India Recycled Plastics Market Size, Share, Trends and Forecast by Plastic Type, Raw Material, Application, and Region, 2026-2034

India Recycled Plastics Market Summary:

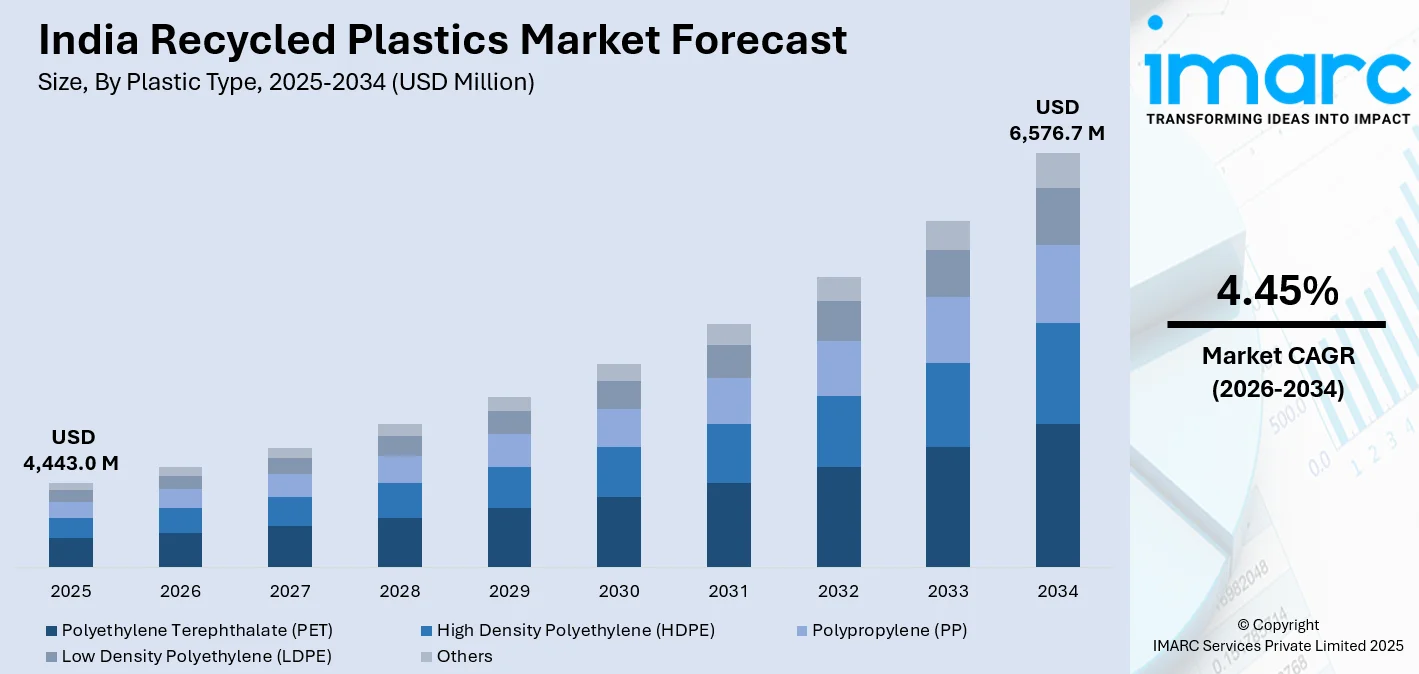

The India recycled plastics market size was valued at USD 4,443.0 Million in 2025 and is projected to reach USD 6,576.7 Million by 2034, growing at a compound annual growth rate of 4.45% from 2026-2034.

The market is driven by increasing environmental consciousness and stringent regulatory frameworks mandating recycled content usage across packaging applications. Rising corporate sustainability commitments, expanding circular economy initiatives, and growing consumer preference for eco-friendly products are further accelerating demand. Government policies promoting extended producer responsibility are compelling industries to adopt recycled materials. These factors collectively contribute to the expanding India recycled plastics market share.

Key Takeaways and Insights:

- By Plastic Type: Polyethylene terephthalate (PET) dominates the market with a share of 34% in 2025, driven by its high usage in beverage packaging and strong recovery levels enabled by well-established informal collection networks.

- By Raw Material: Plastic bottles lead the market with a share of 40% in 2025, owing to efficient collection infrastructure and strong demand from beverage and personal care industries.

