India Ready Mix Concrete Market Size, Share, Trends and Forecast by Product, End Use Sector, and Region, 2025-2033

India Ready Mix Concrete Market Overview:

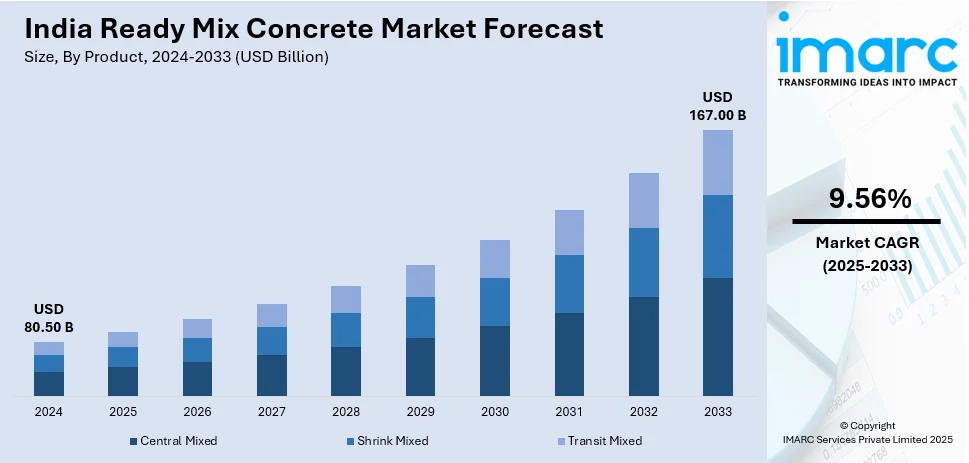

The India ready mix concrete market size reached USD 80.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 167.00 Billion by 2033, exhibiting a growth rate (CAGR) of 9.56% during 2025-2033. Urbanization, infrastructure projects, government initiatives, real estate growth, smart city developments, highway expansion, rising high-rise construction, cost efficiency, sustainability focus, labor shortages, advanced batching technologies, quality consistency, time-saving benefits, foreign investments, and increasing demand for durable building materials are driving India’s ready-mix concrete market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.50 Billion |

| Market Forecast in 2033 | USD 167.00 Billion |

| Market Growth Rate (2025-2033) | 9.56% |

India Ready Mix Concrete Market Trends:

Rising Demand for Sustainable and Green Concrete Solutions

Sustainability is reshaping India's ready-mix concrete (RMC) market as the construction industry increasingly adopts eco-friendly materials and low-carbon technologies. Green concrete, which incorporates recycled aggregates, fly ash, and slag, is gaining traction due to environmental regulations and corporate sustainability goals. Government programs like the Green Rating for Integrated Habitat Assessment (GRIHA) and Leadership in Energy and Environmental Design (LEED) certifications are encouraging developers to adopt sustainable ready-mix concrete (RMC) solutions. In 2023, around 28% of the RMC produced in India included supplementary cementitious materials such as fly ash and Ground Granulated Blast Furnace Slag (GGBS), contributing to lower carbon emissions. By 2025, this percentage is expected to rise to 35%, driven by stricter environmental norms and growing awareness. Moreover, several leading RMC manufacturers have announced carbon-neutral production goals, with companies investing in carbon capture and utilization (CCU) technologies. Additionally, the demand for self-healing and pervious concrete is increasing, particularly in metro projects and smart city developments, where water conservation and longevity are crucial, creating a positive outlook for market expansion.

