India Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

India Private Equity Market Summary:

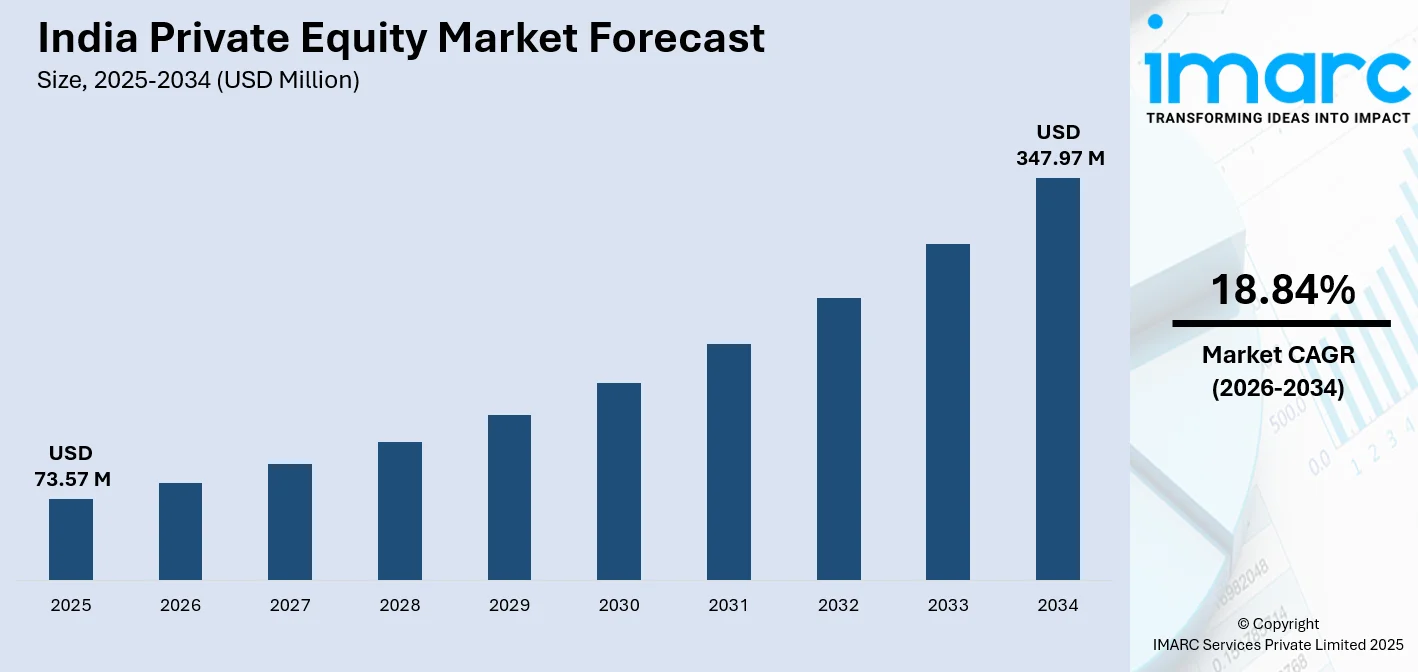

The India private equity market size was valued at USD 73.57 Million in 2025 and is projected to reach USD 347.97 Million by 2034, growing at a compound annual growth rate of 18.84% from 2026-2034.

The India private equity market is experiencing robust growth, driven by strong macroeconomic fundamentals, progressive regulatory reforms, and increasing investor confidence in the country's long-term economic trajectory. Rising domestic consumption, expanding digital infrastructure, and favorable government policies supporting entrepreneurship are accelerating capital deployment. Growing participation from family offices, deepening exit pathways through public markets, and enhanced governance standards are strengthening the investment ecosystem and attracting both domestic and international capital.

Key Takeaways and Insights:

