India Renewable Energy Storage Market Size, Share, Trends and Forecast by Source, Technology, Application, and Region 2026-2034

India Renewable Energy Storage Market Summary:

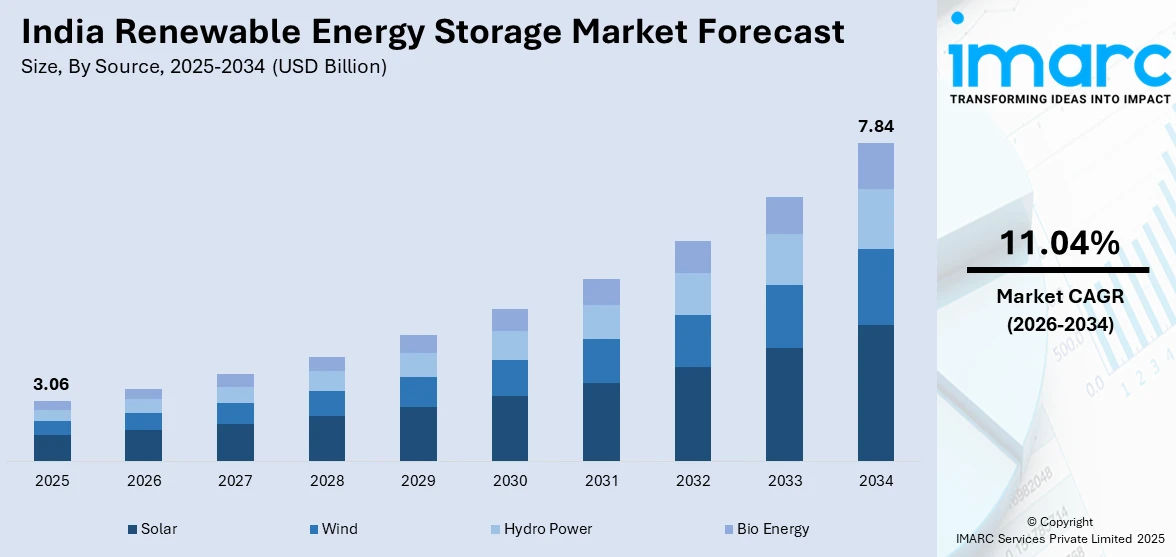

The India renewable energy storage market size was valued at USD 3.06 Billion in 2025 and is projected to reach USD 7.84 Billion by 2034, growing at a compound annual growth rate of 11.04% from 2026-2034.

The market growth is primarily driven by India's ambitious renewable energy targets and the imperative need for grid stability solutions as solar and wind capacity expands rapidly. The convergence of supportive government policies, including viability gap funding mechanisms and energy storage obligations, declining battery costs, and increasing demand for firm and dispatchable renewable energy is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Source: Solar dominates the market with a share of 35% in 2025, driven by India's exceptional solar irradiance levels, massive utility-scale installations, and government initiatives promoting solar-plus-storage hybrid projects.

- By Technology: Battery energy storage leads the market with a share of 41% in 2025, owing to its rapid deployment capability, declining lithium-ion costs, locational flexibility, and ability to provide multiple grid services, including peak shaving and frequency regulation.

