India Roofing Market Size, Share, Trends and Forecast by Material Type, Type, Application, and Region, 2025-2033

India Roofing Market Outlook 2025-2033:

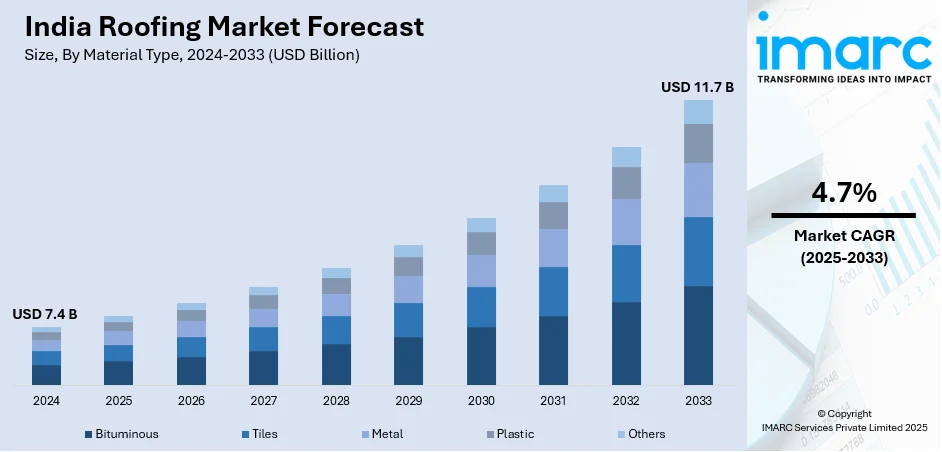

The India roofing market size reached USD 7.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.4 Billion |

|

Market Forecast in 2033

|

USD 11.7 Billion |

| Market Growth Rate 2025-2033 | 4.7% |

Roofing refers to the process of constructing a top covering of a building. It is generally made using materials, such as drain, slate, copper, ridge cap, plastic cement, and base ply and sheet. It adds significant value to buildings, improves their durability, and offers protection against harsh environmental conditions. Nowadays, several manufacturers are introducing advanced roofing solutions that provide innovative features and increase the overall lifespan of a structure. This, coupled with significant growth in industrial construction, is catalyzing the demand for roofing in India.

To get more information on this market, Request Sample

India Roofing Market Trends:

A shift in consumer preferences from conventional roofing materials towards reliable product variants on account of inflating income levels represents one of the major factors bolstering the market growth in India. Moreover, polycarbonate roofing sheets are gaining traction as they are easy to install in industrial and large-scale commercial buildings, weather-resistant, and available in various textures and designs with low maintenance costs. They are also utilized in sky lighting, swimming pools, walkways, and display signboards. Apart from this, the emerging trend of clear roofing panels in patios, sunrooms, and places that need natural light through the roof is contributing to market growth. These panels contain protective film layers that filter out harmful ultraviolet (UV) sun rays. Furthermore, as corrugated roofing sheets are strong, durable, and eco-friendly and offer reliable utility and enhanced strength, they are finding extensive applications in the agriculture sector for protecting garages, porches, and sheds. The expansion of the agriculture sector in the country on account of the rising population and surging food requirements is influencing the market positively. Additionally, the emerging green building concept is increasing public awareness about climate change, which is catalyzing the demand for zinc-aluminum coated sheets that provide excellent atmospheric resistance.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India roofing market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on material type, type and application.

Breakup by Material Type:

- Bituminous

- Tiles

- Metal

- Plastic

- Others

Nowadays, there is a rise in the demand for bituminous roofing as it provides a durable, waterproof barrier that can withstand harsh weather conditions and is relatively easy to install.

Breakup by Type:

- Flat Roof

- Slope Roof

Flat roofs are low cost and offer ease of accessibility, whereas sloped roofs provide improved aesthetics and are a better alternative for areas with high rain and snowfall.

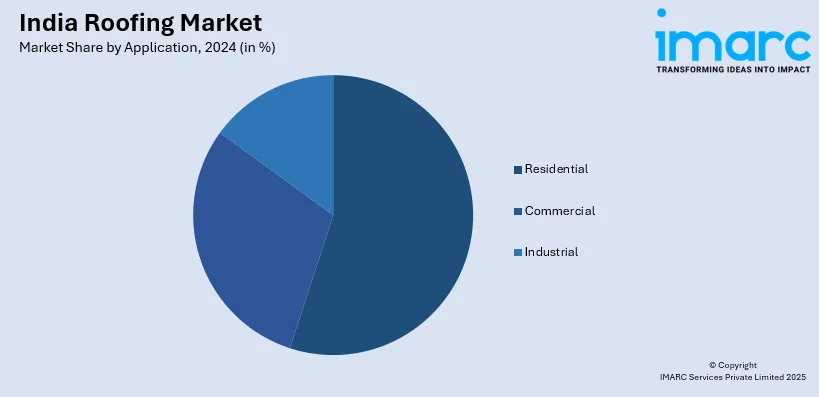

Breakup by Application:

- Residential

- Commercial

- Industrial

Factors like rapid urbanization, inflating income levels and the growing population are resulting in increasing construction activities in the residential, commercial, and industrial sectors of India.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Innovations in roofing technologies, along with the growing popularity of green roofing, are resulting in rising roofing installations in different parts of India.

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the India roofing market with detailed profiles of all major companies, including:

- Bansal Roofing Products Limited

- BirlaNu Limited

- Dion Incorporation

- Everest Industries Limited

- Hindalco Industries Ltd

- JSW Steel

- Tata Bluescope Steel Private Limited

- Visaka Industries Limited

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Material Type, Type, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Bansal Roofing Products Limited, BirlaNu Limited, Dion Incorporation, Everest Industries Limited, Hindalco Industries Ltd, JSW Steel, Tata Bluescope Steel Private Limited, Visaka Industries Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India roofing market was valued at USD 7.4 Billion in 2024.

We expect the India roofing market to exhibit a CAGR of 4.7% during 2025-2033.

The growing demand for roofing to add a value to buildings, improve their durability, offer protection against harsh environmental conditions, etc., is primarily driving the India roofing market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous construction activities, thereby negatively impacting the Indian market for roofing.

Based on the material type, the India roofing market can be divided into bituminous, tiles, metal, plastic, and others. Currently, bituminous holds the majority of the total market share.

Based on the type, the India roofing market has been segregated into flat roof and slope roof, where flat roof currently accounts for the largest market share.

Based on the application, the India roofing market can be bifurcated into residential, commercial, and industrial. Among these, the residential sector currently exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India.

Some of the major players in the India roofing market include Bansal Roofing Products Limited, BirlaNu Limited, Dion Incorporation, Everest Industries Limited, Hindalco Industries Ltd, JSW Steel, Tata Bluescope Steel Private Limited, and Visaka Industries Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)