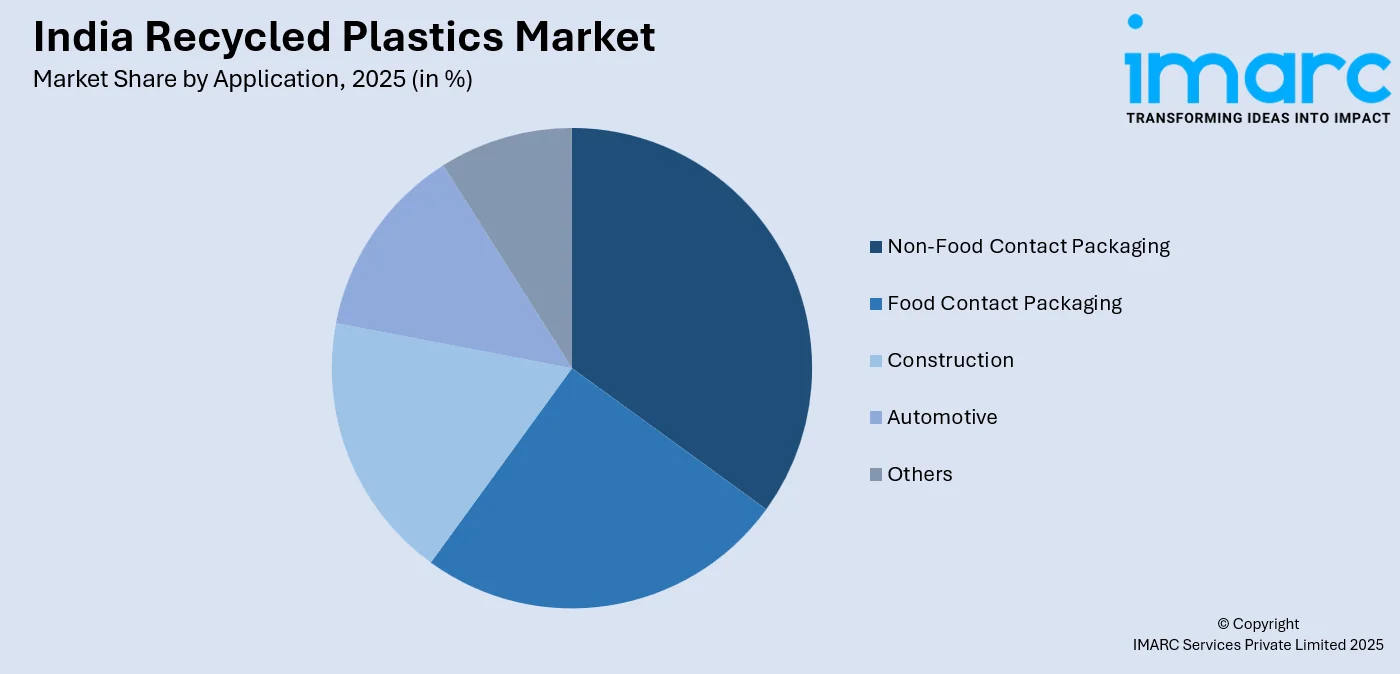

- By Application: Non-food contact packaging represents the largest segment with a market share of 33% in 2025, driven by acceptance from governing bodies for recycled materials used in secondary packaging and growing e-commerce demands.

- By Region: North India leads the market with a share of 27% in 2025, owing to concentration of manufacturing facilities in Delhi-NCR and substantial plastic waste generation from urban centers.

- Key Players: The India recycled plastics market exhibits a fragmented competitive structure, with numerous domestic recyclers competing alongside international sustainability-focused corporations. Market participants are investing in advanced recycling technologies and capacity expansion to meet growing demand.

To get more information on this market Request Sample

The India recycled plastics market is experiencing robust expansion driven by comprehensive regulatory frameworks and evolving sustainability mandates. Extended Producer Responsibility guidelines now require producers, importers, and brand owners to incorporate mandatory recycled content in plastic packaging, with rigid packaging requiring minimum recycled content in the coming years. As per sources, in 2025 Tetra Pak became the first company in India’s food and beverage packaging industry to launch packaging with certified recycled polymers ahead of the regulatory deadline, incorporating 5% recycled content in its cartons. Moreover, corporate sustainability commitments are accelerating adoption, with major consumer goods companies pledging recyclable packaging targets. The circular economy model is gaining traction through reverse logistics systems ensuring efficient collection and transportation of plastic waste to processing facilities. Technological advancements in sorting and processing, including artificial intelligence-integrated systems, are enhancing recycling efficiency while improving output quality across diverse applications including packaging, textiles, automotive, and construction sectors. These developments position India as an emerging leader in sustainable plastics management globally.

