India Reusable Sanitary Napkin Market Size, Share, Trends and Forecast by Material Type, Distribution Channel, and Region, 2025-2033

Market Overview:

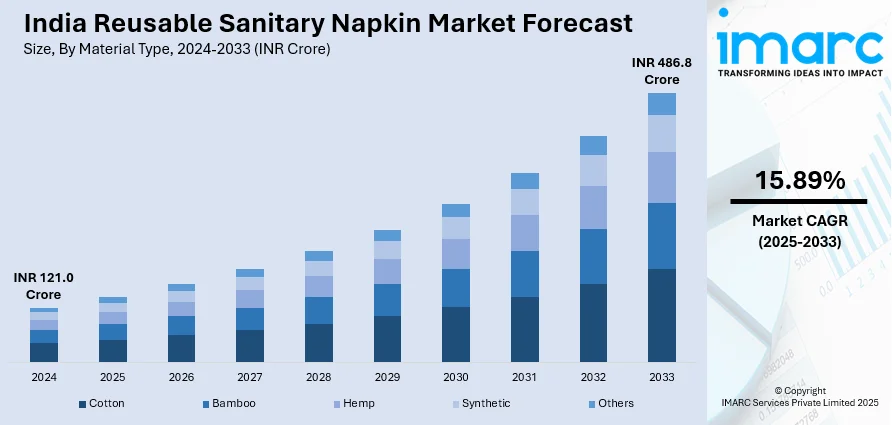

The India reusable sanitary napkin market size reached INR 121.0 Crore in 2024. Looking forward, IMARC Group expects the market to reach INR 486.8 Crore by 2033, exhibiting a growth rate (CAGR) of 15.89% during 2025-2033. The rising accessibility and affordability of reusable sanitary napkins, educational programs focusing on menstrual health and hygiene in educational institutions, and continual advancements in manufacturing techniques are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 121.0 Crore |

|

Market Forecast in 2033

|

INR 486.8 Crore |

|

Market Growth Rate 2025-2033

|

15.89% |

A reusable sanitary napkin is an eco-friendly and sustainable alternative to traditional disposable sanitary pads. It is manufactured from soft, absorbent fabrics, such as cotton or bamboo, these pads are designed to be washed, dried, and reused multiple times, reducing the environmental impact of menstrual waste. They come in various sizes, thicknesses, and absorbencies to cater to individual needs. Reusable sanitary napkins are comfortable, breathable, and free from harmful chemicals often found in disposable pads. By choosing to use these eco-conscious pads, individuals not only contribute to a greener planet by reducing plastic waste but also save money in the long run.

To get more information of this market, Request Sample

The rising accessibility and affordability of reusable sanitary napkins are driving the market in India. Moreover, with continual advancements in manufacturing techniques and economies of scale, these products are becoming more readily available at competitive prices, making them a viable option for women across different socio-economic backgrounds. Additionally, the government's initiatives and various NGOs' efforts to promote menstrual hygiene have further increased the demand for reusable pads, especially in rural areas. Furthermore, the evolving attitudes towards menstruation are contributing to the market as menstrual health is gradually shedding its stigma, and conversations around it are becoming more open and inclusive. This cultural shift is encouraging women to explore alternative menstrual products, such as reusable sanitary napkins, which offer comfort, better absorption, and the potential for long-term cost savings. Along with this, educational programs focusing on menstrual health and hygiene in educational institutions and community settings are also positively influencing the market.

India Reusable Sanitary Napkin Market Trends/Drivers:

Increasing Focus on Environmental Concerns and Sustainability

With heightened awareness about the detrimental impact of plastic waste on the planet, consumers are actively seeking eco-friendly alternatives to everyday products, including menstrual hygiene products. Disposable pads contribute significantly to environmental pollution, as they take hundreds of years to decompose, leading to overflowing landfills and ocean pollution. Reusable sanitary napkins offer a sustainable solution, as they are made from biodegradable materials, such as organic cotton, bamboo, or hemp, reducing their environmental footprint. By opting for reusable pads, individuals can significantly reduce the amount of waste they generate over their menstruating years. As more individuals embrace a zero-waste lifestyle and prioritize eco-conscious choices, the demand for reusable sanitary napkins is experiencing substantial growth, driving the market forward.