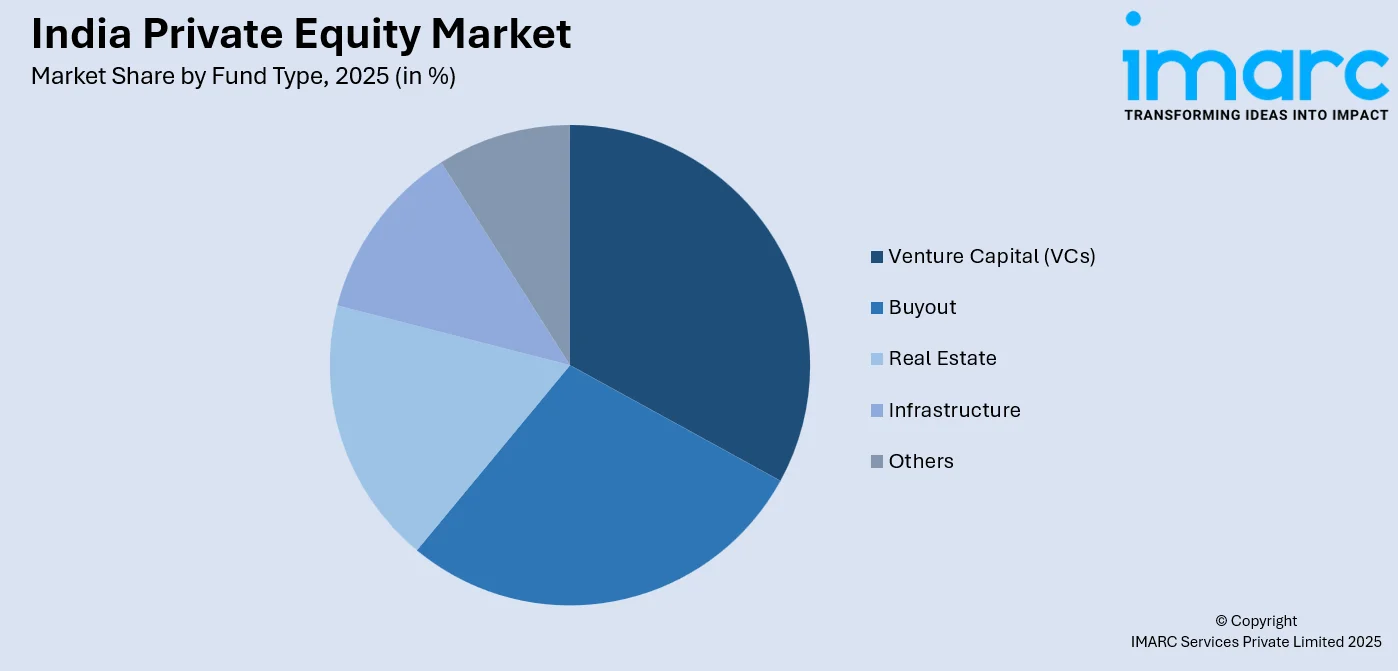

- By Fund Type: Venture Capital (VCs) dominates the market with a share of 32% in 2025, owing to India's thriving startup ecosystem, strong government support through initiatives promoting innovation, and robust digital infrastructure enabling high-growth technology ventures across the fintech, consumer tech, and deeptech sectors.

- By Region: West and Central India lead the market with a share of 30% in 2025, driven by Mumbai's position as the country's financial capital, concentration of major private equity firms and institutional investors, presence of global fund headquarters, and Gujarat's emerging Gujarat International Finance Tec (GIFT) City international financial services hub.

- Key Players: Key players drive the India private equity market by deploying capital across high-growth sectors, building operational expertise within portfolio companies, establishing strategic partnerships with entrepreneurs, and capitalizing on strong exit opportunities through public markets and secondary transactions to deliver attractive returns.

To get more information on this market Request Sample

In India, the market is advancing rapidly, as the country consolidates its position as one of the largest destinations for private equity and venture capital investments in the Asia-Pacific region. Multiple factors are propelling this growth trajectory, including robust gross domestic product (GDP) expansion projected at 6.5% for fiscal year 2026-2027, controlled inflation environment, and progressive policy measures, including interest rate cuts and tax reforms, aimed at stimulating private consumption and investment. The market is witnessing structural evolution with buyouts gaining prominence, reflecting investor preference for control transactions that enable operational value creation. Additionally, increasing deal activities across the technology, healthcare, renewable energy, and consumer sectors are broadening the investment landscape. Improved exit opportunities through public markets and strategic acquisitions are enhancing investor confidence. Domestic institutional participation is also rising, strengthening capital availability and market depth.

India Private Equity Market Trends:

Surge in Buyout and Control Transactions

The India private equity market is increasingly shaped by the growing preferences for buyout transactions, as investors shift towards control-oriented investment strategies. Buyouts allow private equity firms to actively influence management decisions, implement operational efficiencies, and pursue long-term strategic initiatives that enhance value creation. This approach reflects greater market maturity and investor confidence in scaling Indian businesses through hands-on ownership. In February 2025, KKR acquired a controlling interest in Healthcare Global Enterprises Ltd. in a deal valued at USD 400 Million, exemplifying this trend of larger control-oriented investments across the healthcare and technology sectors.

Expansion of Deeptech and Emerging Sector Investments

Private equity firms are increasingly directing capital towards deep technology sectors, including artificial intelligence (AI), semiconductors, space technology, and clean energy. In 2025, total deeptech financing increased to USD 1.6 Billion in 2025, rising from USD 1.2 Billion in 2024 and USD 1.1 Billion in 2023. This surge reflects growing investor confidence in India’s innovation ecosystem and long-term commercialization potential of deeptech solutions. Government support, expanding research and development (R&D) infrastructure, and stronger academia–industry collaborations are further accelerating deal activities.

