India Rubber Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Rubber Market Summary:

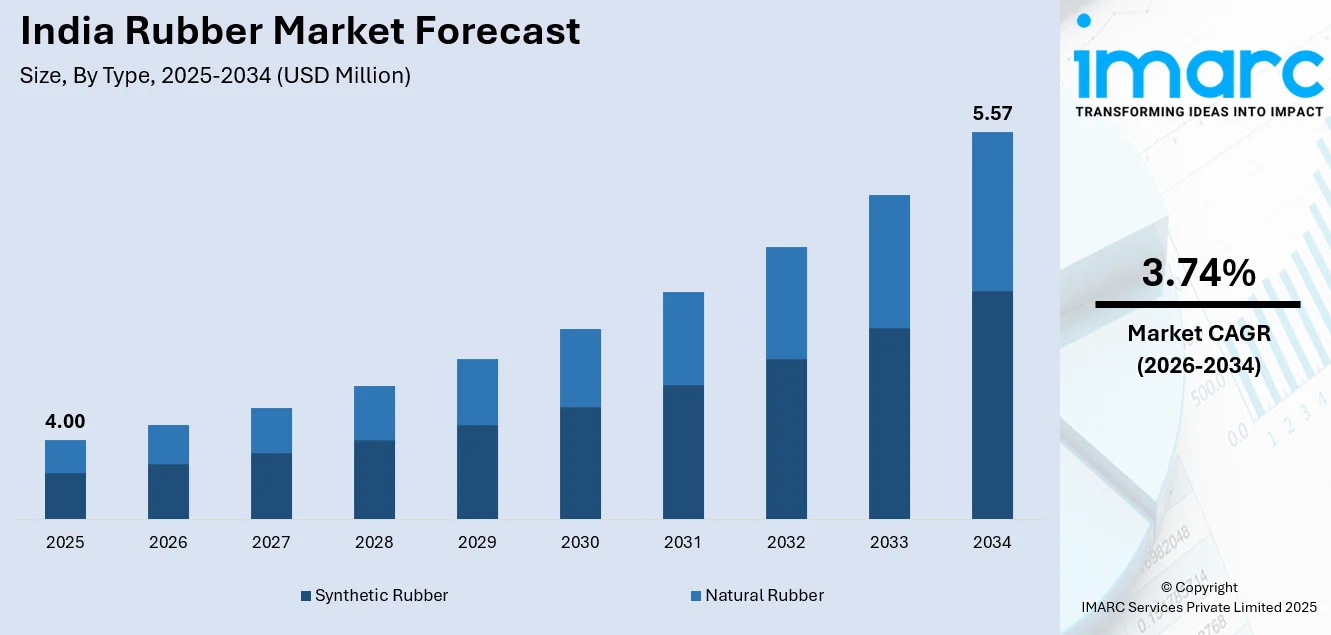

The India rubber market size was valued at USD 4.00 Million in 2025 and is projected to reach USD 5.57 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

The market is driven by rapid expansion in the automotive sector, increasing infrastructure development activities, and growing industrial manufacturing requirements across diverse sectors. Rising demand for high-performance rubber products in tire manufacturing and non-tire automotive applications continues to fuel market expansion. Government initiatives promoting domestic rubber cultivation and processing, coupled with increasing export opportunities to neighbouring markets, are further strengthening the industry ecosystem. The growing emphasis on sustainable rubber production practices and eco-friendly product development is reshaping market dynamics and contributing to increasing India rubber market share.

Key Takeaways and Insights:

- By Type: Synthetic rubber dominates the market with a share of 68% in 2025, driven by its superior heat resistance, abrasion resistance, and cost-effectiveness across automotive and industrial manufacturing applications.

