India Respiratory Inhalers Market Size, Share, Trends and Forecast by Product Type, Technology, Disease Indication, Distribution Channel, End User, and Region, 2025-2033

India Respiratory Inhalers Market Overview:

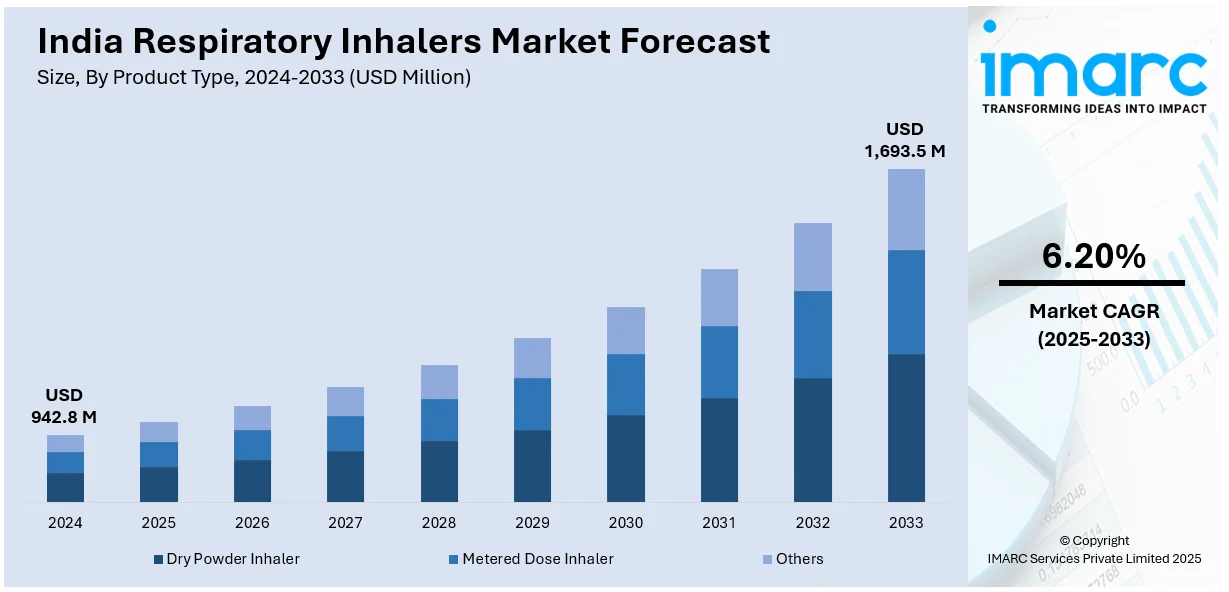

The India respiratory inhalers market size reached USD 942.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,693.5 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is expanding owing to the increasing prevalence of asthma and COPD, rising healthcare consciousness, technological advancement, growing online distribution, government support, enhanced accessibility, and a shift towards convenient, effective drug delivery systems improving compliance and treatment success.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 942.8 Million |

| Market Forecast in 2033 | USD 1,693.5 Million |

| Market Growth Rate 2025-2033 | 6.20% |

India Respiratory Inhalers Market Trends:

Growing Adoption of Digitally Operated Inhalers

The India market for respiratory inhalers is witnessing a surge in demand for digitally regulated inhalers since they can enhance drug compliance and provide real-time monitoring. The smart inhalers contain sensors to track inhalation behavior, dosing frequency, and usage patterns, allowing the healthcare provider and patient to more effectively manage respiratory conditions. The integration of mobile apps and Bluetooth ensures seamless connectivity, ensuring tailored treatment plans and prompt intervention upon abnormal usage. With increasing smartphone penetration and telemedicine innovations, digital inhalers are also playing a vital role in driving improved patient outcomes. Additionally, awareness programs and governmental backing for digital healthcare technologies are fueling the uptake of these next-generation devices. The shift towards data-driven respiratory care is revolutionizing treatment approaches, enhancing disease management, and promoting quality of life among patients with chronic respiratory illness.

To get more information on this market, Request Sample

Rising Demand for Dry Powder Inhalers (DPIs)

Dry powder inhalers (DPIs) are picking up tremendous momentum in India because of their convenience, portability, and efficacy in treating respiratory conditions like asthma and COPD. For instance, in January 2023, Lupin introduced DIFIZMA®, India's first fixed-dose combination triple drug dry powder inhaler for uncontrolled asthma, enhancing lung function, symptom management, and decreasing exacerbations, which was approved by the Drug Controller General of India. Moreover, DPIs do not need coordination between inhalation and drug release, unlike metered dose inhalers (MDIs), and hence are a patient-friendly option for all age groups. The increasing demand for propellant-free inhalers is consistent with India's emphasis on green healthcare solutions, further fueling DPI adoption. Furthermore, advancement in formulation technology and particle engineering is increasing the efficiency of drug delivery, delivering improved therapeutic effects. The expanding availability of DPIs in both rural and urban regions, as well as awareness programs on the correct way to use inhalers, are fueling market growth. As more physicians prescribe DPIs due to their reliability and ease of use, their market share increases, further solidifying their role as a critical part of respiratory disease care.

