India Pumped Hydro Storage Market Size, Share, Trends and Forecast by Type, Sources, and Region, 2025-2033

Market Overview:

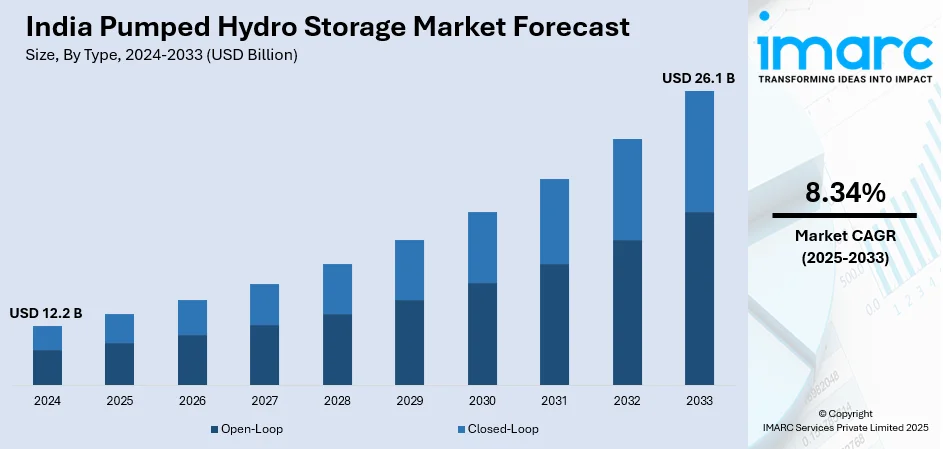

The India pumped hydro storage market size reached USD 12.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.34% during 2025-2033. The growing emphasis on building a robust energy infrastructure, the increasing participation of private players across the globe, along with numerous public-sector undertakings, the augmenting trend of renovating aging dams and promotion of sustainable energy solutions are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.2 Billion |

|

Market Forecast in 2033

|

USD 26.1 Billion |

| Market Growth Rate 2025-2033 | 8.34% |

Pumped hydro storage (PHS) is a type of large-scale energy storage system that utilizes gravitational potential energy to store and release electricity. The system primarily consists of two water reservoirs placed at different elevations, including one at a higher level and another at a lower level. When electricity demand is low, excess electricity from the grid is used to pump water from the lower reservoir to the upper reservoir. This process converts electrical energy into potential energy. Conversely, when electricity demand is high, water from the upper reservoir is released to flow back down to the lower reservoir, passing through turbines that generate electricity in the process. This conversion from potential energy back to electrical energy helps meet peak electricity demands. Pumped Hydro Storage is known for its efficiency, long lifecycle, and ability to provide a significant amount of power on demand.

To get more information on this market, Request Sample

The growing emphasis on building a robust energy infrastructure is driving the market in India. The Indian government has been proactive in promoting sustainable energy solutions. Policy frameworks, subsidies, and incentives provided for renewable energy projects have a ripple effect on associated sectors, including PHS. Moreover, investments in infrastructure development, including dams and water reservoir projects, can be leveraged for PHS, making it economically viable in regions with existing water storage infrastructure. Moreover, the shift towards closed loop pumped hydro storage systems is gaining traction due to their reduced ecological footprint. Furthermore, encouraging policies aimed at promoting sustainable energy storage, combined with energy-efficiency measures, enhance the appeal of these systems. The trend of renovating aging dams and the growing inclination to integrate PHS into existing reservoirs are also accelerating the sector's growth in India. Besides, initiatives aiming at electrifying distant regions, combined with the steady progression of smart grid technology, are providing an impetus to the market. Apart from this, the participation of private players, along with public-sector undertakings, is leading to increased investments and technological advancements in the PHS sector.

India Pumped Hydro Storage Market Trends/Drivers:

Increasing integration of renewable energy sources

The global push towards sustainable energy solutions has led to a significant rise in the integration of renewable energy sources, such as solar and wind, into the power grid. Pumped hydro storage (PHS) offers a solution to this problem by acting as a buffer. When there's an overproduction of renewable energy, it is utilized to pump water to the upper reservoir of a PHS system. Later, when renewable production wanes or there's a spike in demand, this stored potential energy can be released to generate electricity. This increasing reliance on renewables necessitates efficient energy storage solutions, and PHS, being one of the most established and large-scale storage technologies, is perfectly poised to cater to this demand. As countries and regions aim for higher renewable integration targets, the role of PHS in grid balancing and energy storage becomes even more prominent.

Need for grid stability and reliability

From daily household activities to vital operations in hospitals, industries, and data centers, a consistent power supply is imperative. Fluctuations or disturbances in the grid can lead to significant economic and operational losses. Pumped hydro storage plays a crucial role in maintaining grid stability. Its quick response time, in terms of both charging (pumping water up) and discharging makes it an invaluable tool in grid management. As the complexity of power grids increases, with diverse power generation sources and varying consumption patterns, the role of energy storage in ensuring smooth grid operations becomes vital. PHS systems, with their high capacity and rapid ramp-up and ramp-down capabilities, are uniquely suited to provide both short-term and long-term grid support. As the need for a stable power supply grows in importance across sectors and regions, the demand for PHS systems as a tool for grid reliability is expected to rise.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on type and sources.

