India Reinsurance Market Size, Share, Trends and Forecast by Type, Mode, Distribution Channel, Application, and Region, 2026-2034

Market Overview:

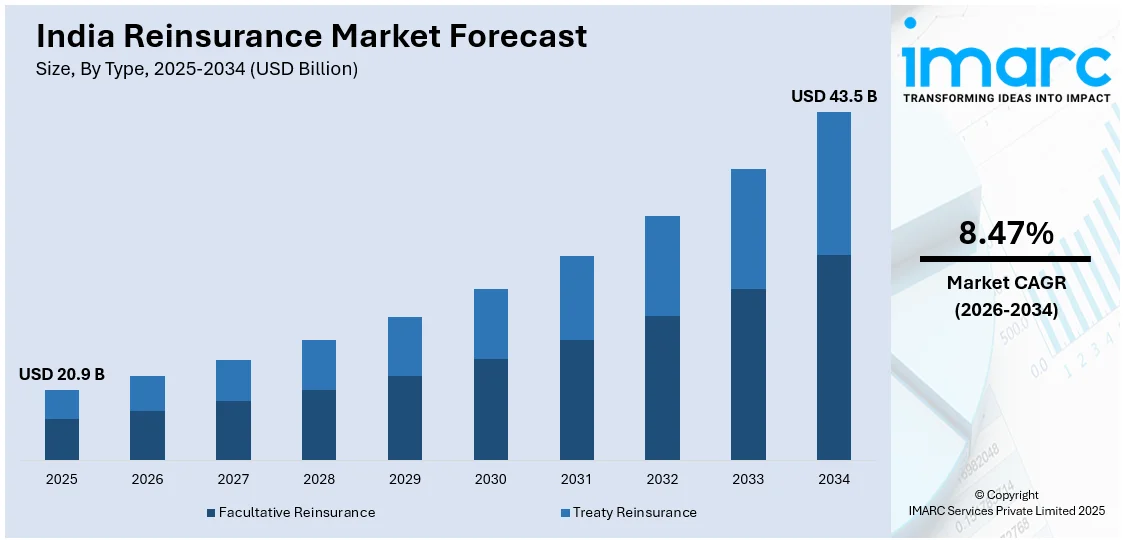

India reinsurance market size reached USD 20.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 43.5 Billion by 2034, exhibiting a growth rate (CAGR) of 8.47% during 2026-2034. The increasing technological innovations, such as artificial intelligence, big data analytics, and blockchain, that can influence the way insurers assess and manage risks, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20.9 Billion |

| Market Forecast in 2034 | USD 43.5 Billion |

| Market Growth Rate (2026-2034) | 8.47% |

Reinsurance is a financial arrangement wherein an insurance company transfers a portion of its risk to another insurer, known as the reinsurer. This process helps the primary insurer mitigate potential financial losses resulting from large or unexpected claims. Reinsurance serves as a strategic risk management tool, allowing insurance companies to protect their financial stability and capacity to underwrite policies. Reinsurers assume a predetermined share of the risk in exchange for a premium paid by the ceding insurer. This practice enables the original insurer to diversify its risk portfolio and ensure solvency in the face of catastrophic events. Reinsurance can be proportional, where the reinsurer shares a fixed percentage of each policy, or non-proportional, where it covers losses exceeding a predefined threshold. Overall, reinsurance plays a crucial role in stabilizing the insurance industry and safeguarding against the adverse impacts of unforeseen and severe events.

To get more information on this market Request Sample

India Reinsurance Market Trends:

The reinsurance market in India is propelled by several key drivers, each influencing the industry's dynamics. Firstly, the growing complexity and frequency of catastrophic events, such as natural disasters, underscore the need for robust risk mitigation strategies. Consequently, insurers seek to share and transfer risks through reinsurance arrangements. Moreover, advancements in technology have enabled insurers to better assess and quantify risks, fostering a more nuanced understanding of their portfolios. This increased precision in risk modeling facilitates more targeted reinsurance solutions, enhancing overall market efficiency. Additionally, regulatory developments play a pivotal role, with evolving compliance requirements encouraging insurers to bolster their risk management frameworks through reinsurance partnerships. In tandem, the burgeoning insurtech landscape contributes to market evolution, with innovative solutions and data-driven approaches reshaping traditional underwriting practices. As reinsurers adapt to these technological advancements, they position themselves to better navigate the evolving risk landscape. In essence, the reinsurance market in India is driven by a confluence of factors, from regional risk dynamics and technological innovation to regulatory imperatives, collectively shaping its trajectory in an ever-changing environment.

India Reinsurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, mode, distribution channel, and application.

Type Insights:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

The report has provided a detailed breakup and analysis of the market based on the type. This includes facultative reinsurance and treaty reinsurance (proportional reinsurance and non-proportional reinsurance).

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

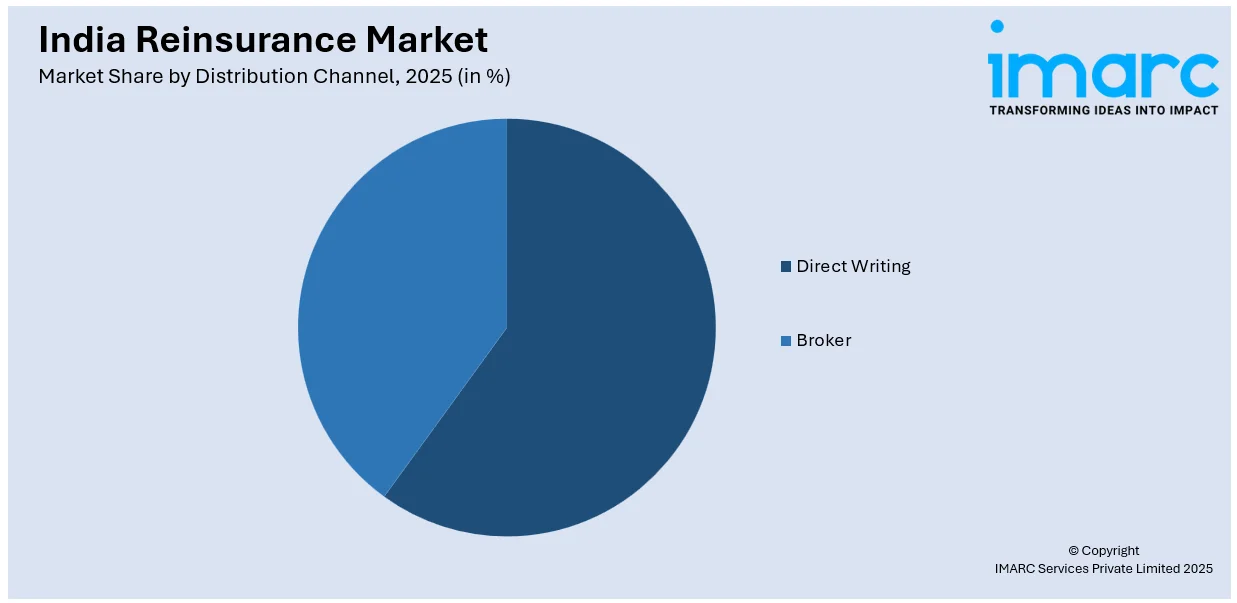

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Writing

- Broker

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct writing and broker.

Application Insights:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes property and casualty reinsurance and life and health reinsurance (disease insurance and medical insurance).

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Reinsurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Modes Covered | Online, Offline |

| Distribution Channels Covered | Direct Writing, Broker |

| Applications Covered |

|

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India reinsurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India reinsurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India reinsurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The reinsurance market in India was valued at USD 20.9 Billion in 2025.

The reinsurance market in India is projected to exhibit a CAGR of 8.47% during 2026-2034, reaching a value of USD 43.5 Billion by 2034.

The reinsurance market in India is fueled by enhancing risk management awareness, enhancing insurance penetration, and regulatory encouragement from IRDAI. Economic growth, urbanization, and climate risks have driven the demand for risk transfer products. Increasing natural disasters and mega infrastructure projects necessitate enhanced cover, making insurers cede more risks. Liberalized rules providing permission to foreign reinsurers and the presence of local reinsurers also fuel market growth, as do technological and data analysis advancements for risk underwriting.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)