India Refrigerated Trucks Market Size, Share, Trends and Forecast by Vehicle Capacity GVW, Sector, Body Type, Application, and Region, 2026-2034

India Refrigerated Trucks Market Summary:

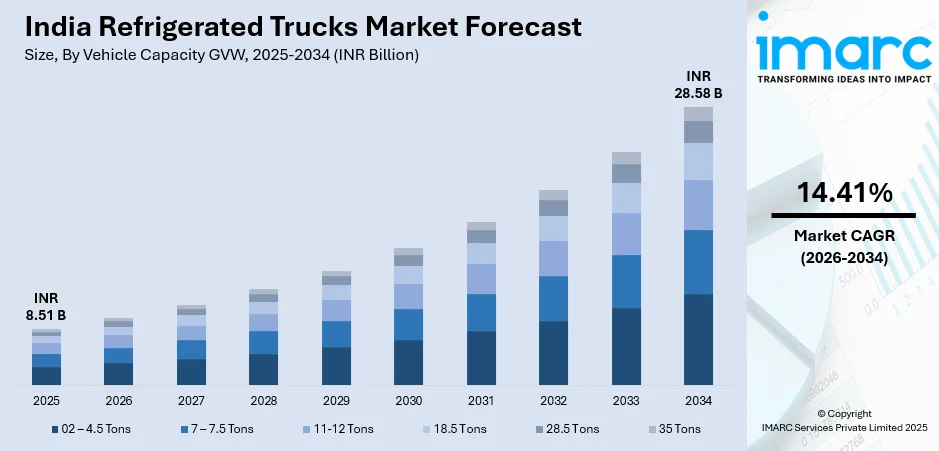

The India refrigerated trucks market size was valued at INR 8.51 Billion in 2025 and is projected to reach INR 28.58 Billion by 2034, growing at a compound annual growth rate of 14.41% from 2026-2034.

India's refrigerated transport sector is experiencing robust expansion driven by evolving cold chain infrastructure demands across perishable goods logistics. Apart from this, the market reflects transformative shifts in temperature-controlled distribution networks, supported by heightened food safety awareness, expanding organized retail penetration, and pharmaceutical distribution modernization initiatives nationwide, thereby expanding the India refrigerated trucks market.

Key Takeaways and Insights:

- By Vehicle Capacity GVW: 11-12 tons segment dominate the market with a share of 23% in 2025, offering optimal payload capacity balanced with urban maneuverability for regional distribution networks.

- By Sector: Organized sector leads the market with a share of 65% in 2025, reflecting corporate adoption of standardized cold chain protocols and compliance-driven fleet management practices.

- By Body Type: Fully built segment represents the largest segment with a market share of 57% in 2025, delivering turnkey refrigerated solutions with integrated cooling systems and insulation specifications.

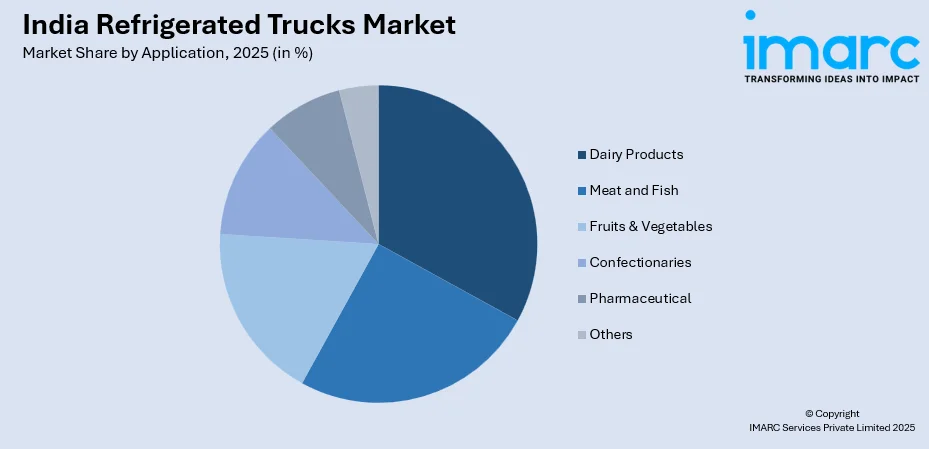

- By Application: Dairy products account for the largest share of 22% in 2025, driven by India's status as the top global milk producer necessitating a vast temperature-regulated distribution system.

