India Safes and Vaults Market Size, Share, Trends and Forecast by Type, Function Type, Application, End User, and Region, 2026-2034

Market Overview:

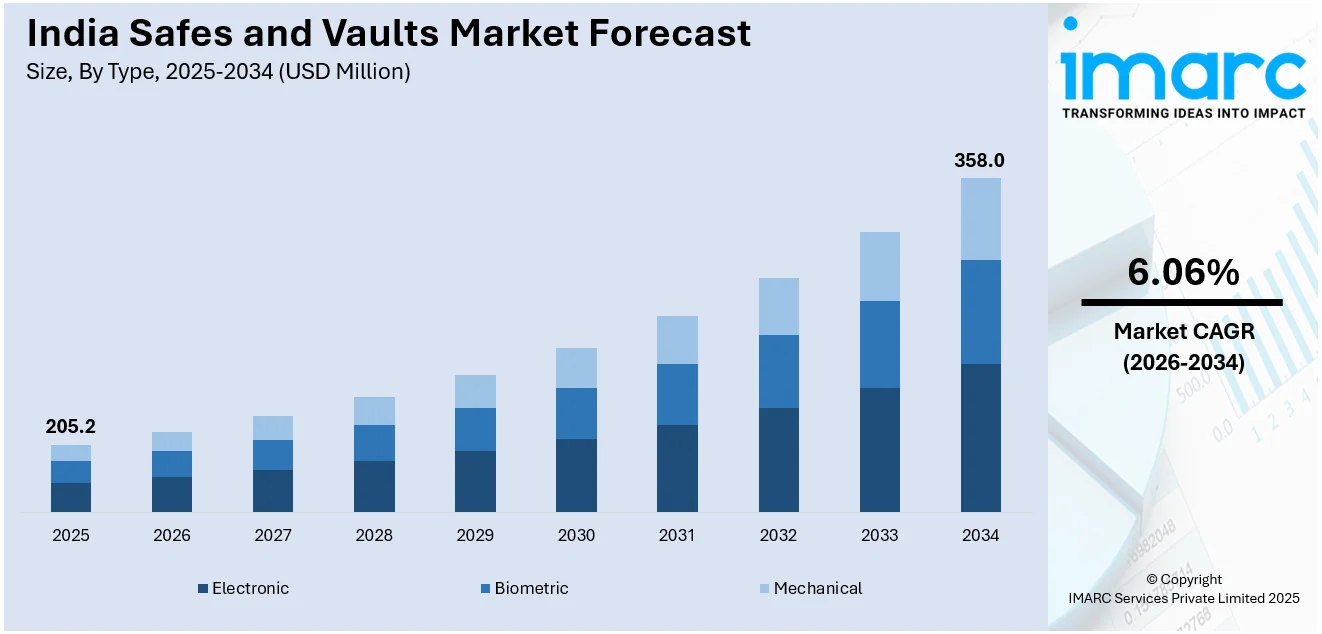

The India safes and vaults market size reached USD 205.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 358.0 Million by 2034, exhibiting a growth rate (CAGR) of 6.06% during 2026-2034. The increasing consciousness regarding the safety of valuables among Indian households and businesses, rising stringency in the regulatory landscape, and continual technological advancements and innovations represent some of the factors that are propelling the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 205.2 Million |

| Market Forecast in 2034 | USD 358.0 Million |

| Market Growth Rate 2026-2034 | 6.06% |

Safes and vaults are secure storage systems that are designed to protect valuables and important documents from theft, damage, and unauthorized access. In the context of India, they hold considerable significance due to the cultural propensity towards accumulating and safeguarding tangible assets like gold, jewelry, and critical documents. Safes are typically smaller and portable, often used in residential and small business settings. Vaults, on the other hand, are larger and built into the structure of a building. They incorporate barriers like walls, floors, and doors, constructed from high-strength materials, to ensure an elevated level of protection. They are generally made from metal, and equipped with a variety of security features such as lock mechanisms, time locks, relocking devices, and fire-resistant materials.

