India RF Test Equipment Market Size, Share, Trends and Forecast by Type, Form Factor, Application, End User, and Region, 2025-2033

India RF Test Equipment Market Overview:

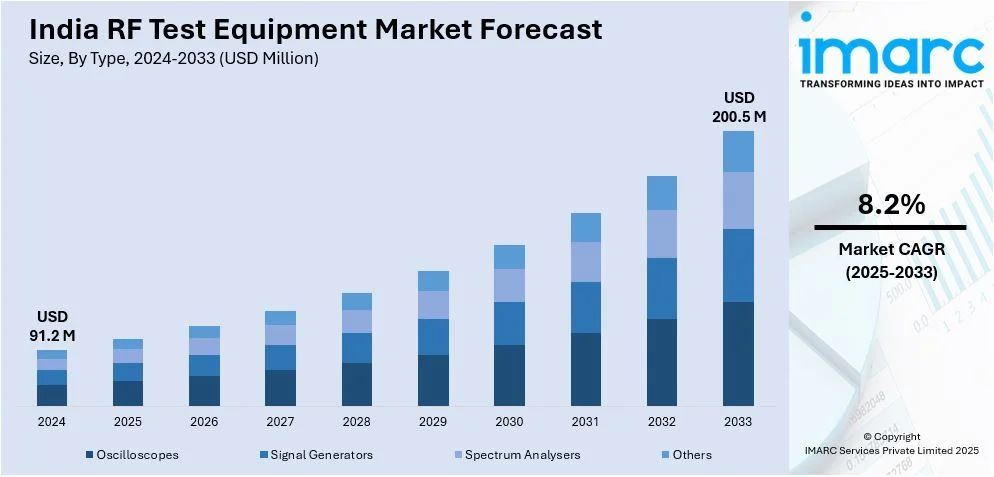

The India RF test equipment market size reached USD 91.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.5 Million by 2033, exhibiting a growth rate (CAGR) of 8.2% during 2025-2033. The rising 5G deployments, increasing IoT adoption, growing demand for wireless communication, expanding aerospace and defense investments, rapid industrial automation, stringent regulatory compliance needs, advancements in semiconductor technology, expanding telecom infrastructure, and the proliferation of smart devices across various sectors are some of the major factors augmenting the India RF test equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.2 Million |

| Market Forecast in 2033 | USD 200.5 Million |

| Market Growth Rate 2025-2033 | 8.2% |

India RF Test Equipment Market Trends:

Expansion of 5G Networks and Associated Testing Needs

India's 5G rollout is a key driver for the RF test equipment market, as telecom operators and network providers invest heavily in advanced testing solutions. As per reports, 5G services had been rolled out across all states and union territories in India by October 2024. At present, 5G connectivity is accessible in 779 out of 783 districts nationwide. With 5G's complex architecture, including higher frequency bands and increased network densification, demand for sophisticated RF test equipment is growing. Network equipment manufacturers require precision testing tools to validate signal integrity, measure latency, and ensure optimal performance across diverse environments. Moreover, the deployment of small cells and massive MIMO technology necessitates rigorous testing of beamforming capabilities, antenna efficiency, and RF interference. As telecom companies partner with global technology providers to expand 5G coverage, RF testing solutions must also evolve to accommodate Over-the-Air (OTA) testing and real-time network analysis. India's focus on indigenously developed telecom solutions under the "Make in India" initiative is positively influencing the India RF test equipment market outlook. The market demand is also fueled by spectrum allocation activities by the Telecom Regulatory Authority of India (TRAI), which requires comprehensive frequency compliance testing to prevent cross-channel interference.

To get more information on this market, Request Sample

Growing Adoption of IoT and Wireless Connectivity Solutions

The rapid proliferation of IoT devices in India is driving the need for advanced RF test equipment to ensure seamless connectivity, reliability, and regulatory compliance. According to an industry report, the anticipated number of IoT devices in India is projected to be 2.1 Billion By 2025. With applications spanning industrial automation, smart cities, healthcare, and automotive sectors, IoT networks rely on multiple wireless communication standards, including Wi-Fi, Zigbee, Bluetooth, LoRa, and NB-IoT. As these networks operate in unlicensed and licensed spectrum bands, RF test equipment is essential for evaluating signal integrity, power consumption, and interference management. The Indian government's push toward digital transformation and smart infrastructure projects is further accelerating the deployment of IoT-based solutions, which is propelling the India RF test equipment market growth. Also, testing solutions must support multi-protocol environments, ensuring devices can coexist without degrading network performance. Additionally, with the increasing adoption of low-power wide-area networks (LPWANs) in India, manufacturers of RF test equipment are concentrating on creating solutions that are both high-precision and cost-effective tailored for long-range, low-energy IoT applications. The need for real-time monitoring and diagnostics leads to advancements in cloud-based RF testing, thereby enhancing remote accessibility and data analytics capabilities.