- By Region: North India captures the largest market share of 28% in 2025, anchored by Delhi NCR's consumption centers and Punjab-Haryana agricultural production hubs demanding sophisticated cold logistics.

- Key Players: The India refrigerated trucks market exhibits moderate competitive intensity with established commercial vehicle manufacturers competing alongside specialized refrigeration equipment suppliers. Major participants include Carrier Airconditioning & Refrigeration Limited (Carrier Global Corporation), Ice Make Refrigeration Limited, JCBL Limited, KOLD SEAL, Motherson Sumi System Limited, Subros Limited, Surin International Private Limited, Tata Motors Limited, Trane Technologies India Pvt Ltd, and TransACNR.

To get more information on this market Request Sample

India's refrigerated trucking landscape is undergoing fundamental transformation as perishable goods supply chains modernize across agricultural, dairy, pharmaceutical, and food retail sectors. The market's expansion trajectory is intrinsically linked to government initiatives like the Pradhan Mantri Kisan Sampada Yojana, which allocates substantial funding for cold chain infrastructure development. Witness the rapid deployment of refrigerated fleets by major dairy cooperatives expanding beyond traditional markets, organizations are investing in temperature-controlled logistics to reach emerging consumption centers in tier-two and tier-three cities. The pharmaceutical sector's stringent transportation requirements, particularly for vaccine distribution programs demonstrated during national immunization campaigns, have elevated quality standards across the entire cold chain ecosystem. Additionally, organized retail chains establishing pan-India footprints are contracting dedicated refrigerated transport capacity to maintain product integrity from distribution centers to store locations, fundamentally reshaping logistics service provider capabilities. In 2025, Celcius Logistics announced the introduction of Celcius+, a specialized logistics division focused on the efficient management of the pharmaceutical supply chain in India. Created to satisfy the industry's strict standards for temperature regulation, compliance, and real-time monitoring, Celcius+ guarantees that medications, vaccines, and other delicate items are transported with utmost safety and effectiveness, the firm stated in an announcement.

India Refrigerated Trucks Market Trends:

Integration of Internet of Things (IoT)-Enabled Temperature Monitoring Systems

Refrigerated truck operators are rapidly adopting IoT technologies that provide real-time temperature tracking, location monitoring, and predictive maintenance capabilities throughout transportation cycles. Fleet management platforms now integrate sensor networks that transmit continuous data streams on refrigeration unit performance, cargo compartment conditions, and vehicle diagnostics to centralized control centers. Consider how leading pharmaceutical logistics providers have implemented end-to-end cold chain visibility solutions that generate automated alerts when temperature deviations occur, enabling immediate corrective actions to protect sensitive medications. These digital transformation initiatives are establishing new industry benchmarks for operational transparency, regulatory compliance documentation, and quality assurance protocols across perishable goods distribution networks. In 2026, GMR Aero Cargo & Logistics has introduced India's inaugural airside reefer truck at Rajiv Gandhi International Airport. This new truck maintains cold-chain consistency for temperature-sensitive goods. It keeps accurate temperatures ranging from +2°C to +25°C. The system prevents temperature exposure during ramp transfers. This represents a major progress for the logistics of perishables and pharmaceuticals in India.

Shift Toward Multi-Temperature Zone Compartmentalization

Transport operators are increasingly deploying refrigerated trucks featuring multiple independently controlled temperature zones within single vehicle bodies, enabling simultaneous transport of diverse product categories with varying thermal requirements. This technological advancement allows distributors to optimize route efficiency by consolidating mixed cargo loads, frozen foods, chilled dairy products, and temperature-sensitive pharmaceuticals, in one vehicle rather than deploying separate specialized trucks. Organized retail chains supplying store networks with comprehensive product ranges have embraced multi-zone refrigerated vehicles to streamline last-mile delivery operations. The compartmentalization trend is particularly pronounced in urban distribution scenarios where delivery density justifies investment in sophisticated refrigeration systems that maximize payload diversity while maintaining stringent temperature control standards. In 2025, the Minister of Environment, Forest and Climate Change (MoEFCC), stated that India is among the first nations globally to implement a cooling action plan. In his video message at the 31st World Ozone Day celebration in New Delhi, he mentioned that India succeeded in accomplishing a 67.5% reduction in the manufacturing and use of hydrofluorocarbons.

