India Precious Metals Market Size, Share, Trends and Forecast by Metal Type, Application, and Region, 2026-2034

Market Overview:

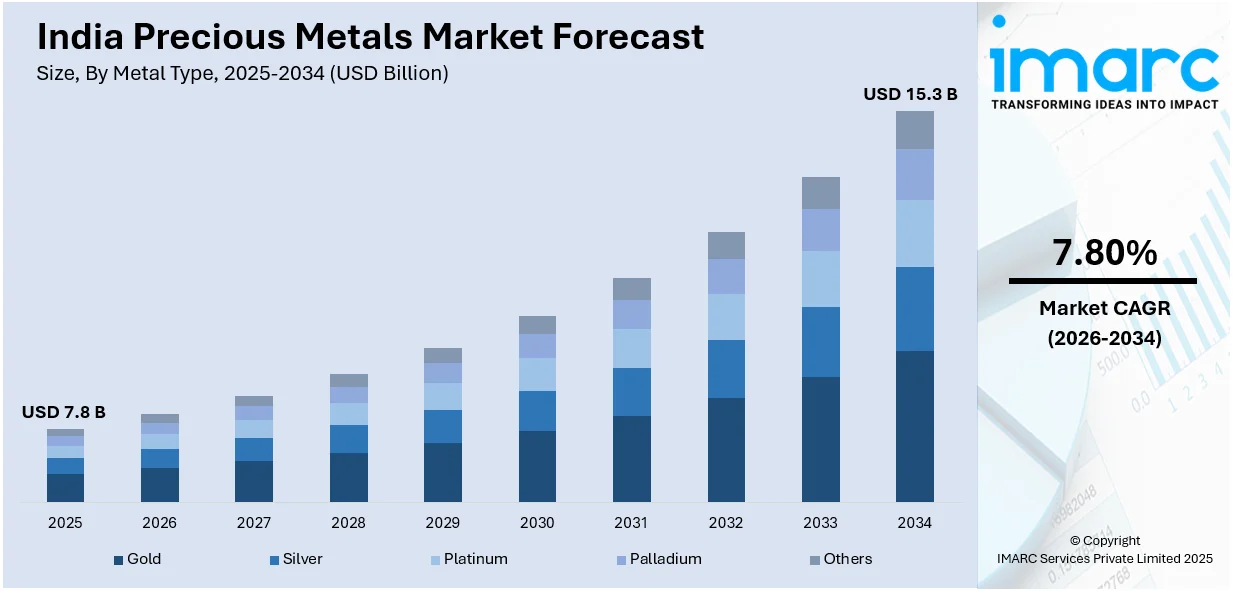

The India precious metals market size reached USD 7.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.3 Billion by 2034, exhibiting a growth rate (CAGR) of 7.80% during 2026-2034. The rising affluence of the expanding middle class, the implementation of favorable policies by the Government of India (GoI), increasing product utilization in the automotive industry, and the introduction of digital technologies represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7.8 Billion |

|

Market Forecast in 2034

|

USD 15.3 Billion |

| Market Growth Rate 2026-2034 | 7.80% |

Precious metals are naturally occurring metallic elements that hold high economic value due to their rarity, durability, and industrial applications. These include various metals, such as gold, silver, platinum, palladium, and rhodium. Their manufacturing process involves mining, extraction, refining, and shaping into various forms. Precious metals are widely used in jewelry making, coinage, investments, electronics, dentistry, automotive, pharmaceuticals, aerospace, glass manufacturing, photography, and catalytic converters. They are strong and durable materials that offer aesthetic appeal, conductivity, malleability, reflectivity, thermal stability, biocompatibility, and high resistance to corrosion. Precious metals also act as a hedge against inflation, provide portfolio diversification, offer stability during economic downturns, and hold universal acceptance.

To get more information on this market Request Sample

India Precious Metals Market Trends:

The rising affluence of the expanding middle class in India is driving the market growth. The increased disposable income allows consumers to invest greatly in precious metals, such as gold and silver, as a means of wealth storage and for cultural traditions tied to marriages and festivals. Furthermore, the widespread product utilization in the automotive industry as catalytic converters to reduce emission levels, improve air quality, and extend engine lifespan is contributing to the market growth. Apart from this, the imposition of supportive policies by the Government of India (GoI) to increase investment in defense and aerospace industries that heavily rely on metals, such as platinum and silver, for manufacturing critical components is boosting the market growth. Additionally, the introduction of digital technologies, such as online platforms and mobile applications, to facilitate easier investment in precious metals and enhance user convenience is positively influencing the market growth. Moreover, the growing product demand for manufacturing photovoltaic (PV) cells used in solar panels, owing to the emerging shift towards renewable energy generation, is strengthening the market growth. Besides this, the significant growth in the jewelry industry is facilitating the product demand to create necklaces, wedding rings, bracelets, earrings, anklets, pendants, cufflinks, and toe rings. Along with this, the rising product adoption in the medical industry for dental fillings and manufacturing radiology equipment is supporting the market growth. In addition to this, growing product demand as a safe-haven asset that can preserve value and provide financial security during economic instability is catalyzing the market growth. Other factors, including rapid industrialization, increasing investment in advanced extraction processes, and growing demand for ethically sourced products, are anticipated to drive the market growth.

