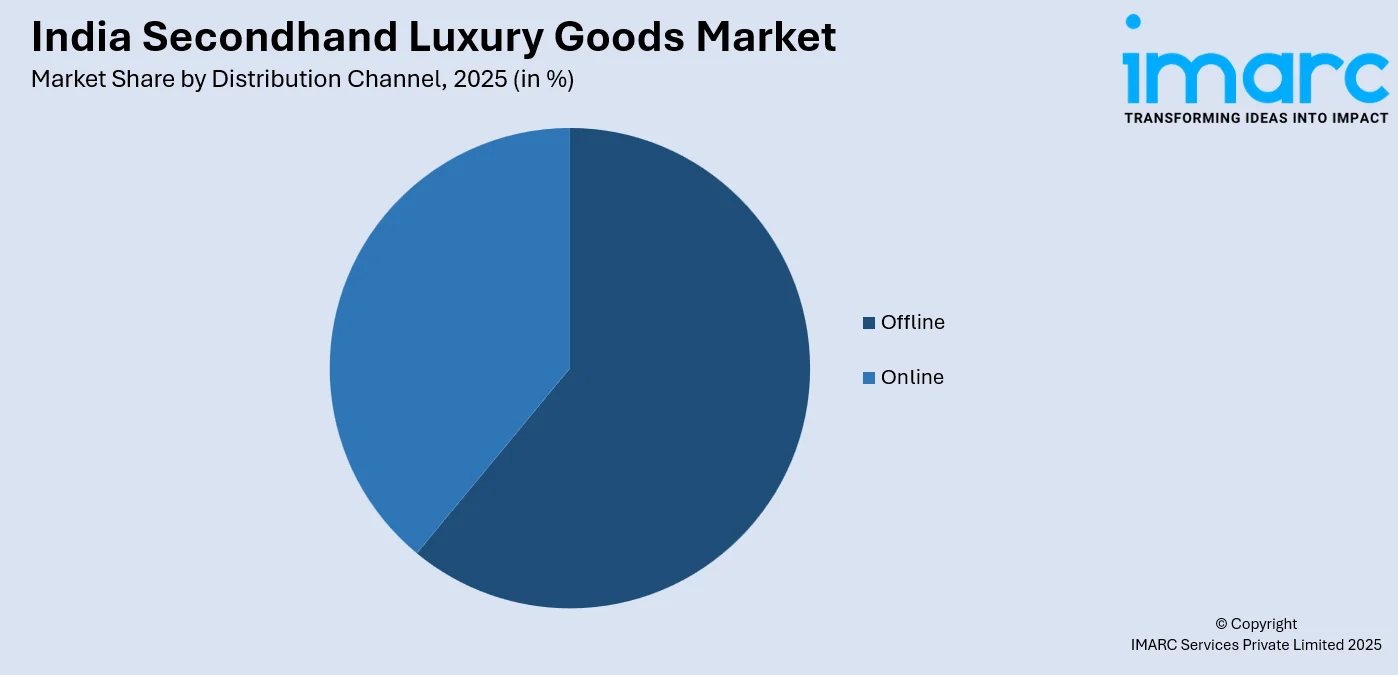

- By Distribution Channel: Offline represents the biggest segment with a market share of 61% in 2025, reflecting consumer preference for physical inspection and authentication verification of luxury items before purchase, alongside personalized service experiences at retail boutiques.

- By Region: North India is the largest region with 35% share in 2025, driven by the concentration of affluent consumers in Delhi-NCR, higher disposable incomes, established retail infrastructure, and strong presence of luxury resale boutiques and platforms.

- Key Players: Key players drive the India secondhand luxury goods market by expanding authentication capabilities, strengthening digital platforms, and enhancing consumer trust through quality assurance. Their investments in retail expansion, strategic partnerships, and curated collections accelerate adoption and ensure consistent product availability.