To get more information on this market, Request Sample

Expansion of Infrastructure and Mega Projects

The Indian government’s push for large-scale infrastructure projects is a significant driver of RMC market growth. Massive investments in highways, metro rail, airports, and smart city projects are creating a surge in demand for high-quality, pre-mixed concrete. Under the Pradhan Mantri Gati Shakti National Master Plan, infrastructure spending is set to exceed ₹100 lakh crore ($1.2 trillion) by 2025, with RMC playing a critical role in ensuring efficiency and quality control in construction. The National Highway Development Program (NHDP) aims to build 25,000 km of new highways by 2025, with RMC demand growing at 10% annually due to its consistency and faster construction capabilities. Similarly, metro rail projects across cities like Delhi, Mumbai, Bengaluru, and Chennai are expected to require over 50 million cubic meters of RMC by 2025. This rising demand is also fueling investments in automated batching plants and digital quality control systems, which enhance precision and reduce material wastage. Prefabrication and modular construction techniques are further boosting RMC adoption, especially in urban housing and commercial real estate. With India’s construction sector accounting for over 9% of GDP, infrastructure expansion is cementing RMC’s position as a preferred material, bolstering the market growth.

India Ready Mix Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and end use sector.

Product Insights:

- Central Mixed

- Shrink Mixed

- Transit Mixed

The report has provided a detailed breakup and analysis of the market based on the product. This includes central mixed, shrink mixed, and transit mixed.

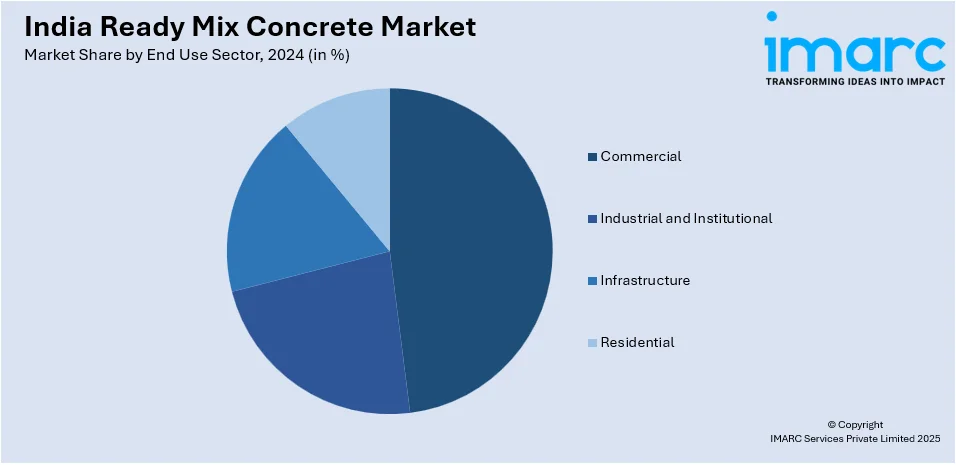

End Use Sector Insights:

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes commercial, industrial and institutional, infrastructure, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ready Mix Concrete Market News:

- March 2024: Shree Cement acquired five ready-mix concrete (RMC) plants in Mumbai from StarCrete LLP, marking a strategic move into the cement business. The plants, with an aggregate capacity of 422 cubic meters per hour, are expected to grow due to government push for large infrastructure projects and housing construction. The move is part of Shree Cement's vision to become a multi-product company centered around the core cement business.

- March 2024: Shree Cement announced its foray into the ready-mix concrete (RMC) market with the start of its first greenfield project in Hyderabad. The new facility, which has a capacity of 90 cubic meters per hour, will enable the Bangur family-owned company to become a multi-product cement manufacturer.

India Ready Mix Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Central Mixed, Shrink Mixed, Transit Mixed |

| End Use Sectors Covered | Commercial, Industrial and Institutional, Infrastructure, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ready mix concrete market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ready mix concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ready mix concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ready mix concrete market was valued at USD 80.50 Billion in 2024.

The India ready mix concrete market is projected to exhibit a CAGR of 9.56% during 2025-2033, reaching a value of USD 167.00 Billion by 2033.

Expanding infrastructure projects, rapid urbanization, and government initiatives like smart cities drive India’s ready-mix concrete market. Demand rises from commercial and residential construction, highways, and metro development. Advantages such as labor efficiency, quality consistency, waste reduction, and faster project timelines further propel adoption across urban and peri-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)