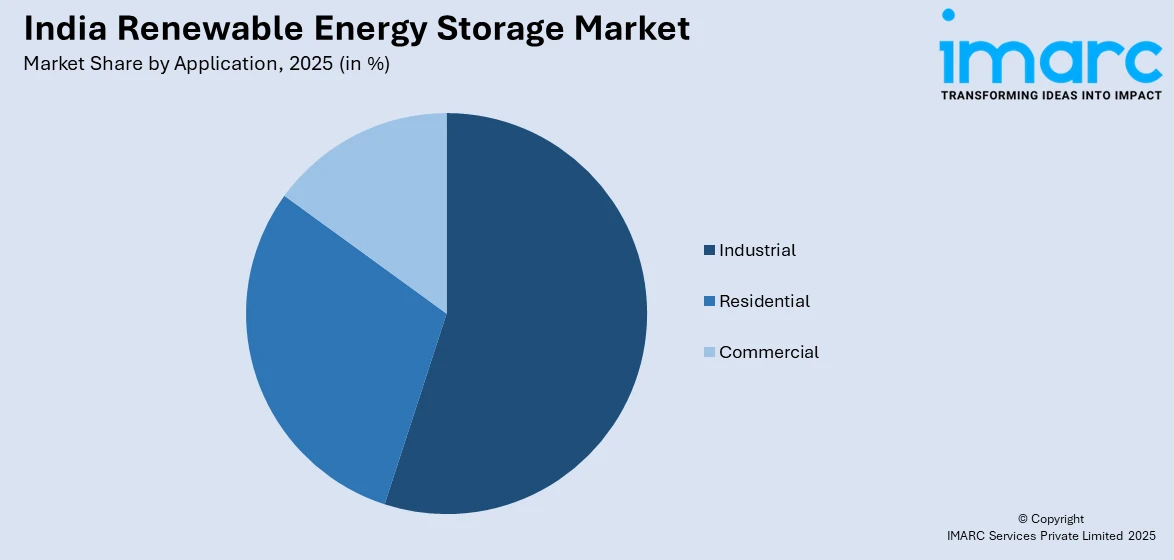

- By Application: Industrial represents the largest segment with a market share of 39% in 2025. This dominance is because of manufacturing sector requirements for reliable power, energy cost optimization needs, and captive renewable energy integration demands.

- By Region: North India dominates the market with a share of 30% in 2025, supported by the exceptional solar resources and states like Uttar Pradesh implementing aggressive renewable energy capacity addition programs.

- Key Players: The India renewable energy storage market exhibits increasing competitive intensity, with domestic energy conglomerates competing alongside international technology providers across utility-scale and commercial segments.

To get more information on this market Request Sample

The India renewable energy market is driven by firm policy commitment to energy transition, rising power demand, and the strategic need to reduce reliance on imported fossil fuels. Clear government targets for solar, wind, and energy storage capacity provide long-term confidence for investors and developers. Falling renewable generation costs enhance competitiveness against conventional power, while ongoing grid modernization supports higher integration levels. Corporate decarbonization goals and the growing demand for clean electricity from industrial and commercial users further influences the market. These drivers are reflected in 2025, when India launched a pilot to install battery storage at coal-fired power plants, led by the CEA with NTPC, involving a 1.7 GW battery tender covering up to 4 GWh across 11 plants. Expansion of transmission networks, hybrid projects, and storage deployment continues to improve reliability, dispatchability, and large-scale renewable adoption nationwide.

India Renewable Energy Storage Market Trends:

Expansion of Integrated Clean Energy Manufacturing Ecosystems

The rise of integrated clean energy platforms is strengthening the renewable energy storage market growth by aligning generation, manufacturing, and storage development under unified investment strategies. Large-scale manufacturing of solar components increases renewable capacity additions, which in turn raises the need for balancing and storage solutions. This linkage was evident in 2026 when LNK Energy announced plans to invest ₹10,000 crore over five years, starting with a 6 GW integrated solar manufacturing facility in Maharashtra while also planning expansion into energy storage and green hydrogen. Such vertically aligned investments improve supply chain coordination, reduce cost inefficiencies, and create long-term demand for storage systems to support high renewable penetration, thus contributing to the market growth.

Rise of Utility-Scale Hybrid Renewable Projects

Large utility-scale renewable projects increasingly incorporate energy storage to ensure grid stability and dispatchable power supply. As solar and wind capacity expands, storage integration becomes essential to manage intermittency, firm capacity delivery, and peak demand support. This shift toward hybrid project design was reinforced in 2026 when Rajasthan issued a global tender for a 2,450 MW solar PV project at Pugal Solar Park, integrated with 1,600 MW / 6,400 MWh of energy storage through tariff-based competitive bidding. Such large hybrid deployments improve grid confidence, reduce curtailment risks, and strengthen the commercial case for storage. As states pursue ambitious renewable targets, hybrid projects are emerging as a primary factor for energy storage market growth in India.

