India Probiotics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Probiotics Market Summary:

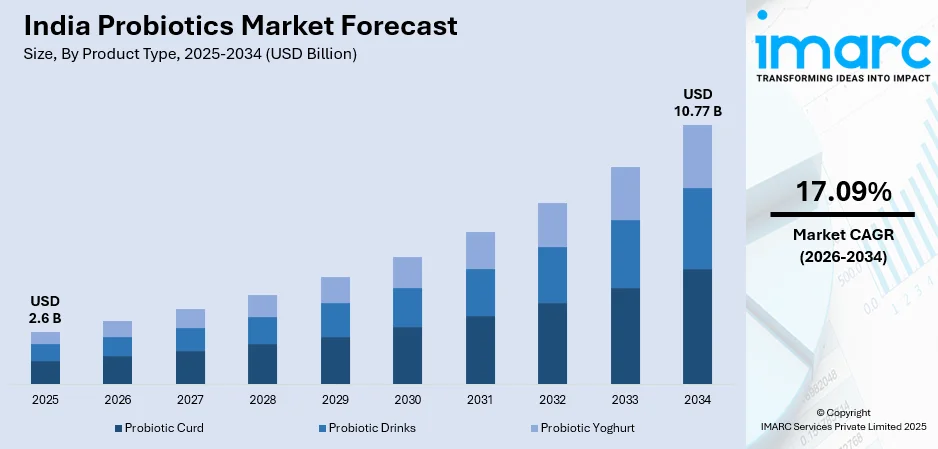

The India probiotics market size was valued at USD 2.6 Billion in 2025 and is projected to reach USD 10.77 Billion by 2034, growing at a compound annual growth rate of 17.09% from 2026-2034.

The India probiotics market is experiencing robust expansion as consumers increasingly prioritize gut health and preventive healthcare solutions. Rising awareness about the connection between digestive wellness and overall immunity is reshaping dietary preferences across urban and semi-urban populations. The growing incidence of lifestyle-related digestive disorders, coupled with favorable government initiatives promoting functional foods and nutraceuticals, continues to strengthen adoption rates. Advancements in probiotic formulations, expanding distribution networks through both traditional retail and e-commerce platforms, and aggressive marketing by established dairy brands are accelerating the India probiotics market share.

Key Takeaways and Insights:

- By Product Type: Probiotic curd dominates the market with a share of 41% in 2025, supported by its strong cultural relevance in Indian diets, cost-effective positioning, and easy accessibility through both conventional outlets and organized retail formats.

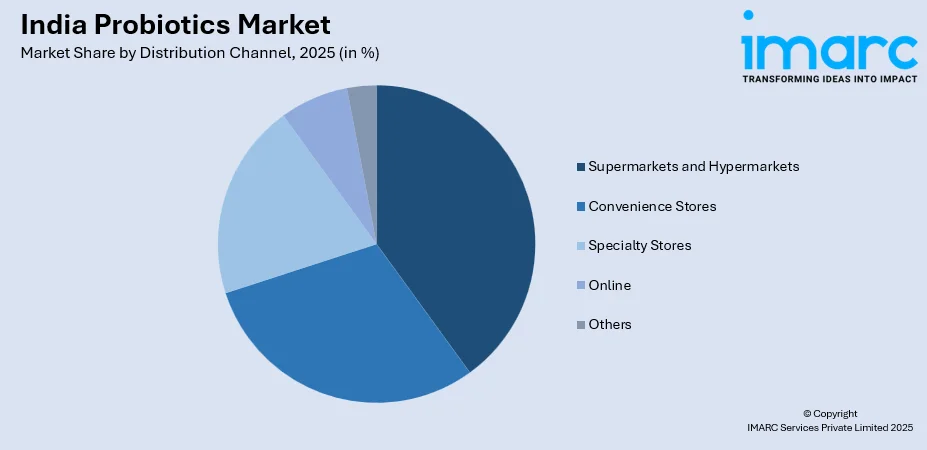

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 30% in 2025, driven by shoppers’ inclination toward physical product evaluation, higher confidence in established brands, and the continued expansion of organized retail formats in metropolitan and emerging urban centers.

- By Region: North India represents the largest segment with a market share of 32% in 2025, supported by higher urbanization levels, greater health consciousness, robust retail infrastructure, and strong penetration of e-commerce platforms enabling convenient product access.