India RF Test Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, form factor, application, and end user.

Type Insights:

- Oscilloscopes

- Signal Generators

- Spectrum Analysers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes oscilloscopes, signal generators, spectrum analysers, and others.

Form Factor Insights:

- Benchtop

- Portable

- Modular

A detailed breakup and analysis of the market based on the form factor have also been provided in the report. This includes benchtop, portable, and modular.

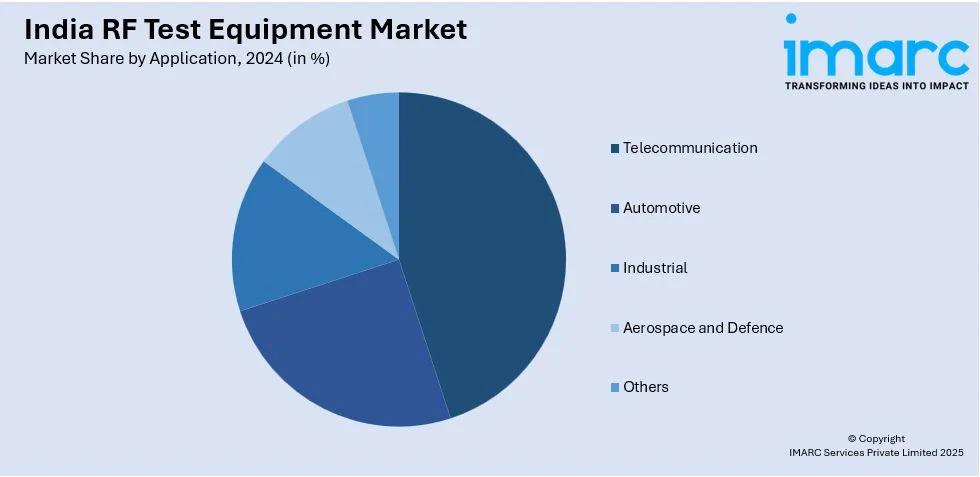

Application Insights:

- Telecommunication

- Automotive

- Industrial

- Aerospace and Defence

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes telecommunication, automotive, industrial, aerospace and defence, and others.

End User Insights:

- Energy and Utilities

- Automotive

- Food and Beverages

- Electronics and Communication

- Chemicals and Materials

- Aerospace and Defence

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes energy and utilities, automotive, food and beverages, electronics and communication, chemicals and materials, aerospace and defence, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India RF Test Equipment Market News:

- On February 8, 2024, Anritsu Corporation unveiled the NR Licensed 6GHz Band Measurement MX800010A-014 software for its Radio Communication Test Station MT8000A. It enables RF testing in the newly allocated 6 GHz licensed band (5.925 GHz to 7.125 GHz) for 5G FR1 devices. The MT8000A's expanded testing capabilities support the deployment of 6 GHz licensed bands, addressing increasing mobile data traffic and global spectrum allocation shifts.

India RF Test Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Oscilloscopes, Signal Generators, Spectrum Analysers, Others |

| Form Factors Covered | Benchtop, Portable, Modular |

| Applications Covered | Telecommunication, Automotive, Industrial, Aerospace and Defence, Others |

| End Users Covered | Energy and Utilities, Automotive, Food and Beverages, Electronics and Communication, Chemicals and Materials, Aerospace and Defence, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India RF test equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India RF test equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India RF test equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The RF test equipment market in India was valued at USD 91.2 Million in 2024.

The India RF test equipment market is projected to exhibit a CAGR of 8.2% during 2025-2033, reaching a value of USD 200.5 Million by 2033.

The India RF test equipment market is shaped by the widespread adoption of IoT devices and the rapid rollout of 5G networks. The increasing demand for wireless communication, expanding electronics manufacturing, rising investments in aerospace and defense, and stringent regulatory compliance also fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)