Financial Incentives to Improve Storage Project Viability

Targeted financial support mechanisms are accelerating the adoption of renewable energy storage by addressing high upfront capital costs and improving project bankability. Viability gap funding reduces tariff pressure and shortens payback periods, enabling wider participation from utilities and private developers. This policy direction was strengthened in 2025 when the Ministry of Power announced a ₹54 billion viability gap funding package to support 30 GWh of battery energy storage under the second tranche of the BESS program, offering ₹1.8 million per MWh and allocating capacity across states and NTPC. Such funding frameworks lower investment risk, unlock large-scale deployments, and create momentum toward meeting India’s projected storage requirement of 236 GWh by 2031–32.

Market Outlook 2026-2034:

The India renewable energy storage market demonstrates robust growth potential throughout the forecast period, underpinned by irreversible energy transition dynamics and strengthening policy support. Rising renewable capacity additions, grid stability requirements, and increasing focus on energy security are accelerating storage adoption across utility-scale and commercial applications. Advancements in battery technologies and declining costs further improve project feasibility and investment interest. The market generated a revenue of USD 3.06 Billion in 2025 and is projected to reach a revenue of USD 7.84 Billion by 2034, growing at a compound annual growth rate of 11.04% from 2026-2034.

India Renewable Energy Storage Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Solar |

35% |

|

Technology |

Battery Energy Storage |

41% |

|

Application |

Industrial |

39% |

|

Region |

North India |

30% |

Source Insights:

- Wind

- Hydro Power

- Solar

- Bio Energy

Solar dominates with a market share of 35% of the total India renewable energy storage market in 2025.

Solar exhibits a clear dominance in the market because of the country’s large installed solar capacity and continued pipeline of utility-scale and rooftop projects. High solar generation during daylight hours creates a need for storage to manage intermittency and shift energy supply to peak demand periods. Co-locating storage with solar plants improves grid stability, enhances power dispatchability, and maximizes asset utilization. Decreasing solar tariffs further encourage developers to integrate storage solutions.

This dominance is reinforced by strong government support for solar-led energy transition, including large solar parks, rooftop programs, and hybrid renewable tenders. For example, in 2025, India announced plans to launch a utility-led solar program under the PM Surya Ghar: Muft Bijli Yojana to serve households without rooftop space. Storage paired with solar enables compliance with round-the-clock power supply requirements and grid balancing mandates. Industrial and commercial users also adopt solar-plus-storage systems to reduce electricity costs and ensure reliable power. As solar capacity continues to expand nationwide, it remains the primary driver for energy storage deployment across India.

Technology Insights:

- Pumped Hydroelectric Storage

- Battery Energy Storage

- Flywheel Energy Storage

- Compressed Air Energy Storage

- Thermal Energy Storage

- Hydrogen Energy Storage

Battery energy storage leads with a market share of 41% of the total India renewable energy storage market in 2025.

Battery energy storage represents the largest segment driven by its operational flexibility, fast response capability, and suitability across multiple use cases. Battery system can be deployed at utility, commercial, and industrial scales, enabling effective management of renewable intermittency and grid stability. Its modular design allows scalable installations, while declining battery costs improve project economics. Short installation timelines and compatibility with solar and wind projects further strengthen adoption across grid-connected and behind-the-meter applications.

This dominance is reinforced by continuous improvements in lithium-ion and emerging battery chemistries, enhancing energy density, operational life, and safety performance. Policy support for standalone and co-located storage projects strengthens deployment momentum, while battery systems enable frequency regulation, peak shaving, and backup power, expanding revenue opportunities. Market confidence is further reflected in 2025, when ENGIE entered India’s utility-scale storage segment by securing a 280 MW/560 MWh BESS project under GUVNL’s national tender, scheduled for commissioning in 2027 to deliver two hours of peak power. As renewable capacity and grid modernization accelerate, battery energy storage remains the preferred technology for flexible and reliable power systems.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Industrial exhibits a clear dominance with a 39% share of the total India renewable energy storage market in 2025.

