India Process Analyzer Market Size, Share, Trends, and Forecast by Product Type, End Use Industry, and Region, 2025-2033

India Process Analyzer Market Overview:

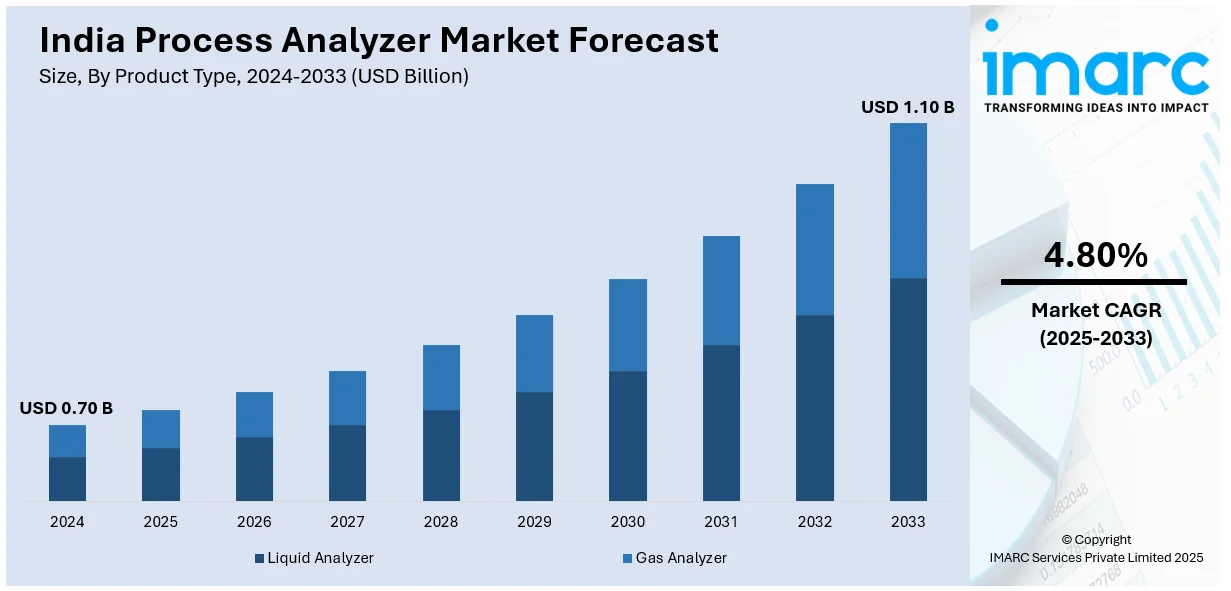

The India process analyzer market size reached USD 0.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.10 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of process analyzers in industrial automation and rising demand for process analyzers in environmental monitoring and compliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.70 Billion |

| Market Forecast in 2033 | USD 1.10 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

India Process Analyzer Market Trends:

Increasing Adoption of Process Analyzers in Industrial Automation

The process analyzer market in India is witnessing increasing integration with industrial automation systems on account of the demand for continuous monitoring, quality control, and process optimization in key industries such as chemicals, pharmaceuticals, oil and gas, and food and beverages. Manufacturers are increasingly focusing on Industry 4.0 initiatives to utilize process analyzers for operational efficiency improvements, waste reductions, and compliance with stringent regulations. Such process analyzers include spectroscopy-based gas analyzers, liquid chromatography systems, and near-infrared (NIR) spectroscopy technologies; all are now being integrated into smart factories to keep constant surveillance over critical parameters without human interference, thereby increasing the reliability of the entire process. For instance, in 2024, through its gas analyzer solutions in the Bengaluru facility, ABB announced the export of around 85% of its production overseas, thus widening and strengthening the global presence of ABB's advanced gas analysis technology and industrial solutions. Digital transformation also facilitates the collection of necessary data for process analyzers for predictive maintenance and remote monitoring. An increase in the deployment of IIoT solutions will certainly open avenues for the better performance of process analyzers as they will allow real-time connectivity and seamless information exchange amongst various operating units. As industries are continually driving toward automation to boost productivity and cost savings, intelligent process analyzers with enhanced connectivity, real-time data processing, and cloud integration will create a sustained demand growth trajectory for the market in India.

To get more information on this market, Request Sample

Rising Demand for Process Analyzers in Environmental Monitoring and Compliance

The increasing emphasis on environmental sustainability and stricter regulatory criteria are some of the factors boosting the market for process analyzers in the industrial sector in India. Government schemes such as the National Clean Air Program (NCAP) and Central Pollution Control Board (CPCB) guidelines demand the installation of advanced emission monitoring systems by the industries to ensure compliance with permissible pollution levels. For example, during India Energy Week 2024, TotalEnergies and ONGC signed a Cooperation Agreement for deploying AUSEA technology for methane detection in support of India's emission reduction goals for 2030 under the Oil and Gas Decarbonization Charter (OGDC). Process analyzers are used in air and water quality monitoring to detect pollutants, monitor gaseous emissions, and check whether industrial discharge is compliant with environmental standards. Continuous emissions monitoring systems in oil & gas and power generation sectors are now becoming mandatory, driving the acceptance of gas chromatographs, mass spectrometers, and infrared analyzers. The wastewater treatment sector uses process analyzers to monitor heavy metals, nitrates, and organic contaminants for compliance with wastewater discharge regulations in real time. The growing focus on sustainability reporting and carbon footprints is encouraging industries to further invest in sophisticated process analyzers fitted with digital interfaces and remote monitoring capability. As India ventures to better its environmental policies, the demand for precision, automatic process analyzers is likely to grow significantly across various industrial sectors.