To get more information on this market Request Sample

India Secondhand Luxury Goods Market Trends:

Proliferation of Digital Resale Platforms

The India secondhand luxury goods market is witnessing a significant shift toward digital platforms, with specialized marketplaces revolutionizing how consumers access pre-owned premium items. These platforms offer authenticated products with detailed provenance information, enhancing buyer confidence and transaction security. The culture of online luxury shopping is expanding beyond metropolitan cities into tier two and tier three markets, democratizing access to premium brands. Advanced verification systems and seamless user interfaces are strengthening consumer trust while enabling broader geographic reach across diverse consumer segments.

Sustainability-Driven Consumer Behavior

Environmental consciousness is fundamentally reshaping purchasing decisions within the India secondhand luxury goods market growth trajectory. Consumers increasingly view pre-owned luxury purchases as responsible consumption choices that extend product lifecycles and reduce textile waste. This mindset shift is particularly pronounced among younger demographics who prioritize circular fashion principles. In August 2024, H&M and Save the Children India collaborated to create Tikau Fashion, a project that reduces waste and promotes sustainable practices through programs for used apparel. This effort reflects a larger industry commitment to circular economy concepts.

Growing Participation of Younger Consumers

Millennials and Generation Z consumers are emerging as the primary drivers of secondhand luxury adoption in India, fundamentally transforming market dynamics and demand patterns. These demographics prioritize unique styles, affordability, and value retention over traditional luxury ownership models, seeking distinctive pieces that express individuality. Social media influence and creator-driven content significantly impact purchasing decisions among these consumers. The preference for pre-owned products aligns with environmental consciousness and sustainable consumption values increasingly reflected in Indian consumer behavior patterns among younger generations.

Market Outlook 2026-2034:

The India secondhand luxury goods market is poised for sustained expansion as digital infrastructure improvements, authentication technology advancements, and evolving consumer attitudes converge to strengthen market fundamentals. The increasing penetration of organized resale platforms into tier two and tier three cities will unlock substantial demand from aspirational consumers seeking accessible luxury options. The market generated a revenue of USD 751.03 Million in 2025 and is projected to reach a revenue of USD 1,707.04 Million by 2034, growing at a compound annual growth rate of 9.55% from 2026-2034. Strategic partnerships between luxury brands and resale platforms, enhanced verification systems, and curated retail experiences will continue driving consumer confidence and market penetration throughout the forecast period.

India Secondhand Luxury Goods Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Handbags | 38% |

| Demography | Women | 64% |

| Distribution Channel | Offline | 61% |

| Region | North India | 35% |

Product Type Insights:

- Handbags

- Jewelry & Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

Handbags dominate with a market share of 38% of the total India secondhand luxury goods market in 2025.

The handbags segment leads the India secondhand luxury goods market owing to the enduring appeal of designer bags as status symbols and fashion staples among Indian consumers. Premium brands like Louis Vuitton, Gucci, Hermès, and Chanel command significant demand in the pre-owned market due to their timeless designs and exceptional craftsmanship. The high resale value retention of luxury handbags makes them attractive for both buyers seeking affordable luxury and sellers looking to recover investment. In April 2024, Hermès announced the opening of its first store dedicated exclusively to its leather goods collection in Mumbai, marking significant geographic expansion in the Indian market.

The popularity of secondhand luxury handbags is particularly pronounced among working professionals and fashion-conscious consumers who view these accessories as investment pieces rather than disposable purchases. Online platforms specializing in authenticated pre-owned handbags have simplified the buying experience, offering detailed condition reports and verification certificates. The category benefits from lower depreciation compared to other luxury segments, with iconic styles often appreciating in value.

Demography Insights:

- Women

- Men

- Unisex

Women lead with a share of 64% of the total India secondhand luxury goods market in 2025.

The women's segment dominates the India secondhand luxury goods market driven by extensive product categories spanning handbags, jewelry, watches, clothing, and accessories that cater to diverse style preferences. Female consumers demonstrate higher engagement frequency with luxury fashion, seeking variety in designer pieces for different occasions and seasons. The cultural emphasis on jewelry and accessories for weddings and festivals further strengthens women's participation in the pre-owned luxury market. This demographic exhibits strong brand awareness and appreciation for craftsmanship that translates into sustained demand for authenticated pre-owned items.