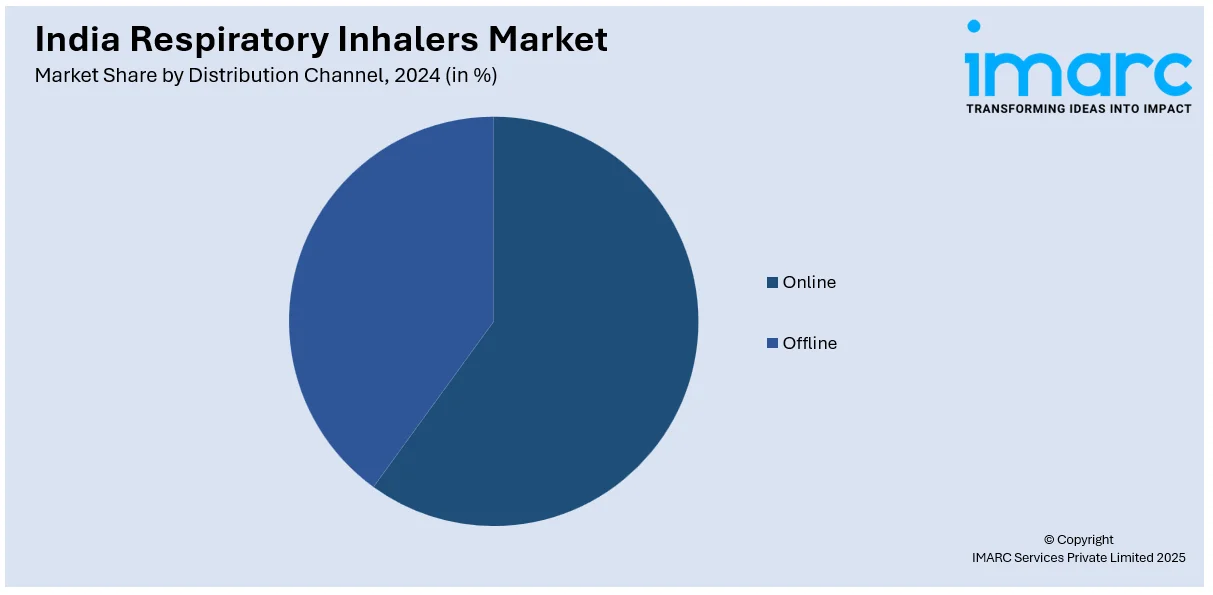

Expanding Accessibility Through Online Distribution Channels

The rapid growth of digital healthcare platforms and e-commerce is revolutionizing the supply of respiratory inhalers in India. Telehealth operators and online pharmacies are simplifying access to inhalers from home, increasing efficiency over traditional retail outlets. The attraction of doorstep delivery, discounts, and subscription-based drug services is nudging people towards buying inhalers online. Furthermore, digital channels also offer quality education material on inhaler use to support more consistent compliance with the treatment as directed. The strengthened collaboration between pharmaceutical industry and online medical professionals is further making this distribution channel robust, which maintains a regular flow of inhalers in both urban and rural geographies. With increasing smartphone penetration and better internet connectivity, online sales of respiratory inhalers are likely to keep increasing, bringing respiratory care closer and more efficiently to patients nationwide.

India Respiratory Inhalers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, technology, disease indication, distribution channel, and end user.

Product Type Insights:

- Dry Powder Inhaler

- Metered Dose Inhaler

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry powder inhaler, metered dose inhaler, and others.

Technology Insights:

- Manually Operated Inhalers

- Digitally Operated Inhalers

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes manually operated inhalers and digitally operated inhalers.

Disease Indication Insights:

- COPD

- Asthma

- Pulmonary Atrial Hypertension

- Others

The report has provided a detailed breakup and analysis of the market based on the disease indication. This includes COPD, asthma, pulmonary atrial hypertension, and others.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Hospitals and Clinics

- Homecare

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, homecare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Respiratory Inhalers Market News:

- In December 2024, Cipla received CDSCO approval to market and distribute Afrezza, MannKind Corporation's inhaled insulin, in India. The rapid-acting insulin provides a needle-free solution for diabetes control, dissolving rapidly when inhaled and replicating the natural insulin response of the body for better glycemic control.

- In March 2024, AstraZeneca Pharma India collaborated with Mankind Pharma to increase access to Symbicort, a popular asthma medication. The partnership will enhance patient access via Mankind's large distribution network, making the inhaler more widely available in urban and rural markets.

India Respiratory Inhalers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Powder Inhaler, Metered Dose Inhaler, Others |

| Technologies Covered | Manually Operated Inhalers, Digitally Operated Inhalers |

| Disease Indications Covered | COPD, Asthma, Pulmonary Atrial Hypertension, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Hospitals and Clinics, Homecare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India respiratory inhalers market performed so far and how will it perform in the coming years?

- What is the breakup of the India respiratory inhalers market on the basis of product type?

- What is the breakup of the India respiratory inhalers market on the basis of technology?

- What is the breakup of the India respiratory inhalers market on the basis of disease indication?

- What is the breakup of the India respiratory inhalers market on the basis of distribution channel?

- What is the breakup of the India respiratory inhalers market on the basis of end user?

- What is the breakup of the India respiratory inhalers market on the basis of region?

- What are the various stages in the value chain of the India respiratory inhalers market?

- What are the key driving factors and challenges in the India respiratory inhalers?

- What is the structure of the India respiratory inhalers market and who are the key players?

- What is the degree of competition in the India respiratory inhalers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India respiratory inhalers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India respiratory inhalers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India respiratory inhalers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)