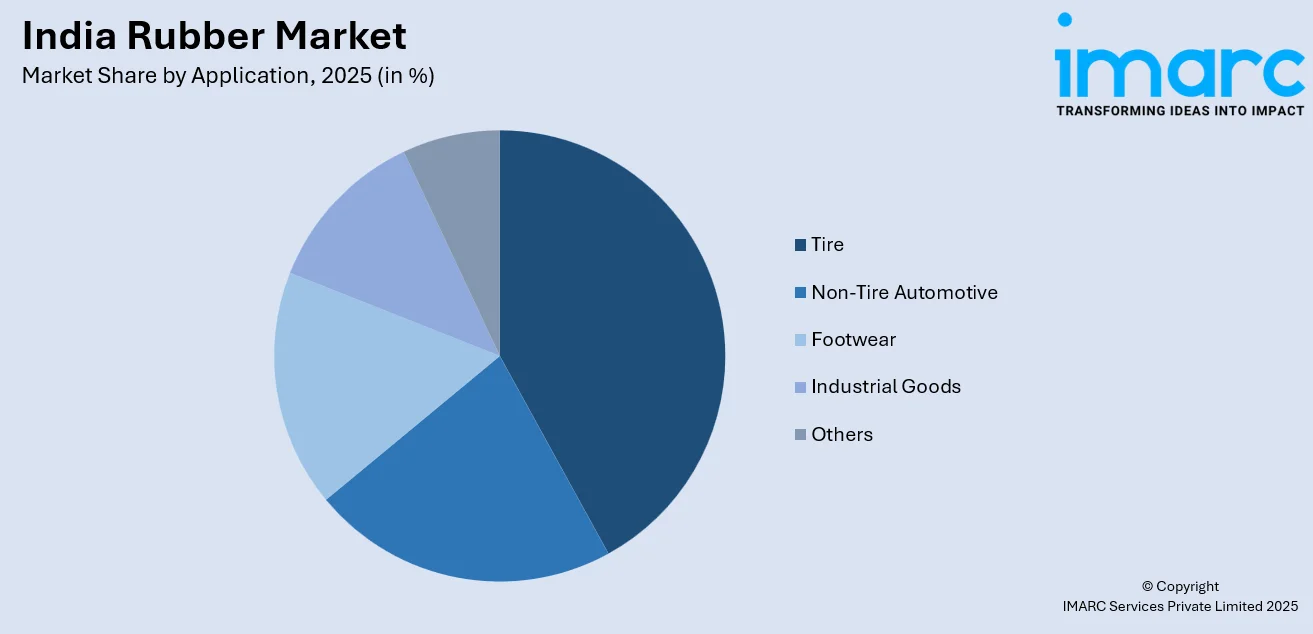

- By Application: Tire leads the market with a share of 50% in 2025, owing to the booming automotive industry, rising vehicle production volumes, and growing replacement tire demand across India.

- By Region: North India represents the market with a share of 31% in 2025, driven by the concentration of major tire manufacturing facilities, robust automotive production hubs, and well-established supporting industrial infrastructure.

- Key Players: The India rubber market exhibits moderate competitive concentration, with established tire manufacturers commanding significant presence alongside diversified industrial rubber producers. Leading participants leverage vertical integration strategies, extensive distribution networks, and strong research capabilities to maintain competitive positioning across product segments.

To get more information on this market Request Sample

The India rubber market is experiencing robust growth driven by a confluence of industrial, economic, and policy-driven factors reshaping the competitive landscape. The booming automotive sector stands as a primary growth catalyst, requiring substantial quantities of natural and synthetic rubber for tire manufacturing, sealing systems, transmission belts, and various automotive components. According to reports, natural rubber production during 2023-24 reached 857000 Tonnes, reflecting a 2.1 percent year-on-year increase, while domestic consumption rose 4.9 percent to 1416000 Tonnes, highlighting strong end-use demand. Moreover, infrastructure development initiatives across transportation, construction, and urban development projects are generating sustained demand for rubber-based products including pipes, roofing materials, flooring solutions, and industrial goods. Government support through cultivation subsidies, training programs, and production incentive schemes has strengthened the domestic rubber ecosystem. Additionally, growing environmental consciousness is driving innovation in sustainable rubber production practices and eco-friendly product development, while expanding export opportunities to neighbouring countries and international markets are adding momentum to overall industry growth.