Women consumers increasingly view secondhand luxury purchases as smart financial decisions that enable access to prestigious brands without full retail pricing. The segment benefits from active social media communities where pre-owned luxury items are showcased and discussed, driving awareness and normalizing resale consumption. Working women in metropolitan cities particularly favor pre-owned designer items that offer workplace-appropriate sophistication at accessible price points. The strong cultural affinity for jewelry and fashion accessories among Indian women naturally extends purchasing interest toward pre-owned luxury markets offering curated selections.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline exhibits a clear dominance with a 61% share of the total India secondhand luxury goods market in 2025.

The offline distribution channel maintains dominance in the India secondhand luxury goods market as consumers prefer physical inspection of pre-owned items before committing to purchase decisions. Brick-and-mortar stores and curated boutiques offer tangible authentication experiences where buyers can examine product condition, verify craftsmanship details, and receive expert guidance from trained professionals. The personal shopping experience and immediate possession appeal strongly to consumers wary of potential authenticity issues in unseen transactions. Physical retail environments enable detailed assessment of material quality, stitching precision, and hardware authenticity that photographs cannot adequately convey, reinforcing buyer confidence in high-value purchases.

Premium resale boutiques in metropolitan cities have cultivated loyal customer bases by offering curated selections, authentication guarantees, and personalized service that online channels struggle to replicate effectively. The offline channel also benefits from consignment models where sellers can receive immediate payment or transparent commission structures upon sale completion. Trust-building through face-to-face interactions remains crucial in a market where authentication concerns persist among first-time buyers. Additionally, the tactile experience of handling luxury items and trying accessories before purchase enhances emotional connection and reduces post-purchase dissatisfaction risks.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents the leading segment with a 35% share of the total India secondhand luxury goods market in 2025.

North India commands the largest regional share in the secondhand luxury goods market driven by Delhi-NCR's concentration of affluent consumers, established luxury retail infrastructure, and strong presence of dedicated resale platforms. The region benefits from higher disposable incomes, cosmopolitan consumer preferences, and proximity to fashion-forward trends influencing purchasing decisions. The presence of multiple organized resale boutiques and authenticated online platforms operating from Delhi strengthens market accessibility for regional consumers. Culture Circle, a leading luxury resale platform, secured a Rs 3 Crore investment from prominent entrepreneurs Kunal Bahl and Ritesh Agarwal, with physical stores operating in Delhi among other metropolitan cities.

The wedding season demand for luxury accessories and jewelry significantly bolsters North India's secondhand luxury market, with consumers seeking premium items for celebrations at accessible prices. Corporate professionals in Gurgaon and Delhi prefer pre-owned luxury watches and accessories that project professional sophistication without full retail investment. The region's well-developed logistics infrastructure enables efficient authentication and delivery services essential for market growth. North India's dominance is further supported by the concentration of high-net-worth individuals who both purchase and consign pre-owned luxury items through established channels.

Market Dynamics:

Growth Drivers:

Why is the India Secondhand Luxury Goods Market Growing?

Rising Disposable Incomes and Expanding Affluent Consumer Base

The India secondhand luxury goods market is experiencing robust growth fueled by steadily rising disposable incomes among urban middle-class and upper-middle-class consumers. Economic prosperity has expanded the base of aspirational buyers who seek luxury brand experiences without the substantial financial commitment required for new purchases. This income growth enables consumers to allocate discretionary spending toward premium pre-owned items that offer prestigious brand ownership at accessible prices. The expansion of organized retail employment and entrepreneurial opportunities in metropolitan areas has created new consumer segments with appreciation for luxury aesthetics and willingness to explore secondhand alternatives. Additionally, changing attitudes toward pre-owned goods among younger affluent consumers have normalized resale purchases as financially astute choices.

