India Prebiotic Ingredients Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Prebiotic Ingredients Market Overview:

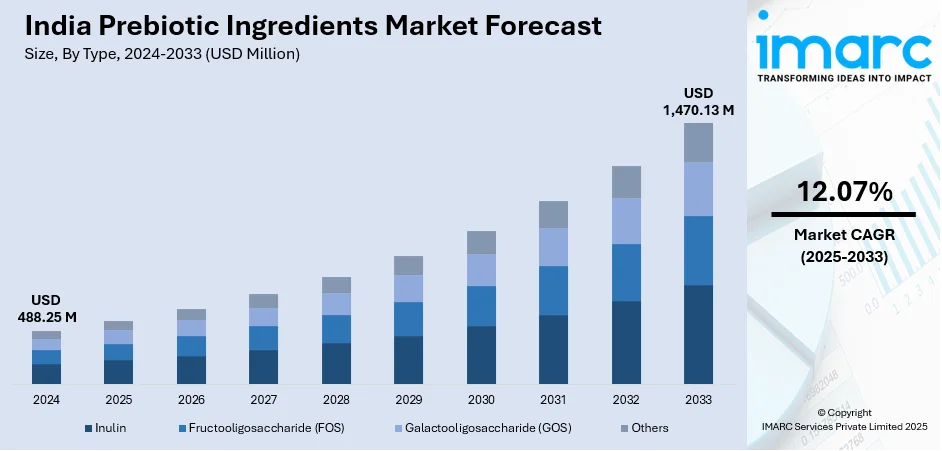

The India prebiotic ingredients market size reached USD 488.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,470.13 Million by 2033, exhibiting a growth rate (CAGR) of 12.07% during 2025-2033. The India prebiotic ingredients market is being driven by rising consumer awareness of gut health, escalating demand for functional foods, expanding probiotic-prebiotic synergy in dietary supplements, government support for food innovation, and the growing product applications in animal nutrition, aligning with evolving dietary preferences and the country's increasing focus on preventive healthcare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 488.25 Million |

| Market Forecast in 2033 | USD 1,470.13 Million |

| Market Growth Rate 2025-2033 | 12.07% |

India Prebiotic Ingredients Market Trends:

Rising Consumer Health Awareness

Among the strongest drivers of the India prebiotic ingredients market is the elevating consumer awareness about gut health and digestive well-being. Indian consumers are increasingly aware of the connection between gut microbiota and overall well-being, driving demand for products that are high in prebiotic ingredients like inulin, fructooligosaccharides (FOS), and galactooligosaccharides (GOS). This rising consciousness has been fueled by an increase in health-conscious consumers, the impact of social media influencers, and doctors advocating for the advantages of prebiotics in having a healthy gut microbiome. Furthermore, the inflating incidences of gastrointestinal disorders, such as irritable bowel syndrome (IBS), acid reflux, and constipation, are also encouraging individuals to adopt functional foods and supplements that have prebiotics. IBS, for instance, impacts around 4 to 7% of the Indian population. In line with this, consumers are extensively seeking yogurt, fortified cereals, and dietary supplements that provide gut health benefits.

To get more information on this market, Request Sample

Growing Demand for Functional Dairy Products

Another key driver of the India prebiotic ingredients market is the fast development of the country's dairy sector and the growing need for functional dairy foods. India’s dairy market is projected to reach INR 57,001.8 Billion by 2033, exhibiting a CAGR of 12.35% during 2025-2033. India is the largest producer and consumer of milk in the world, and dairy is a common food in the majority of Indian homes. Historically, dairy foods such as curd and buttermilk have been eaten for their inherent probiotic qualities. But with higher health awareness, the industry now incorporates prebiotics to enrich their nutritional quality and aid digestive health. Major dairy players in India, including Amul, Mother Dairy, and Nestlé India, are introducing prebiotic-enriched dairy products, including lactose-fortified yogurts, probiotic beverages, and lactose-free milk, to address changing consumer dietary needs. The synergy of probiotics (live and beneficial bacteria) and prebiotics (which feed these bacteria) is particularly enticing, as it creates a symbiotic effect that enhances digestion, strengthens immunity, and promotes well-being. Furthermore, the increasing trend of plant-based dairy alternatives, including almond, soy, and oat milk, has further propelled the adoption of prebiotic ingredients in non-dairy products. Such products are becoming highly popular among lactose-intolerant consumers and those embracing vegan lifestyles, further expanding the market for prebiotic-enriched functional dairy.

India Prebiotic Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Inulin

- Fructooligosaccharide (FOS)

- Galactooligosaccharide (GOS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes inulin, fructooligosaccharide (FOS), galactooligosaccharide (GOS), others.

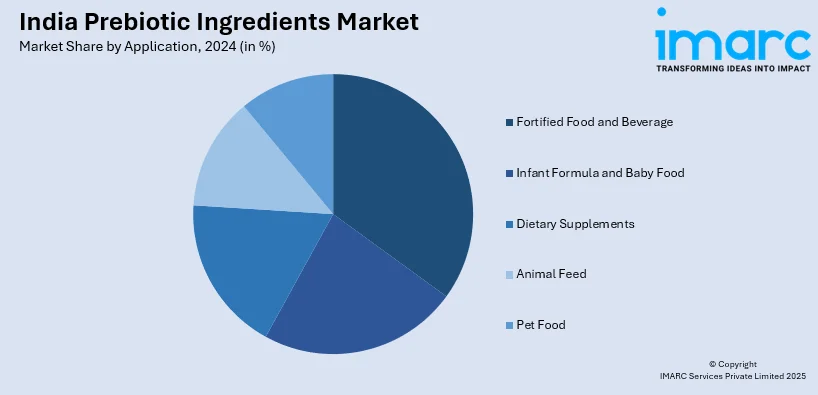

Application Insights:

- Fortified Food and Beverage

- Infant Formula and Baby Food

- Dietary Supplements

- Animal Feed

- Ruminant

- Poultry

- Swine

- Aquaculture

- Others

- Pet Food

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fortified food and beverage, infant formula and baby food, dietary supplements, animal feed (ruminant, poultry, swine, aquaculture, and others), and pet food.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Prebiotic Ingredients Market News:

- December 2024: Dr. Morepen, a brand of health and wellness products, launched LightLife, a prebiotic product targeting weight management and gut health in India. LightLife incorporates prebiotics sourced from the UK, specifically designed to enhance gut health, reduce cravings, and promote satiety.

- November 2024: Evonik launched Ecobiol Soluble Plus, a water-soluble probiotic for improving poultry gut health. The product, containing Bacillus amyloliquefaciens CECT 5940, aims to enhance nutrient absorption and combat pathogens in India's tropical conditions.

India Prebiotic Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inulin, Fructooligosaccharide (FOS), Galactooligosaccharide (GOS), Others |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India prebiotic ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the India prebiotic ingredients market on the basis of type?

- What is the breakup of the India prebiotic ingredients market on the basis of application?

- What are the various stages in the value chain of the India prebiotic ingredients market?

- What are the key driving factors and challenges in the India prebiotic ingredients?

- What is the structure of the India prebiotic ingredients market and who are the key players?

- What is the degree of competition in the India prebiotic ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India prebiotic ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India prebiotic ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India prebiotic ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)