Adoption of Alternative Refrigeration Technologies for Sustainability

The market is witnessing growing interest in environmentally responsible cooling solutions as operators seek to reduce carbon footprints and operating costs associated with traditional diesel-powered refrigeration units. Transport companies are exploring cryogenic nitrogen-based systems, eutectic plate technology, and electric-powered refrigeration alternatives that minimize greenhouse gas emissions while maintaining thermal performance. Food processing companies committed to sustainability targets are piloting refrigerated trucks equipped with solar-assisted cooling systems for daytime operations in high-ambient-temperature regions. This transition toward greener refrigeration technologies aligns with evolving environmental regulations and corporate social responsibility commitments, positioning early adopters as innovation leaders in temperature-controlled logistics markets increasingly influenced by environmental considerations. In 2025, Celcius Logistics, a third-party cold supply chain solutions provider, and Switch Mobility, the electric vehicle division of Ashok Leyland, signed a memorandum of understanding (MoU) for the deployment of 350 electric reefer (eLCV) vehicles. Celcius has obtained and deployed 100 trucks and plans to launch the remaining 250 by the conclusion of FY26.

Market Outlook 2026-2034:

India's refrigerated trucking sector is poised for substantial growth as cold chain infrastructure gaps narrow and organized distribution networks expand across agricultural, food processing, pharmaceutical, and retail sectors. The convergence of rising consumer expectations for product freshness, regulatory mandates for temperature-controlled transportation, and institutional investments in cold logistics infrastructure will propel market expansion. The market generated a revenue of INR 8.51 Billion in 2025 and is projected to reach a revenue of INR 28.58 Billion by 2034, growing at a compound annual growth rate of 14.41% from 2026-2034. Witness the transformative impact of government-backed cold chain development schemes catalyzing private sector investments in modern refrigerated fleets equipped with advanced monitoring technologies.

India Refrigerated Trucks Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Capacity GVW |

11-12 Tons |

23% |

|

Sector |

Organized Sector |

65% |

|

Body Type |

Fully Built |

57% |

|

Application |

Dairy Products |

22% |

|

Region |

North India |

28% |

Vehicle Capacity GVW Insights:

- 02 – 4.5 Tons

- 7 – 7.5 Tons

- 11-12 Tons

- 18.5 Tons

- 28.5 Tons

- 35 Tons

11-12 tons dominate with a market share of 23% of the total India refrigerated trucks market in 2025.

The eleven to twelve-ton gross vehicle weight category has emerged as the preferred capacity specification for regional distribution networks serving urban and semi-urban markets across India. This weight class delivers an optimal balance between payload capacity and operational flexibility, accommodating substantial cargo volumes while maintaining maneuverability through congested metropolitan road networks and navigating infrastructure constraints in developing markets. Transportation companies appreciate how this segment meets regulatory weight limits without requiring specialized permits while offering sufficient refrigerated space for consolidated multi-stop delivery routes covering dairy distribution centers, food processing plant dispatches, and pharmaceutical warehouse operations.

The segment's dominance reflects its alignment with India's evolving cold chain architecture, where hub-and-spoke distribution models require medium-capacity vehicles for spoke-level operations connecting regional warehouses to retail outlets and institutional customers. Consider how dairy cooperatives deploy eleven-ton refrigerated trucks for daily milk collection routes aggregating produce from village-level societies while simultaneously distributing processed dairy products to urban retail networks. This capacity configuration supports efficient fleet utilization patterns across forward and reverse logistics applications, establishing the segment as the backbone of India's expanding temperature-controlled distribution infrastructure serving diverse perishable goods categories.

Sector Insights:

- Organized Sector

- Unorganized Sector

Organized sector leads with a share of 65% of the total India refrigerated trucks market in 2025.

The organized sector's commanding market position reflects the increasing professionalization of India's cold chain logistics industry as corporate entities, institutional food processors, pharmaceutical companies, and modern retail chains establish standardized temperature-controlled distribution networks. These organizations prioritize compliance with food safety regulations, pharmaceutical transportation guidelines, and quality management systems that mandate documented cold chain integrity throughout product journeys. Large-scale operators invest in purpose-built refrigerated fleets equipped with advanced monitoring technologies, GPS tracking systems, and automated temperature logging capabilities that satisfy regulatory requirements while providing operational visibility absent in traditional transport operations.

