India Pulmonary Arterial Hypertension Drugs Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, End User, and Region, 2025-2033

India Pulmonary Arterial Hypertension Drugs Market Overview:

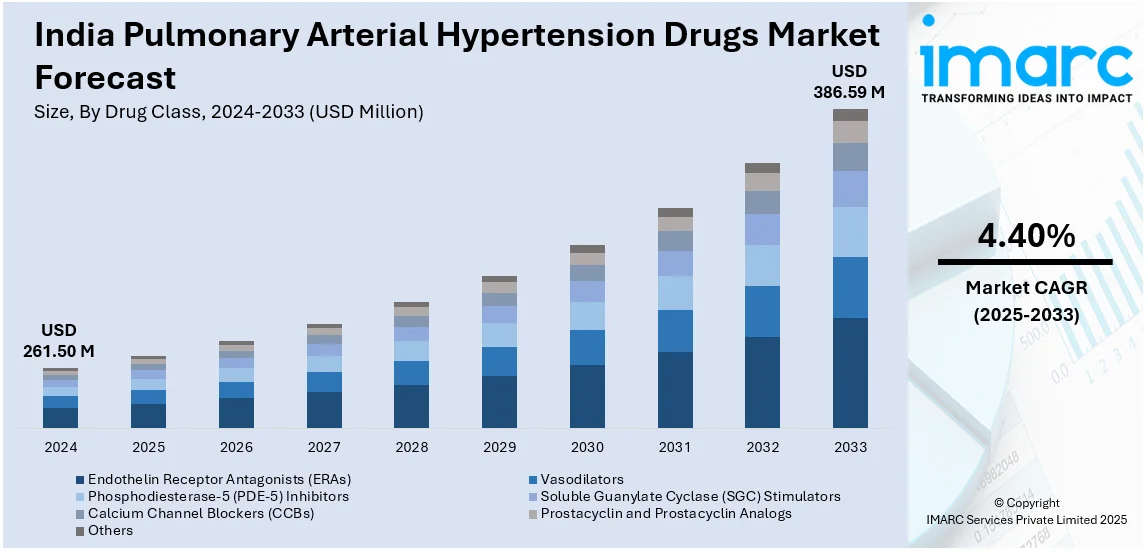

The India pulmonary arterial hypertension drugs market size reached USD 261.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 386.59 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market in India for pulmonary arterial hypertension drugs is growing due to rising PAH cases, improved diagnosis, and increased access to advanced therapies. Also, government initiatives, expanding healthcare infrastructure, and new drug launches are driving demand, while affordability and innovative treatment options enhance market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 261.50 Million |

| Market Forecast in 2033 | USD 386.59 Million |

| Market Growth Rate (2025-2033) | 4.40% |

India Pulmonary Arterial Hypertension Drugs Market Trends:

Rising Prevalence Driving Drug Demand

The growing number of pulmonary arterial hypertension (PAH) patients in India is driving demand for advanced treatment procedures. Rising cases associated with genetic causes, connective tissue diseases, and congenital heart malformations are propelling healthcare providers to increase diagnosis and treatment. Moreover, the population growth and rising numbers of diseases such as chronic lung disease and heart failure are adding to the number of PAH cases. As the awareness level increases, patients are increasingly being diagnosed at an early stage, thus creating a higher demand for successful drug therapies. Along with this, the market is also undergoing a move towards precision medicine, where the drug therapies are targeted to address specific patient requirements, enhancing the treatment outcomes. Additionally, pharma firms are putting money into research to identify targeted treatments that better manage diseases. Besides this, government schemes favorable towards the treatment of rare diseases are making drugs advanced in quality and accessible. Also contributing to a greater availability for a larger section of patients of PAH medicine are generic medicines available in their place. With enhanced diagnostic equipment and increased emphasis on specialty care, the Indian PAH pharmaceutical market is experiencing gradual growth. Also, technological innovation in drug formulation and delivery systems will continue to fuel market growth.

To get more information on this market, Request Sample

Expanding Access to Advanced Therapies

The Indian healthcare sector is in the process of a fast-paced transformation, enhancing access to expensive PAH drugs. Significant investment in specialty hospitals and the rise of pulmonary care centers are helping to provide patients with better treatment options. Rare disease management drives by the government and financial aid programs are also helping to promote the availability of high-cost PAH drugs. In addition, increased participation in telemedicine and digital health solutions is encouraging consultations with specialists by patients and timely prescriptions, improving disease management. Expanding insurance coverage is also contributing to the increase in affordability and access to treatment of PAH in both urban and rural regions. Pharmaceutical companies are introducing new medicines with better efficacy and lower side effects. Along with this, increased use of oral and inhalation treatments is decreasing the number of hospital visits and increasing patient compliance. International partnerships between Indian companies and multinational drug companies are also making it easier to bring new, innovative treatment options to the market. Furthermore, the research and development focus is also bringing in new drug approvals, guaranteeing a consistent pipeline of innovative PAH treatments. As public and private healthcare facilities strive to improve medical infrastructure, the supply of specialized treatments is likely to rise. Consequently, the Indian PAH drug market is likely to grow substantially in the next few years with substantial awareness and improved accessibility.

