India Ready to Drink Coffee Market Size, Share, Trends and Forecast by Packaging, Distribution Channel, and Region, 2025-2033

India Ready to Drink Coffee Market Overview:

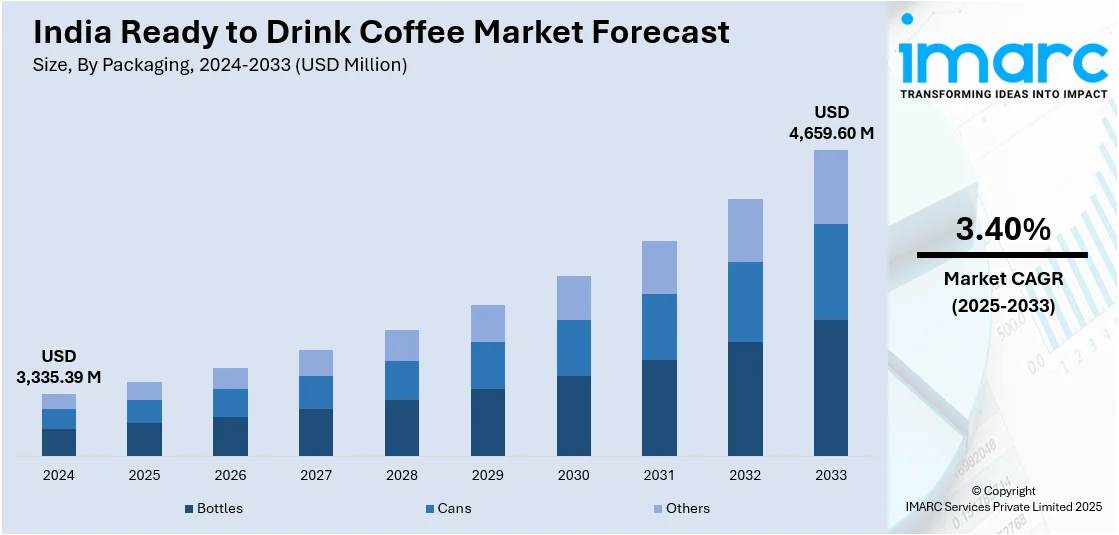

The India ready to drink coffee market size reached USD 3,335.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,659.60 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The India ready to drink coffee market share is expanding, driven by innovations in flavor, encouraging trial purchases, along with the expansion of e-commerce sites, enabling people to browse a diverse range of product selections, evaluate different brands, and check reviews.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,335.39 Million |

| Market Forecast in 2033 | USD 4,659.60 Million |

| Market Growth Rate (2025-2033) | 3.40% |

India Ready to Drink Coffee Market Trends:

Innovations in flavor

Innovations in flavor are impelling the India ready to drink coffee market growth. New savors attract a wider range of consumers looking for variety and unique taste experiences. Brands are constantly experimenting with new flavors, such as salted caramel, mocha, vanilla, and seasonal options like pumpkin spice, to keep customers engaged. In October 2024, Tata Consumer Products (TCP), the company that consolidated the key food and beverage (F&B) interests of the Tata Group, unveiled the introduction of Tata Coffee Grand Cold Coffee in India. It aimed to provide people a luxurious and creamy cold coffee experience in three globally inspired varieties- Swiss Caramel, French Vanilla, and Belgian Chocolate. The firm was well cherished for its ready to drink beverage options. Functional ingredients like adaptogens, protein, and probiotics are also gaining popularity, appealing to health-conscious buyers. Dairy-free and plant-based flavors using oat, almond, or coconut milk cater to lactose-intolerant individuals. Limited-edition and regionally inspired flavors create excitement and encourage trial purchases. As people seek premium and artisanal coffee experiences, companies introduce bold and exotic blends, enhancing the overall appeal of ready to drink coffee. With these continuous innovations, the market remains dynamic, attracting both traditional coffee lovers and adventurous drinkers.