Industrial holds the biggest market share owing to the sectors high and continuous power demand, coupled with rising electricity costs and reliability concerns. Manufacturing units, process industries, and large facilities increasingly deploy energy storage to manage peak loads, reduce grid dependence, and ensure uninterrupted operations. Storage systems enable better integration of on-site solar and wind installations, helping industries stabilize power supply and improve energy efficiency. This is particularly important for energy-intensive sectors that require consistent power quality.

The dominance of industrial applications is further supported by cost savings achieved through peak shaving, demand charge reduction, and improved power reliability. Energy storage allows industries to optimize energy utilization schedules and mitigate the impact of grid outages. Government incentives, open access renewable policies, and corporate sustainability commitments also encourage adoption. As industries pursue decarbonization and energy resilience, storage systems remain a strategic investment, reinforcing their leading role in the market.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 30% of the total India renewable energy storage market in 2025.

North India leads the market due to its high concentration of renewable energy capacity, grid-scale projects, and power demand centers. States like Rajasthan, Uttar Pradesh, Haryana, and Punjab host large solar and wind installations that require storage solutions to manage intermittency and peak load balancing. The region’s extensive transmission network and proximity to industrial and urban utilization hubs support deployment of utility-scale and commercial energy storage systems.

This dominance is reinforced by supportive policy measures, government-backed pilot programs, and active participation from both public and private utilities. North India benefits from early grid modernization efforts, renewable integration mandates, and targeted tenders for standalone and co-located storage projects. Investment momentum is further strengthened by land availability, improving transmission infrastructure, and access to institutional financing. This trajectory was underscored in 2026 when GoodEnough Energy commissioned India’s largest battery energy storage gigafactory in Noida with an initial 7 GWh capacity, aligned with national non-fossil power targets and long-term grid stability requirements. Such developments strengthen regional leadership and accelerate large-scale storage adoption.

Market Dynamics:

Growth Drivers:

Why is the India Renewable Energy Storage Market Growing?

Large-Scale Private Sector Investment in Utility-Scale Storage

Rising participation from large conglomerates is propelling the growth of India renewable energy storage market by bringing capital scale, execution capability, and long-term commitment. Utility-scale battery projects support round-the-clock renewable power delivery, enhance grid stability, and improve confidence in high renewable penetration scenarios. This trend was reinforced in 2025 when the Adani Group announced its entry into battery energy storage with a 1,126 MW / 3,530 MWh BESS project at Khavda, Gujarat, among the world’s largest single-site installations. Planned commissioning by March 2026 and a roadmap to scale storage capacity to 50 GWh over five years highlight how large private investments are creating momentum, reducing deployment risk, and contributing to the growth of the market.

Integration of Battery Storage into Urban Distribution Networks

Deployment of battery energy storage within urban power systems is bolstering the market growth by addressing reliability and peak demand challenges in dense load centers. Urban grids require fast-response solutions to manage demand fluctuations, renewable variability, and space constraints. Battery storage provides localized flexibility without extensive network expansion, improving power quality and outage resilience. This progress was demonstrated in 2025 when India’s first commercial utility-scale BESS was commissioned at BSES Rajdhani’s Kilokri substation in south Delhi, with a 20 MW/40 MWh system supplying up to four hours of stored renewable power daily. Such urban integration validates operational feasibility, encourages replication across cities, and strengthens long-term demand for renewable energy storage solutions.

Entry of Established Power Equipment Manufacturers

Participation of established energy and power equipment companies is accelerating the adoption of renewable energy storage by improving technology credibility and deployment readiness. Such players bring engineering expertise, manufacturing capability, and service networks that reduce performance and reliability concerns for buyers. This trend was reinforced in 2025 when Cummins India Limited launched its modular battery energy storage systems in Pune, based on lithium-iron-phosphate technology to support peak shaving, energy shifting, and renewable integration. Alignment with long-term decarbonization strategies and national net-zero targets strengthens confidence among utilities and commercial users. As trusted manufacturers expand storage portfolios, market acceptance improves, project execution risks decline, and adoption across utility-scale and distributed applications increases steadily.