India Rubber Market Trends:

Rising Adoption of Sustainable and Eco-Friendly Rubber Production Practices

The India rubber market is witnessing a significant shift towards sustainable production practices as environmental consciousness grows among manufacturers and consumers alike. Industry participants are increasingly investing in eco-friendly processing technologies and sustainable sourcing methods to reduce their environmental footprint. As per sources, in May 2025, JK Tyre & Industries commenced production of India’s first ISCC Plus-certified sustainable passenger car tyre using traceable recycled and renewable raw materials, highlighting the sector’s transition toward certified and transparent rubber supply chains. Furthermore, the adoption of traceability systems and certification programs is gaining momentum, enabling transparent supply chain management from plantation to finished product.

Growing Integration of Advanced Manufacturing Technologies

The rubber manufacturing sector in India is embracing advanced technologies to enhance production efficiency, product quality, and operational excellence. Automation and digitalization initiatives are transforming traditional manufacturing processes, enabling precise quality control and reduced wastage across production facilities. In May 2024, Apollo Tyres implemented an AWS-based IoT solution that boosted manufacturing productivity by 9% and reduced energy usage by 3% through real-time data analytics and automation. Moreover, smart manufacturing solutions incorporating sensors, data analytics, and machine learning are being deployed to optimize rubber compounding and processing operations. Research and development activities are focusing on developing specialty rubber formulations with enhanced performance characteristics for demanding applications.

Expansion of Domestic Natural Rubber Cultivation in Non-Traditional Regions

India is witnessing significant expansion of natural rubber cultivation beyond traditional growing regions to reduce import dependency and ensure stable domestic supply. According to reports, Tripura, Assam, and Meghalaya together accounted for 17.5% of India’s total natural rubber output in 2023–24, up from 7.8% in 2013–14. Moreover, northeastern states are emerging as important rubber-producing areas, supported by government initiatives promoting cultivation in suitable agro-climatic zones. Extension services and training programs are empowering smallholder farmers with modern agronomic practices and improved planting materials. The development of processing infrastructure in new cultivation areas is enhancing the marketability of domestically produced rubber.

Market Outlook 2026-2034:

The India rubber market is positioned for sustained revenue growth through the forecast period, supported by favorable macroeconomic conditions and expanding end-use industries. The automotive sector is expected to remain the dominant revenue contributor, with increasing vehicle production and replacement tire demand driving consumption growth. Infrastructure development projects across transportation, construction, and industrial sectors will continue generating substantial demand for rubber-based products. Government initiatives promoting domestic manufacturing, cultivation expansion, and export development are expected to strengthen market fundamentals. The market generated a revenue of USD 4.00 Million in 2025 and is projected to reach a revenue of USD 5.57 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

India Rubber Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Synthetic Rubber |

68% |

|

Application |

Tire |

50% |

|

Region |

North India |

31% |

Type Insights:

- Synthetic Rubber

- Natural Rubber

Synthetic rubber dominates with a market share of 68% of the total India rubber market in 2025.

The synthetic rubber commands the largest market share in India, driven by its versatile applications across automotive, industrial, and consumer goods sectors. Synthetic rubber offers superior performance characteristics including enhanced heat resistance, chemical stability, and consistent quality compared to natural alternatives. In August 2024, Zeon Corp. expanded its technical support team in India to strengthen synthetic rubber product development, responding to growing domestic market demand from automotive and industrial manufacturers. Moreover, the segment benefits from established domestic production capabilities and growing investments in expanding manufacturing capacity.

