India Power Transformer Market Size, Share, Trends and Forecast by Core, Insulation, Phase, Rating, Application, and Region, 2026-2034

Market Overview:

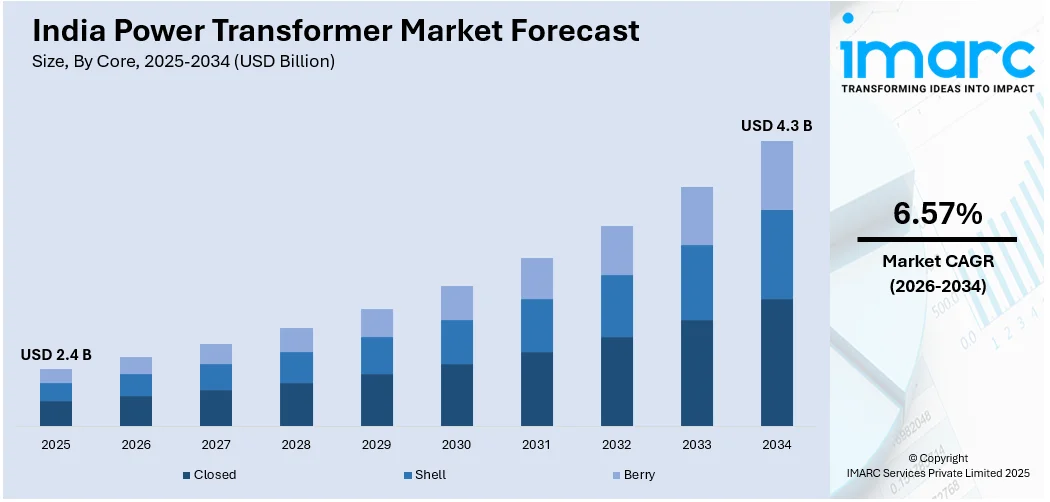

India power transformer market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.57% during 2026-2034. The rising focus among key players on meeting growing electricity demands, using smart technologies, and adhering to environmental sustainability is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.4 Billion |

|

Market Forecast in 2034

|

USD 4.3 Billion |

| Market Growth Rate 2026-2034 | 6.57% |

A power transformer is an electromagnetic device that passively converts energy from one circuit to another via inductive coupling. Comprising various windings, tap changing systems, a core, tank, and bushings, it operates within an alternating current (AC) electrical system and is categorized as a static device. Commercially available types include berry-type, core-type, shell-type, isolation, step-down, step-up, single-phase, and air core transformers. This device facilitates the transmission of electrical power between generators and distribution primary circuits, adjusting voltage levels in distribution networks. Its role in minimizing energy losses during long-distance power transmission involves converting electricity into high-voltage current and then into a safer low-voltage current. Ensuring high mechanical strength and preventing flux leakage and iron loss, the power transformer also provides electrical isolation between primary and secondary windings, prioritizing equipment and user safety. Additionally, it contributes to enhancing power quality by mitigating the impact of fluctuations, harmonics, and other disturbances.

To get more information of this market Request Sample

India Power Transformer Market Trends:

The India power transformer market is undergoing significant shifts driven by key drivers and emerging trends that reflect the nation's commitment to a resilient and efficient power infrastructures. A primary driver is the increasing demand for electricity, spurred by industrial growth and urbanization. Besides this, the inflating need for upgrading aging power infrastructures, is propelling investments in advanced transformers, thereby bolstering the market growth across India. Moreover, the increasing integration of digital monitoring, remote diagnostics, and predictive maintenance technologies enhances the operational efficiency and reliability of power transformers. These innovations align with India's vision of a modernized and technology-driven power sector. Furthermore, government initiatives and policies, such as the Integrated Power Development Scheme (IPDS) and the National Smart Grid Mission, are steering the market growth. These initiatives aim to enhance the quality and reliability of the power supply, promoting the adoption of state-of-the-art power transformers. Moreover, there is a growing emphasis on environmentally sustainable transformers, with a focus on reducing losses and improving energy efficiency. Apart from this, the introduction of green transformers that comply with international standards for environmental conservation is anticipated to fuel the market growth across India over the forecasted period.

India Power Transformer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on core, insulation, phase, rating, and application.