- Key Players: The India probiotics market exhibits moderate competitive intensity, with established dairy cooperatives and multinational corporations competing alongside emerging gut health startups. Companies are differentiating through product innovation, scientifically validated formulations, and multi-channel distribution strategies spanning supermarkets, pharmacies, and digital platforms. Some of the major players include Amul (GCMMF), Epigamia (Drums Food International Private Limited), Heritage Foods Limited, Mother Dairy Fruits and Vegetables Pvt. Ltd., Milkmantra Dairy Pvt. Ltd., Milky Mist Dairy Food Private Ltd., Nestle India Limited (Nestle SA), and Yakult Danone India Pvt. Ltd.

To get more information on this market Request Sample

The India probiotics market is advancing as manufacturers integrate beneficial microorganisms into traditional food formats that resonate with local dietary habits. The growing middle class with rising disposable incomes is increasingly willing to invest in premium functional foods that offer tangible health benefits. Healthcare professionals and nutritionists are actively recommending probiotic consumption for digestive wellness, further legitimizing the category among health-conscious consumers. For instance, in February 2025, Amul announced plans to invest Rs 600 crore to establish the world's largest curd manufacturing plant in Kolkata, with a capacity of 10 lakh kg per day, demonstrating the significant capital commitments being made to expand probiotic dairy production capabilities. The convergence of traditional fermented food heritage with modern probiotic science continues to position India as a high-growth market for gut health solutions.

India Probiotics Market Trends:

Rise of Functional Foods and Beverages

Indian consumers are increasingly incorporating probiotics into their daily diets through functional foods and beverages that offer convenience without compromising on health benefits. Products such as probiotic yogurts, fortified buttermilk, and enriched snacks provide accessible options for promoting gut health and immunity. The trend aligns with busy urban lifestyles where ready-to-consume formats are preferred. According to Swiggy's How India Eats 2025 report, health-oriented food orders grew 2.3 times compared to overall order growth, indicating strong consumer preference for wellness-focused products. Companies are innovating with diverse formats including plant-based alternatives to address varying dietary requirements and preferences.

Emergence of Personalized Probiotic Solutions

The India probiotics market growth is being driven by innovations in personalized gut health solutions that address individual microbiome profiles. Consumers are seeking targeted formulations rather than generic probiotic supplements, creating opportunities for science-backed customization. For instance, in June 2024, Bengaluru-based MicrobioTx launched Personal Probiotics, India's first hyper-personalized pre- and probiotic blend developed using patented clinically validated gut microbiome testing. This approach enables tailored solutions that match specific digestive needs, reflecting growing consumer sophistication and demand for evidence-based wellness products that deliver measurable health outcomes.

Expansion of E-Commerce and Direct-to-Consumer Channels

Digital platforms are transforming probiotic product distribution across India, enabling brands to reach consumers directly while providing detailed product information and educational content. E-commerce channels offer convenience, wider product assortment, and competitive pricing that appeal to urban millennials and health-conscious professionals. Direct-to-consumer models facilitate closer brand-consumer relationships and enable customized subscription services. According to industry reports, online retail now accounts for over 25 percent of beauty and personal care sales in India, with similar growth patterns emerging in the functional foods segment. Rising internet penetration and digital literacy continue to expand market accessibility.

Market Outlook 2026-2034:

The India probiotics market is positioned for sustained expansion through 2034 as preventive healthcare gains prominence and functional food consumption becomes mainstream. Growing scientific validation of probiotic benefits, combined with regulatory clarity from FSSAI guidelines, is strengthening consumer confidence and manufacturer investment. According to PharmaTrac data, the probiotics market registered 22 percent growth on a Moving Annual Total basis for May 2025, with the market nearly doubling from Rs 1,016 crore in 2021 to Rs 2,070 crore in 2025, underscoring robust demand momentum. The market generated a revenue of USD 2.6 Billion in 2025 and is projected to reach a revenue of USD 10.77 Billion by 2034, growing at a compound annual growth rate of 17.09% from 2026-2034.

India Probiotics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Probiotic Curd |

41% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

30% |

|

Region |

North India |

32% |

Product Type Insights:

- Probiotic Curd

- Probiotic Drinks

- Probiotic Yoghurt

Probiotic curd leads the market with a share of 41% of the total India probiotics market in 2025.

Probiotic curd maintains its dominant position due to strong cultural affinity and seamless integration into traditional Indian meal patterns. Curd has been a staple component of daily diets across regions for generations, making the transition to probiotic-enriched variants natural and intuitive for consumers. The products deliver enhanced digestive and immunity benefits while preserving familiar taste profiles and textures. Budget-friendly pricing and widespread availability across neighborhood stores, supermarkets, and e-commerce platforms ensure accessibility across diverse income segments.