Rising Awareness About Menstrual Health and Hygiene

With the growing consciousness about the potential health risks associated with certain chemicals and materials used in disposable menstrual products, more individuals are seeking safer alternatives. Reusable sanitary napkins, typically manufactured from organic or natural fibers, are gaining popularity as they offer a healthier and skin-friendly option. Reusable pads are free from such chemicals, reducing the risk of skin irritation, allergies, and other health concerns. Additionally, the emphasis on menstrual health and hygiene has led to increased scrutiny of the environmental impact of menstrual waste. As people become more conscious of their environmental footprint, they are actively seeking sustainable alternatives to reduce waste generation. Moreover, the growing conversation around menstrual health and hygiene has helped break taboos surrounding menstruation, encouraging open discussions and dialogue.

India Reusable Sanitary Napkin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India reusable sanitary napkin market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on material type and distribution channel.

Breakup by Material Type:

- Cotton

- Bamboo

- Hemp

- Synthetic

- Others

Cotton represents the most widely used material type

The report has provided a detailed breakup and analysis of the market based on the material type. This includes cotton, bamboo, hemp, synthetic and others. According to the report, cotton represented the largest segment.

Cotton has been a popular choice for menstrual hygiene products due to its exceptional absorbent and breathable properties. As a natural fiber, cotton is gentle on the skin and minimizes the risk of irritation or allergies, making it a preferred material for individuals with sensitive skin or allergies to synthetic materials. The soft texture of cotton provides a comfortable and non-abrasive experience during menstruation, enhancing overall user satisfaction. Furthermore, the widespread availability and affordability of cotton contribute to its dominance in the reusable sanitary napkin market. Moreover, cotton is biodegradable, which means that once the reusable pads reach the end of their life cycle, they can decompose naturally, reducing their impact on the environment. Moreover, cotton is amenable to easy washing and care, allowing users to maintain the hygiene and longevity of their reusable pads effectively.

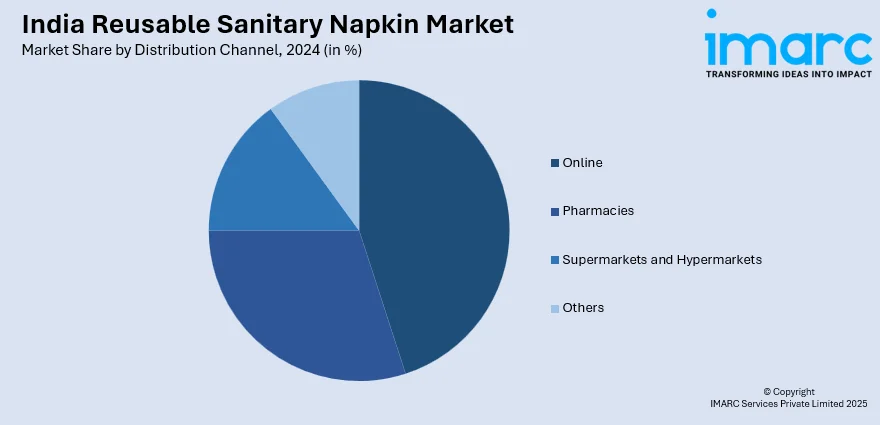

Breakup by Distribution Channel:

- Online

- Pharmacies

- Supermarkets and Hypermarkets

- Others

Online channel holds the majority of the market share

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online, pharmacies, supermarkets and hypermarkets, and others. According to the report, online channel represented the largest segment.

The convenience and accessibility of online shopping platforms have propelled the popularity of reusable sanitary napkins in the digital realm. Consumers can easily browse through a wide range of brands and products, compare prices, read reviews, and make informed choices from the comfort of their homes. Also, online channels offer the extensive reach to both manufacturers and consumers. Reusable sanitary napkin brands can reach the individuals through online marketplaces, allowing them to expand their customer base beyond their geographical boundaries. Furthermore, these platforms enable consumers to access a diverse array of reusable sanitary napkins, including different sizes, styles, materials, and absorbencies. The vast selection caters to the varying needs and preferences of individuals, enhancing the overall customer experience. Additionally, online stores often offer exclusive deals, discounts, and promotional offers, making the purchase of reusable pads more cost-effective for consumers.

