India Propylene Oxide Market Size, Share, Trends and Forecast by Production Process, Application, End Use Industry, and Region, 2025-2033

Market Overview:

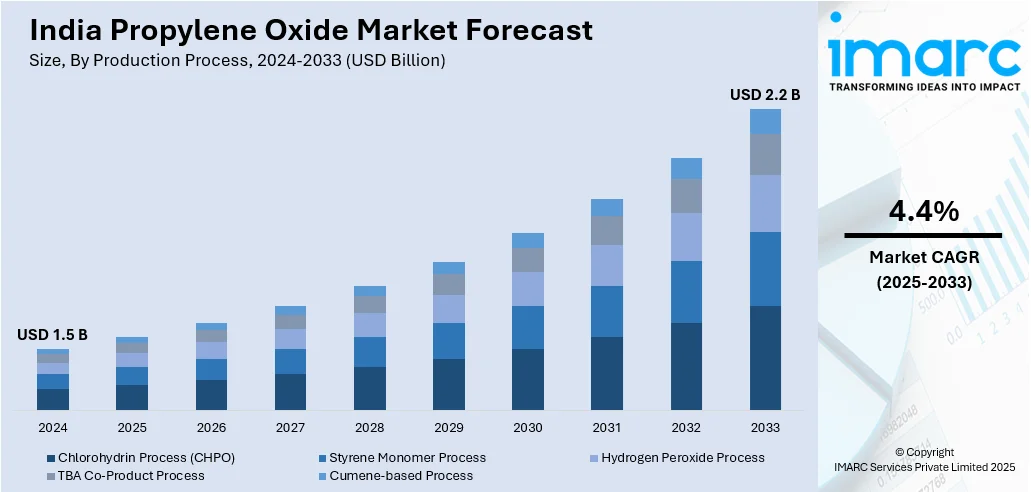

India propylene oxide market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The increasing adoption of polyurethane in the production of consumer goods and appliances, such as refrigerators and furniture, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.5 Billion |

|

Market Forecast in 2033

|

USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

Propylene oxide (PO) is a volatile, colorless liquid chemical compound with the molecular formula C3H6O. It is a highly versatile industrial chemical primarily used in the production of polyether polyols, which serve as essential components in the manufacturing of polyurethane foams, coatings, and adhesives. PO is produced through the chlorohydrin process or the more environmentally friendly epoxidation process, wherein propylene reacts with an oxidizing agent. This epoxide compound exhibits reactivity due to its strained three-membered ring structure, making it valuable for various applications. Despite its industrial importance, propylene oxide has raised environmental and health concerns, as it is classified as a probable human carcinogen. Consequently, efforts continue to find safer and more sustainable production methods for this crucial chemical in the realm of polymer and material science.

To get more information on this market, Request Sample

India Propylene Oxide Market Trends:

The propylene oxide market in India is experiencing robust growth, primarily driven by several key factors. Firstly, the escalating demand for polyurethane, a versatile polymer derived from propylene oxide, serves as a prominent driver. Polyurethane finds widespread application in industries such as construction, automotive, and furniture, thereby fostering the demand for propylene oxide. Additionally, the expanding automotive sector, marked by a surge in lightweight material adoption for enhanced fuel efficiency, further propels the market forward. Furthermore, the regional push toward eco-friendly and energy-efficient solutions has elevated the significance of propylene oxide in the production of polyols, essential components for manufacturing green and sustainable polyurethane products. Moreover, the pharmaceutical sector's increasing reliance on propylene oxide for manufacturing pharmaceuticals, including various antibiotics and anti-cancer drugs, significantly contributes to the market's upward trajectory. The market dynamics are also influenced by the growing consumer preference for packaged goods, driving the demand for propylene oxide in the production of glycol ethers—a vital ingredient in packaging materials. In conclusion, the propylene oxide market in India is intricately woven into diverse industries, with its growth underpinned by the interplay of factors ranging from industrial demand trends to environmental consciousness and technological advancements.

India Propylene Oxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on production process, application, and end use industry.

Production Process Insights:

- Chlorohydrin Process (CHPO)

- Styrene Monomer Process

- Hydrogen Peroxide Process

- TBA Co-Product Process

- Cumene-based Process

The report has provided a detailed breakup and analysis of the market based on the production process. This includes chlorohydrin process (CHPO), styrene monomer process, hydrogen peroxide process, TBA co-product process, and cumene-based process.

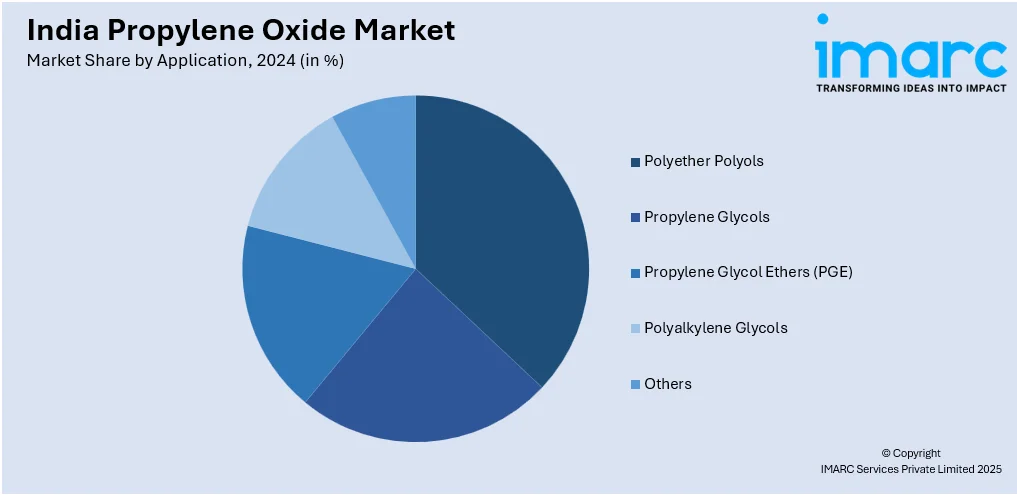

Application Insights:

- Polyether Polyols

- Propylene Glycols

- Propylene Glycol Ethers (PGE)

- Polyalkylene Glycols

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polyether polyols, propylene glycols, propylene glycol ethers (PGE), polyalkylene glycols, and others.

End Use Industry Insights:

- Automotive

- Construction

- Chemicals and Pharmaceuticals

- Packaging

- Textile and Furnishing

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, construction, chemicals and pharmaceuticals, packaging, textile and furnishing, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Propylene Oxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Processes Covered | Chlorohydrin Process (CHPO), Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-based Process |

| Applications Covered | Polyether Polyols, Propylene Glycols, Propylene Glycol Ethers (PGE), Polyalkylene Glycols, Others |

| End Use Industries Covered | Automotive, Construction, Chemicals and Pharmaceuticals, Packaging, Textile and Furnishing, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India propylene oxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India propylene oxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India propylene oxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The propylene oxide market in India was valued at USD 1.5 Billion in 2024.

The India propylene oxide market is projected to exhibit a (CAGR) of 4.4% during 2025-2033, reaching a value of USD 2.2 Billion by 2033.

The market is is driven by increasing demand from polyurethane, epoxy resin, and propylene glycol businesses. Development in the automobile, construction, and coatings industries, along with enhanced production capacities and industrialization, facilitates market growth. Petrol chemical investment incentives by the government and rising exports further consolidate the propylene oxide market in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)