To get more information on this market Request Sample

The market in India is primarily driven by the increasing consciousness regarding the safety of valuables among Indian households and businesses. In line with this, the rising crime rates including theft, intrusion and burglary are resulting in a higher product uptake. Moreover, the rapid expansion of banking, retail, and commercial sectors necessitating advanced and secure storage solutions is fueling the demand for high-quality safes and vaults. Also, the inflating disposable income levels of the masses along with improved living standards are resulting in a higher investment on safes and vaults by consumers. Besides this, the rapid transition from traditional lock-and-key systems to more technologically advanced electronic and biometric safes is creating a positive outlook for the market. Moreover, favorable government initiatives supporting digitization and secure data storage is encouraging the use of data safes, thereby fueling the market. Furthermore, a growing focus on sustainability is fostering the development of eco-friendly safes and vaults, with reduced energy consumption and environmental impact, thereby contributing to the market's expansion.

India Safes and Vaults Market Trends/Drivers:

Rising stringency in the regulatory landscape

One of the primary forces driving the market for safes and vaults in India is the stringent regulatory landscape. Industries such as banking, insurance, and healthcare are subject to laws and regulations that mandate the secure storage of sensitive data and assets. These requirements put a significant onus on companies to adopt robust security solutions. In addition, the introduction of data protection laws, like the proposed Personal Data Protection Bill, is compelling businesses to be more accountable for the safekeeping of personal data. This has led to a surge in the demand for data safes designed to safeguard electronic media from physical damage, theft, and cyber threats. Furthermore, the requirement to comply with international standards for security, such as those set by the International Organization for Standardization (ISO), is promoting the usage of certified and tested safes and vaults, thereby contributing to market growth.

Rapid urbanization and infrastructure development

Rapid urbanization and infrastructure development in India are also major factors fueling the market growth. With increasing urban population, the number of commercial and residential buildings is on the rise. This directly translates into the growing demand for safes and vaults as secure storage becomes a standard requirement in these structures. Furthermore, as part of infrastructure development, cities are witnessing a surge in the number of hotels, hospitals, and educational institutions. These establishments also necessitate the need for high-quality product variants for the protection of valuables, cash, and critical documents. Moreover, infrastructure projects such as smart cities are incorporating advanced security solutions, including biometric and electronic safes, as an integral part of their design, providing impetus to the market.

Continual technological advancements and innovations

The market in India is also being propelled by continuous innovation and technological advancements. Companies are constantly striving to enhance the security features of their products, leading to the introduction of smart safes equipped with features like remote monitoring, automatic locks, and alarm systems. Moreover, the advent of biometric technology has revolutionized the sector, offering an added layer of security by allowing access only through unique biological traits like fingerprints or iris patterns. Such innovations are not only making safes and vaults more secure but also more convenient to use, thereby attracting a larger customer base. In addition, technological advancements have enabled the development of fire and water-resistant safes, enhancing their durability and reliability, and further driving their demand.

India Safes and Vaults Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India safes and vaults market report, along with forecasts at the country levels from 2026-2034. Our report has categorized the market based on type, function type, application and end user.

Breakup by Type:

- Electronic

- Biometric

- Mechanical

Mechanical represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes electronic, biometric, and mechanical. According to the report, mechanical represented the largest segment.

Mechanical safes are renowned for their reliability and durability, attributes that continue to attract consumers. Despite the rise of electronic and biometric safes, there's a segment of consumers that prefers the simplicity and traditional security of mechanical safes. Coupled with the fact that they are typically available at a lower cost compared to high-tech safe options, the demand for mechanical safes remains steady.

On the other hand, as consumers increasingly prefer advanced security features, the demand for biometric safes is on the rise. These safes offer unique benefits, such as ease of access and enhanced security, driving their popularity. Moreover, the decreasing cost of biometric technology is making these safes more accessible, further stimulating the market.

Furthermore, electronic safes offer ease of use and high-security features, attracting a growing consumer base. The increasing adoption of smart home security solutions is another factor driving this demand. With technological advancements making electronic safes more affordable and reliable, this market segment is expected to continue growing.

Breakup by Function Type:

- Cash Management Safes

- Depository Safes

- Gun Safes and Vaults

- Vaults and Vault Doors

- Media Safes

- Others

Cash management safes account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the function type. This includes cash management safes, depository safes, gun safes and vaults, vaults and vault doors, media safes, and others. According to the report, cash management safes represented the largest segment.