India Precious Metals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India precious metals market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on metal type and application.

Metal Type Insights:

- Gold

- Silver

- Platinum

- Palladium

- Others

The report has provided a detailed breakup and analysis of the India precious metals market based on the metal type. This includes gold, silver, platinum, palladium, and others. According to the report, gold represented the largest segment.

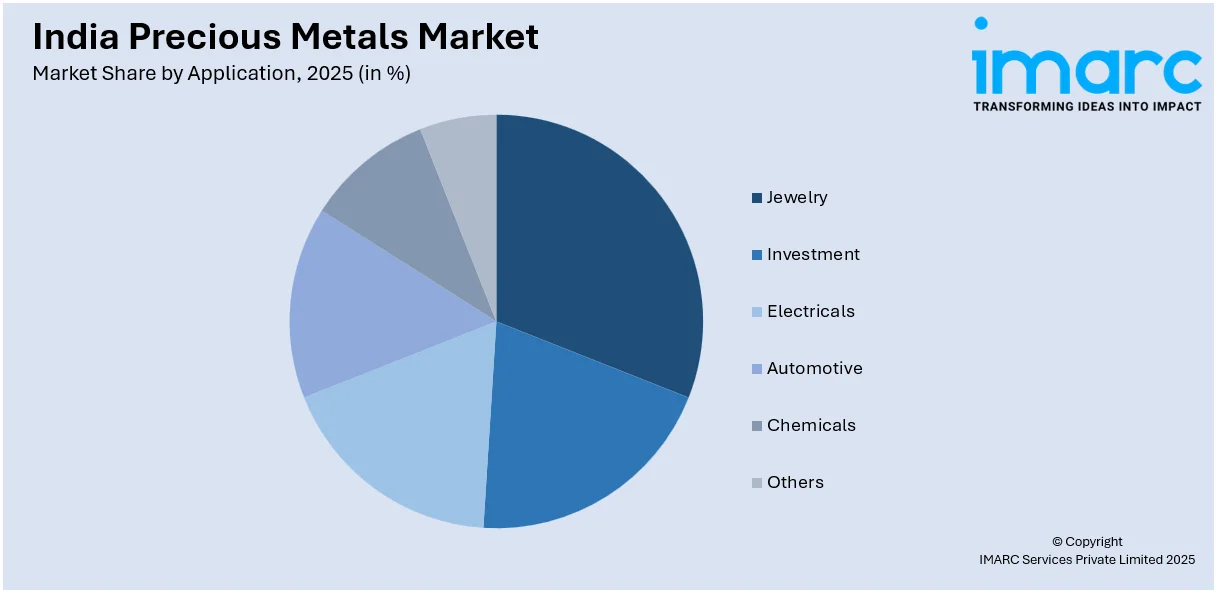

Application Insights:

Access the comprehensive market breakdown Request Sample

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

A detailed breakup and analysis of the India precious metals market based on the application has also been provided in the report. This includes jewelry, investment, electricals, automotive, chemicals, and others. According to the report, jewelry accounted for the largest market share.

Regional Insights:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India. According to the report, South India was the largest market for precious metals. The predominant consumption of precious metals, particularly gold, in South India can be ascribed to deep-rooted cultural, historical, and economic factors. The region, characterized by an abundance of temples and a robust middle-class demographic, perceives gold as more than mere ornamentation. It's seen as a symbol of affluence and a pragmatic financial investment. This consistently high demand solidifies South India's position as the largest market for precious metals in India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India precious metals market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Metal Types Covered | Gold, Silver, Platinum, Palladium, Others |

| Applications Covered | Jewelry, Investment, Electricals, Automotive, Chemicals, Others |

| Regions Covered | South India, North India, West and Central India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India precious metals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India precious metals market?

- What is the breakup of the India precious metals market on the basis of metal type?

- What is the breakup of the India precious metals market on the basis of application?

- What are the various stages in the value chain of the India precious metals market?

- What are the key driving factors and challenges in the India precious metals market?

- What is the structure of the India precious metals market and who are the key players?

- What is the degree of competition in the India precious metals market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India precious metals market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India precious metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India precious metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)