India PropTech Market Size, Share, Trends, and Forecast by Solution, Application, Deployment, End User, and Region, 2025-2033

India PropTech Market Overview:

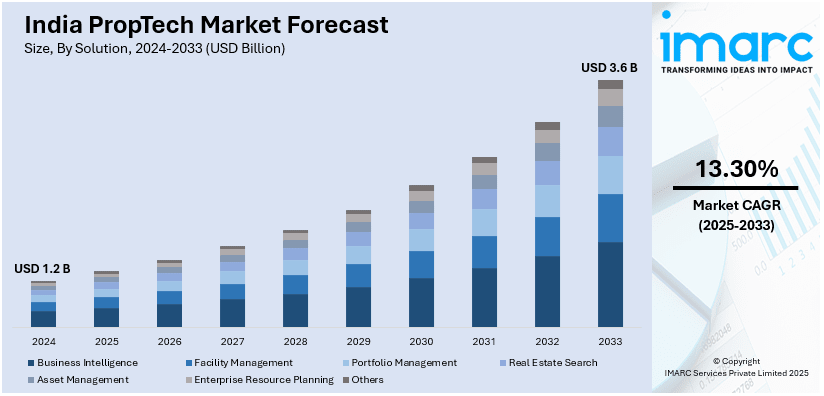

The India proptech market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.30% during 2025-2033. The market is expanding with AI-enabled real estate solutions, blockchain-linked transactions, and smart property management. Additionally, the rising urbanization, infusion of fintechs, and automation are increasing the efficiency, transparency, and accessibility of property purchases, sales, and management transactions across the residential and commercial asset classes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Market Growth Rate 2025-2033 | 13.30% |

India PropTech Market Trends:

Growth of Fractional Ownership and Real Estate Tokenization

Fractional ownership and real estate tokenization are becoming disruptive forces in India's proptech industry, opening up high-end property investments to more people. Investors can now buy a fraction of high-end commercial or residential properties, lowering financial hurdles and enhancing liquidity in the real estate market. Digital platforms that enable fractional ownership are becoming popular, providing retail investors with access to Grade-A office buildings, co-working spaces, and luxury assets. Blockchain tokenization is also transforming property investment further by allowing secure, transparent, and tradable digital property assets. By tokenizing property into digital property tokens, transactions are more efficient, eliminating the requirement for third parties and paperwork. For instance, in March 2024, as per industry reports, Gujarat International Finance Tec-City (GIFT City) emerged as a hub for regulated real estate asset tokenization. The International Financial Services Centres Authority (IFSCA) granted approvals to entities like Realdom India Pvt Ltd to launch platforms facilitating fractional ownership of properties through digital tokens. This initiative aims to enhance liquidity and accessibility in the real estate market. Furthermore, as regulatory frameworks evolve to accommodate these advancements, the Indian real estate market is expected to see wider adoption of blockchain-powered property transactions, improving market transparency and investment accessibility.

To get more information on this market, Request Sample

Expansion of Smart Homes and IoT-Enabled Infrastructure

The demand for smart homes and Internet of Things (IoT)-enabled real estate infrastructure is reshaping India’s proptech landscape. Homebuyers and developers are prioritizing intelligent automation systems for energy management, security, and convenience. Smart lighting, automated climate control, and AI-powered home assistants are becoming key differentiators in residential properties. Real estate developers are integrating IoT solutions into building management systems, enhancing operational efficiency in commercial and residential projects. Additionally, IoT-enabled security features, such as biometric access control and AI-powered surveillance, are improving safety and asset protection. The adoption of digital twin technology is also growing, allowing developers to create virtual models of properties for better planning and maintenance. With urbanization and disposable incomes rising, buyers are willing to pay a premium for technology-driven living spaces. As smart infrastructure becomes a standard feature, proptech companies are focusing on innovation and seamless integration of digital solutions to enhance property value and user experience. For instance, in June 2023, Design Forum International announced collaboration with the Government of Odisha to design the Odisha Mining Corporation project, featuring AI-powered kinetic facades, dynamic projections, and flexible spaces, blending corporate, commercial, and recreational functions to showcase Odisha's technological and architectural advancements

India PropTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on solution, application, deployment, and end user.

Solution Insights:

- Business Intelligence

- Facility Management

- Portfolio Management

- Real Estate Search

- Asset Management

- Enterprise Resource Planning

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes business intelligence, facility management, portfolio management, real estate search, asset management, enterprise resource planning, and others.

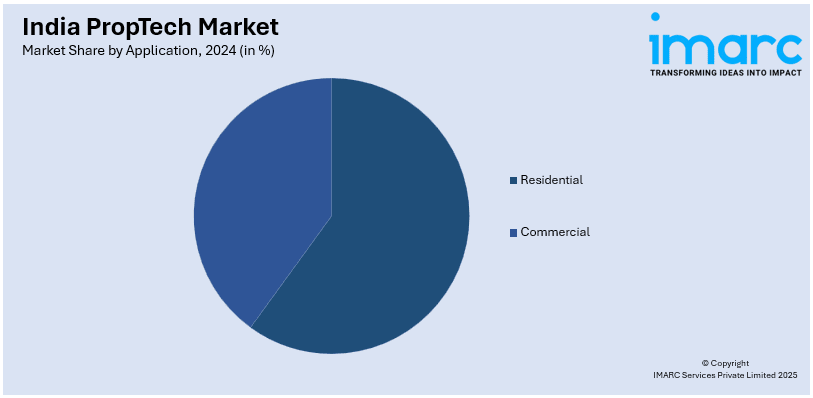

Application Insights:

- Residential

- Multi-Family Housing

- Single Family Housing

- Others

- Commercial

- Retail Spaces

- Office Spaces

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential (multi-family housing, single family housing, and others) and commercial (retail spaces, office spaces, and others).

Deployment Insights:

- On-premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premises and cloud.

End User Insights:

- Housing Associations

- Real Estate Agents

- Property Investors

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes housing associations, real estate agents, property investors, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India PropTech Market News:

- In November 2023, Terazo, a private market investment platform, announced its partnership with Tokeny to launch India’s first regulated tokenized real estate asset under IFSCA’s regulatory sandbox. The USD 50 Million Oryx project in GIFT SEZ enables fractional ownership, blockchain transparency, and automated asset management.

India PropTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Business Intelligence, Facility Management, Portfolio Management, Real Estate Search, Asset Management, Enterprise Resource Planning, Others |

| Applications Covered |

|

| Deployments Covered | On-premises, Cloud |

| End Users Covered | Housing Associations, Real Estate Agents, Property Investors, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India proptech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India proptech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India proptech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India proptech market was valued at USD 1.2 Billion in 2024.

The India PropTech market is projected to exhibit a CAGR of 13.30% during 2025-2033, reaching a value of USD 3.6 Billion by 2033.

The market is being driven by the increasing adoption of AI-enabled real estate solutions, blockchain-linked transactions, and smart property management. Additionally, urbanization, the infusion of fintechs, and the growing demand for automated property management systems are further contributing to the market's growth, improving transparency and accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)