Core Insights:

- Closed

- Shell

- Berry

The report has provided a detailed breakup and analysis of the market based on the core. This includes closed, shell, and berry.

Insulation Insights:

- Gas

- Oil

- Solid

- Air

- Others

A detailed breakup and analysis of the market based on the insulation have also been provided in the report. This includes gas, oil, solid, air, and others.

Phase Insights:

- Single

- Three

The report has provided a detailed breakup and analysis of the market based on the phase. This includes single and three.

Rating Insights:

- 100 MVA To 500 MVA

- 501 MVA To 800 MVA

- 801 MVA To 1200 MVA

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes 100 MVA to 500 MVA, 501 MVA to 800 MVA, and 801 MVA to 1200 MVA.

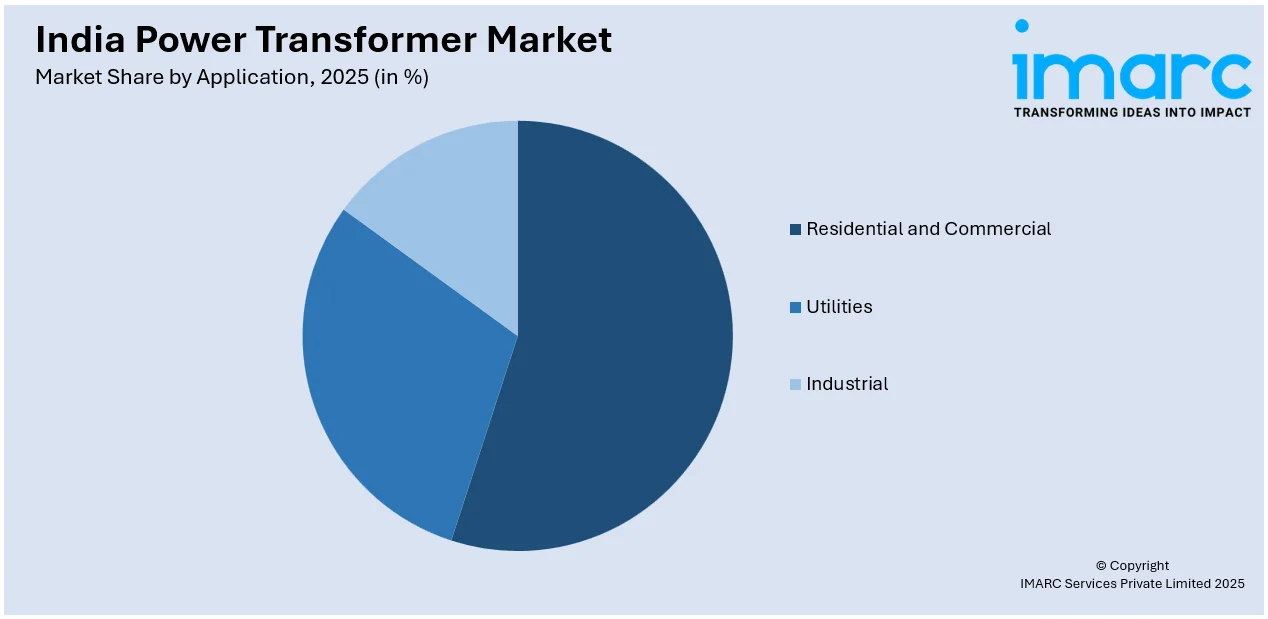

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential and Commercial

- Utilities

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial, utilities, and industrial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Power Transformer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cores Covered | Closed, Shell, Berry |

| Insulations Covered | Gas, Oil, Solid, Air, Others |

| Phases Covered | Single, Three |

| Ratings Covered | 100 MVA To 500 MVA, 501 MVA To 800 MVA, 801 MVA To 1200 MVA |

| Applications Covered | Residential and Commercial, Utilities, Industrial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India power transformer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India power transformer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India power transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India power transformer market was valued at USD 2.4 Billion in 2025.

The India power transformer market is projected to exhibit a CAGR of 6.57% during 2026-2034, reaching a value of USD 4.3 Billion by 2034.

The India power transformer market is driven by accelerating energy demand, expansion of transmission and distribution networks, and grid modernization projects. Renewable energy integration and smart grid development, particularly for solar and wind, further boost requirements. Growing investments in infrastructure and electrification of rural areas also support the adoption of advanced transformer technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)