India Satellite Broadband Service Market Size, Share, Trends and Forecast by Frequency Band, Satellite Type, Application, and Region, 2025-2033

India Satellite Broadband Service Market Overview:

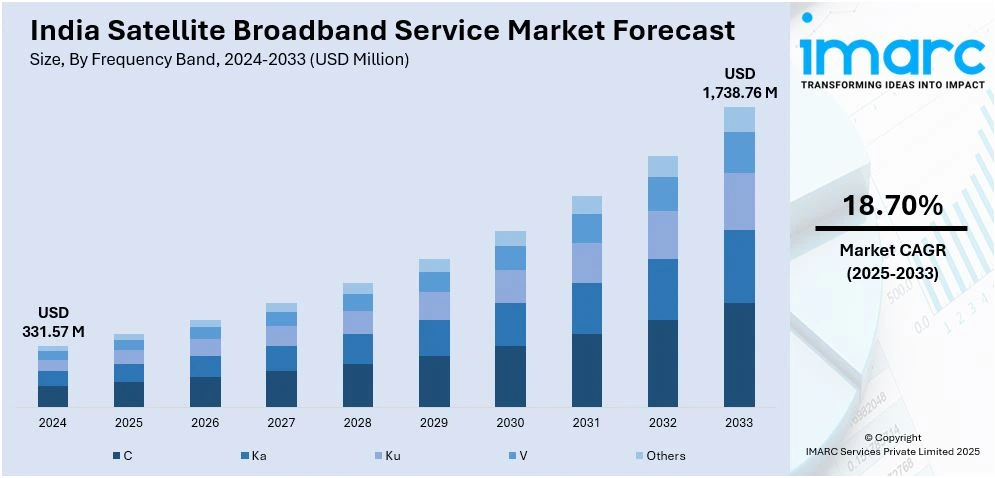

The India satellite broadband service market size reached USD 331.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,738.76 Million by 2033, exhibiting a growth rate (CAGR) of 18.70% during 2025-2033. The market is driven by rising demand for connectivity in rural and remote areas, government digital inclusion initiatives, and private sector investments. Technological advancements including LEO satellites, reduced latency, and competitive pricing are also augmenting the India satellite broadband service market share. Increasing adoption of online education, telemedicine, and enterprise broadband needs also accelerate market expansion. Regulatory reforms and global player entry enhance sector development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 331.57 Million |

| Market Forecast in 2033 | USD 1,738.76 Million |

| Market Growth Rate 2025-2033 | 18.70% |

India Satellite Broadband Service Market Trends:

Rising Demand for Satellite Broadband in Rural and Remote Areas

The increasing demand in rural and underserved regions is significantly supporting the India satellite broadband service market growth. Traditional fiber and wireless networks face challenges in reaching remote locations due to infrastructure limitations, making satellite broadband a viable alternative. With the Indian government's focus on digital inclusion through initiatives such as Digital India, satellite internet providers are expanding coverage to bridge the connectivity gap. In India, INR 1,39,579 Crore (approximately USD 16.81 Billion) has been invested in the BharatNet initiative, which aims to provide high-speed broadband to 2,64,000 Gram Panchayats and 3,80,000 non-GP villages through optical fiber and satellite technology. Currently, 615,836 villages have 4G mobile connectivity, while the upcoming 5G rollout in the country is also improving India's satellite broadband service market, which has led to greater digital access in rural parts of the country. Companies are deploying Low Earth Orbit (LEO) and Geostationary (GEO) satellites to deliver high-speed internet to villages, hilly terrains, and maritime areas. Additionally, the growing adoption of online education, telemedicine, and e-governance in rural India is further driving demand. As satellite technology advances, costs are expected to decrease, making services more affordable for end-users. This trend is set to accelerate, positioning satellite broadband as a key enabler of universal internet access in India.

To get more information on this market, Request Sample

Integration of Satellite Broadband with 5G and IoT Ecosystems

Satellite broadband is increasingly being integrated with 5G and IoT networks to support seamless connectivity across India. According to an industry report, India's 5G user base is expected to reach 970 Million by 2030, which is equivalent to 74% of mobile subscribers. This expansion is driven by innovations in Generative AI and a growing appetite for high-quality services. By the end of 2024, 5G subscriptions were expected to touch 270 Million, pointing to rapid change in India's telecom industry. This expansion has found a huge opportunity in the satellite broadband sector. Telecom operators are exploring hybrid models that combine terrestrial 5G with satellite backhaul to ensure uninterrupted coverage in hard-to-reach areas which is creating a positive India satellite broadband service market outlook. This trend is particularly beneficial for industries including agriculture, logistics, and smart cities, where IoT devices require reliable, low-latency connectivity. Companies such as Reliance Jio and Bharti Airtel are investing in satellite-based solutions to complement their 5G rollouts. Furthermore, continual advancements in multi-orbit satellite systems (LEO, MEO, GEO) enhance network resilience and bandwidth capacity. As India's digital economy grows, the convergence of satellite broadband with next-gen technologies will play a pivotal role in enabling nationwide high-speed connectivity.