To get more information on this market, Request Sample

Expansion of e-commerce sites

The expansion of e-commerce portals is offering a favorable India ready to drink coffee market outlook. Online shopping enables individuals to browse a diverse range of ready to drink coffee selections, evaluate different brands, check reviews, and buy their preferred choices without having to go to a physical store. Subscription services and direct-to-consumer (D2C) approaches enable brands to foster customer loyalty through exclusive offers, tailored suggestions, and regular deliveries. Smaller coffee brands can rival established firms by connecting with people directly via e-commerce channels, circumventing the constraints of conventional retail shelf availability. Online marketing, social media advertising, and influencer campaigns enhance visibility and draw in new customers. Moreover, e-commerce sites offer comprehensive item details, nutritional data, and user reviews, assisting health-aware individuals in making educated decisions. Quick and dependable home delivery options promote bulk buying, simplifying the process for busy professionals and students to stock up on their preferred ready to drink coffee beverages. Seasonal and limited-time flavors rapidly gain popularity online, as brands can market them directly to specific audiences through e-commerce portals. According to the IMARC Report, the India e-commerce market is set to reach USD 259.0 Billion by 2032, exhibiting a growth rate (CAGR) of 29.3% during 2024-2032.

India Ready to Drink Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on packaging and distribution channel.

Packaging Insights:

- Bottles

- Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes bottles, cans, and others.

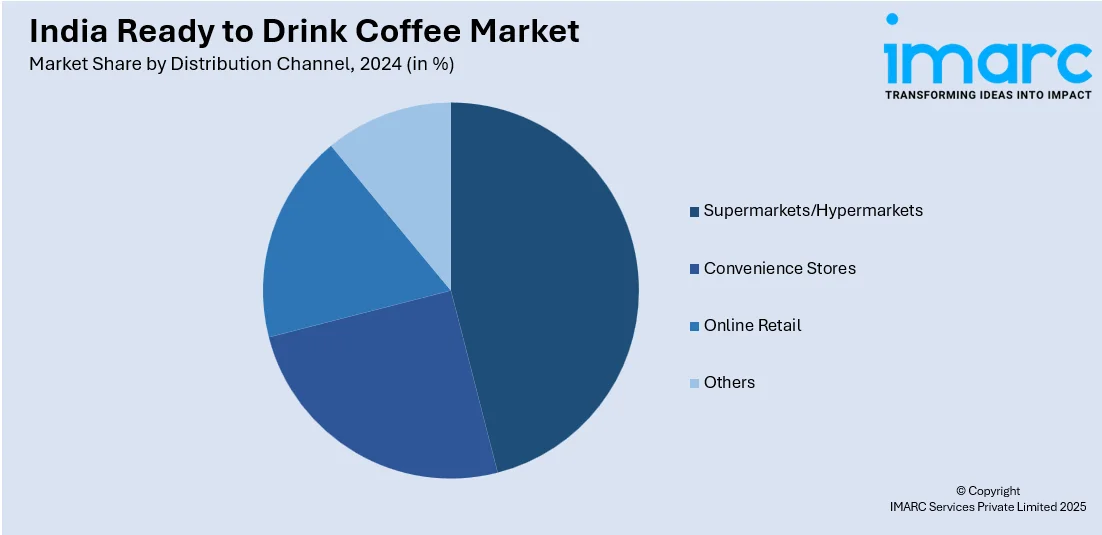

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channels have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, online retail, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ready to Drink Coffee Market News:

- In November 2024, abCoffee, a leading ready to drink coffee chain in India’s retail sector, unveiled the nation’s first-ever collection of 13 coconut-based non-dairy drinks, featuring both coffee and non-coffee varieties. Available at over 75 retail locations in India, this lineup merged the creamy consistency of coconut milk with abCoffee’s specialty coffee blends, appealing to individuals looking for health-oriented choices.

- In February 2024, Nestle, a well-known F&B brand, intended to sell Starbucks ready to drink coffee in the retail sector of India. This action would be a component of Nestle's worldwide collaboration with Starbucks Corporation, permitting it to market Starbucks’ packaged coffee and drinks outside of its coffeehouses.

India Ready to Drink Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Bottles, Cans, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ready to drink coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ready to drink coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ready to drink coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ready to drink coffee market in India was valued at USD 3,335.39 Million in 2024.

The India ready to drink coffee market is projected to exhibit a CAGR of 3.40% during 2025-2033, reaching a value of USD 4,659.60 Million by 2033.

The India ready to drink (RTD) coffee market is driven by rising urbanization, evolving lifestyles, and increasing demand for convenient, on-the-go beverages. Growing café culture, expanding retail availability, and youth preference for cold, flavored coffee options are fueling consumption. Health-conscious variants and aggressive marketing by domestic and global brands further boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)