Breakup by Region:

- South India

- North India

- West and Central India

- East India

South India exhibits a clear dominance, accounting for the largest India reusable market share

The report has also provided a comprehensive analysis of all the major regional markets, which include the North India, West and Central India, South India, and East India. According to the report, south India represented the largest regional market.

South India boasts a higher level of awareness and acceptance of sustainable practices and environmental concerns compared to other regions. The population in this region is known for its progressive attitude towards embracing eco-friendly alternatives, making reusable sanitary napkins a popular choice among environmentally conscious consumers. Moreover, the availability and accessibility of raw materials used in manufacturing reusable pads also contribute to South India's dominance. The region has an expanding textile industry, offering a steady supply of high-quality fabrics, including cotton and bamboo, which are commonly used in making reusable sanitary napkins. Additionally, initiatives by local NGOs, government bodies, and menstrual health organizations have played a significant role in promoting reusable sanitary napkins and raising awareness about their benefits in South India. These efforts have contributed to a more significant market penetration and a higher adoption rate in the region.

Competitive Landscape:

Several major companies are heavily investing in research and development to enhance the design, materials, and absorbency of their pads. They are exploring new sustainable materials, introducing different sizes and shapes to cater to diverse user needs, and incorporating features, such as leak-proof layers and snap closures for better fit and convenience. Moreover, companies in this market typically have a strong commitment to sustainability. They emphasize using eco-friendly and biodegradable materials in their products to reduce the environmental impact of menstrual waste. Some companies also focus on minimizing packaging waste and opt for eco-conscious packaging materials. Furthermore, numerous companies engage in educational campaigns to raise awareness about menstrual health, hygiene, and the environmental benefits of using reusable pads. These initiatives help break the stigma surrounding menstruation and encourage individuals to make informed and responsible choices.

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

- Eco Femme

- FabPad

- Femy

- iSWEVEN

- Pee Safe (Redcliffe Hygiene Pvt. Ltd.)

- Re:Pad

- Rebelle Pads

- Reboot-U

- Relief Line

- Sanfe (Redroom Technology Pvt. Ltd.)

- Saukhyam

- Soch Green.

India Reusable Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | Cotton, Bamboo, Hemp, Synthetic, Others |

| Distribution Channels Covered | Online, Pharmacies, Supermarkets and Hypermarkets, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Companies Covered | Eco Femme, FabPad, Femy, Isweven, Pee Safe (Redcliffe Hygiene Pvt. Ltd.), Re:Pad, Rebelle Pads, Reboot-U, Relief Line, Sanfe (Redroom Technology Pvt. Ltd.), Saukhyam, Soch Green. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India reusable sanitary napkin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India reusable sanitary napkin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India reusable sanitary napkin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India reusable sanitary napkin market was valued at INR 121.0 Crore in 2024.

We expect the India reusable sanitary napkin market to exhibit a CAGR of 15.89% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer preferences from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of reusable sanitary napkin across the nation.

The introduction of reusable sanitary napkins with the natural materials, that are more breathable and lower the risk of infections upon exposure to harsh and harmful chemicals present in conventional disposable pads, is primarily driving the India reusable sanitary napkin market.

Based on the material type, the India reusable sanitary napkin market has been divided into cotton, bamboo, hemp, synthetic, and others. Among these, cotton currently exhibits a clear dominance in the market.

Based on the distribution channel, the India reusable sanitary napkin market can be bifurcated into online, pharmacies, supermarkets and hypermarkets, and others. Currently, online channel accounts for the majority of the total market share.

On a regional level, the market has been classified into South India, North India, West and Central India, and East India, where South India currently dominates the market.

Some of the major players in the India reusable sanitary napkin market include Eco Femme, FabPad, Femy, Isweven, Pee Safe (Redcliffe Hygiene Pvt. Ltd.), Re:Pad, Rebelle Pads, Reboot-U, Relief Line, Sanfe (Redroom Technology Pvt. Ltd.), Saukhyam, and Soch Green.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)