Businesses handling large amounts of cash such as retail outlets, restaurants, and gas stations are increasingly turning to cash management safes. These safes often come with advanced features such as automatic cash deposit systems and anti-theft alarms, making them more appealing. The digitization and automation of the cash handling process also increases the demand for these types of safes.

Additionally, businesses with regular cash transactions have a strong need for secure storage options, resulting in growing demand for depository safes. These safes are seeing increased usage in hotels, restaurants, and retail shops where they are used for depositing daily earnings. This safe type's convenience and security make it a popular choice for businesses handling cash.

Moreover, rising awareness about gun safety and related regulations in India is on the rise, leading to an increase in the use of gun safes and vaults. Furthermore, there's a rise in the number of licensed firearm owners, creating a higher demand for secure storage options. The importance of responsible firearm storage is increasingly recognized, contributing to the growth of this segment.

Besides this, the high demand from financial institutions and jewelry stores for vaults and vault doors due to the high-value assets they handle. Additionally, private safe deposit box companies and data centers, which require extreme security measures, are also contributing to the demand. The increasing reliance on these high-security options indicates a promising future for this segment.

Furthermore, the rising concern for the safekeeping of digital media and data is driving the demand for media safes. With the rise in digitization, businesses and individuals increasingly depend on digital data storage devices, necessitating secure storage solutions. The need to protect sensitive data from potential threats such as fire, water damage, and theft is contributing to the segment growth.

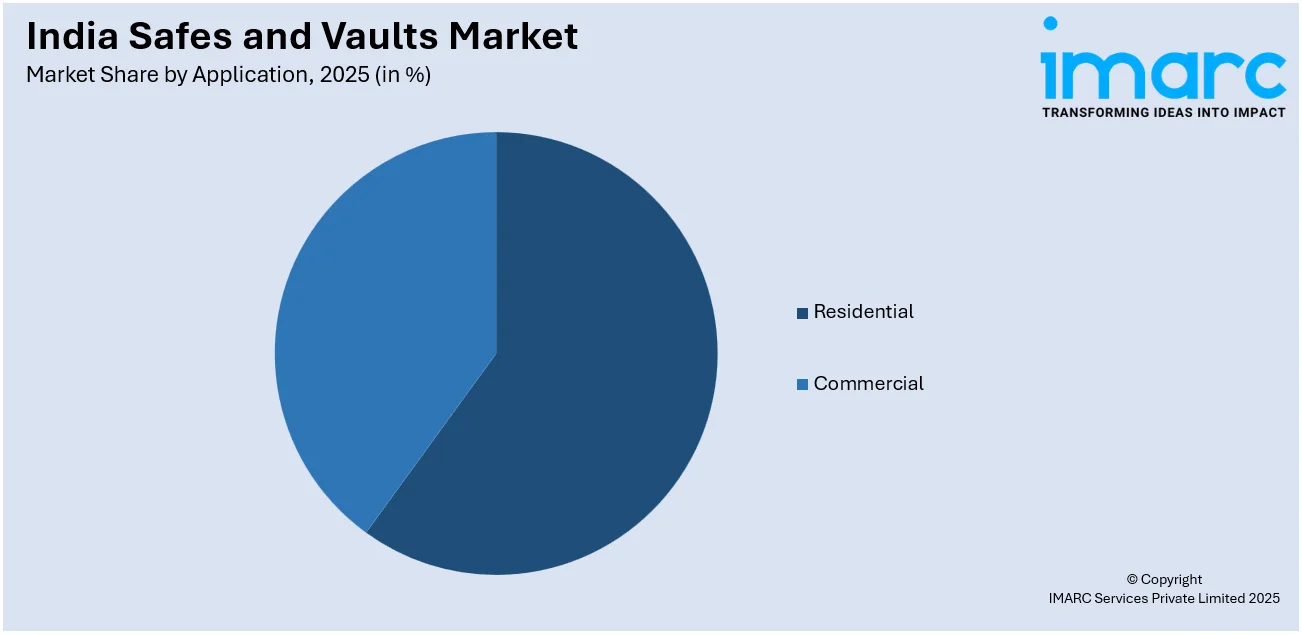

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Commercial represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial. According to the report, commercial represented the largest segment.