Market Restraints:

What Challenges the India Renewable Energy Storage Market is Facing?

Underbidding Concerns and Project Execution Risks

Aggressive bidding behavior in competitive auctions has increased concerns around project viability and execution risk. Developers submitting underpriced bids face pressure on margins, which can affect project quality and timely completion. These challenges raise the likelihood of delays, renegotiations, and financial stress, potentially impacting overall market stability and investor confidence.

Power Purchase Agreement Delays and Regulatory Complexities

Significant delays in power purchase agreement execution are slowing project commissioning across the market. Lengthy negotiations, approval processes, and evolving contractual terms extend development timelines. Complex structures associated with hybrid and firm dispatchable renewable energy projects further increase execution risk, affecting investor confidence, financing closures, and the timely deployment of generation and storage assets.

Supply Chain Constraints and Import Dependency

Limited domestic battery cell manufacturing capacity and strong dependence on imported critical minerals expose the market to global price fluctuations and geopolitical risks. Most utility-scale projects rely on a narrow group of suppliers, often linked to international joint ventures. Delays in domestic refining and processing infrastructure further restrict near-term localization, increasing cost uncertainty and supply chain vulnerability.

Competitive Landscape:

The India renewable energy storage market exhibits increasing competitive intensity characterized by the presence of domestic energy conglomerates, international technology providers, and engineering firms competing across utility-scale and distributed storage segments. Market dynamics reflect strategic positioning, ranging from integrated energy companies leveraging existing renewable portfolios to pure-play storage developers and equipment manufacturers. The competitive landscape is increasingly shaped by technological partnerships, domestic manufacturing investments, viability gap funding allocations, and ability to execute complex hybrid projects within challenging timelines. Players are differentiating through technology expertise, project financing capabilities, and grid service offerings.

Recent Developments:

- January 2026: Swelect Energy Systems unveiled a new brand identity and launched its NUMERGY energy storage portfolio to strengthen its presence in solar and integrated energy solutions. The NUMERGY range includes Battery Energy Storage Systems for residential and commercial use, addressing rising demand for reliable power. The move signals the company’s strategic focus on clean energy, grid stability, and energy independence.

- January 2026: Genus Group showcased its integrated clean energy portfolio at Bharat Renewable Expo 2026 in Jaipur, launching a new Hybrid Solar Inverter. The company highlighted energy storage systems, smart meters, and residential–commercial solutions aimed at accelerating renewable adoption and improving energy monitoring across Rajasthan.

India Renewable Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Wind, Hydro Power, Solar, Bio Energy |

| Technologies Covered | Pumped Hydroelectric Storage, Battery Energy Storage, Flywheel Energy Storage, Compressed Air Energy Storage, Thermal Energy Storage, Hydrogen Energy Storage |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India renewable energy storage market size was valued at USD 3.06 Billion in 2025.

The India renewable energy storage market is expected to grow at a compound annual growth rate of 11.04% from 2026-2034 to reach USD 7.84 Billion by 2034.

Battery energy storage dominates the market with 41% share in 2025, driven by rapid deployment capability, declining lithium-ion costs, and ability to provide multiple grid services.

Key factors driving the India renewable energy storage market include financial support that lowers upfront costs and improves bankability. In 2025, the Ministry of Power approved ?54 billion VGF for 30 GWh of BESS at ?1.8 million/MWh, supporting large-scale deployment toward the 236 GWh requirement by 2031–32.

Major challenges include underbidding concerns in auctions creating project execution risks, significant delays in power purchase agreement signing, transmission infrastructure gaps restricting grid connectivity, supply chain constraints with limited domestic manufacturing, and import dependency for critical minerals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)