India Reverse Logistics Market Size, Share, Trends and Forecast by Return Type, Service, End User, and Region, 2026-2034

India Reverse Logistics Market Overview:

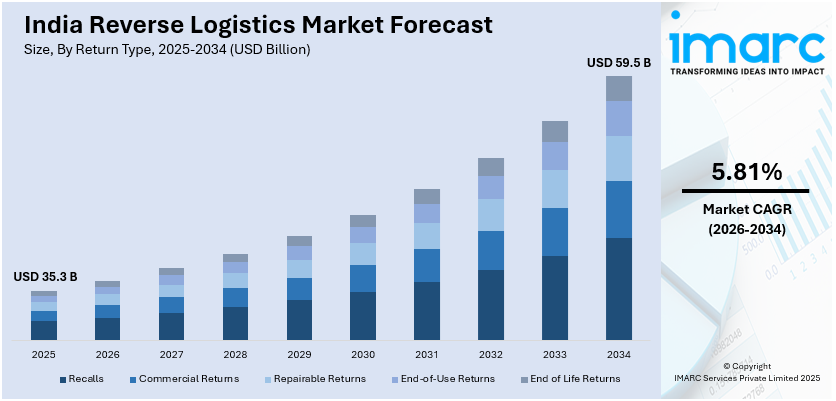

The India reverse logistics market size reached USD 35.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 59.5 Billion by 2034, exhibiting a growth rate (CAGR) of 5.81% during 2026-2034. The e-commerce growth, rising product returns, stricter environmental regulations, increased focus on sustainability, advancements in tracking technologies, expanding retail and automotive sectors, and government initiatives promoting circular economy practices for waste reduction and resource optimization are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 35.3 Billion |

| Market Forecast in 2034 | USD 59.5 Billion |

| Market Growth Rate 2026-2034 | 5.81% |

India Reverse Logistics Market Trends:

Rising Demand for Secure High-Value Logistics Solutions

India is witnessing a shift toward specialized logistics services for high-value and critical shipments. The increasing reliance on e-commerce, coupled with rising demand for secure transportation of electronics, pharmaceuticals, and sensitive goods, is driving companies to strengthen their capabilities. Investments in advanced tracking, real-time monitoring, and secure handling solutions are becoming essential to ensure safe deliveries. Businesses are expanding their networks and integrating technology-driven solutions to optimize supply chains and minimize risks associated with damage or theft. The push for efficiency and security is also leading to greater collaboration between logistics providers and industry stakeholders. As high-value shipments grow, enhanced logistics infrastructure and expertise are becoming crucial for ensuring seamless and reliable deliveries across the country. For example, in January 2025, Shadowfax, a leading e-commerce logistics provider, acquired CriticaLog, known for handling high-value and critical logistics. This acquisition enhances Shadowfax's capabilities in managing high-value shipments, including electronics and pharmaceuticals, across its extensive network in India. The integration aims to address the growing demand for secure and efficient logistics solutions for high-value goods in the country.

To get more information on this market Request Sample

Expanding Access to Efficient Reverse Logistics Solutions

India is shifting towards optimized last-mile and reverse logistics services, spurred by the expansion of the e-commerce industry. Firms are consolidating countrywide networks to provide quicker and more dependable deliveries to almost the entire population. Sophisticated logistics solutions are enhancing return management, minimizing turnaround time, and improving efficiency for sellers and consumers alike. The widespread use of technology, such as automation and real-time tracking, is streamlining reverse logistics and reducing costs. Companies are concentrating on offering end-to-end logistics services that make operations easier for online shoppers, making returns easy to handle. With increasing demand for quicker processing and broader service coverage, logistics companies are expanding operations and streamlining networks to accommodate the changing requirements of India's digital commerce environment. For instance, in December 2024, RapidShyp partnered with Delhivery to enhance last-mile and reverse logistics across India. This collaboration enables RapidShyp to offer Delhivery's express services across 18,700 pin codes, reaching 99.5% of India's population. The partnership provides e-commerce sellers with efficient, end-to-end logistics solutions, including advanced reverse logistics for seamless handling of returns.

India Reverse Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on return type, service, and end user.

Return Type Insights:

- Recalls

- Commercial Returns

- Repairable Returns

- End-of-Use Returns

- End of Life Returns

The report has provided a detailed breakup and analysis of the market based on the return type. This includes recalls, commercial returns, repairable returns, end-of-use returns, and end of life returns.

Service Insights:

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management Authorization

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation, warehousing, reselling, replacement management, refund management authorization, and others.

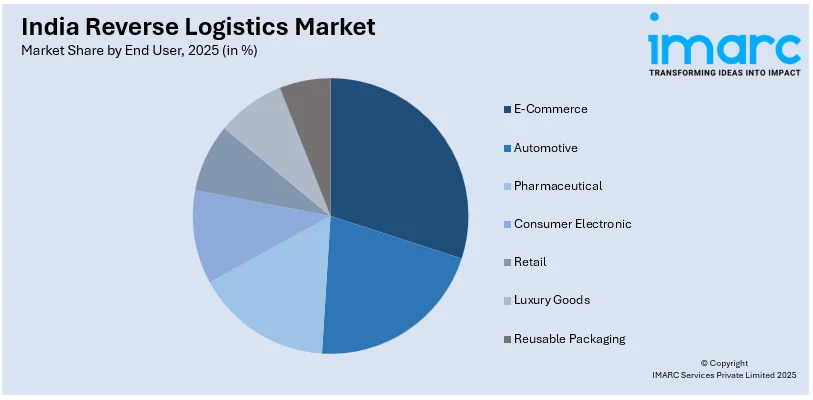

End User Insights:

Access the comprehensive market breakdown Request Sample

- E-Commerce

- Automotive

- Pharmaceutical

- Consumer Electronic

- Retail

- Luxury Goods

- Reusable Packaging

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes e-commerce, automotive, pharmaceutical, consumer electronic, retail, luxury goods, and reusable packaging.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Reverse Logistics Market News:

- In January 2025, Unboxify announced its achievements in transforming e-commerce returns into profitable and sustainable opportunities. Since its 2023 launch, Unboxify has processed over 40,000 returned products, preventing 4.5 Million kilograms of CO₂ emissions. Leveraging AI for quality checks and inventory management, the platform has achieved a deadstock rate of less than 1% and reduced marketing costs to 4% of revenue.

- In October 2024, Cellecor Gadgets Limited partnered with Dixon Technologies (India) Limited to manufacture washing machines, enhancing Cellecor's home appliance offerings. Dixon, a leader in electronic manufacturing services, also provides reverse logistics solutions, including repair and refurbishment services for LED TV panels. This collaboration would lead to expanded reverse logistics services in India's home appliance sector, potentially boosting efficiency and sustainability in the market.

India Reverse Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Return Types Covered | Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of Life Returns |

| Services Covered | Transportation, Warehousing, Reselling, Replacement Management, Refund Management Authorization, Others |

| End Users Covered | E-Commerce, Automotive, Pharmaceutical, Consumer Electronic, Retail, Luxury Goods, Reusable Packaging |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India reverse logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India reverse logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India reverse logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The reverse logistics market in India was valued at USD 35.3 Billion in 2025.

The India reverse logistics market is projected to exhibit a CAGR of 5.81% during 2026-2034, reaching a value of USD 59.5 Billion by 2034.

The India reverse logistics market is primarily driven by the rapid growth of e-commerce, rising product return volumes, and increasing focus on sustainability. Manufacturers and retailers are adopting efficient return, recycling, and refurbishment processes to enhance customer satisfaction, reduce waste, and comply with evolving environmental regulations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)