India Recycled Plastics Market Trends:

Advancement in Chemical Recycling Technologies

The recycled plastics industry is witnessing significant technological transformation through adoption of advanced chemical recycling processes including glycolysis and methanolysis. These innovative technologies enable production of food-grade recycled PET with superior purity compared to traditional mechanical methods. As per sources, in 2024 revalyu Resources commissioned its second glycolysis-based chemical PET recycling plant at Nashik, capable of processing over 20 Million post-consumer PET bottles daily into high-quality PET chips and polymers that help brand owners meet sustainability targets. Furthermore, chemical recycling facilities are processing substantial volumes of post-consumer bottles daily, converting them into high-quality chips and polymers suitable for premium applications.

Digital Traceability and EPR Compliance Systems

The market is experiencing rapid digitalization through mandatory QR code and barcode implementation for plastic packaging traceability. All plastic packaging must carry digital identifiers enabling precise product tracking throughout the supply chain. In 2025, under India’s Plastic Waste Management (Amendment) Rules, all producers, importers, and brand owners were mandated to include QR codes or barcodes on packaging for traceable EPR compliance, with data integrated into the CPCB portal for real-time monitoring. Moreover, the Central Pollution Control Board portal facilitates registration and compliance monitoring for producers, importers, and brand owners. This digital infrastructure is transforming waste management by enabling verified recycling claims, discouraging greenwashing, and creating transparent audit trails.

Integration of Recycled Content in Mainstream Manufacturing

Major consumer goods manufacturers and packaging companies are systematically incorporating recycled plastics into their production processes. Companies in the FMCG sector are using recyclable PET materials in packaging soft drinks and personal care products, and companies in the pharmaceutical sector are using bottles made of recyclable materials. In December 2025, Hindustan Unilever, in collaboration with Atal Innovation Mission and NITI Aayog, launched Project Circular Bharat to support 50 start-ups innovating in plastic recycling, reuse, and next-generation sustainable packaging, advancing India’s circular plastics economy. Furthermore, the automotive sector is incorporating recycled plastics in interior components and under-hood applications, leveraging their lightweight properties.

Market Outlook 2026-2034:

The India recycled plastics market is positioned for sustained revenue growth, supported by strengthening regulatory frameworks and expanding industrial adoption. Extended Producer Responsibility mandates requiring progressive increases in recycled content utilization will drive consistent demand across packaging, automotive, and construction applications. Investment in advanced recycling infrastructure, including chemical recycling facilities and automated sorting systems, will enhance processing capacity and output quality. Corporate sustainability commitments and consumer preference for environmentally responsible products will further accelerate market expansion and circular economy initiatives. The market generated a revenue of USD 4,443.0 Million in 2025 and is projected to reach a revenue of USD 6,576.7 Million by 2034, growing at a compound annual growth rate of 4.45% from 2026-2034.

India Recycled Plastics Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Plastic Type | Polyethylene Terephthalate (PET) | 34% |

| Raw Material | Plastic Bottles | 40% |

| Application | Non-Food Contact Packaging | 33% |

| Region | North India | 27% |

Plastic Type Insights:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

Polyethylene terephthalate (PET) dominates with a market share of 34% of the total India recycled plastics market in 2025.

Polyethylene terephthalate (PET) leads India recycled plastics market due to its exceptional recyclability and well-established collection infrastructure. The beverage industry's extensive use of PET bottles creates a consistent and high-volume waste stream that feeds recycling operations. India maintains one of the highest PET collection rates globally, supported by efficient informal collection networks and formalized reverse logistics systems. As per sources, in September 2025, Great Galleon Ventures Limited relaunched its V21 beverage in India’s first 100% food‑grade recycled PET bottles, setting a precedent for high‑quality rPET adoption in domestic packaging.

This benefits from regulatory mandates requiring increasing recycled content in beverage packaging, driving sustained demand for high-quality recycled resin. Major beverage and consumer goods brands are actively incorporating recycled PET into their packaging portfolios to meet corporate sustainability targets and regulatory compliance requirements. Chemical recycling technologies are further expanding the potential for recycling mixed and contaminated PET streams that mechanical processes cannot handle, enhancing overall recovery rates and material availability for diverse manufacturing applications.