Growing Consumer Awareness of Environmental Sustainability

Environmental consciousness is fundamentally reshaping purchasing behaviors in the India secondhand luxury goods market as consumers increasingly recognize the ecological impact of fashion consumption. The circular fashion movement has gained significant traction among environmentally aware consumers who view pre-owned luxury purchases as responsible alternatives to new production. Awareness campaigns and social media discourse around textile waste have highlighted the environmental benefits of extending product lifecycles through resale. Younger demographics particularly embrace sustainability principles, driving demand for pre-owned luxury items that align with their values while offering access to prestigious brands. The fashion industry's substantial environmental footprint has motivated conscious consumers to explore secondhand markets as meaningful steps toward reducing personal ecological impact.

Expansion of Organized Resale Platforms and Authentication Technology

The proliferation of organized resale platforms equipped with advanced authentication technologies has transformed the India secondhand luxury goods market by addressing trust concerns that previously hindered growth. Digital platforms have democratized access to pre-owned luxury items, enabling consumers in smaller cities to participate in markets previously concentrated in metropolitan areas. Sophisticated verification systems employing artificial intelligence, microscopy, and blockchain technology have substantially reduced counterfeit risks, building buyer confidence essential for market expansion. The convenience of digital browsing, secure transactions, and doorstep delivery has accelerated adoption among time-constrained urban consumers who value efficiency alongside authenticity assurance.

Market Restraints:

What Challenges the India Secondhand Luxury Goods Market is Facing?

Prevalence of Counterfeit Products and Authentication Challenges

The significant presence of counterfeit luxury goods in the Indian market poses substantial challenges to secondhand luxury growth by eroding consumer trust and complicating authentication processes. Sophisticated counterfeiting operations produce increasingly convincing replicas that challenge even experienced buyers and authentication systems. The widespread nature of counterfeit penetration across retail channels undermines buyer confidence and necessitates substantial investment in verification technologies and expertise.

Limited Consumer Awareness in Tier Two and Tier Three Cities

Consumer awareness of organized secondhand luxury markets remains concentrated in metropolitan areas, with significant knowledge gaps persisting in smaller cities and towns. Many potential buyers in these regions remain unfamiliar with authentication processes, platform reliability, and the value proposition of pre-owned luxury items. This awareness deficit limits market penetration beyond established urban centers and restricts growth potential in emerging consumer segments.

Social Stigma and Cultural Perceptions Around Pre-Owned Goods

Cultural perceptions associating secondhand goods with diminished value or social standing continue to restrain market growth among certain consumer segments. Traditional attitudes favoring new purchases, particularly for gifts and special occasions, limit acceptance of pre-owned luxury items despite their quality and authenticity. Overcoming deeply ingrained preferences requires sustained education efforts and shifting social narratives around sustainable consumption.

Competitive Landscape:

The India secondhand luxury goods market features a dynamic competitive landscape with established resale platforms, emerging digital marketplaces, and traditional consignment boutiques vying for consumer attention. Companies are differentiating through authentication expertise, curated selections, and omnichannel experiences that combine digital convenience with physical verification options. Investment in technology infrastructure, customer service excellence, and strategic geographic expansion characterizes competitive strategies across market participants. The market structure accommodates both specialized platforms focusing on specific product categories and comprehensive marketplaces offering diverse luxury item selections. Partnerships with authentication technology providers and luxury brand collaborations are strengthening market credibility and consumer trust. Competitive intensity continues increasing as new entrants recognize growth potential and established players expand service offerings.

India Secondhand Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handbags, Jewelry & Watches, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographies Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India secondhand luxury goods market size was valued at USD 751.03 Million in 2025.

The India secondhand luxury goods market is expected to grow at a compound annual growth rate of 9.55% from 2026-2034 to reach USD 1,707.04 Million by 2034.

Handbags dominated the market with a share of 38%, driven by strong brand recognition, exceptional value retention, and enduring fashion appeal among Indian consumers seeking accessible luxury.

Key factors driving the India secondhand luxury goods market include rising disposable incomes, growing sustainability awareness, expansion of authenticated digital resale platforms, and increasing acceptance of pre-owned luxury among younger consumers.

Major challenges include prevalence of counterfeit products, authentication complexities, limited consumer awareness in smaller cities, persistent social stigma around secondhand purchases, and trust barriers among first-time buyers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)