India Pulmonary Arterial Hypertension Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug class, route of administration, and end user.

Drug Class Insights:

- Endothelin Receptor Antagonists (ERAs)

- Vasodilators

- Phosphodiesterase-5 (PDE-5) Inhibitors

- Soluble Guanylate Cyclase (SGC) Stimulators

- Calcium Channel Blockers (CCBs)

- Prostacyclin and Prostacyclin Analogs

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes endothelin receptor antagonists (ERAs), vasodilators, phosphodiesterase-5 (PDE-5) inhibitors, soluble guanylate cyclase (SGC) stimulators, calcium channel blockers (CCBS), prostacyclin and prostacyclin analogs, and others.

Route of Administration Insights:

- Inhalation

- Injectable

- Oral Administration

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes inhalation, injectable, and oral administration.

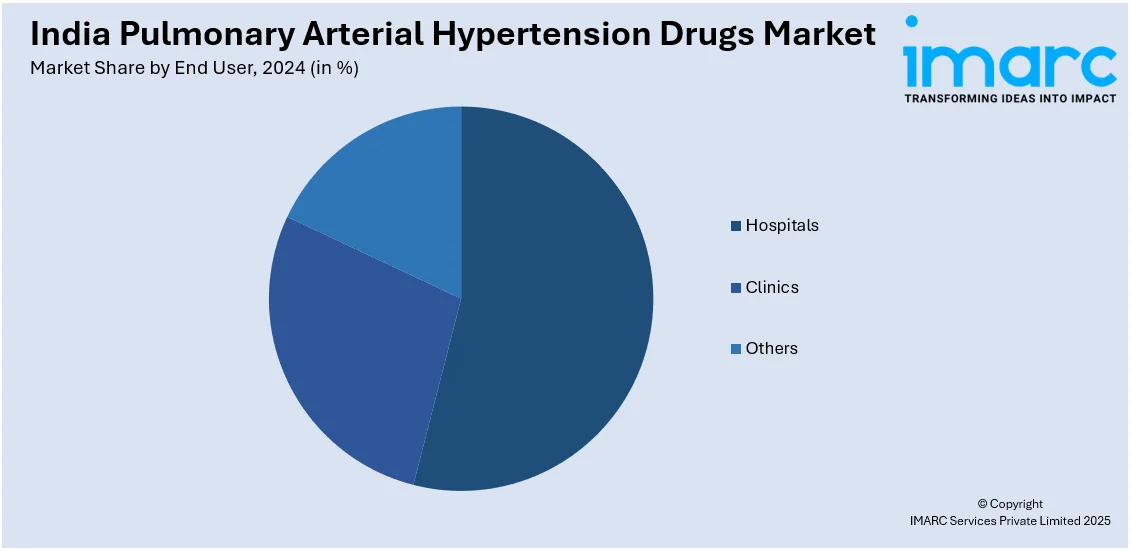

End User Insights:

- Hospitals

- Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, clinics, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pulmonary Arterial Hypertension Drugs Market News:

- February 2025: Natco Pharma secured USFDA approval for Bosentan 32mg tablets, a generic version of Tracleer for Pulmonary Arterial Hypertension (PAH) in pediatric patients. This strengthens India's generic PAH drug industry, boosting affordability, market competition, and accessibility.

- July 2024: Alembic Pharmaceuticals received FDA tentative approval for Selexipag Injection (1,800 mcg/vial), a prostacyclin receptor agonist for Pulmonary Arterial Hypertension (PAH). This development enhances India's generic PAH drug segment, improving affordability, competition, and global access to advanced PAH treatments.

India Pulmonary Arterial Hypertension Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Class Covered | Endothelin Receptor Antagonists (ERAs), Vasodilators, Phosphodiesterase-5 (PDE-5) Inhibitors, Soluble Guanylate Cyclase (SGC) Stimulators, Calcium Channel Blockers (CCBs), Prostacyclin and Prostacyclin Analogs, Others |

| Route of Administration Covered | Inhalation, Injectable, Oral Administration |

| End User Covered | Hospitals, Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pulmonary arterial hypertension drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the India pulmonary arterial hypertension drugs market on the basis of drug class?

- What is the breakup of the India pulmonary arterial hypertension drugs market on the basis of route of administration?

- What is the breakup of the India pulmonary arterial hypertension drugs market on the basis of end user?

- What are the various stages in the value chain of the India pulmonary arterial hypertension drugs market?

- What are the key driving factors and challenges in the India pulmonary arterial hypertension drugs market?

- What is the structure of the India pulmonary arterial hypertension drugs market and who are the key players?

- What is the degree of competition in the India pulmonary arterial hypertension drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pulmonary arterial hypertension drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pulmonary arterial hypertension drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pulmonary arterial hypertension drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)