India Refractories Market Size, Share, Trends and Forecast by Form, Alkalinity, Manufacturing Process, Composition, Refractory Mineral, Application, and Region, 2025-2033

India Refractories Market Overview:

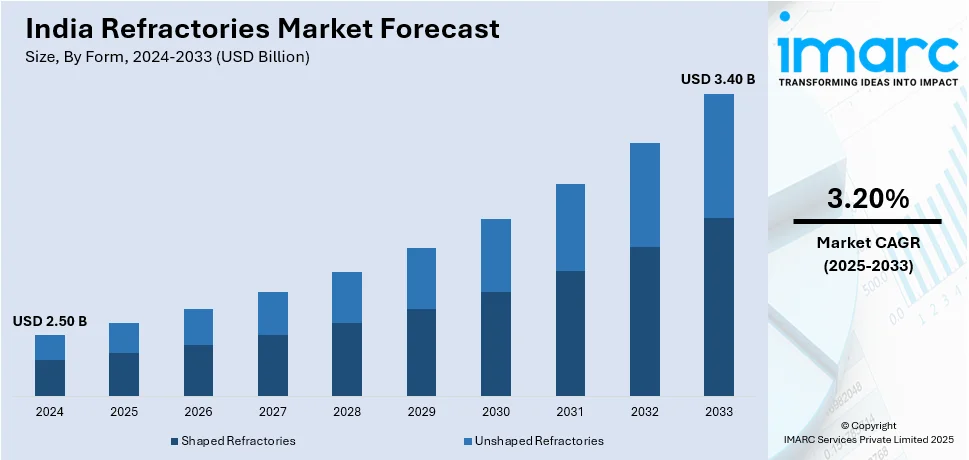

The India refractories market size reached USD 2.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.40 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is driven by the expanding steel and cement industries, fueled by infrastructure development and government initiatives such as "Make in India." Increasing demand for high-performance, energy-efficient, and eco-friendly refractory materials, along with the growing adoption of cost-effective monolithic refractories, further augments the India refractories market share, encouraging innovation and competition among manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.50 Billion |

| Market Forecast in 2033 | USD 3.40 Billion |

| Market Growth Rate 2025-2033 | 3.20% |

India Refractories Market Trends:

Increasing Demand for High-Performance Refractories in Steel Industry

The rise in demand for high-performance refractories, driven by the expanding steel industry is significantly supporting the India refractories market growth. India is positioning itself as one of the largest producers of steel in the world, indicative of its growing demand for high-end refractory materials that can resist extreme temperatures and the difficult vast operational conditions that exist within the plant. Some are used for lining furnaces, converters, and ladles and during any steel manufacturing process, thus promoting energy efficiency and also adding years to the equipment's life. Rising steel production supported by the government's focus on infrastructure development and initiatives such as "Make in India" is expected to generate a positive impact on the refractories market subsequently. According to a research report published from The IMARC Group, the steel market in India reached a volume of 144.43 Million Tons in 2024. In the given projection, the market is expected to reach 256.73 Million Tons by the year 2033, with a CAGR of 6.20% from 2025 to 2033. Additionally, the shift toward eco-friendly and energy-efficient refractory solutions is gaining traction, as manufacturers aim to reduce carbon emissions and operational costs. This trend is encouraging innovations in refractory materials, such as the development of low-cement castables and alumina-based products, which offer superior durability and thermal resistance.

To get more information on this market, Request Sample

Growing Adoption of Monolithic Refractories for Cost Efficiency

The India refractories market is experiencing a growing preference for monolithic refractories over traditional brick-shaped refractories, primarily due to their cost efficiency and ease of installation. Therefore, this is creating a positive India refractories market outlook. In addition to steel, monolithic refractories, which include castables, plastics, and ramming mixes, continue to grow into sectors including cement, glass, and non-ferrous metals. The materials used offer applications flexibility, reduce installation downtime, and are able to perform in complex shapes and structures. This trend is largely driven by the cement industry, which requires ceramic solutions for kilns and preheaters that can withstand higher thermal stress. On 12th November 2024, RHI Magnesita launched 4PRO, an innovative contract model for refractory solutions designed to improve sustainability and technological advancements in high-temperature sectors such as cement, steel, and glass. The company, which employs more than 20,000 individuals and operates 67 production facilities along with 12 recycling centers, is committed to promoting efficiency and environmental stewardship. As the cement and refractory industries in India continue to expand, 4PRO’s emphasis on performance, collaboration, workforce, and environmental considerations is well-suited to meet the changing demands of the sector. One of the major factors responsible for the widespread utilization of monolithic refractories is the ability to repair and maintain them without requiring their full replacement. With Indian industries focusing on maximized production costs and minimized operational downtimes, the demand for monolithic refractories is expected to rise and propel innovation as well as competition among refractory manufacturers in the region.