The dominance of synthetic rubber is further reinforced by its cost-effectiveness and availability advantages over natural rubber in many applications. Tire manufacturers prefer synthetic rubber for its predictable quality parameters and formulation flexibility in developing high-performance products. Industrial applications including conveyor belts, hoses, seals, and gaskets utilize synthetic rubber compounds designed for specific operating conditions. The growing demand for specialty synthetic rubber products in automotive, construction, and electrical applications continues driving segment expansion.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Tire

- Non-Tire Automotive

- Footwear

- Industrial Goods

- Others

Tire leads with a share of 50% of the total India rubber market in 2025.

Tire represents the leading demand driver for rubber in India, accounting for the majority share of total consumption. The segment growth is primarily fueled by the expanding automotive industry encompassing passenger vehicles, commercial vehicles, two-wheelers, and agricultural equipment. According to sources, In January 2025, MRF Ltd introduced its 'Muscle in Motion' theme at Bharat Mobility 2025, showcasing advanced EV-specific tyres and supporting key electric vehicle models across India, reflecting growing innovation in the tire sector. Rising vehicle ownership levels across urban and rural markets are generating sustained replacement tire demand.

Tire benefits from India's emergence as a significant automotive manufacturing hub attracting substantial domestic and international investments. Original equipment manufacturer (OEM) demand continues growing alongside the robust aftermarket replacement business serving the expanding vehicle parc. The development of electric vehicles (EVs) is creating new opportunities for specialized tire formulations designed for unique performance requirements. Export-oriented tire production is further strengthening segment growth as Indian manufacturers expand their international market presence.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The North India dominates with a market share of 31% of the total India rubber market in 2025.

North India leads the regional market, benefiting from strong industrial infrastructure and proximity to major automotive manufacturing clusters across the northern industrial belt. The region houses several major tire production facilities and rubber processing units serving both domestic and export markets very effectively. Well-developed transportation networks and comprehensive logistics infrastructure enable efficient distribution across the vast northern consumer markets. The concentration of automotive component manufacturers and industrial goods producers generates substantial and sustained rubber demand.

The regional market growth is strongly supported by ongoing industrialization and extensive infrastructure development activities across northern states. Urban expansion and major construction projects are consistently driving increased demand for rubber-based building materials and industrial products across the region. The region benefits from well-established trading networks facilitating raw material procurement and finished goods distribution throughout the area. Government industrial policies promoting manufacturing investments are attracting significant capacity expansion initiatives across rubber processing and manufacturing sectors.

Market Dynamics:

Growth Drivers:

Why is the India Rubber Market Growing?

Expanding Automotive Sector

The automotive industry represents the primary growth engine for India rubber market, with vehicle manufacturing activities generating substantial demand across natural and synthetic rubber categories. The sector encompasses diverse vehicle segments including passenger cars, commercial vehicles, two-wheelers, three-wheelers, and agricultural equipment, each requiring significant rubber inputs for tires and non-tire components. As per sources, in FY 2024–25, India’s tyre exports rose 9% to ₹25,051 Crore, with the Automotive Tyre Manufacturers Association highlighting strong domestic manufacture and global demand driving robust rubber usage in automotive production. Moreover, rising domestic vehicle ownership levels are driven by increasing disposable incomes and improving financing accessibility, fueling the production growth.

Infrastructure Development Activities

Massive infrastructure development initiatives across transportation, urban development, and industrial sectors are generating sustained demand for rubber-based products throughout India. Construction projects require rubber materials for roofing membranes, waterproofing solutions, flooring systems, expansion joints, and sealing applications. As per sources, in November 2025, Ameenji Rubber Ltd received pilot orders for 10 mm railway rubber pads from Indian Railways, reflecting rising demand for specialized rubber components in infrastructure projects. Furthermore, the development of highways, railways, airports, and port facilities utilizes rubber products in various structural and operational applications.