Rise of Environmental, Social and Governance (ESG)-Focused Investment Strategies

Sustainability considerations and ESG factors are playing a growing role in shaping private equity investment strategies, as firms increasingly align portfolios with environmental standards and evolving regulatory expectations. Investors are prioritizing opportunities in renewable energy, clean infrastructure, and low-carbon technologies that support long-term economic resilience. This focus on responsible investing enhances risk management, improves governance practices, and strengthens stakeholder confidence. As sustainability becomes integral to value creation, such strategies are attracting patient, long-term institutional capital seeking stable returns while contributing to climate goals and inclusive growth.

Market Outlook 2026-2034:

The India private equity market outlook remains cautiously optimistic, as the country navigates global uncertainties while maintaining strong domestic fundamentals. The market generated a revenue of USD 73.57 Million in 2025 and is projected to reach a revenue of USD 347.97 Million by 2034, growing at a compound annual growth rate of 18.84% from 2026-2034. Strong investor interest is expected to persist in the financial services, healthcare, and technology sectors, while infrastructure and real estate continue to attract significant capital. Progressive regulatory reforms, including foreign direct investment (FDI) liberalization in space and insurance sectors, enhanced delisting mechanisms, and simplified cross-border transaction frameworks are creating favorable conditions for continued market expansion and sophisticated deal structures.

India Private Equity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fund Type |

Venture Capital (VCs) |

32% |

|

Region |

West and Central India |

30% |

Fund Type Insights:

Access the comprehensive market breakdown Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Venture capital (VCs) dominates with a market share of 32% of the total India private equity market in 2025.

Venture capital (VCs) has become the central engine of private equity activity in India, supported by the country’s globally significant startup ecosystem. The market has shown strong resilience as funding momentum recovered following a challenging investment cycle. Increased deal activity reflects renewed investor confidence in scalable, well-governed startups that demonstrated operational discipline and sustainable business models. Improved quality of deal flow, stronger founder maturity, and clearer paths to monetization have reinforced VC’s role in driving innovation-led growth across the broader private equity landscape.

Consumer technology has emerged as the most influential VCs subsector, driven by rapid digital adoption and evolving consumption patterns. Segments, such as quick commerce, fintech, software-as-a-service, and deep technology, are attracting sustained investor interest due to strong demand visibility and improving unit economics. Supportive government initiatives, regulatory clarity, and enhanced capital access mechanisms are further strengthening early-stage investment activities. Together, these factors are accelerating ecosystem maturity and positioning venture capital as a long-term growth catalyst.

Regional Insights:

- South India

- North India

- West and Central India

- East India

West and Central India lead with a share of 30% of the total India private equity market in 2025.

West and Central India have emerged as the core hub of private equity activity, anchored by Mumbai’s role as the country’s financial capital and home to leading global and domestic investment firms. The region benefits from a dense concentration of deal-making capabilities, experienced advisory networks, and close access to corporate headquarters across sectors, such as financial services, infrastructure, manufacturing, and consumer industries. This ecosystem enables faster transactions, deeper due diligence, and stronger post-investment engagement, reinforcing sustained private equity inflows.

Gujarat’s GIFT City International Financial Services Centre has become a key enabler of regional private equity growth. The platform offers an internationally aligned regulatory environment, operational efficiency, and attractive tax incentives for fund managers. Simplified compliance processes and access to global capital markets enhance its appeal for alternative investment funds. As a result, GIFT City is positioning the region as India’s preferred base for offshore and cross-border private equity operations.

Market Dynamics:

Growth Drivers:

Why is the India Private Equity Market Growing?

Strong Macroeconomic Fundamentals and GDP Growth

India's robust economic fundamentals serve as the cornerstone supporting private equity expansion, significantly outpacing global peers and positioning the country as one of the fastest-growing major economies. This sustained economic momentum creates a conducive environment for capital deployment across sectors benefiting from domestic consumption expansion, industrial growth, and infrastructure development. The country's favorable demographics, with 43% of the population under 25 years of age in 2025, generate a substantial demographic dividend driving consumption and digital adoption patterns. Rising disposable incomes, expanding middle-class populations, and increasing financialization of savings are creating multiple pools of capital supporting market activity. Additionally, policy stability and ongoing structural reforms are enhancing investor confidence and long-term visibility. Improved ease of doing business and capital market depth further strengthen India’s attractiveness as a preferred private equity destination.