India Satellite Broadband Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on frequency band, satellite type, and application.

Frequency Band Insights:

- C

- Ka

- Ku

- V

- Others

The report has provided a detailed breakup and analysis of the market based on the frequency band. This includes C, Ka, Ku, V, and others.

Satellite Type Insights:

- Geostationary Orbit

- Medium Earth Orbit

- Low Earth Orbit

A detailed breakup and analysis of the market based on the satellite type have also been provided in the report. This includes geostationary orbit, medium earth orbit, and low earth orbit.

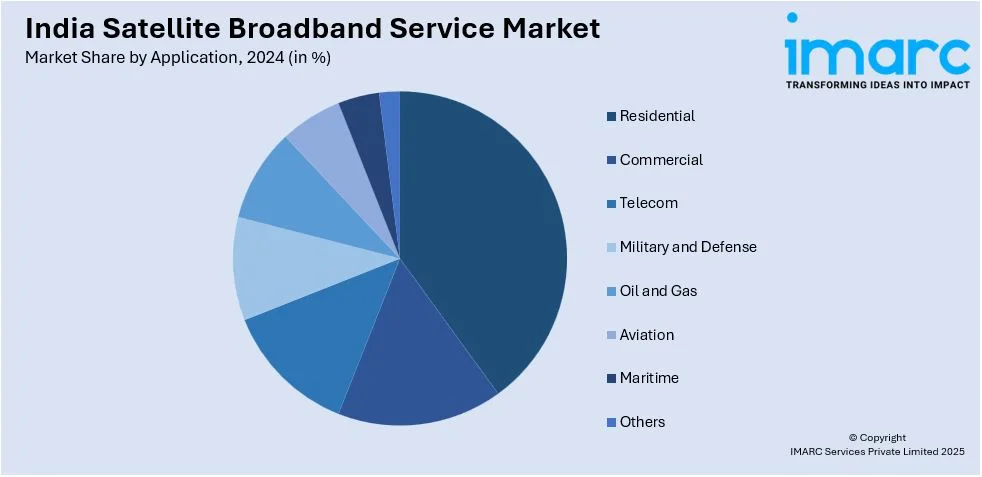

Application Insights:

- Residential

- Commercial

- Telecom

- Military and Defense

- Oil and Gas

- Aviation

- Maritime

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, telecom, military and defense, oil and gas, aviation, maritime, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Satellite Broadband Service Market News:

- January 22, 2025: Bharti Airtel (Airtel) established two base stations in Gujarat and Tamil Nadu and is waiting for spectrum allocation ahead of the service's launch. The addition of 635 already operational satellites globally will be used to strengthen broadband connectivity in remote areas, creating a stronghold in building the satellite broadband services industry in India.

- June 13, 2024: Jio Platforms, in collaboration with Luxembourg's SES, received permission from the Indian space regulator to launch satellites. As a result, this partnership puts them directly against competition posed by Amazon's Project Kuiper as well as Elon Musk's Starlink while enhancing India's satellite broadband service industry in the face of growing connectivity demands.

India Satellite Broadband Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Frequency Bands Covered | C, Ka, Ku, V, Others |

| Satellite Types Covered | Geostationary Orbit, Medium Earth Orbit, Low Earth Orbit |

| Applications Covered | Residential, Commercial, Telecom, Military and Defense, Oil and Gas, Aviation, Maritime, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India satellite broadband service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India satellite broadband service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India satellite broadband service industry and its attractiveness.

Key Questions Answered in This Report

The Satellite Broadband Service market in India was valued at USD 331.57 Million in 2024.

The India satellite broadband service market is projected to exhibit a CAGR of 18.70% during 2025-2033, reaching a value of USD 1,738.76 Million by 2033.

Growing demand for rural and remote connectivity, government digital inclusion projects like BharatNet, LEO satellite deployments, integration with 5G and IoT, and rising adoption of online education, telemedicine, and enterprise broadband are driving market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)