Government Support Initiatives

Comprehensive government support through cultivation promotion schemes, production incentives, and manufacturing development policies is strengthening India's rubber industry ecosystem. According to reports, the Government of India increased financial assistance for the rubber sector to ₹708.69 Crore under the ‘Sustainable & Inclusive Development of Natural Rubber Sector’ scheme to boost cultivation and productivity. Furthermore, initiatives targeting natural rubber cultivation expansion in suitable regions are helping reduce import dependency and ensure stable domestic supply. Training programs and extension services are enhancing productivity and quality standards across rubber plantations.

Market Restraints:

What Challenges the India Rubber Market is Facing?

Price Volatility in Raw Material Markets

Significant price fluctuations in natural rubber and petrochemical feedstocks create planning challenges for manufacturers and impact industry profitability. Global supply-demand dynamics, weather conditions affecting plantation output, and crude oil price movements influence raw material costs. Price volatility complicates long-term contract negotiations and inventory management decisions across the value chain. Manufacturers face difficulties in maintaining stable product pricing while managing input cost variations.

Import Dependency for Natural Rubber Requirements

Despite significant domestic production, India remains partially dependent on imports to meet natural rubber consumption requirements, exposing the industry to supply chain vulnerabilities. International price movements and currency fluctuations impact procurement costs for imported rubber. Logistics challenges and lead times associated with imports can affect production planning and inventory management. Competition for global supplies during periods of tight availability creates procurement pressures for domestic manufacturers.

Environmental and Regulatory Compliance Requirements

Increasing environmental regulations and sustainability requirements are imposing additional compliance burdens on rubber manufacturers and processors. Emission control standards, effluent treatment requirements, and waste management obligations necessitate investments in pollution control infrastructure. International sustainability certification requirements for export markets demand implementation of traceability systems and responsible sourcing practices. Meeting evolving regulatory standards requires ongoing operational modifications and compliance monitoring investments.

Competitive Landscape:

The India rubber market exhibits a moderately consolidated competitive structure characterized by the presence of established tire manufacturers alongside diversified industrial rubber producers serving various end-use segments. Market leaders leverage vertical integration strategies encompassing rubber cultivation, processing, and manufacturing operations to optimize supply chain efficiency and maintain quality control. Competition occurs across multiple dimensions including product quality, technological capabilities, distribution network reach, and customer service offerings. Companies are investing in research and development to develop specialty rubber formulations addressing specific application requirements and performance specifications. Strategic capacity expansion initiatives, geographic market development, and product portfolio diversification represent key competitive strategies employed by industry participants seeking to strengthen their market positioning.

Recent Developments:

- In December 2025, Rubber King Tyres launched two high-performance tyres at EXCON 2025, the 19.5R24 Emperador pneumatic tyre and the 12.00-24 Mighty Midas solid tyre. Engineered for durability and demanding construction and mining applications, these REACH-compliant tyres enhance traction, reliability, and operational efficiency for Indian OEMs and global exports.

- In March 2024, ARLANXEO unveiled sustainable and innovative synthetic rubber solutions at India Rubber Expo, Mumbai, featuring Keltan® Eco bio-circular products, S-SBR and NdBR for green tires, and Levamelt® EVM for adhesives, strengthening its presence in India and supporting eco-friendly mobility and urbanization initiatives.

India Rubber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Rubber, Natural Rubber |

| Applications Covered | Tire, Non-Tire Automotive, Footwear, Industrial Goods, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India rubber market size was valued at USD 4.00 Million in 2025.

The India rubber market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach USD 5.57 Million by 2034.

Synthetic rubber held the largest India rubber market share, driven by its superior performance characteristics including enhanced heat resistance, chemical stability, and cost-effectiveness across diverse automotive, industrial, and consumer goods manufacturing applications.

Key factors driving the India rubber market include expanding automotive production, infrastructure development activities, rising industrial manufacturing demand, government support initiatives promoting cultivation and processing, and growing export opportunities to international markets.

Major challenges include raw material price volatility affecting industry profitability, import dependency for natural rubber requirements, increasing environmental compliance costs, competition from alternative materials, supply chain disruptions, and evolving regulatory requirements demanding operational adaptations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)