Raw Material Insights:

- Plastic Bottles

- Plastic Films

- Rigid Plastic and Foam

- Fibres

- Others

Plastic bottles lead with a share of 40% of the total India recycled plastics market in 2025.

Plastic bottles represent the leading raw material source for recycled plastics in India, driven by their uniform composition and ease of collection. The beverage sector's high consumption volume ensures consistent feedstock availability for recycling facilities across the country. Well-organized collection networks spanning urban and semi-urban areas efficiently capture post-consumer bottles, achieving collection rates significantly higher than global averages. In April 2025, Coca‑Cola India installed reverse vending machines in Puri to incentivize plastic bottle returns via digital interfaces and reward points redeemable for product discounts, strengthening local collection and traceability.

Recyclers prefer plastic bottle feedstock due to its predictable composition and higher value compared to heterogeneous waste streams. Major brands operating deposit return schemes and in-store collection programs are enhancing bottle recovery rates while ensuring traceability of materials throughout the supply chain. The integration of reverse vending machines at retail locations is expanding collection infrastructure, providing consumer incentives and channeling clean bottle waste directly to recycling facilities for efficient processing and conversion into high-quality recycled resins.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

Non-food contact packaging exhibits a clear dominance with a 33% share of the total India recycled plastics market in 2025.

Non-food contact packaging applications dominate recycled plastics consumption due to fewer regulatory barriers and broader acceptance of recycled content. Secondary packaging, protective wraps, shrink films, and industrial containers readily incorporate recycled materials without requiring food-safety certifications. The explosive growth of e-commerce is driving substantial demand for recycled plastic packaging solutions including protective mailers, cushioning materials, and shipping containers. In September 2024, Ganesha Ecopet expanded its PET recycling capacity from 14,000 tons to 42,000 Tons annually with new Starlinger recycling lines in Warangal, enhancing supply of food-grade rPET for packaging applications across India.

Brand owners across consumer goods, pharmaceuticals, and personal care sectors are transitioning secondary packaging to recycled materials to demonstrate environmental responsibility and meet sustainability commitments. Extended Producer Responsibility requirements are accelerating this transition by mandating progressive increases in recycled content utilization across packaging categories. The automotive and construction sectors are emerging as significant consumers, utilizing recycled plastics in interior components, under-body panels, pipes, and insulation materials, further diversifying demand beyond traditional packaging applications.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 27% of the total India recycled plastics market in 2025.

North India has established clear leadership in the recycled plastics landscape, driven by substantial plastic waste generation from densely populated urban centers including Delhi-NCR and surrounding industrial corridors. The region hosts numerous recycling facilities processing waste from both residential and commercial sources. Moreover, proximity to major manufacturing clusters consuming recycled materials enhances logistical efficiency and reduces transportation costs significantly. Strong government enforcement of waste management regulations and active participation in Extended Producer Responsibility programs support formalized recycling operations across the region.

The concentration of packaging industries in North India creates robust local demand for recycled resins, minimizing supply chain distances between recyclers and end-users. Investment in modern recycling infrastructure including automated sorting lines and washing systems is enhancing processing capacity and output quality consistently. The region benefits from established informal collection networks that efficiently channel post-consumer plastics to formal recycling channels, ensuring consistent feedstock availability throughout the year and supporting sustained growth in recycling operations.

Market Dynamics:

Growth Drivers:

Why is the India Recycled Plastics Market Growing?

Stringent Extended Producer Responsibility Mandates and Regulatory Frameworks

The India recycled plastics market is experiencing significant growth propelled by comprehensive Extended Producer Responsibility regulations requiring producers, importers, and brand owners to take responsibility for plastic packaging throughout its lifecycle. Mandatory recycled content requirements for rigid plastic packaging are progressively increasing, compelling manufacturers to source recycled resins consistently. As per sources, Go Rewise partnered with Coca‑Cola India to recycle 25 percent of India’s PET bottle waste and supply rPET for 100 percent recycled PET bottles, supporting compliance with EPR mandates and strengthening the circular plastics supply chain. Furthermore, digital traceability requirements are enhancing transparency and accountability across the value chain, creating guaranteed demand for recycled plastics while ensuring verifiable recycling claims.

