India Rhodium Market Size, Share, Trends and Forecast by Source, Product Type, Application, End Use Industry, and Region, 2025-2033

Market Overview:

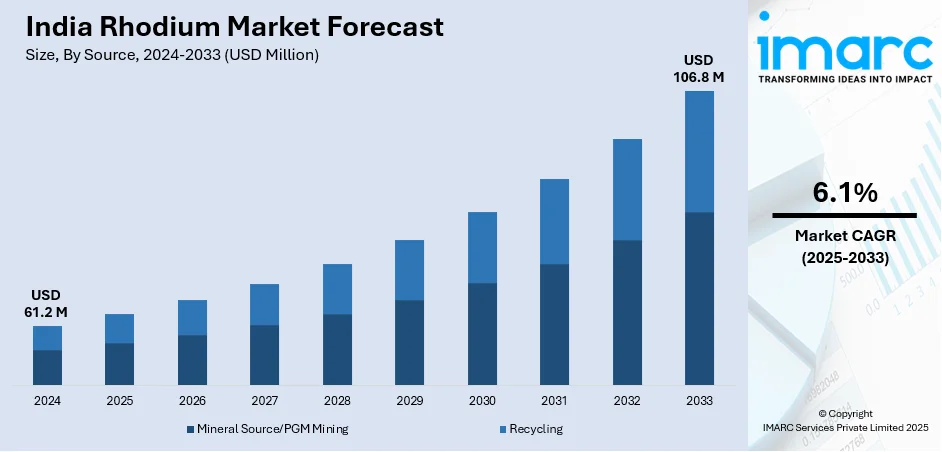

The India rhodium market size reached USD 61.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 106.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.1% during 2025-2033. The growing utilization in manufacturing catalytic convertors in the automotive industry, rising initiatives by the Government of India to reduce air pollution, and increasing application in the production of high-temperature thermocouples represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.2 Million |

| Market Forecast in 2033 | USD 106.8 Million |

| Market Growth Rate (2025-2033) | 6.1% |

Rhodium is a rare and valuable metallic element that belongs to the platinum group of metals (PGMs). It is one of the most expensive metals due to its rarity and various industrial applications. It plays a crucial role in reducing harmful emissions from vehicles by converting toxic gases, such as nitrogen oxides (NOx), carbon monoxide (CO), and unburned hydrocarbons, into less harmful substances. The catalytic converters use rhodium as a catalyst to accelerate these chemical reactions, thereby helping to minimize air pollution from automotive exhaust. It is often applied to white gold and silver jewelry to enhance their appearance and protect them from scratches and discoloration due to its high reflectivity and resistance to tarnishing. It is used in the production of acetic acid, which is a key component in the manufacturing of vinyl acetate monomer (VAM), a vital ingredient in the production of adhesives, coatings, and textiles. As it has excellent electrical conductivity and high resistance to corrosion, making it an ideal choice for manufacturing electrical connectors and switches, the demand for rhodium is rising in India.

To get more information on this market, Request Sample

India Rhodium Market Trends:

At present, the thriving automotive industry in India represents one of the key factors supporting the growth of the market. Rhodium is a key component in catalytic converters, which are essential in reducing harmful emissions from vehicles. As the Indian automotive sector is expanding due a growing middle class and increasing disposable incomes, the demand for vehicles and catalytic converters is rising. This, in turn, is leading to a higher demand for rhodium in the country. Besides this, the Government of India is implementing stricter emission norms to combat air pollution, particularly in major cities. These regulations necessitate the use of advanced emission control technologies, such as catalytic converters, which rely on rhodium. Compliance with these regulations requires automakers to increase the usage of rhodium in their catalytic converters, which is propelling the growth of the market. In addition, there is a rise in the demand for rhodium in nuclear reactors, where it acts as a neutron reflector, in India. This, along with the increasing utilization of rhodium in the production of high-temperature thermocouples and furnace components due to its exceptional heat resistance, is strengthening the growth of the market. Moreover, the growing demand for rhodium catalysts, as they are used in the synthesis of pharmaceuticals, fragrances, and fine chemicals, along with the escalating demand for rhodium in various industries, is positively influencing the market in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India rhodium market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on source, product type, application, and end use industry.

Source Insights:

- Mineral Source/PGM Mining

- Recycling

The report has provided a detailed breakup and analysis of the market based on the source. This includes mineral source/PGM mining and recycling.

Product Type Insights:

- Alloys

- Metals and Compounds

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes alloys and metals and compounds.

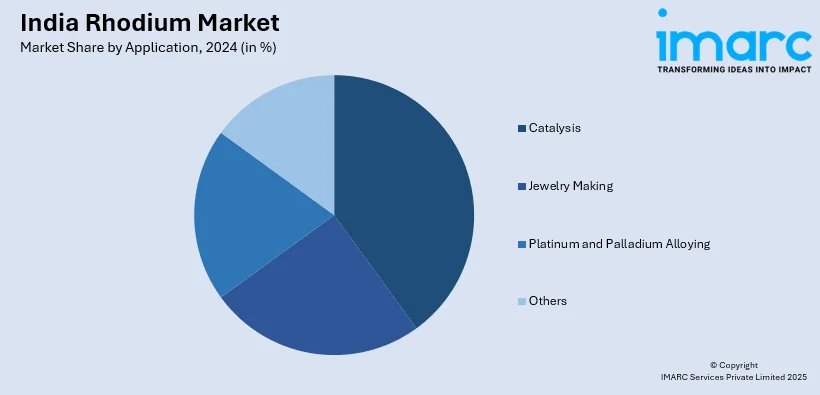

Application Insights:

- Catalysis

- Jewelry Making

- Platinum and Palladium Alloying

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes catalysis, jewelry making, platinum and palladium alloying, and others.

End Use Industry Insights:

- Automotive

- Chemical

- Glass

- Electricals and Electronics

- Others

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes automotive, chemical, glass, electricals and electronics, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India rhodium market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Mineral Source/PGM Mining, Recycling |

| Product Types Covered | Alloys, Metals and Compounds |

| Applications Covered | Catalysis, Jewelry Making, Platinum and Palladium Alloying, Others |

| End Use Industries Covered | Automotive, Chemical, Glass, Electricals and Electronics, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India rhodium market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India rhodium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India rhodium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rhodium market in India was valued at USD 61.2 Million in 2024.

The India rhodium market is projected to exhibit a (CAGR) of 6.1% during 2025-2033, reaching a value of USD 106.8 Million by 2033.

The market is dominated by amplifying demand within the automotive industry for catalytic converters to minimize harmful emissions. Higher government control over emissions from vehicles, along with industrial uses in electronics and chemical procedures, drive expansion. Supply bottlenecks and the ability of rhodium to contribute to sustainability make it even more strategically significant within India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)