This sector concentration is accelerating as food safety legislation like the Food Safety and Standards Authority of India regulations impose stricter cold chain compliance obligations on commercial food businesses. Multinational corporations entering India's processed food and pharmaceutical markets partner exclusively with organized logistics providers capable of demonstrating validated cold chain credentials and maintaining comprehensive temperature documentation. Consider how leading e-commerce platforms developing fresh food delivery capabilities contract dedicated refrigerated transport capacity from organized fleet operators offering service-level agreements, insurance coverage, and technology integration capabilities. The organized sector's growth trajectory is further reinforced by institutional financing access, allowing operators to scale fleets systematically while maintaining stringent operational standards that distinguish professional cold chain services from informal transportation alternatives.

Body Type Insights:

- Fully Built

- Customizable

Fully built exhibits a clear dominance with a 57% share of the total India refrigerated trucks market in 2025.

Fully built refrigerated trucks represent turnkey cold chain solutions where vehicle manufacturers integrate refrigeration systems, insulated cargo bodies, and temperature control equipment into complete operational units during production processes. This configuration appeals to fleet operators seeking standardized specifications, manufacturer warranties covering both vehicle chassis and refrigeration components, and simplified procurement processes eliminating coordination challenges between multiple suppliers. Corporate logistics providers managing large fleets prioritize fully built options for their uniformity in performance characteristics, maintenance protocols, and operational training requirements across geographically dispersed operations. The segment benefits from established quality assurance frameworks where integrated manufacturing ensures component compatibility and system reliability.

The fully built segment's market leadership reflects the professionalization of India's cold chain industry as operators transition from improvised refrigerated conversions toward purpose-engineered temperature-controlled vehicles meeting international standards. Consider how pharmaceutical logistics companies serving regulatory-compliant distribution networks exclusively deploy fully built refrigerated trucks with validated thermal performance certifications and documented cooling capacity specifications. Dairy cooperatives expanding regional distribution infrastructure invest in fully built fleets offering predictable lifecycle costs and standardized service support through manufacturer networks. This preference for integrated solutions is reshaping India's refrigerated transport landscape as quality-conscious operators prioritize reliability and compliance over the cost advantages associated with customizable after-market refrigeration installations on standard truck chassis.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Meat and Fish

- Dairy Products

- Fruits & Vegetables

- Confectionaries

- Pharmaceutical

- Others

Dairy products lead with a share of 22% of the total India refrigerated trucks market in 2025.

Dairy products application commands the largest market share, reflecting India's status as the world's largest milk producer with an extensive cooperative network requiring sophisticated temperature-controlled logistics infrastructure. The sector's distribution demands are uniquely intensive, involving daily collection of raw milk from millions of small-scale producers through village-level collection centers, transportation to processing facilities, and subsequent delivery of processed dairy products to urban retail networks. This two-way logistics flow generates substantial refrigerated transport demand as cooperatives maintain product quality standards from farm gate to consumer point of purchase. Major dairy organizations operate extensive refrigerated fleets supporting chilled distribution networks spanning procurement zones and consumption markets across multiple states.

The dairy segment's prominence is reinforced by India's evolving consumption patterns favoring processed dairy products like flavored milk, yogurt, cheese, and value-added offerings requiring consistent cold chain maintenance throughout distribution cycles. Consider how leading dairy brands expanding national footprints invest heavily in refrigerated logistics capabilities to deliver products with extended shelf life guarantees to emerging markets. The segment's growth trajectory is supported by organized retail penetration increasing accessibility of chilled dairy products in temperature-controlled retail environments. Government initiatives promoting dairy sector modernization further stimulate cold chain investments as cooperatives upgrade infrastructure to comply with quality standards and reach premium market segments demanding assured product freshness throughout supply chains.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 28% share of the total India refrigerated trucks market in 2025.

North India's market leadership stems from the region's unique position as both a major agricultural production zone and the country's largest consumption center concentrated around the Delhi National Capital Region metropolis. The region encompasses Punjab and Haryana, India's breadbasket states with intensive dairy production, fruit cultivation, and vegetable farming requiring extensive cold chain infrastructure for transporting perishables to urban markets. Delhi NCR serves as the primary consumption hub with sophisticated retail infrastructure, international airport cargo operations, and distribution centers supplying northern markets. This convergence of production zones and consumption centers generates exceptional demand for refrigerated transport connecting agricultural hinterlands to metropolitan markets.

