India RTA Furniture Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, End User, and Region, 2025-2033

India RTA Furniture Market Overview:

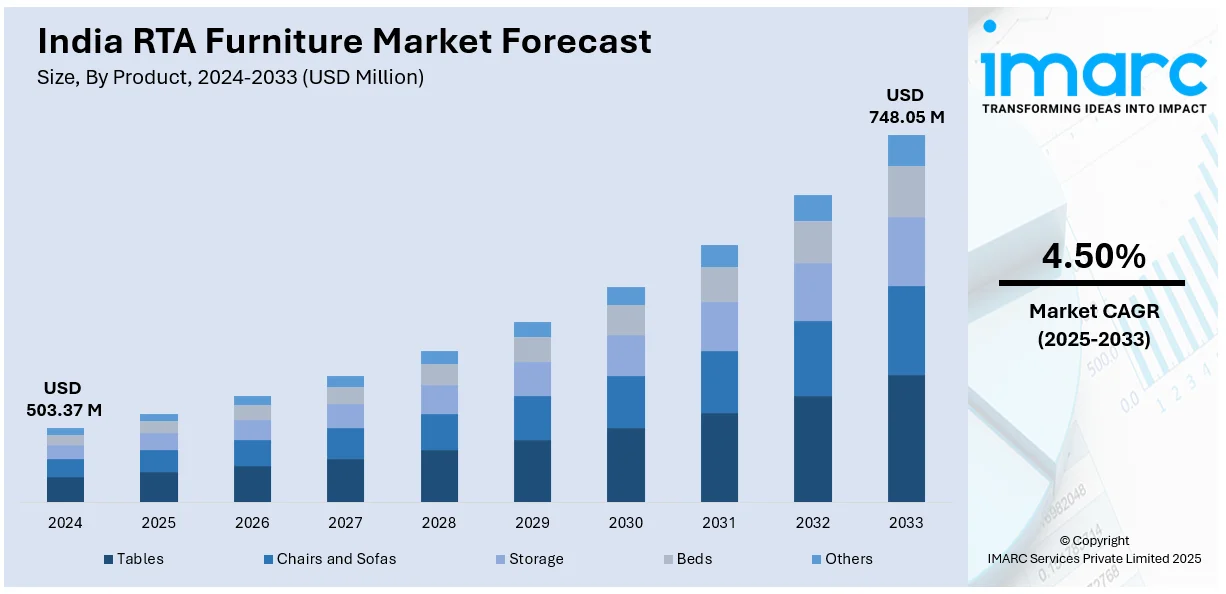

The India RTA furniture market size reached USD 503.37 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 748.05 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The rising demand for space-saving solutions, growing consumer preference for affordable yet stylish furniture, expanding e-commerce platforms, improved logistics, and a surge in do-it-yourself (DIY) home improvement are boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 503.37 Million |

| Market Forecast in 2033 | USD 748.05 Million |

| Market Growth Rate (2025-2033) | 4.50% |

India RTA Furniture Market Trends:

Growing Popularity of E-Commerce Platforms for RTA Furniture Sales

The rapid expansion of e-commerce platforms is significantly transforming the India ready-to-assemble (RTA) furniture market. Online retail channels are increasingly preferred for their convenience, extensive product variety, and competitive pricing. By 2030, India will emerge as the world's second-largest online consumer market, with an estimated 600 million shoppers. This growth will be fueled by expanded smartphone accessibility, increasing urban adoption, and a projected increase in online retail penetration from 25% to 37% of the total market. Major e-commerce giants, such as Amazon and Flipkart, along with dedicated furniture platforms, like Pepperfry and Urban Ladder, are driving this trend. Digital platforms offer enhanced shopping experiences through augmented reality (AR)-based visualization tools, enabling customers to preview furniture in their spaces before purchase. This has improved customer confidence and reduced return rates. Additionally, e-commerce players are improving delivery timelines and assembly services, further boosting the RTA furniture market. For instance, companies are increasingly partnering with third-party service providers like Housejoy and Urban Company to ensure seamless assembly and installation. With India’s internet user base amounting to 900 million by 2025, digital retail channels are poised to expand further, making online sales a major driver of RTA furniture growth.

To get more information on this market, Request Sample

Rising Demand for Space-Saving and Multi-Functional Furniture

The growing trend of compact living spaces in urban areas is fueling demand for space-saving and multi-functional RTA furniture in India. As metropolitan regions witness rising property prices, smaller apartments are becoming more common, prompting consumers to seek innovative furniture designs that maximize space efficiency. Multi-functional RTA furniture, such as foldable tables, convertible sofa beds, and modular storage units, is gaining popularity for its practicality and aesthetic appeal. According to reports, average apartment sizes in major Indian cities have reduced by nearly 10% between 2020 and 2023, driving the need for space-efficient solutions. With the hybrid work model trend, there has also been an increase in demand for home office arrangements. Nearly 30% of Indian businesses have implemented flexible working arrangements, increasing demand for tiny workstations, ergonomic seats, and foldable desks that fit neatly into tight areas. Furthermore, as consumers choose smart storage and minimalist designs, the market for space-saving RTA furniture is expected to rise extensively.