Major dairy cooperatives and private players are actively expanding their probiotic curd and fermented dairy production capabilities to keep pace with rising consumer demand. Investments in processing infrastructure and product diversification highlight the growing strategic importance of probiotic offerings within dairy portfolios. Strong market uptake of probiotic buttermilk and curd products is encouraging manufacturers to scale operations further, reflecting industry confidence in long-term category growth and the continued shift toward functional and health-focused dairy products.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets dominate the market with a 30% share of the total India probiotics market in 2025.

Supermarkets and hypermarkets command the largest distribution share due to consumer preferences for in-store product evaluation and the trust established through organized retail environments. These channels offer extensive product assortment, refrigerated storage infrastructure essential for probiotic viability, and promotional activities that educate consumers about product benefits. The expansion of modern trade formats across metropolitan and tier-two cities continues to enhance category accessibility and visibility.

According to Heritage Foods' CEO Srideep Kesavan, approximately 95 percent of the company's probiotic sales come from supermarket chains and home delivery services, contrasting with traditional packaged food sales that remain dominated by neighborhood shops. This channel shift reflects changing consumer shopping patterns and the importance of cold chain infrastructure for maintaining product quality. Manufacturers are strengthening partnerships with organized retailers to secure premium shelf positioning and drive category growth.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents the largest share at 32% of the total India probiotics market in 2025.

North India maintains regional leadership driven by rising health awareness, rapid urbanization, and evolving dietary preferences among consumers in major metropolitan areas. The region encompasses significant urban centers where preventive healthcare consciousness is most pronounced, with consumers increasingly prioritizing functional food investments. A growing middle class with higher disposable incomes demonstrates a greater willingness to purchase premium probiotic products for wellness benefits.

Retail and e-commerce penetration is notably stronger in North India, enhancing product accessibility across urban and peri-urban markets. According to the World Bank, India's urban population constituted 36.87 percent of the total population in 2024, with northern states representing significant concentrations. The influence of healthcare professionals and nutritionists promoting gut health is particularly prominent in this region, accelerating consumer education and adoption. Robust cold chain infrastructure and established distribution networks further support market development across North Indian states.

Market Dynamics:

Growth Drivers:

Why is the India Probiotics Market Growing?

Rising Health Consciousness and Preventive Healthcare Focus

Indian consumers are steadily moving away from reactive treatment models toward proactive wellness management, supporting sustained demand for probiotics as preventive health solutions. Increasing awareness of the gut–brain connection and the role of beneficial bacteria in immunity, digestion, and overall well-being is influencing purchasing decisions. Interest in immunity-supporting products has strengthened routine probiotic consumption as part of daily nutrition. Recommendations from healthcare professionals and nutritionists are further reinforcing consumer trust, while a broader cultural shift toward wellness-oriented lifestyles is creating favorable conditions for continued market expansion across diverse demographic groups.

Increasing Prevalence of Digestive Disorders

The rising prevalence of gastrointestinal disorders in India is fueling demand for probiotic products that support digestive relief and gut microbiome balance. Shifts toward processed food consumption, sedentary lifestyles, and higher stress levels are contributing to increased digestive discomfort across age groups. Common concerns such as bloating, acidity, constipation, and other chronic gut-related conditions are becoming more widespread. Probiotics formulated with well-researched strains like Lactobacillus and Bifidobacterium are increasingly recognized for their role in improving digestive health, positioning them as natural, preventive alternatives to conventional pharmaceutical treatments.

Government Support and Regulatory Framework Development

Government initiatives promoting improved nutrition and functional food adoption are creating favorable conditions for probiotics market expansion across India. Regulatory agencies have established clearer guidelines for probiotic product standards, enhancing consumer confidence and encouraging manufacturer investment in research and development. In 2024, the Department of Biotechnology under the Ministry of Science and Technology released guidelines for probiotic evaluation in food, while the Indian government allocated INR 1 billion to the Ministry of AYUSH for research and development of natural health products including probiotics. The Food Safety and Standards Authority of India has implemented requirements that mandate products contain at least 100 million colony-forming units per gram of specific microorganisms to qualify as probiotics, thereby establishing quality benchmarks. Public health campaigns emphasizing preventive care and balanced nutrition further support category awareness and adoption.

Market Restraints:

What Challenges the India Probiotics Market is Facing?

High Cost of Premium Probiotic Products

Probiotic products in India are generally priced much higher than conventional food options, which limits their affordability for price-sensitive consumers. The use of specialized formulations, imported bacterial cultures, and rigorous quality control processes significantly increases production costs. As a result, these products remain out of reach for many lower-income households and rural consumers, constraining wider adoption and slowing overall market penetration despite growing awareness of probiotic health benefits.