The region's cold chain intensity is amplified by its role as a pharmaceutical manufacturing cluster with companies operating temperature-controlled distribution networks serving national markets from northern bases. Consider how Uttar Pradesh's dairy cooperatives deploy refrigerated fleets supporting the state's massive milk production while simultaneously distributing processed dairy products throughout northern consumption markets. The region benefits from relatively developed highway infrastructure connecting production zones to metropolitan areas, facilitating efficient cold chain operations. North India's harsh seasonal temperature variations necessitate robust refrigeration capabilities to maintain product integrity during extreme summer conditions when ambient temperatures challenge cooling system performance, driving demand for advanced refrigerated trucking solutions.

Market Dynamics:

Growth Drivers:

Why is the India Refrigerated Trucks Market Growing?

Expansion of Organized Retail and Modern Trade Channels

India's retail landscape transformation through proliferation of supermarket chains, hypermarkets, and organized grocery formats is fundamentally reshaping cold chain logistics requirements as modern trade channels mandate temperature-controlled distribution for perishable goods categories. These retail formats maintain strict quality standards requiring suppliers to demonstrate documented cold chain integrity from manufacturing facilities through distribution centers to store-level delivery. Consider how leading retail chains establishing pan-India operations contract dedicated refrigerated transport capacity ensuring consistent product quality across their store networks. The shift from traditional wet markets toward organized retail environments creates sustained demand for professional cold chain services as consumers increasingly purchase perishables from temperature-controlled retail settings expecting assured freshness and extended shelf life guarantees unavailable through conventional distribution channels. IMARC Group predicts that the India retail market will reach USD 3,434.1 Billion by 2033.

Government Infrastructure Development and Policy Support

Institutional initiatives like the Pradhan Mantri Kisan Sampada Yojana and Infrastructure Roadmap for Cold Chain Development are catalyzing private sector investments in refrigerated transport through financial incentives, subsidized credit programs, and regulatory frameworks promoting cold chain modernization. Government recognition of post-harvest losses in agricultural value chains has translated into policy measures encouraging cold storage facility development, reefer vehicle procurement, and integrated cold chain solutions connecting production zones to consumption markets. Agricultural export promotion schemes emphasize cold chain capabilities as essential infrastructure for accessing international markets demanding stringent temperature control throughout supply chains. In 2025, the Agricultural and Processed Food Products Export Development Authority (APEDA) introduced its latest initiative BHARATI, Bharat’s Hub for Agritech, Resilience, Advancement, and Incubation for Export Enablement, during the “Food & Beverages Sector Stakeholders Meeting” led by Union Minister of Commerce and Industry, together with UAE Minister of Foreign Trade, and Union Minister of Food Processing Industries. The initiative seeks to support 100 agri-food and agri-tech startups, boosting innovation, generating export prospects, and aligning with APEDA’s goal of reaching Rs. 4,40,150 crore (US$ 50 billion) in Scheduled Products agri-food exports by 2030.

Growing Pharmaceutical and Healthcare Logistics Requirements

India's pharmaceutical sector expansion, coupled with stringent temperature-controlled distribution mandates for vaccines, biologics, and sensitive medications, is driving specialized refrigerated trucking demand across healthcare logistics networks. The COVID-19 vaccination campaign demonstrated cold chain capabilities at unprecedented scale, establishing infrastructure and operational protocols that continue supporting routine immunization programs and pharmaceutical distribution. Regulatory authorities are implementing stricter guidelines for temperature-sensitive drug transportation, requiring validated cold chain processes with continuous monitoring and documentation. Consider how pharmaceutical companies developing biosimilars and specialty medications invest in dedicated temperature-controlled logistics ensuring product efficacy throughout distribution cycles. The healthcare sector's quality-conscious approach establishes premium service standards influencing cold chain practices across broader perishable goods markets as operators adopt pharmaceutical-grade protocols for food and dairy applications. IMARC Group predicts that the India cold chain pharmaceutical logistics market is expected to attain USD 0.80 Billion by 2033.

Market Restraints:

What Challenges the India Refrigerated Trucks Market is Facing?

High Capital Investment and Operational Costs

Refrigerated trucks command substantial premium pricing compared to standard cargo vehicles due to specialized refrigeration equipment, insulated cargo bodies, and advanced monitoring systems required for temperature-controlled transportation. The ongoing operational expenses including fuel consumption for refrigeration units, maintenance of cooling systems, and replacement of specialized components create financial burdens particularly challenging for small and medium logistics operators. These elevated costs limit market accessibility for regional transport providers serving secondary markets where freight rates may not justify premium cold chain investments.