India RTA Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, material, distribution channel, and end user.

Product Insights:

- Tables

- Chairs and Sofas

- Storage

- Beds

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes tables, chairs and sofas, storage, beds, and others.

Material Insights:

- Wood

- Glass

- Steel

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes wood, glass, steel, and others.

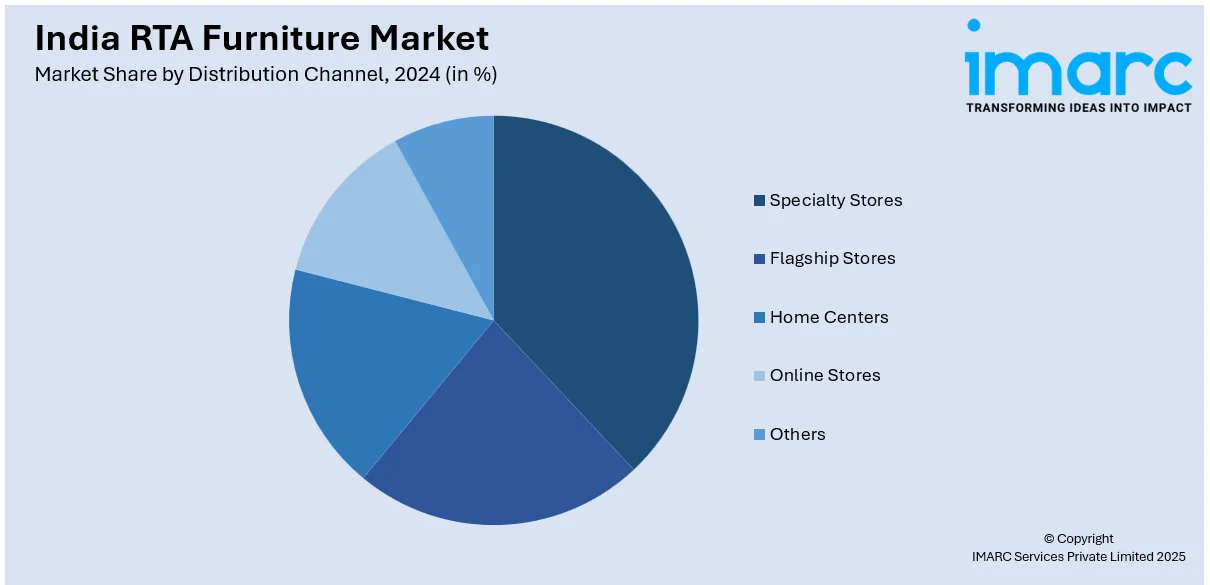

Distribution Channel Insights:

- Specialty Stores

- Flagship Stores

- Home Centers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty stores, flagship stores, home centers, online stores, and others.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India RTA Furniture Market News:

- October 2024: Indian Furniture Products Limited (IFPL) acquired a 50% stake in Forte Furniture Products India Private Limited (FFPIPL), a company recognized for its ready-to-assemble furniture. This stake was acquired from Fabryki Mebli Forte S.A., a Polish joint venture partner. As a result, FFPIPL has become a subsidiary of IFPL and a step-down subsidiary of ZIL.

- January 2024: IKEA expanded its e-commerce deliveries to new pin codes across 62 districts in Maharashtra, Karnataka, Telangana, and Andhra Pradesh, allowing customers to purchase RTA furniture via its app, website, or phone assistance service.

India RTA Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Tables, Chairs and Sofas, Storage, Beds, Others |

| Materials Covered | Wood, Glass, Steel, Others |

| Distribution Channels Covered | Specialty Stores, Flagship Stores, Home Centers, Online Stores, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India RTA furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the India RTA furniture market on the basis of product?

- What is the breakup of the India RTA furniture market on the basis of material?

- What is the breakup of the India RTA furniture market on the basis of distribution channel?

- What is the breakup of the India RTA furniture market on the basis of end user?

- What are the various stages in the value chain of the India RTA furniture market?

- What are the key driving factors and challenges in the India RTA furniture market?

- What is the structure of the India RTA furniture market and who are the key players?

- What is the degree of competition in the India RTA furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India RTA furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India RTA furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India RTA furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)