Commercial establishments such as retail stores, restaurants, and office buildings are increasing their security measures, boosting the demand for safes and vaults. This trend is further backed by the rise in commercial real estate development, providing more venues for these products. There's also an increased demand for fireproof safes for the secure storage of crucial documents and cash in commercial settings.

Additionally, growing consumer awareness regarding home security in India is on the rise, driving homeowners to invest in residential safes. The rapid expansion of residential real estate and home improvement applications are contributing to this trend, as new and renovated homes often include security enhancements. Additionally, increasing internet penetration and online sales of residential safes provides easier access for consumers.

Breakup by End User:

- Banking Sector

- Non Banking Sector

Banking Sector accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banking sector and non banking sector. According to the report, banking sector represented the largest segment.

The banking sector in India is expanding, leading to increased need for safes and vaults for secure transactions. Additionally, stringent regulatory norms imposed by financial authorities for ensuring security are pushing banks to invest more in high-security safes and vaults. These institutions are seeking advanced security solutions to prevent thefts and robberies, thereby augmenting the growth of the market.

On the other hand, the rise in the number of high-net-worth individuals in India, and these individuals require secure storage for their valuables, boosting the demand for safes and vaults in this sector. Concurrently, an increasing number of businesses and corporations are looking for secure storage options for crucial documents and cash, further propelling the market. Also, industries such as jewelry, real estate, and hospitals are demonstrating enhanced security requirements, contributing to the growth.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

West and Central India exhibits a clear dominance, accounting for the largest India safes and vaults market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India. According to the report, West and Central India represented for the largest market region.

Rapid urbanization and industrialization in West and Central India are leading to a wealthier middle class and greater investments in infrastructure, businesses, and private homes. This wealth generation is raising demand for safes and vaults as individuals and businesses alike look to protect their assets. The high population density in these regions also means that even minor changes in consumption patterns can result in significant market shifts.

The increase in residential security awareness is likely driven by increased media coverage of theft and crime, as well as the widespread sharing of information about home security solutions online. These regions in the country are experiencing increased security concerns due to rising criminal activities, which is leading to a considerable growth in the market. Moreover, the high population density in these regions translates to a larger consumer base of these products.

Competitive Landscape:

The top players in the Indian market are investing heavily in research and development activities to innovate and improve their product offerings. This includes the integration of advanced technologies such as biometrics, smart connectivity, and superior material technology to enhance product features. They are also looking at diversifying their product portfolios to cater to a wide range of customer needs, from residential to commercial and institutional requirements. Apart from this, strategic partnerships and collaborations with tech companies are being pursued to incorporate advanced technology into their products. Furthermore, various companies are focusing on improving their supply chain efficiency and distribution network.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

India Safes and Vaults Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electronic, Biometric, Mechanical |

| Function Types Covered | Cash Management Safes, Depository Safes, Gun Safes and Vaults, Vaults and Vault Doors, Media Safes, Others |

| Applications Covered | Residential, Commercial |

| End Users Covered | Banking Sector, Non Banking Sector |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India safes and vaults market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India safes and vaults market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India safes and vaults industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India safes and vaults market was valued at USD 205.2 Million in 2025.

We expect the India safes and vaults market to exhibit a CAGR of 6.06% during 2026-2034.

The increasing crime rate in the country and the growing consumer concerns towards the safety of valuable assets are primarily driving the India safes and vaults market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for safes and vaults.

Based on the type, the India safes and vaults market has been categorized into electronic, biometric, and mechanical. Among these, mechanical currently exhibits a clear dominance in the market.

Based on the function type, the India safes and vaults market can be bifurcated into cash management safes, depository safes, gun safes and vaults, vaults and vault doors, media safes, and others. Currently, cash management safes hold the majority of the total market share.

Based on the application, the India safes and vaults market has been divided into residential and commercial, where commercial currently exhibits a clear dominance in the market.

Based on the end user, the India safes and vaults market can be segmented into banking sector and non-banking sector. Currently, the banking sector accounts for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India safes and vaults market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)