India Refractories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on form, alkalinity, manufacturing process, composition, refractory mineral, and application.

Form Insights:

- Shaped Refractories

- Unshaped Refractories

The report has provided a detailed breakup and analysis of the market based on the form. This includes shaped refractories and unshaped refractories.

Alkalinity Insights:

- Acidic and Neutral

- Basic

A detailed breakup and analysis of the market based on the alkalinity have also been provided in the report. This includes acidic and neutral and basic.

Manufacturing Process Insights:

- Dry Press Process

- Fused Cast

- Hand Molded

- Formed

- Unformed

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes dry press process, fused cast, hand molded, formed, and unformed.

Composition Insights:

- Clay-Based

- Nonclay-Based

A detailed breakup and analysis of the market based on the composition have also been provided in the report. This includes clay-based and nonclay-based.

Refractory Mineral Insights:

- Graphite

- Magnesite

- Chromite

- Silica

- High Alumina

- Zirconia

- Others

The report has provided a detailed breakup and analysis of the market based on the refractory mineral. This includes graphite, magnesite, chromite, silica, high alumina, zirconia, and others.

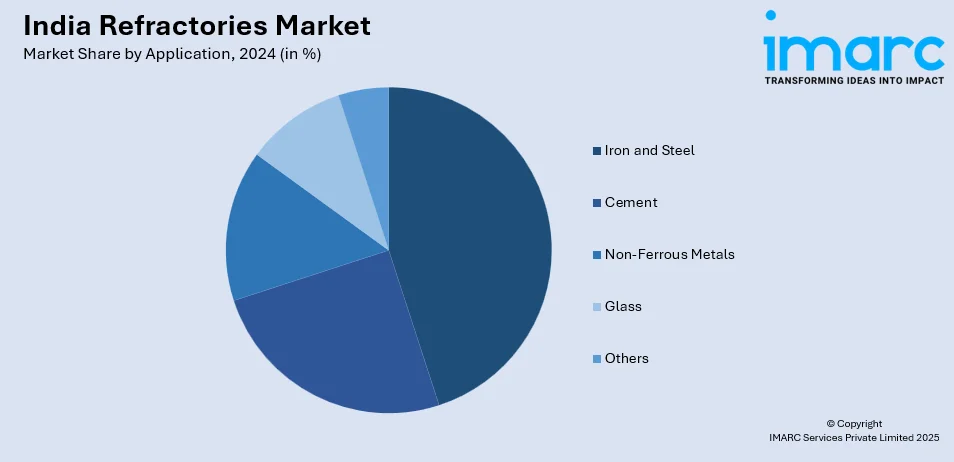

Application Insights:

- Iron and Steel

- Cement

- Non-Ferrous Metals

- Glass

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes Iron and steel, cement, non-ferrous metals, glass, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Refractories Market News:

- November 22, 2024: Vesuvius commissioned new alumina-silica and monolithic refractory manufacturing plants in Visakhapatnam, which will add 250,000 tonnes of annual production capacity to support India’s growing iron and steel industries. Aligned with the Make in India initiative, these facilities encourage local manufacturing, thereby reducing costs. With a focus on efficiency, sustainability, and state-of-the-art technology, Vesuvius further affirms its commitment to the refractory industry in India.

- October 31, 2024: Calderys announced investing in the largest greenfield refractory plant in India, to be located in Odisha. The 40-acre facility is expected to begin production in late 2025. The plant's five production lines include three for acidic and basic bricks and two for monolithic and steel casting fluxes. The state-of-the-art for manufacturing in India emphasizes sustainability. This is expected to generate 350 jobs by 2026 and is another testament to Calderys' commitment to India's growing industrial and economic landscape.

India Refractories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Shaped Refractories, Unshaped Refractories |

| Alkalinities Covered | Acidic, Neutral and Basic |

| Manufacturing Processes Covered | Dry Press Process, Fused Cast, Hand Molded, Formed, Unformed |

| Compositions Covered | Clay-Based, Nonclay-Based |

| Refractory Minerals Covered | Graphite, Magnesite, Chromite, Silica, High Alumina, Zirconia, Others |

| Applications Covered | Steel, Cement, Non-Ferrous Metals, Glass, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India refractories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India refractories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India refractories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India refractories market was valued at USD 2.50 Billion in 2024.

The India Refractories market is projected to exhibit a CAGR of 3.20% during 2025-2033, reaching a value of USD 3.40 Billion by 2033.

The market is driven by the expanding steel and cement industries, fueled by infrastructure development and government initiatives like "Make in India." Increasing demand for high-performance, energy-efficient, and eco-friendly refractory materials, along with the growing adoption of cost-effective monolithic refractories, further augments the India refractories market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)