India Process analyzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Liquid Analyzer

- pH Analyzers

- Conductivity Analyzers

- Dissolved Oxygen Analyzers

- Turbidity Analyzers

- Others

- Gas Analyzer

- Electrochemical

- Zirconia

- Tunable Diode Laser

- Infrared

- Paramagnetic

- Catalytic

- Others

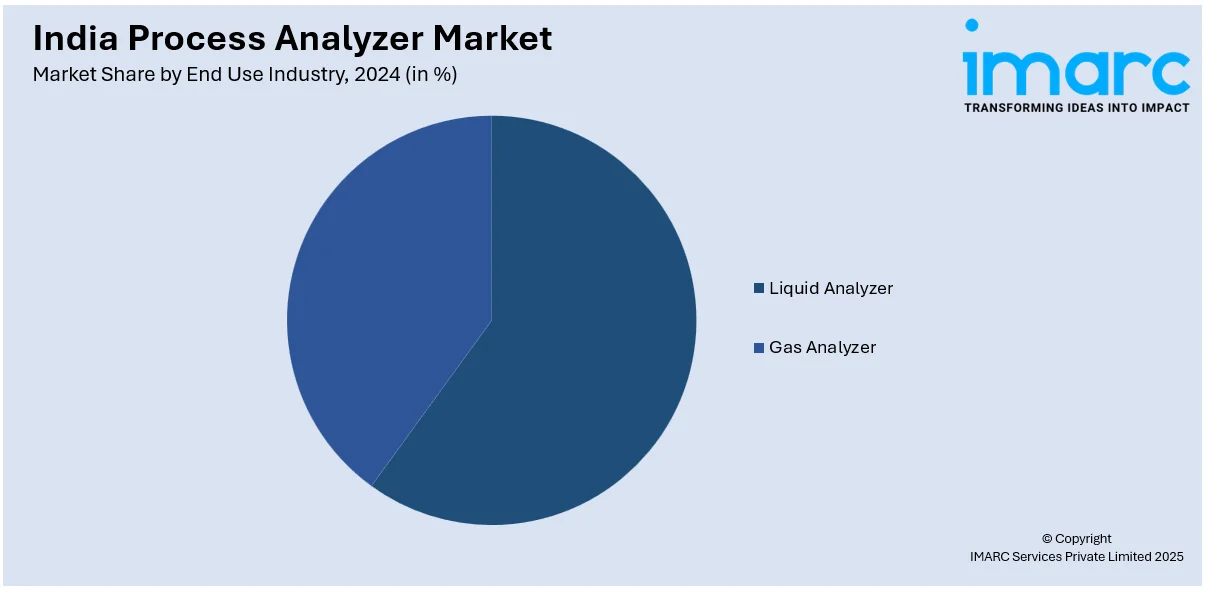

The report has provided a detailed breakup and analysis of the market based on the product type. This includes liquid analyzer(pH analyzers, conductivity analyzers, dissolved oxygen analyzers, turbidity analyzers, others) and gas analyzer (electrochemical, zirconia, tunable diode laser, infrared, paramagnetic, catalytic, and others).

End Use Industry Insights:

- Liquid Analyzer

- Power

- Water and Wastewater

- Pharmaceuticals

- Chemicals

- Oil and Gas

- Food and Beverage

- Others

- Gas Analyzer

- Oil and Gas

- Power

- Chemicals

- Food and Beverage

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes liquid analyzer (power, water and wastewater, pharmaceuticals, chemicals, oil and gas, food and beverage, and others) and gas analyzer (oil and gas, power, chemicals, food and beverage, pharmaceuticals, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Process analyzer Market News:

- In August 2024, Siemens Healthineers announced the launch of Atellica CI Analyzer, India’s first AI-enhanced, eco-friendly multi-testing diagnostic system, at Mahajan Imaging & Labs. It processes 200+ parameters across 20 disease states, uses microvolume technology for minimal samples, and includes advanced tests like ELF for early liver disease detection and management.

India Process analyzer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Use Industries Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India process analyzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India process analyzer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India process analyzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India process analyzer market was valued at USD 0.70 Billion in 2024.

The India process analyzer market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 1.10 Billion by 2033.

The India process analyzer market is propelled by growing industrial automation across sectors like chemicals, pharmaceuticals, oil and gas, and food & beverage, driving demand for real-time monitoring and process optimization. Additionally, tightening environmental regulations and government pollution control initiatives are pushing manufacturers to invest in advanced analyzers for compliance and sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)