Limited Consumer Awareness in Rural and Semi-Urban Areas

Despite growing urban awareness, significant knowledge gaps persist regarding probiotic benefits among rural and semi-urban populations. Many consumers remain unfamiliar with distinctions between probiotic strains, proper usage protocols, and potential health outcomes. Conflicting information and insufficient educational initiatives create skepticism that hinders broader category adoption. Distribution challenges and limited retail infrastructure in smaller markets further constrain accessibility beyond metropolitan centers.

Cold Chain and Storage Infrastructure Constraints

Maintaining probiotic viability throughout the supply chain presents ongoing challenges due to temperature sensitivity and refrigeration requirements. Inadequate cold storage facilities, particularly in rural distribution networks, can compromise product efficacy before reaching consumers. Transportation logistics across diverse geographic and climatic conditions increase operational complexities and costs. These infrastructure limitations affect product quality consistency and consumer confidence in probiotic effectiveness.

Competitive Landscape:

The India probiotics market exhibits moderate competitive intensity with established dairy cooperatives, multinational corporations, and emerging gut health startups competing for consumer attention. Companies differentiate through product innovation, scientifically validated formulations, and multi-channel distribution strategies. Pharmaceutical giants leverage extensive distribution networks and clinical expertise, while dairy leaders capitalize on cultural affinity for traditional fermented products. Strategic partnerships between fitness brands and probiotic specialists are creating new market entry points. Competition centers on strain viability, product diversity, and FSSAI-compliant portfolios. Investment in research and development, manufacturing capacity expansion, and digital marketing capabilities remain critical success factors as brands seek to establish category leadership and capture growing consumer demand.

Some of the key market players are:

- Amul (GCMMF)

- Epigamia (Drums Food International Private Limited)

- Heritage Foods Limited

- Mother Dairy Fruits and Vegetables Pvt. Ltd.

- Milkmantra Dairy Pvt. Ltd.

- Milky Mist Dairy Food Private Ltd.

- Nestle India Limited (Nestle SA)

- Yakult Danone India Pvt. Ltd.

Recent Developments:

- April 2025: The Good Bug, a Mumbai-based gut health startup, launched a novel probiotic product featuring a GLP-1-based formulation combining clinically proven probiotics with metabolic fibers. The product targets weight management through enhanced metabolic activity and gut health support, with a 90-day clinical trial demonstrating approximately 12 percent weight loss and 9.64 percent waist reduction.

- November 2024: Sova Health unveiled SOVA-X, Asia's first personalized probiotic solution, offering customized gut health support based on individual microbiome analysis. The subscription-based service utilizes innovative robotic compounding technologies to develop tailored probiotic formulations suited to each user's unique gut profile.

- November 2024: MilkyMist, a Tamil Nadu-based dairy manufacturer, partnered with SIG and AnaBio Technologies to pioneer the world's first probiotic buttermilk packaged in aseptic carton packs with extended shelf life. This innovation was presented at Gulfood Manufacturing 2024 in Dubai, enabling probiotic integration into shelf-stable beverage formats.

- July 2024: Yakult Danone India expanded its product portfolio by introducing Yakult Light Mango Flavor, containing 650 crores of Lactobacillus casei Shirota probiotic strain. The new variant launched across retail outlets in 28 states and 5 Union Territories, targeting Indian consumers' flavor preferences while maintaining the brand's signature probiotic benefits.

India Probiotics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Kg |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Probiotic Curd, Probiotic Drinks, Probiotic Yoghurt |

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Amul (GCMMF), Epigamia (Drums Food International Private Limited), Heritage Foods Limited, Mother Dairy Fruits and Vegetables Pvt. Ltd., Milkmantra Dairy Pvt. Ltd., Milky Mist Dairy Food Private Ltd., Nestle India Limited (Nestle SA) and Yakult Danone India Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India probiotics market size was valued at USD 2.6 Billion in 2025.

The India probiotics market is expected to grow at a compound annual growth rate of 17.09% from 2026-2034 to reach USD 10.77 Billion by 2034.

Probiotic curd, representing the largest revenue share of 41% in 2025, dominates the India probiotics market owing to its cultural integration, affordability, widespread availability, and the natural transition from traditional curd consumption to enhanced probiotic variants among Indian households.

Key factors driving the India probiotics market include rising health consciousness and preventive healthcare focus, increasing prevalence of digestive disorders, government support through regulatory clarity and public health initiatives, expanding e-commerce distribution, and growing investment in product innovation by established dairy brands and emerging startups.

Major challenges include high product costs limiting accessibility for price-sensitive consumers, limited awareness in rural and semi-urban areas, cold chain infrastructure constraints affecting product viability, regulatory compliance requirements, and consumer skepticism regarding probiotic efficacy due to insufficient education about strain-specific benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)