Infrastructure Limitations and Last-Mile Connectivity Challenges

India's road infrastructure quality varies significantly across regions, with rural and semi-urban areas presenting connectivity challenges that complicate efficient refrigerated transport operations. Inadequate highway networks, poorly maintained rural roads, and limited truck parking facilities with power backup capabilities for overnight refrigeration create operational inefficiencies. The absence of comprehensive temperature-controlled warehousing networks in tier-two and tier-three cities forces refrigerated trucks into extended transit operations without proper staging facilities, increasing product loss risks and operational costs throughout distribution chains.

Shortage of Skilled Workforce and Technical Expertise

The specialized nature of refrigerated transport operations demands technically proficient drivers and maintenance personnel capable of managing sophisticated refrigeration systems, temperature monitoring equipment, and emergency response protocols for cooling system failures. India faces significant skill gaps in cold chain logistics with limited training infrastructure producing qualified professionals. This workforce shortage results in suboptimal equipment utilization, increased breakdown incidents, and inconsistent temperature maintenance practices that undermine cold chain integrity across distribution networks serving diverse perishable goods categories.

Competitive Landscape:

India's refrigerated trucks market demonstrates moderate competitive intensity with established commercial vehicle manufacturers competing alongside specialized refrigeration equipment suppliers and integrated cold chain service providers. The competitive landscape features multinational corporations leveraging global cold chain expertise alongside domestic players offering localized solutions adapted to Indian operating conditions. Market participants differentiate through technology integration capabilities, service network coverage, financing solutions, and industry-specific expertise spanning dairy, pharmaceutical, and food distribution sectors. The sector is witnessing consolidation trends as larger logistics operators acquire regional cold chain specialists to expand geographic footprints and service capabilities. Competition increasingly centers on operational reliability, regulatory compliance credentials, and digital transformation capabilities as customers prioritize service quality over traditional cost-based procurement decisions in temperature-sensitive logistics applications. Some of the key market players include:

- Carrier Airconditioning & Refrigeration Limited (Carrier Global Corporation)

- Ice Make Refrigeration Limited

- JCBL Limited

- KOLD SEAL

- Motherson Sumi System Limited

- Subros Limited

- Surin International Private Limited

- Tata Motors Limited

- Trane Technologies India Pvt Ltd

- TransACNR

India Refrigerated Trucks Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicles Capacity GVW Covered | 02 – 4.5 Tons, 7 – 7.5 Tons, 11-12 Tons, 18.5 Tons, 28.5 Tons, 35 Tons |

| Sectors Covered | Organized Sector, Unorganized Sector |

| Body Types Covered | Fully Built, Customizable |

| Applications Covered | Meat and Fish, Dairy Products, Fruits & Vegetables, Confectionaries, Pharmaceutical, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Carrier Airconditioning & Refrigeration Limited (Carrier Global Corporation), Ice Make Refrigeration Limited, JCBL Limited, KOLD SEAL, Motherson Sumi System Ltd, Subros Limited, Surin International Private Limited, Tata Motors Limited, Trane Technologies India Pvt Ltd and TransACNR |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India refrigerated trucks market size was valued at INR 8.51 Billion in 2025.

The India refrigerated trucks market is expected to grow at a compound annual growth rate of 14.41% from 2026-2034 to reach INR 28.58 Billion by 2034.

11-12 tons dominated the India refrigerated trucks market with a 23% share in 2025, driven by its optimal balance between payload capacity and operational flexibility for regional distribution networks serving urban and semi-urban markets while maintaining regulatory compliance and maneuverability through diverse road infrastructure conditions.

Key factors driving the India refrigerated trucks market include expansion of organized retail and modern trade channels demanding temperature-controlled distribution, government infrastructure development initiatives supporting cold chain modernization, and growing pharmaceutical logistics requirements with stringent temperature control mandates for vaccine and medication transportation.

Major challenges include high capital investment and operational costs limiting accessibility for regional transport providers, infrastructure limitations and last-mile connectivity issues in rural and semi-urban areas, and shortage of skilled workforce with technical expertise to manage sophisticated refrigeration systems and temperature monitoring equipment across distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)