Breakup by Type:

- Open-Loop

- Closed-Loop

Open-loop accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes open-loop and closed-loop. According to the report, open-loop represented the largest segment.

Open-loop PHS systems use natural water sources, such as rivers or streams for their operation. In this setup, water is pumped from a lower elevation natural water body to an upper reservoir during periods of low electricity demand. When there's a need to generate electricity, the stored water in the upper reservoir is released back into the natural water source, passing through turbines in the process. The main advantage of open-loop systems is that they don't necessarily require two artificially created reservoirs, making them more feasible in locations where suitable natural water bodies are available. The utilization of natural water bodies often results in reduced environmental and land-use impacts compared to creating two separate artificial reservoirs. This can lead to fewer regulatory hurdles and, in some cases, lower initial capital investment. Furthermore, in regions with abundant natural water bodies, open-loop systems can be integrated more harmoniously into the existing landscape, further reducing environmental concerns.

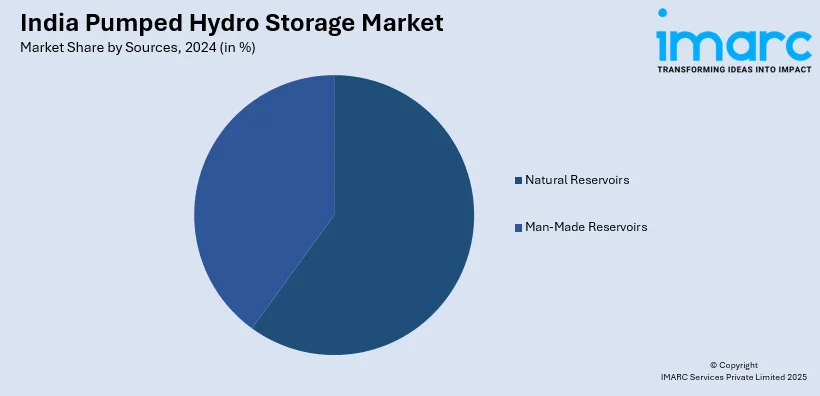

Breakup by Sources:

- Natural Reservoirs

- Man-Made Reservoirs

A detailed breakup and analysis of the market based on the sources has also been provided in the report. This includes natural reservoirs and man-made reservoirs.

Pumped hydro storage systems primarily rely on water reservoirs to store and release energy. These reservoirs can either be natural formations or artificially created. Natural reservoirs encompass bodies of water such as lakes, rivers, and lagoons that have formed due to geographical or environmental factors. Their advantage lies in the fact that they require minimal modification to be integrated into a PHS system, thus often resulting in lower initial investments and fewer environmental concerns.

On the other hand, man-made reservoirs, also known as artificial reservoirs, are specifically constructed to fit the requirements of a PHS system. These are usually created by damming a river or stream and can be designed to meet precise storage and operational needs. While their construction might entail higher initial costs and potential environmental implications, their bespoke design can optimize the efficiency and performance of the PHS system.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

South India leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India. According to the report, South India was the largest market for pumped hydro storage in the country.

South India is geographically diverse, with a rich mix of coastal areas, plateaus, and mountain ranges. This diversity offers a plethora of opportunities for industries, from agriculture to IT and renewable energy. Additionally, South India boasts a rich history of education, with a high literacy rate and a multitude of prestigious institutions. This has resulted in a skilled workforce that is both versatile and adaptive, catering to the ever-evolving demands of various industries. Furthermore, the region's proactive governance, with policies favorable for business growth and investments, has encouraged both domestic and foreign investments. Incentives for startups, tax breaks for certain industries, and streamlined approval processes play a crucial role in fostering a business-friendly environment. the region's natural resources, from abundant sunlight ideal for solar power generation to vast coastal areas promoting wind energy and fisheries, have also contributed to its market dominance in specific sectors.

Competitive Landscape:

Numerous companies are directly involved in the planning, design, and construction of new PHS facilities. This includes identifying suitable locations, performing environmental impact assessments, and overseeing the actual construction of the reservoirs and accompanying infrastructure. Moreover, companies are heavily investing in research and development to advance the technology behind PHS. This includes improving turbine efficiency, developing more durable materials, and integrating digital technologies to optimize operations. Also, as the power grid becomes more complex with the addition of renewable energy sources, companies in the PHS market are focusing on solutions to seamlessly integrate their storage capacity with the grid. This ensures that PHS can effectively balance supply and demand, especially during peak periods. Furthermore, companies offer consultation services to governments, utilities, and private entities looking to explore or invest in PHS. This can cover feasibility studies, design inputs, and operational strategies.

The market research report has provided a comprehensive analysis of the competitive landscape.

India Pumped Hydro Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open-Loop, Closed-Loop |

| Sources Covered | Natural Reservoirs, Man-Made Reservoirs |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pumped hydro storage market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India pumped hydro storage market?

- What is the impact of each driver, restraint, and opportunity on the India pumped hydro storage market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the India pumped hydro storage market?

- What is the breakup of the market based on the sources?

- Which is the most attractive sources in the India pumped hydro storage market?

- What is the competitive structure of the India pumped hydro storage market?

- Who are the key players/companies in the India pumped hydro storage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pumped hydro storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pumped hydro storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pumped hydro storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)