Growing Corporate Sustainability Commitments and Brand Owner Initiatives

Major consumer goods companies, beverage manufacturers, and packaging providers are driving recycled plastics demand through ambitious sustainability pledges. Brand owners are committing to recyclable packaging targets and increasing recycled content incorporation across product portfolios. According to reports, Tata Consumer Products joined the India Plastics Pact, committing to 100% reusable or recyclable packaging, 50% effectively recycled plastic, and 25% average recycled content by 2030, reinforcing circular economy practices across its Tata Salt and Tata Tea brands. Furthermore, multinational corporations operating in India are aligning local operations with global sustainability standards, creating consistent demand for quality recycled materials. Fast-moving consumer goods companies are launching products in recycled packaging to appeal to environmentally conscious consumers.

Expansion of Circular Economy Infrastructure and Technology Investments

Substantial investments in recycling infrastructure are enhancing India's capacity to process plastic waste into high-quality recycled materials. Advanced chemical recycling facilities capable of processing mixed and contaminated plastics are expanding, producing food-grade resins matching virgin quality specifications. Mechanical recycling operations are upgrading with automated sorting systems, washing lines, and extrusion equipment to improve efficiency and output consistency. In February 2025, Re Sustainability and Aarti Circularity announced a ₹100 Crore joint venture to establish large‑scale Plastic Materials Recycling Facilities across India, aimed at segregating, extracting, and recycling diverse plastic waste into advanced circular materials. International recycling companies are establishing operations in India, bringing advanced technologies and operational expertise.

Market Restraints:

What Challenges the India Recycled Plastics Market is Facing?

Inadequate Waste Segregation Infrastructure and Contamination Issues

The recycled plastics market faces constraints from insufficient waste segregation at source, leading to contaminated feedstock that reduces recycling efficiency and output quality. Mixed plastic waste streams require additional sorting and cleaning processes that increase operational costs. Municipal waste collection systems often lack dedicated plastic segregation mechanisms, resulting in recyclable materials being diverted to landfills or contaminated beyond economic recovery.

Price Volatility and Competition from Virgin Plastics

Recycled plastics face persistent competition from virgin resins, particularly during periods of low crude oil prices that reduce virgin plastic costs. Price parity between recycled and virgin materials remains inconsistent, creating challenges for recyclers in maintaining profitability. Fluctuating feedstock availability and quality variations contribute to recycled material price volatility, complicating long-term supply agreements with manufacturers.

Technical Limitations in Processing Multilayer and Flexible Plastics

Flexible and multilayer plastic packaging presents significant recycling challenges due to complex material compositions that are difficult to separate and process. These packaging formats constitute a substantial portion of plastic consumption but have limited recycling pathways. Design-for-recyclability guidelines are still evolving, and many existing products in circulation remain incompatible with current mechanical recycling technologies.

Competitive Landscape:

The India recycled plastics market exhibits a fragmented competitive structure characterized by numerous domestic recyclers operating alongside international sustainability-focused corporations. Market participants range from small-scale mechanical recyclers serving local markets to large integrated operations supplying national and export markets. Competition intensifies around feedstock procurement, processing technology capabilities, and quality consistency. Strategic partnerships between recyclers and brand owners are becoming increasingly common, ensuring feedstock supply and offtake commitments. Investment in advanced recycling technologies serves as a key differentiator, with leading players deploying chemical recycling and automated sorting systems to produce premium-grade materials.

Recent Developments:

- In January 2025, PolyCycl, a Chandigarh-based startup, launched its patented Generation VI chemical recycling technology, converting hard-to-recycle plastics into food-grade polymers. The innovation supports India’s Extended Producer Responsibility targets, advances circular plastics practices, and provides sustainable solutions for FMCG, pharmaceutical, and packaging industries, addressing growing demand for high-quality recycled materials.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plastic Types Covered | Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

| Raw Materials Covered | Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibres, Others |

| Applications Covered | Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India recycled plastics market size was valued at USD 4,443.0 Million in 2025.

The India recycled plastics market is expected to grow at a compound annual growth rate of 4.45% from 2026-2034 to reach USD 6,576.7 Million by 2034.

Polyethylene terephthalate (PET) held the largest market share, driven by its widespread use in beverage packaging, well-established collection infrastructure, exceptional recyclability enabling bottle-to-bottle applications, and strong demand from consumer goods and personal care manufacturers.

Key factors driving the India recycled plastics market include stringent extended producer responsibility mandates, growing corporate sustainability commitments, expanding recycling infrastructure, increasing consumer preference for eco-friendly products, and government initiatives promoting circular economy practices.

Major challenges include inadequate waste segregation infrastructure, feedstock contamination issues, price competition from virgin plastics, technical limitations in recycling flexible and multilayer packaging, inconsistent quality standards, and fragmented collection systems across different regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)