Progressive Regulatory Reforms and Policy Support

Government initiatives and regulatory modernization are systematically reducing barriers to private equity investment while enhancing governance standards and investor protections. The abolition of angel tax in 2024 removed a significant deterrent for foreign capital investment in Indian startups, unlocking greater international investor participation. Ongoing reforms in company law, insolvency frameworks, and securities regulations have improved transparency, creditor rights, and exit certainty for investors. Streamlined FDI norms and clearer taxation structures have further reduced compliance complexity and transaction risks. Digitalization of regulatory filings and faster approval timelines are also improving operational efficiency for fund managers. Additionally, initiatives promoting startup incubation, innovation funding, and public–private partnerships are expanding the investable universe. These policy measures collectively strengthen market credibility, improve ease of capital deployment, and support long-term value creation. As regulatory clarity continues to improve, the India private equity ecosystem is becoming more aligned with global best practices, encouraging sustained domestic and international investment flows.

Deepening Exit Pathways and Public Market Maturity

The maturation of India’s public markets has significantly reshaped exit dynamics for private equity investors, creating dependable liquidity pathways that strengthen overall investment appeal. Investors are increasingly leveraging favorable market conditions to realize value through public listings and secondary market transactions. Public market exits have gained prominence, supported by strong initial public offering (IPO) pipelines and efficient block trade mechanisms that enable large-scale monetization. Sectors, such as financial services, healthcare, and consumer retail, continue to dominate exit activity, reflecting strong investor appetite for established, scalable businesses. High-profile listings have reinforced confidence in India’s equity markets and validated private equity value creation strategies. Alongside IPOs, secondary sales, and strategic trade exits are becoming more common, offering additional flexibility. This broadening mix of exit routes reduces reliance on any single channel, enhances return visibility, and improves capital recycling, making India an increasingly attractive destination for private equity investment.

Market Restraints:

What Challenges the India Private Equity Market is Facing?

Elevated Valuations and Bid-Ask Spreads

High valuation multiples driven by buoyant public markets create persistent challenges for deal execution as bid-ask spreads between investor expectations and seller valuations remain wide. Private equity investors contend with rich valuations that compress potential returns while extending negotiation timelines. This valuation premium particularly affects control transactions where acquiring stakes at reasonable multiples becomes increasingly difficult in competitive auction processes.

Regulatory Complexity and Compliance Requirements

Regulatory complexity and stringent compliance requirements limit the growth of the India private equity market by increasing deal execution time and overall transaction costs. Multiple regulatory approvals, detailed disclosures, and evolving policy interpretations create uncertainty for investors, particularly in large and cross-border deals. Extended review timelines can delay capital deployment and exits, reducing fund efficiency and internal rates of return. Smaller funds and first-time investors face higher entry barriers due to compliance burdens. These challenges can discourage risk-taking and slow investment momentum despite strong underlying market potential.

Geopolitical Uncertainties and Global Market Volatility

Global trade tensions, currency fluctuations, and geopolitical disruptions introduce uncertainties that affect investment sentiment and capital flows. Breakdown of trade negotiations resulting in tariff impositions on key Indian exports creates unpredictability for portfolio companies with international exposure. Rupee depreciation and global interest rate movements impact returns for foreign investors while heightened volatility in mid-cap and small-cap segments limits IPO windows for exit transactions.

Competitive Landscape:

Key players play a crucial role in driving the India private equity market by providing capital, expertise, and strategic direction across high-growth sectors. Global and domestic private equity firms actively identify scalable businesses, support professional management, and implement operational improvements to enhance long-term value. Their involvement strengthens corporate governance, financial discipline, and transparency within portfolio companies. Large funds also help companies expand through acquisitions, technology adoption, and market entry strategies. Additionally, collaborations with investment banks, advisors, and legal firms improve deal structuring and exit readiness. Through active ownership and sector specialization, key players accelerate business growth while deepening market maturity and investor confidence.

India Private Equity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessmen:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India private equity market size was valued at USD 73.57 Million in 2025.

The India private equity market is expected to grow at a compound annual growth rate of 18.84% from 2026-2034 to reach USD 347.97 Million by 2034.

Venture capital (VCs) dominated the market with a share of 32%, driven by India's thriving startup ecosystem, government support initiatives, robust digital infrastructure, and strong investor appetite for high-growth technology ventures across the fintech and consumer tech sectors.

Key factors driving the India private equity market include strong macroeconomic fundamentals, progressive regulatory reforms, expanding exit pathways through public markets, rising domestic consumption, growing family office participation, and enhanced governance standards attracting institutional capital.

Major challenges include elevated valuations creating wide bid-ask spreads, regulatory complexity across multiple authorities, geopolitical uncertainties affecting investor sentiment, global market volatility impacting exit timing, and currency fluctuations affecting foreign investor returns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)