India Rechargeable Battery Market Size, Share, Trends and Forecast by Battery Type, Capacity, Application, and Region, 2025-2033

Market Overview:

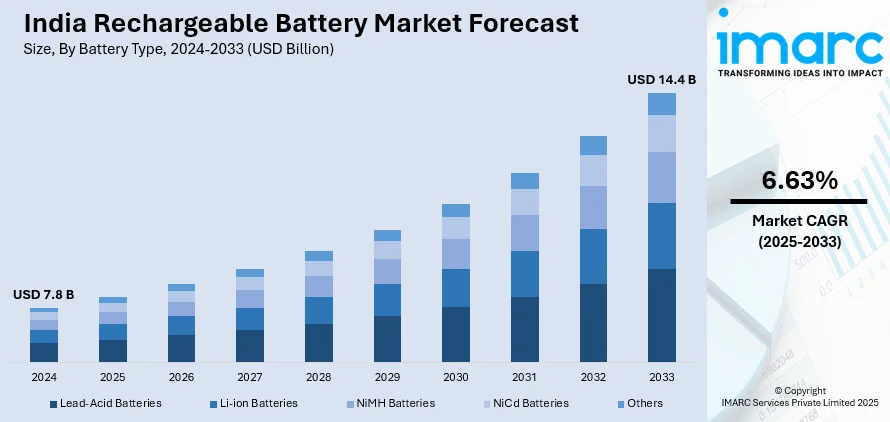

The India rechargeable battery market size reached USD 7.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6.63% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.8 Billion |

|

Market Forecast in 2033

|

USD 14.4 Billion |

| Market Growth Rate (2025-2033) | 6.63% |

Also known as secondary cells and accumulators, rechargeable batteries are electro-chemical devices that convert chemical energy into electrical energy. These batteries are extensively utilized in laptops, MP3 players, mobile phones and cordless power tools. At present, a significant rise in the demand for electronic devices, such as smartphones, laptops, digital cameras and tablets, is positively influencing the demand for rechargeable batteries in India.

To get more information of this market, Request Sample

The increasing utilization of electric vehicles (EVs) on account of the rising environmental concerns and inflating prices of fossil fuels represents one of the key factors strengthening the market growth in India. Apart from this, there is a rise in the demand for rechargeable batteries in the country as they are energy-efficient, produce less waste and can be charged with a simple battery charger. Furthermore, the leading players are focusing on the development of a new rechargeable battery technology, known as the flow battery, which can increase the power output without taking up additional space.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India rechargeable battery market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on battery type, capacity and application.

Breakup by Battery Type:

- Lead-Acid Batteries

- Li-ion Batteries

- NiMH Batteries

- NiCd Batteries

- Others

Breakup by Capacity:

- 150-1000 mAh

- 1300-2700 mAh

- 3000-4000 mAh

- 4000-6000 mAh

- 6000-10000 mAh

- More Than 10000 mAh

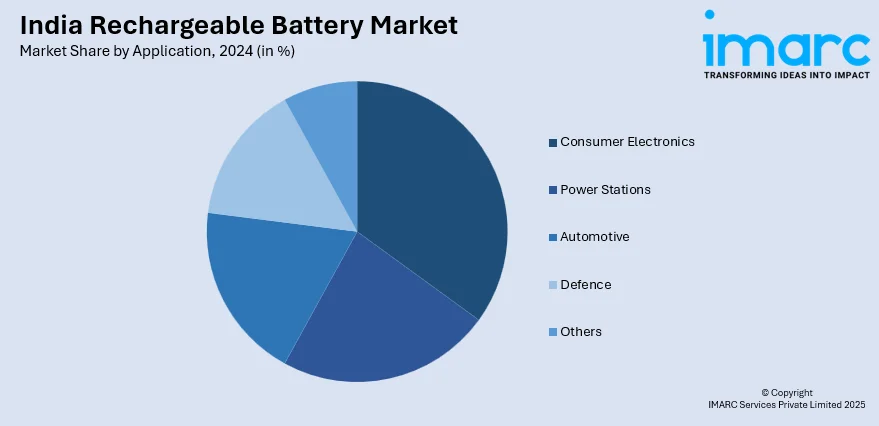

Breakup by Application:

- Consumer Electronics

- Power Stations

- Automotive

- Defence

- Others

Breakup by Region:

- North India

- West and Central India

- East India

- South India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Battery Type, Capacity, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India rechargeable battery market was valued at USD 7.8 Billion in 2024.

We expect the India rechargeable battery market to exhibit a CAGR of 6.63% during 2025-2033.

The increasing utilization of Electric Vehicles (EVs), along with the rising demand for rechargeable batteries, as they are energy-efficient and produce less waste, is primarily driving the India rechargeable battery market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for rechargeable batteries.

Based on the battery type, the India rechargeable battery market can be categorized into lead-acid batteries, Li-ion batteries, NiMH batteries, NiCd batteries, and others. Currently, Li-ion batteries account for the majority of the total market share.

Based on the capacity, the India rechargeable battery market has been segregated into 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, more than 10000 mAh. Among these, 6000 - 10000 mAh currently exhibits a clear dominance in the market.

Based on the application, the India rechargeable battery market can be bifurcated into consumer electronics, power stations, automotive, defence, and others. Currently, automotive holds the largest market share.

On a regional level, the market has been classified into North India, West and Central India, East India, and South India, where West and Central India currently dominates the India rechargeable battery market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)